Answered step by step

Verified Expert Solution

Question

1 Approved Answer

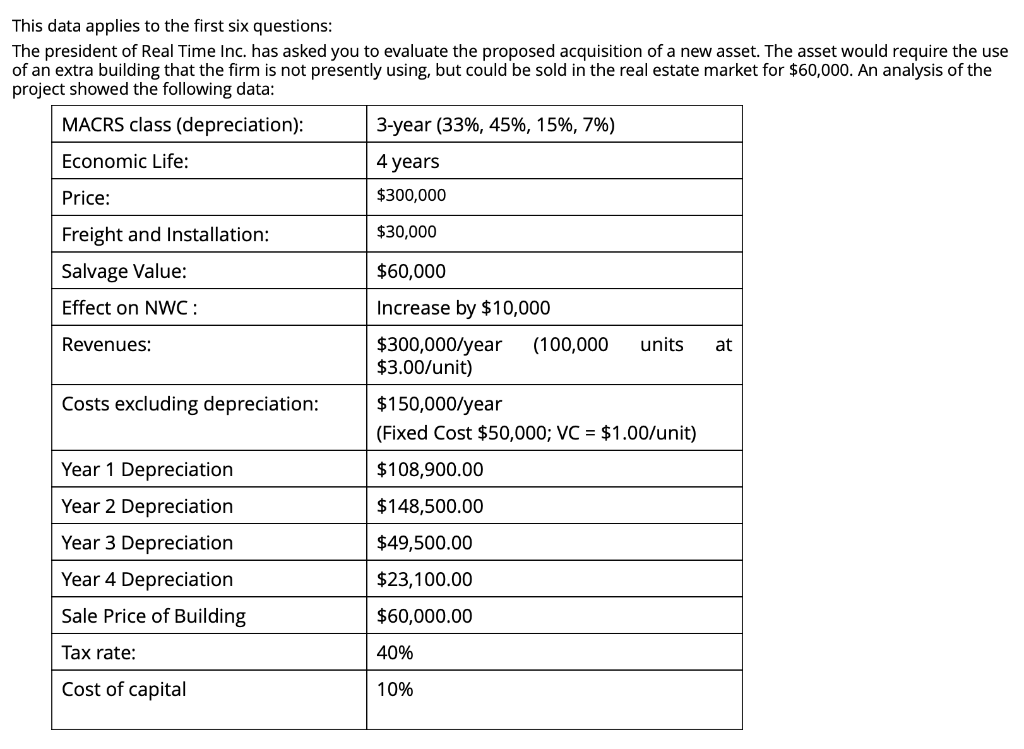

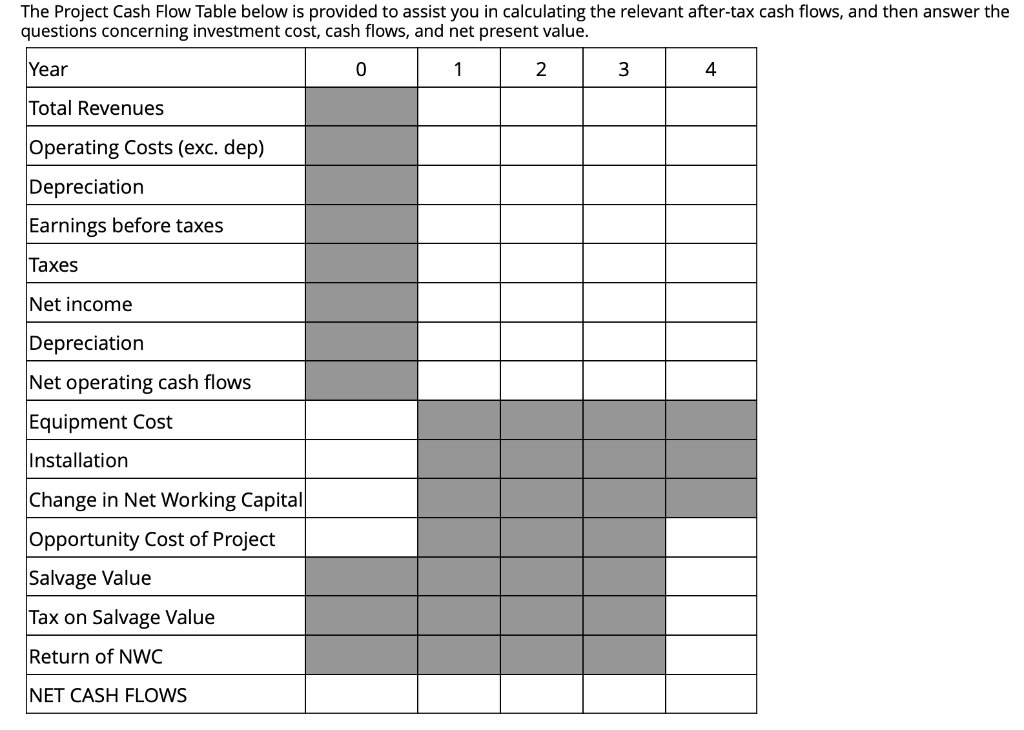

This data applies to the first six questions: The president of Real Time Inc. has asked you to evaluate the proposed acquisition of a new

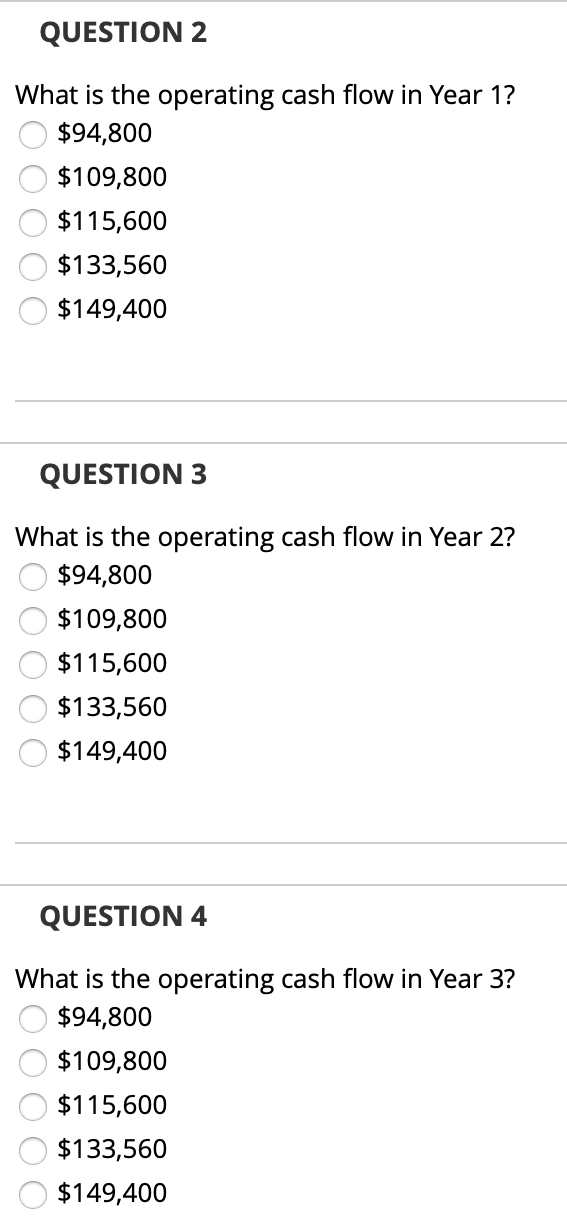

This data applies to the first six questions: The president of Real Time Inc. has asked you to evaluate the proposed acquisition of a new asset. The asset would require the use of an extra building that the firm is not presently using, but could be sold in the real estate market for $60,000. An analysis of the project showed the following data: 3-year (33%, 45%, 15%, 7%) MACRS class (depreciation): Economic Life: 4 years Price: $300,000 $30,000 Freight and Installation: Salvage Value: Effect on NWC: Revenues: $60,000 Increase by $10,000 $300,000/year (100,000 units $3.00/unit) $150,000/year (Fixed Cost $50,000; VC = $1.00/unit) at Costs excluding depreciation: Year 1 Depreciation $108,900.00 Year 2 Depreciation $148,500.00 Year 3 Depreciation Year 4 Depreciation Sale Price of Building Tax rate: Cost of capital $49,500.00 $23,100.00 $60,000.00 40% 10% The Project Cash Flow Table below is provided to assist you in calculating the relevant after-tax cash flows, and then answer the questions concerning investment cost, cash flows, and net present value. Year 3 4 Total Revenues Operating costs (exc. dep) Depreciation Earnings before taxes Taxes Net income Depreciation Net operating cash flows Equipment Cost Installation Change in Net Working Capital Opportunity Cost of Project Salvage Value Tax on Salvage Value Return of NWC NET CASH FLOWS QUESTION 2 What is the operating cash flow in Year 1? $94,800 $109,800 $115,600 $133,560 $149,400 QUESTION 3 What is the operating cash flow in Year 2? $94,800 $109,800 $115,600 $133,560 $149,400 QUESTION 4 What is the operating cash flow in Year 3? $94,800 $109,800 $115,600 $133,560 $149,400 This data applies to the first six questions: The president of Real Time Inc. has asked you to evaluate the proposed acquisition of a new asset. The asset would require the use of an extra building that the firm is not presently using, but could be sold in the real estate market for $60,000. An analysis of the project showed the following data: 3-year (33%, 45%, 15%, 7%) MACRS class (depreciation): Economic Life: 4 years Price: $300,000 $30,000 Freight and Installation: Salvage Value: Effect on NWC: Revenues: $60,000 Increase by $10,000 $300,000/year (100,000 units $3.00/unit) $150,000/year (Fixed Cost $50,000; VC = $1.00/unit) at Costs excluding depreciation: Year 1 Depreciation $108,900.00 Year 2 Depreciation $148,500.00 Year 3 Depreciation Year 4 Depreciation Sale Price of Building Tax rate: Cost of capital $49,500.00 $23,100.00 $60,000.00 40% 10% The Project Cash Flow Table below is provided to assist you in calculating the relevant after-tax cash flows, and then answer the questions concerning investment cost, cash flows, and net present value. Year 3 4 Total Revenues Operating costs (exc. dep) Depreciation Earnings before taxes Taxes Net income Depreciation Net operating cash flows Equipment Cost Installation Change in Net Working Capital Opportunity Cost of Project Salvage Value Tax on Salvage Value Return of NWC NET CASH FLOWS QUESTION 2 What is the operating cash flow in Year 1? $94,800 $109,800 $115,600 $133,560 $149,400 QUESTION 3 What is the operating cash flow in Year 2? $94,800 $109,800 $115,600 $133,560 $149,400 QUESTION 4 What is the operating cash flow in Year 3? $94,800 $109,800 $115,600 $133,560 $149,400

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started