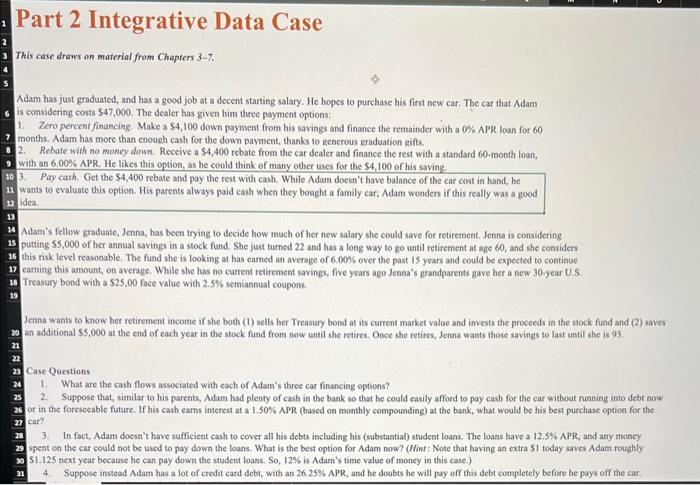

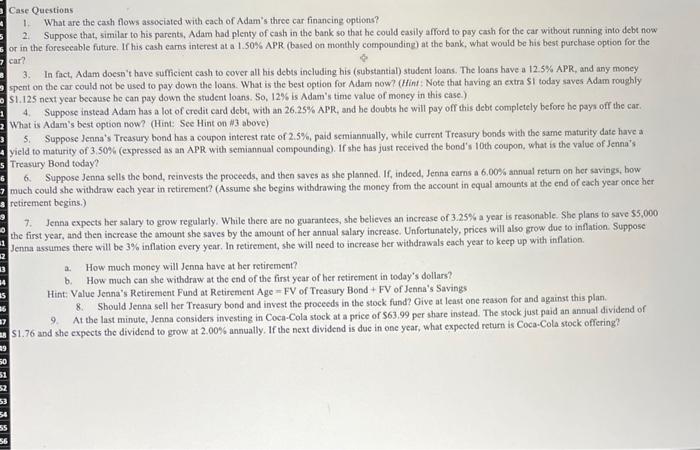

This case draws on material from Chapters 3-7. Adam has just gaduated, and has a good job at a decent starting salary. He hopes to purchase his first new car. The car that Adam is considering costs $47,000. The dealer has given him three payment options: 1. Zero percent financing. Make a $4,100 down payment from his savings and finance the remainder with a 0% APR loan for 60 months. Adam has more than enough cash for the down payment, thanks to eenerous graduation gifts. 2. Rebate with no money dowm. Receive a $4,400 rebate from the car dealer and finance the rest with a standard 60-month loan, with an 6.00% APR. He likes this option, as he could think of many other uses for the $4,100 of his saving 3. Pay cash. Get the $4,400 rebate and pay the rest with cash. While Adam doesn't have balance of the car eost in hand, he wants to evaluate this option. His parents always paid cash when they bought a family car, Adam wonders if this really was a good idea. Adam's fellow graduate, Jenna, has been trying to decide how much of her new salary she could save for retirement. Jenna is considering putting $5,000 of her annual savings in a stock fund. She just turnod 22 and has a long way to go until retirenent at age 60 , and she considers this risk level reasonable. The fund she is looking at has earned an averago of 6.00% over the past 15 years and could be expected to continue caming this amount, on average. While she has no current retirement savings, five years ago Jenna's prandparents gave her a new 30 -year U.S Treasury bond with a $25,00 face value with 2.5% semiannual coupons. Jenna wants to know her retirement income if she both (1) sells ber Treasury bond at its current market value and invests the proceeds in the Mock fund and (2) sav an additional 55,000 at the end of each year in the stock fund from fow until she retires. Once she retires, Jenna wants those savings to last until she is 93. Case Questions 1. What are the cash flows associated with each of Adam's three car financing options? 2. Suppose that, similar to his parents, Adam had plenty of cash in the bank so that he could easily afford to pay cash for the car without running into debt ao or in the foresecable future. If his cash eams interest at a 1.50\% APR (based on monthly compounding) at the bank, what would be his best purchase option for the 3. In fact, Adam doesn't have sufficient eash to cover all his debts including his (substantial) student loans. The loans have a 12.5% APR, and any moncy spent on the car could not be used to pay down the loans. What is the best option for Adam now? (hint: Note that having an extra $1 today saves Adam roughly $1.125 next year because he can pay down the student loans. So, 12% is Adam's time value of money in this case.) 4. Suppose instead Adam has a lot of credit card debt, with an 26.25%APR, and he doubts he will pay off this debt completely beforo be pays off the car. Case Qucstions 1. What are the cach flows associated with cach of Adam's three car financing options? 2. Suppose that, similar to his parents, Adam had plenty of cash in the bank so that he could casily afford to pay cash for the car without rusning into debt non or in the foresecable future. If his cash eams interest at a 1.50\% APR (based on monthly compounding) at the bank, what would be his best purchase option for the car? 3. In fact, Adam doesn't have sufficient cash to cover all his debts including his (substantial) student tosns. The loans have a 12.5\%s APR, and any money spent on the car could not be used to pay down the loans. What is the best option for Adam now? (Hint: Note that having an extra $1 today saves Adam rooghly S1.125 next year because be can pay down the student loans. So, 12% is Adam's time value of money in this case) 4. Suppose instead Adam has a lot of credit card debt, with an 26.25% APR, and be doubes he will pay off this debt completely before be pays off the car. What is Adam's best option now? (Hint: Sce Hint on H3 above) 5. Suppose Jenna's Treasury bond has a coupon interest rate of 2.5%, paid semiannually, while current Treasury beads with the same mafurity date have a yield to maturity of 3.50% (expressed as an APR with semiannual compounding). If she has just received the bond's 10 th coupon, what is the value of Jenna's Treasury Bond today? 6. Suppose Jenna sells the bond, reinvests the proceeds, and then saves as she planned. If, indeed, Jenna carns a 6.00%5 annual return on bet svings, bow much could she withdraw each year in retirement? (Assume she begins withdrawing the money from the account in equal amounts at the end of each year once her retirement begins.) 7. Jenna expects ber salary to grow regularly. While there are no guarantecs, she believes an increase of 3.25% a year is reasonable. She plans to save $5,000 the first year, and then increase the amount she saves by the amount of her annual salary increase. Unfortunately, prices will also grow due to inflation. Suppose Jenna assumes there will be 3% inflation every year. In retiremen, she will need to increase ber withdrawals each year to keep up with inflation. a. How much moncy will Jenna bave at ber retirement? b. How much can sbe withdraw at the end of the first year of her retirement in today's dollars? Hint: Value Jenna's Retirement Fund at Retirement Age = FV of Treasury Bond + FV of Jenna's Savings 8. Should Jenna sell her Treasury bond and invest the proceeds in the stock fund? Give at least one reason for and against this plan. 9. At the last minute, Jenna considers investing in Coca-Cola stock at a price of 563.99 per share instead. The stock just paid an annual dividend of S1.76 and she expects the dividend to grow at 2.00% annually. If the next dividend is duc in one year, what expected return is CocarCola stock offering