Answered step by step

Verified Expert Solution

Question

1 Approved Answer

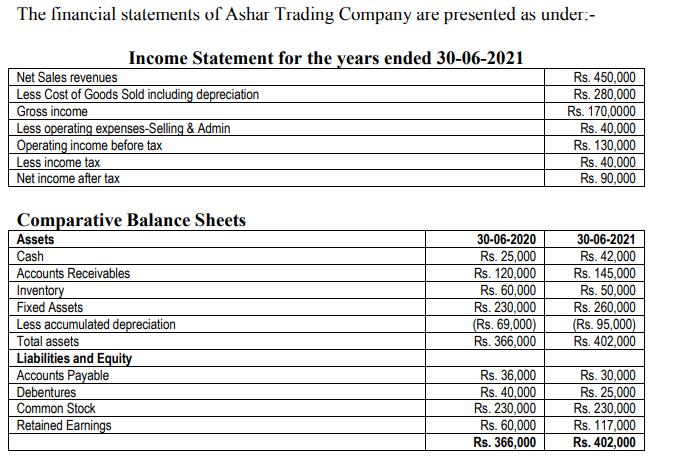

The financial statements of Ashar Trading Company are presented as under:- Income Statement for the years ended 30-06-2021 Net Sales revenues Less Cost of

The financial statements of Ashar Trading Company are presented as under:- Income Statement for the years ended 30-06-2021 Net Sales revenues Less Cost of Goods Sold including depreciation Gross income & Admin Less operating expenses-Selling Operating income before tax Less income tax Net income after tax Comparative Balance Sheets Assets Cash Accounts Receivables Inventory Fixed Assets Less accumulated depreciation Total assets Liabilities and Equity Accounts Payable Debentures Common Stock Retained Earnings 30-06-2020 Rs. 25,000 Rs. 120,000 Rs. 60,000 Rs. 230,000 (Rs. 69,000) Rs. 366,000 Rs. 36,000 Rs. 40,000 Rs. 230,000 Rs. 60,000 Rs. 366,000 Rs. 450,000 Rs. 280,000 Rs. 170,0000 Rs. 40,000 Rs. 130,000 Rs. 40,000 Rs. 90,000 30-06-2021 Rs. 42,000 Rs. 145,000 Rs. 50,000 Rs. 260,000 (Rs. 95,000) Rs. 402,000 Rs. 30,000 Rs. 25,000 Rs. 230,000 Rs. 117,000 Rs. 402,000 Required: a) Prepare cash flow statement for the year ended 30 June, 2021 under direct method. b) Prepare cash flow statement for the year ended 30 June 2021 under indirect method.

Step by Step Solution

★★★★★

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

A Cash Flow Statement for the Year Ended 30 June 2021 Under Direct Method Cash flows from operating ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started