Question

This case presents the cash flows of eight unidentified investments, all of equal initial investment size. Your task is to rank the projects. The first

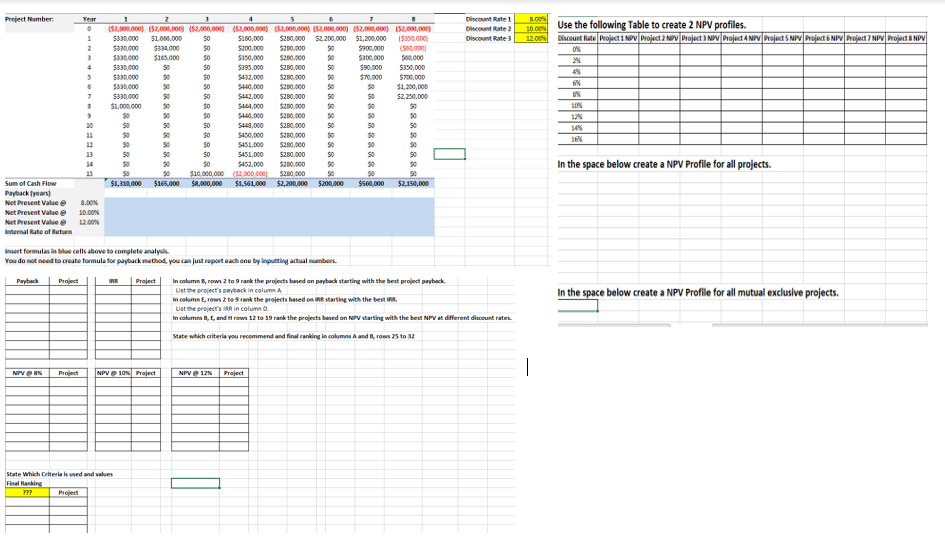

This case presents the cash flows of eight unidentified investments, all of equal initial investment size. Your task is to rank the projects. The first objective of the case is to encourage you to examine critically the principal capital-budgeting criteria. A second objective is for you to consider the problem that arises when net present value (NPV) and internal rate of return (IRR) disagree as to the ranking of two mutually exclusive projects. You were recently hired in the finance department of a corporation that has a number of subsidiaries with different investment projects. You are assigned to analyze eight different projects based strictly on their cash flow streams using the payback, IRR, and NPV techniques. All of the projects are independent projects, except for projects 7 and 8 which are mutually exclusive. Before doing any calculations, can we rank the projects simply by inspecting the cash flows? What analytical criteria can we use to rank the projects? How do you define each criterion? Which of the two projects, 7 or 8, is more attractive? How sensitive is our ranking to the use of high discount rates? Why do NPV and IRR disagree? What rank should we assign to each project? Why do payback and NPV not agree completely? Why do average return on investment and NPV not agree completely? Which criterion is best? Are those projects comparable on the basis of NPV? Because the projects have different lives, are we really measuring the net present value of the short-lived projects? Tasks: Prepare a one page summary of your analysis that addresses the questions. Be sure to reference supporting exhibits (Excel spreadsheets) where appropriate. Copy your Tables that contain all rankings into your Word Doc report and submit both your report and excel files in the dropbox. For your final recommendation assume that the weighted average cost of capital for the firm is equal to 10%. Please fill all excel with formulas

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started