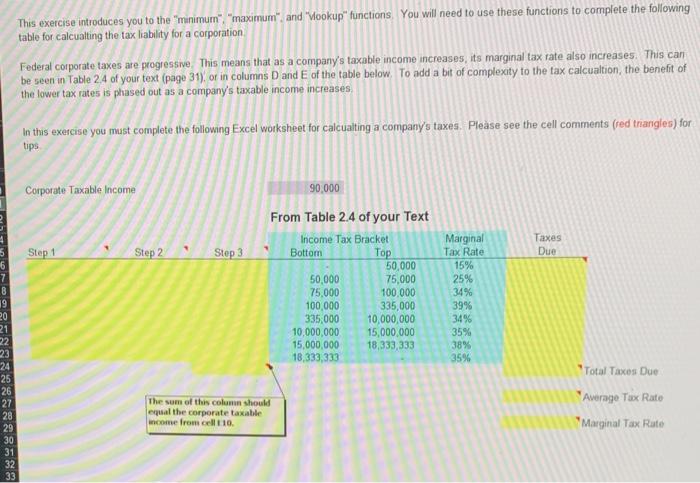

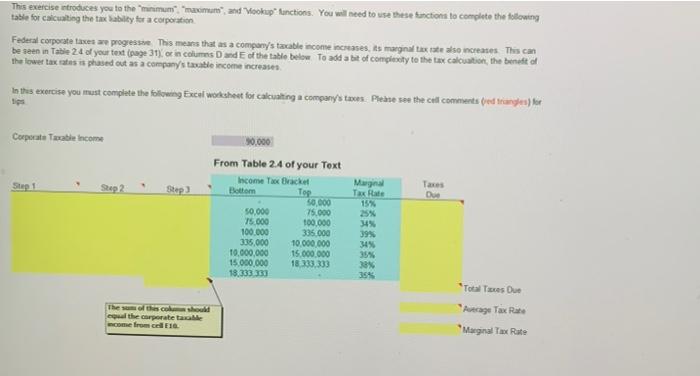

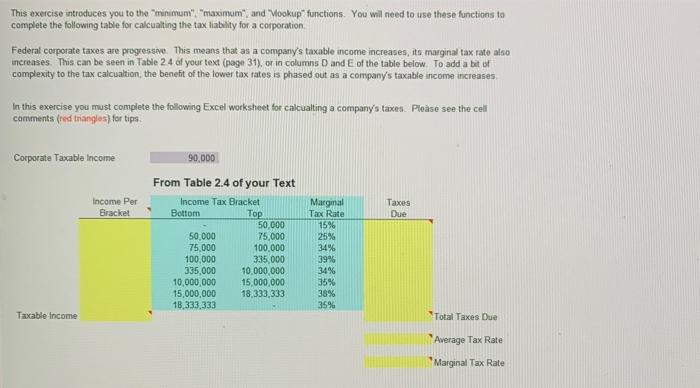

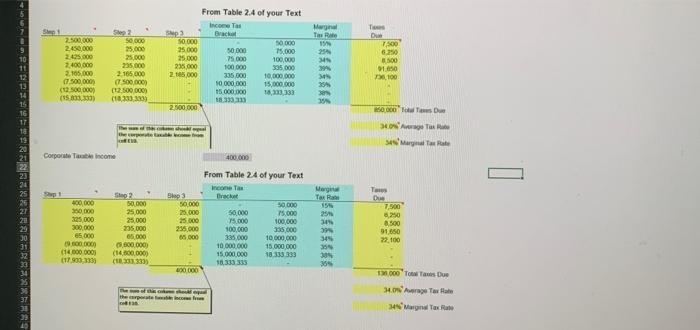

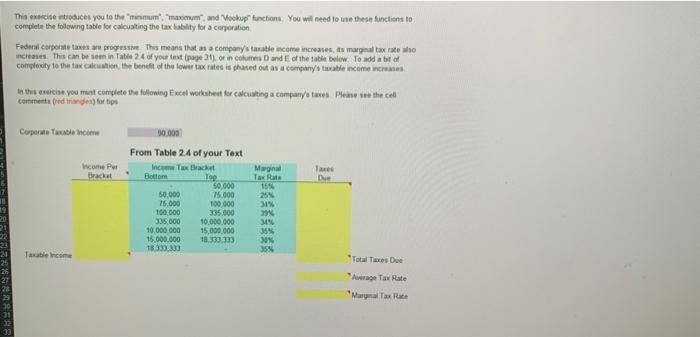

This exercise introduces you to the "minimum", "maximum", and "Mookup" functions. You will need to use these functions to complete the following table for calcualting the tax liability for a corporation. Federal corporate taxes are progressive. This means that as a company's taxable income increases, its marginal tax rate also increases. This can be seen in Table 2.4 of your text (page 31). of in columns D and E of the table below. To add a bit of complexity to the tax calcualtion, the benefi of the lower tax rates is phased out as a company's taxable income increases. In this exercise you must complete the following Excel worksheet for calcualting a company's taxes. Plese see the cell comments (red trangles) for tips This exercise introduces you to the "marimum", "Guicmam", and "Yookup" Alnctions. You will need to use these hanctions to complete the following table for caicualing the tax babilfy for a copporation. Federal corpocate taxes are progyessae. This mears that as a compory/s taxable inconte increases, iss magginal tix tate also increases. This can be geen in Table 2.4 of your text (ovge 31), or in colums D and E of the table beilow To add a bit of complisxity te the tro calcuation, the beineft of the lowet tax ratas is phased out as a cormany/s taxatle incoene increases. In thas exercise you must complete the folvering Fxcal workhoet for calcualting a company's taoes: Phease see the cill comments (yed triangles) lor. This exercise introduces you to the "minimum", "maximum"; and "Yookup" functions. You wil need to use these functions to complete the following table for calcualting the tax liability for a corporation. Federal corporate taxes are progressive. This means that as a company's taxable income increases, its marginal tax rate also increases. This can be seen in Table 2.4 of your text (page 31), or in colamns D and E of the table below. To add a bit of complexity to the tax calcualtion, the benefit of the lower tax rates is phased out as a company/s taxable income increases. In this exercise you must complete the following Excel worksheet for calcualting a company's taxes. Phese see the cell comments (red triangles) for tips. Corporate Taxable income From Table 2.4 of your Text Frem Table 2.4 of your Text Corporite Tazeit tncomi From Table 24 of your Text complete the folowng table for calcuating the tax bablity for a corporation Fidetal cerperate taxes are progrssive. This means that as a compony's tanatle nicome ncreasen, is magnal tax race also incheases. This can be seen in Table 2.4 of your tevt inope 3 if of in cohmen 0 and E of the 1able below. To add a bi of complewity to the tax calcuahion, the beneft of the lover tax tates is phased out as a cerrginy's taxatle moene ncieases In thes esereise you mat complete the following Excel wokshent far calcuating a canpary/s twes. Please ire the cell corrments (rod tranged) for tipt Copperale tauble holere 90.008 From Table 2.4 of your Text This exercise introduces you to the "minimum", "maximum", and "Mookup" functions. You will need to use these functions to complete the following table for calcualting the tax liability for a corporation. Federal corporate taxes are progressive. This means that as a company's taxable income increases, its marginal tax rate also increases. This can be seen in Table 2.4 of your text (page 31). of in columns D and E of the table below. To add a bit of complexity to the tax calcualtion, the benefi of the lower tax rates is phased out as a company's taxable income increases. In this exercise you must complete the following Excel worksheet for calcualting a company's taxes. Plese see the cell comments (red trangles) for tips This exercise introduces you to the "marimum", "Guicmam", and "Yookup" Alnctions. You will need to use these hanctions to complete the following table for caicualing the tax babilfy for a copporation. Federal corpocate taxes are progyessae. This mears that as a compory/s taxable inconte increases, iss magginal tix tate also increases. This can be geen in Table 2.4 of your text (ovge 31), or in colums D and E of the table beilow To add a bit of complisxity te the tro calcuation, the beineft of the lowet tax ratas is phased out as a cormany/s taxatle incoene increases. In thas exercise you must complete the folvering Fxcal workhoet for calcualting a company's taoes: Phease see the cill comments (yed triangles) lor. This exercise introduces you to the "minimum", "maximum"; and "Yookup" functions. You wil need to use these functions to complete the following table for calcualting the tax liability for a corporation. Federal corporate taxes are progressive. This means that as a company's taxable income increases, its marginal tax rate also increases. This can be seen in Table 2.4 of your text (page 31), or in colamns D and E of the table below. To add a bit of complexity to the tax calcualtion, the benefit of the lower tax rates is phased out as a company/s taxable income increases. In this exercise you must complete the following Excel worksheet for calcualting a company's taxes. Phese see the cell comments (red triangles) for tips. Corporate Taxable income From Table 2.4 of your Text Frem Table 2.4 of your Text Corporite Tazeit tncomi From Table 24 of your Text complete the folowng table for calcuating the tax bablity for a corporation Fidetal cerperate taxes are progrssive. This means that as a compony's tanatle nicome ncreasen, is magnal tax race also incheases. This can be seen in Table 2.4 of your tevt inope 3 if of in cohmen 0 and E of the 1able below. To add a bi of complewity to the tax calcuahion, the beneft of the lover tax tates is phased out as a cerrginy's taxatle moene ncieases In thes esereise you mat complete the following Excel wokshent far calcuating a canpary/s twes. Please ire the cell corrments (rod tranged) for tipt Copperale tauble holere 90.008 From Table 2.4 of your Text