Question

This exercise is using the question in the picture, but replacing some of the information as listed below. Please answer question 2 & 3 from

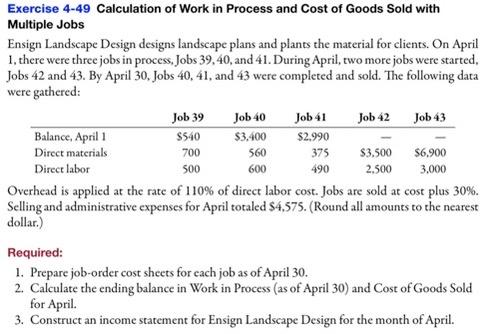

This exercise is using the question in the picture, but replacing some of the information as listed below. Please answer question 2 & 3 from the question in the picture, with the changed information.

*Assume Direct Labor workers make $20 per hour, so with the given labor cost per job, you can determine the number of hours worked. CHANGE the Exercise to say that Overhead is applied at the rate of $32 per direct labor hour. ALSO CHANGE to say that Job #39 and Job #40 were completed and sold, while Job #41 and Job #42 are complete but not sold, and Job #43 is not completed yet.*

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started