Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This case highlights the deficiencies of traditional methods of product costing which employ single volume drivers of overhead cost allocation. It provides the opportunity

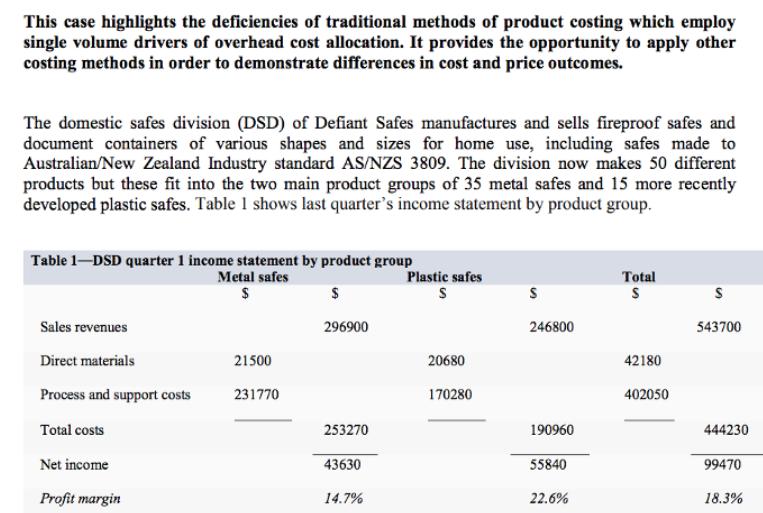

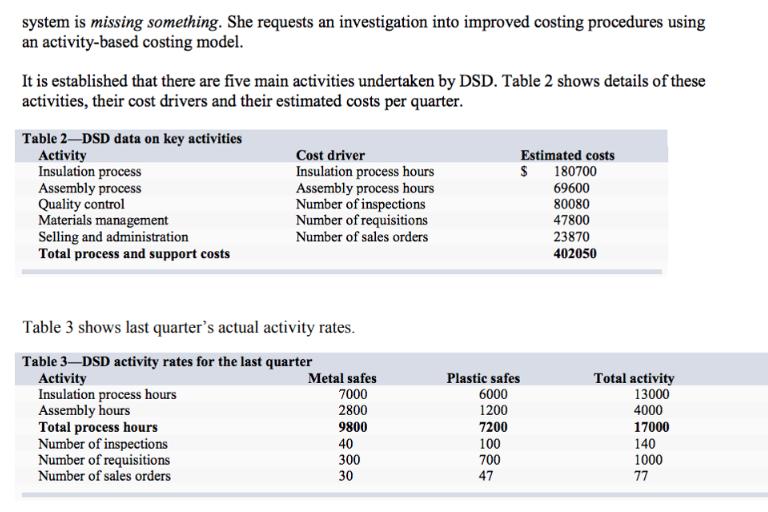

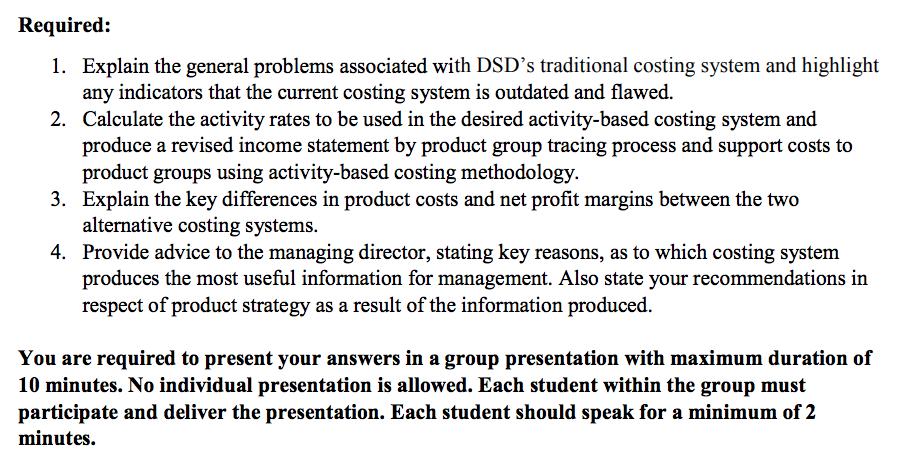

This case highlights the deficiencies of traditional methods of product costing which employ single volume drivers of overhead cost allocation. It provides the opportunity to apply other costing methods in order to demonstrate differences in cost and price outcomes. The domestic safes division (DSD) of Defiant Safes manufactures and sells fireproof safes and document containers of various shapes and sizes for home use, including safes made to Australian/New Zealand Industry standard AS/NZS 3809. The division now makes 50 different products but these fit into the two main product groups of 35 metal safes and 15 more recently developed plastic safes. Table 1 shows last quarter's income statement by product group. Table 1-DSD quarter 1 income statement by product group Metal safes $ $ 296900 Sales revenues Direct materials Process and support costs Total costs Net income Profit margin 21500 231770 253270 43630 14.7% Plastic safes S 20680 170280 S 246800 190960 55840 22.6% Total S 42180 402050 S 543700 444230 99470 18.3% system is missing something. She requests an investigation into improved costing procedures using an activity-based costing model. It is established that there are five main activities undertaken by DSD. Table 2 shows details of these activities, their cost drivers and their estimated costs per quarter. Table 2-DSD data on key activities Activity Insulation process Assembly process Quality control Materials management Selling and administration Total process and support costs Cost driver Insulation process hours Assembly process hours Number of inspections Number of requisitions Number of sales orders Table 3 shows last quarter's actual activity rates. Table 3-DSD activity rates for the last quarter Activity Insulation process hours Assembly hours Total process hours Number of inspections Number of requisitions Number of sales orders Metal safes 7000 2800 9800 40 300 30 Estimated costs $ 180700 69600 80080 47800 23870 402050 Plastic safes 6000 1200 7200 100 700 47 Total activity 13000 4000 17000 140 1000 77 The assembly process for plastic safes is quite complex and there has recently been a high level of rejects. This has resulted in the need for increased quality control activities. Plastic safes generally comprise more components than metal safes, causing more material movements. The plastic safe product group is still new and DSD's customer base is characterised by a large number of customers each ordering small volumes. Required: 1. Explain the general problems associated with DSD's traditional costing system and highlight any indicators that the current costing system is outdated and flawed. 2. Calculate the activity rates to be used in the desired activity-based costing system and produce a revised income statement by product group tracing process and support costs to product groups using activity-based costing methodology. Explain the key differences in product costs and net profit margins between the two alternative costing systems. 3. 4. Provide advice to the managing director, stating key reasons, as to which costing system produces the most useful information for management. Also state your recommendations in respect of product strategy as a result of the information produced. You are required to present your answers in a group presentation with maximum duration of 10 minutes. No individual presentation is allowed. Each student within the group must participate and deliver the presentation. Each student should speak for a minimum of 2 minutes. This case highlights the deficiencies of traditional methods of product costing which employ single volume drivers of overhead cost allocation. It provides the opportunity to apply other costing methods in order to demonstrate differences in cost and price outcomes. The domestic safes division (DSD) of Defiant Safes manufactures and sells fireproof safes and document containers of various shapes and sizes for home use, including safes made to Australian/New Zealand Industry standard AS/NZS 3809. The division now makes 50 different products but these fit into the two main product groups of 35 metal safes and 15 more recently developed plastic safes. Table 1 shows last quarter's income statement by product group. Table 1-DSD quarter 1 income statement by product group Metal safes $ $ 296900 Sales revenues Direct materials Process and support costs Total costs Net income Profit margin 21500 231770 253270 43630 14.7% Plastic safes S 20680 170280 S 246800 190960 55840 22.6% Total S 42180 402050 S 543700 444230 99470 18.3% system is missing something. She requests an investigation into improved costing procedures using an activity-based costing model. It is established that there are five main activities undertaken by DSD. Table 2 shows details of these activities, their cost drivers and their estimated costs per quarter. Table 2-DSD data on key activities Activity Insulation process Assembly process Quality control Materials management Selling and administration Total process and support costs Cost driver Insulation process hours Assembly process hours Number of inspections Number of requisitions Number of sales orders Table 3 shows last quarter's actual activity rates. Table 3-DSD activity rates for the last quarter Activity Insulation process hours Assembly hours Total process hours Number of inspections Number of requisitions Number of sales orders Metal safes 7000 2800 9800 40 300 30 Estimated costs $ 180700 69600 80080 47800 23870 402050 Plastic safes 6000 1200 7200 100 700 47 Total activity 13000 4000 17000 140 1000 77 The assembly process for plastic safes is quite complex and there has recently been a high level of rejects. This has resulted in the need for increased quality control activities. Plastic safes generally comprise more components than metal safes, causing more material movements. The plastic safe product group is still new and DSD's customer base is characterised by a large number of customers each ordering small volumes. Required: 1. Explain the general problems associated with DSD's traditional costing system and highlight any indicators that the current costing system is outdated and flawed. 2. Calculate the activity rates to be used in the desired activity-based costing system and produce a revised income statement by product group tracing process and support costs to product groups using activity-based costing methodology. Explain the key differences in product costs and net profit margins between the two alternative costing systems. 3. 4. Provide advice to the managing director, stating key reasons, as to which costing system produces the most useful information for management. Also state your recommendations in respect of product strategy as a result of the information produced. You are required to present your answers in a group presentation with maximum duration of 10 minutes. No individual presentation is allowed. Each student within the group must participate and deliver the presentation. Each student should speak for a minimum of 2 minutes. This case highlights the deficiencies of traditional methods of product costing which employ single volume drivers of overhead cost allocation. It provides the opportunity to apply other costing methods in order to demonstrate differences in cost and price outcomes. The domestic safes division (DSD) of Defiant Safes manufactures and sells fireproof safes and document containers of various shapes and sizes for home use, including safes made to Australian/New Zealand Industry standard AS/NZS 3809. The division now makes 50 different products but these fit into the two main product groups of 35 metal safes and 15 more recently developed plastic safes. Table 1 shows last quarter's income statement by product group. Table 1-DSD quarter 1 income statement by product group Metal safes $ $ 296900 Sales revenues Direct materials Process and support costs Total costs Net income Profit margin 21500 231770 253270 43630 14.7% Plastic safes S 20680 170280 S 246800 190960 55840 22.6% Total S 42180 402050 S 543700 444230 99470 18.3% system is missing something. She requests an investigation into improved costing procedures using an activity-based costing model. It is established that there are five main activities undertaken by DSD. Table 2 shows details of these activities, their cost drivers and their estimated costs per quarter. Table 2-DSD data on key activities Activity Insulation process Assembly process Quality control Materials management Selling and administration Total process and support costs Cost driver Insulation process hours Assembly process hours Number of inspections Number of requisitions Number of sales orders Table 3 shows last quarter's actual activity rates. Table 3-DSD activity rates for the last quarter Activity Insulation process hours Assembly hours Total process hours Number of inspections Number of requisitions Number of sales orders Metal safes 7000 2800 9800 40 300 30 Estimated costs $ 180700 69600 80080 47800 23870 402050 Plastic safes 6000 1200 7200 100 700 47 Total activity 13000 4000 17000 140 1000 77 The assembly process for plastic safes is quite complex and there has recently been a high level of rejects. This has resulted in the need for increased quality control activities. Plastic safes generally comprise more components than metal safes, causing more material movements. The plastic safe product group is still new and DSD's customer base is characterised by a large number of customers each ordering small volumes. Required: 1. Explain the general problems associated with DSD's traditional costing system and highlight any indicators that the current costing system is outdated and flawed. 2. Calculate the activity rates to be used in the desired activity-based costing system and produce a revised income statement by product group tracing process and support costs to product groups using activity-based costing methodology. Explain the key differences in product costs and net profit margins between the two alternative costing systems. 3. 4. Provide advice to the managing director, stating key reasons, as to which costing system produces the most useful information for management. Also state your recommendations in respect of product strategy as a result of the information produced. You are required to present your answers in a group presentation with maximum duration of 10 minutes. No individual presentation is allowed. Each student within the group must participate and deliver the presentation. Each student should speak for a minimum of 2 minutes. This case highlights the deficiencies of traditional methods of product costing which employ single volume drivers of overhead cost allocation. It provides the opportunity to apply other costing methods in order to demonstrate differences in cost and price outcomes. The domestic safes division (DSD) of Defiant Safes manufactures and sells fireproof safes and document containers of various shapes and sizes for home use, including safes made to Australian/New Zealand Industry standard AS/NZS 3809. The division now makes 50 different products but these fit into the two main product groups of 35 metal safes and 15 more recently developed plastic safes. Table 1 shows last quarter's income statement by product group. Table 1-DSD quarter 1 income statement by product group Metal safes $ $ 296900 Sales revenues Direct materials Process and support costs Total costs Net income Profit margin 21500 231770 253270 43630 14.7% Plastic safes S 20680 170280 S 246800 190960 55840 22.6% Total S 42180 402050 S 543700 444230 99470 18.3% system is missing something. She requests an investigation into improved costing procedures using an activity-based costing model. It is established that there are five main activities undertaken by DSD. Table 2 shows details of these activities, their cost drivers and their estimated costs per quarter. Table 2-DSD data on key activities Activity Insulation process Assembly process Quality control Materials management Selling and administration Total process and support costs Cost driver Insulation process hours Assembly process hours Number of inspections Number of requisitions Number of sales orders Table 3 shows last quarter's actual activity rates. Table 3-DSD activity rates for the last quarter Activity Insulation process hours Assembly hours Total process hours Number of inspections Number of requisitions Number of sales orders Metal safes 7000 2800 9800 40 300 30 Estimated costs $ 180700 69600 80080 47800 23870 402050 Plastic safes 6000 1200 7200 100 700 47 Total activity 13000 4000 17000 140 1000 77 The assembly process for plastic safes is quite complex and there has recently been a high level of rejects. This has resulted in the need for increased quality control activities. Plastic safes generally comprise more components than metal safes, causing more material movements. The plastic safe product group is still new and DSD's customer base is characterised by a large number of customers each ordering small volumes. Required: 1. Explain the general problems associated with DSD's traditional costing system and highlight any indicators that the current costing system is outdated and flawed. 2. Calculate the activity rates to be used in the desired activity-based costing system and produce a revised income statement by product group tracing process and support costs to product groups using activity-based costing methodology. Explain the key differences in product costs and net profit margins between the two alternative costing systems. 3. 4. Provide advice to the managing director, stating key reasons, as to which costing system produces the most useful information for management. Also state your recommendations in respect of product strategy as a result of the information produced. You are required to present your answers in a group presentation with maximum duration of 10 minutes. No individual presentation is allowed. Each student within the group must participate and deliver the presentation. Each student should speak for a minimum of 2 minutes.

Step by Step Solution

★★★★★

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

1 The company currently used traditional costing system of allocating process and support costs to t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started