Question

This exercise serves as a review of basic accounting, but will also become part of a complex consolidation problem. Students may be a bit fuzzy

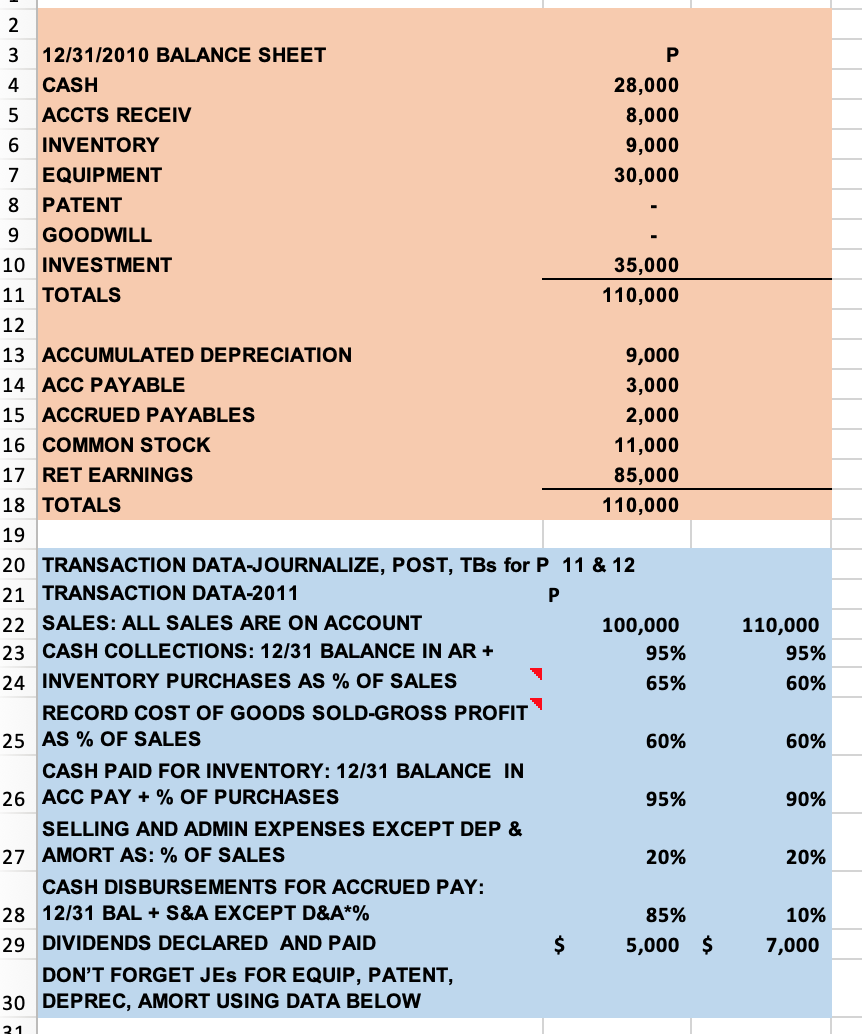

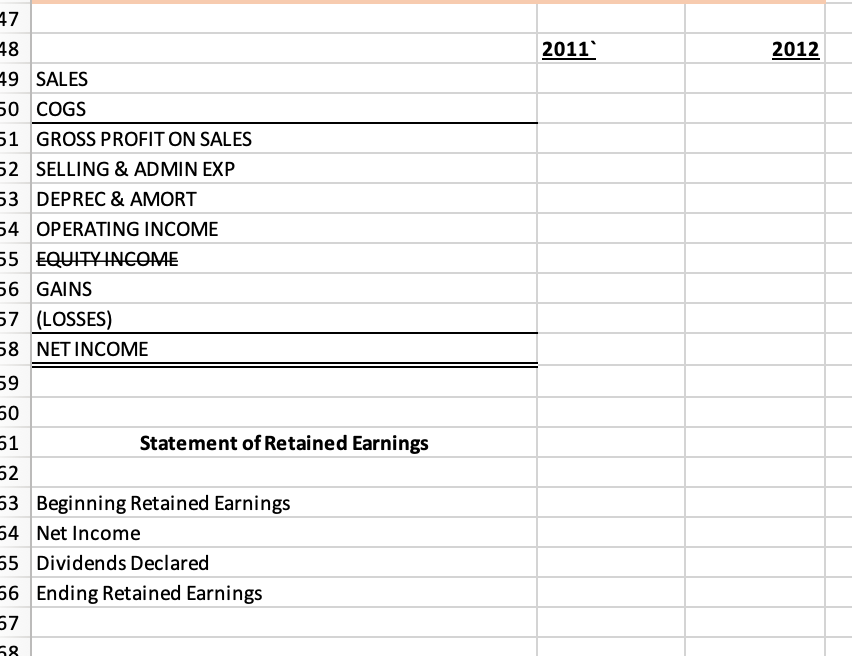

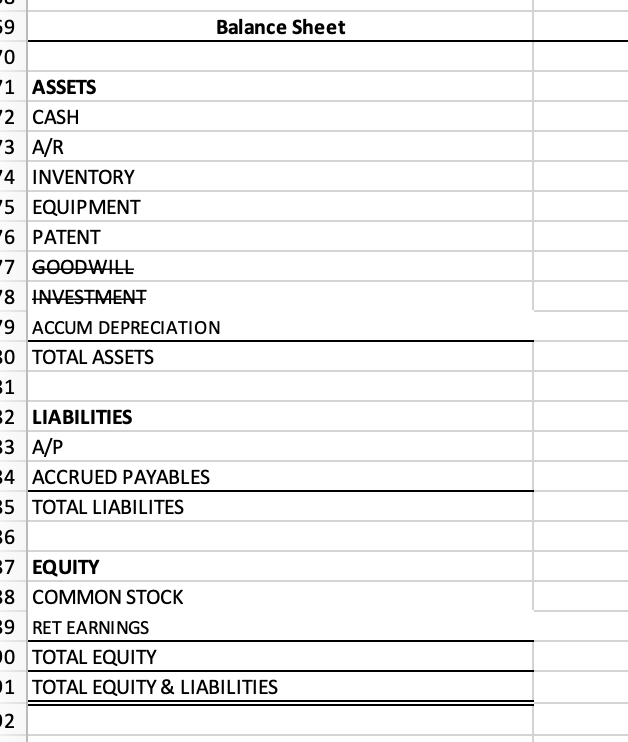

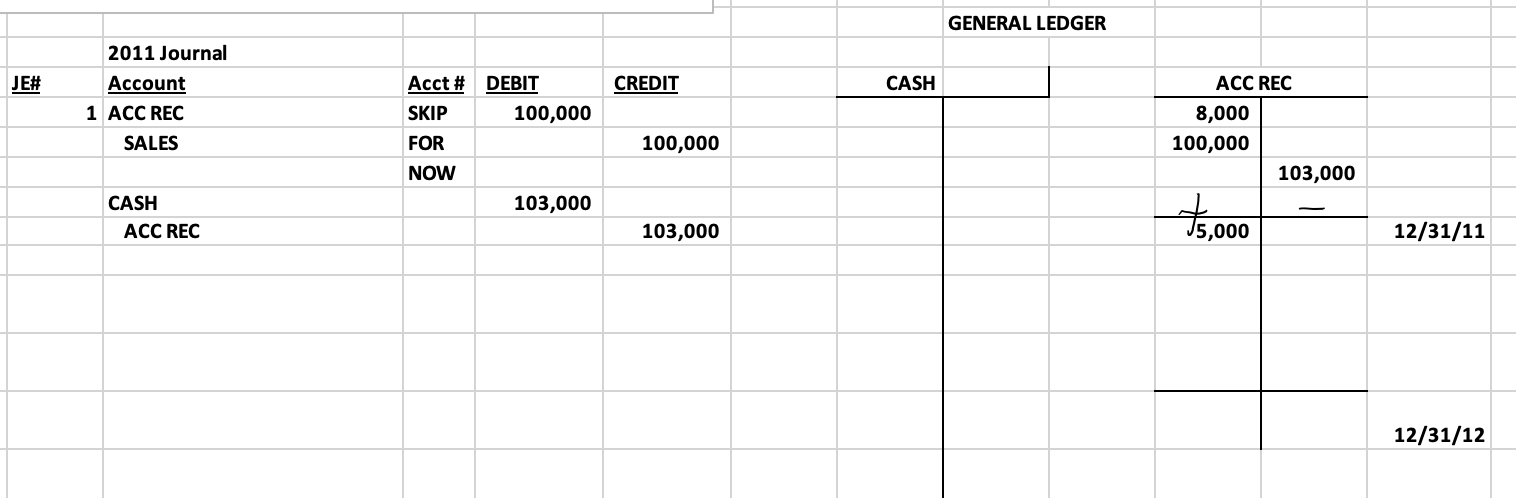

This exercise serves as a review of basic accounting, but will also become part of a complex consolidation problem. Students may be a bit fuzzy on the accounting cycle and understanding consolidations requires a firm grasp of accounting fundamentals. The top panel provides ending ledger balances (post-closing trial balance) for Piels Inc followed by summary tranactions for 2011 and 2012.

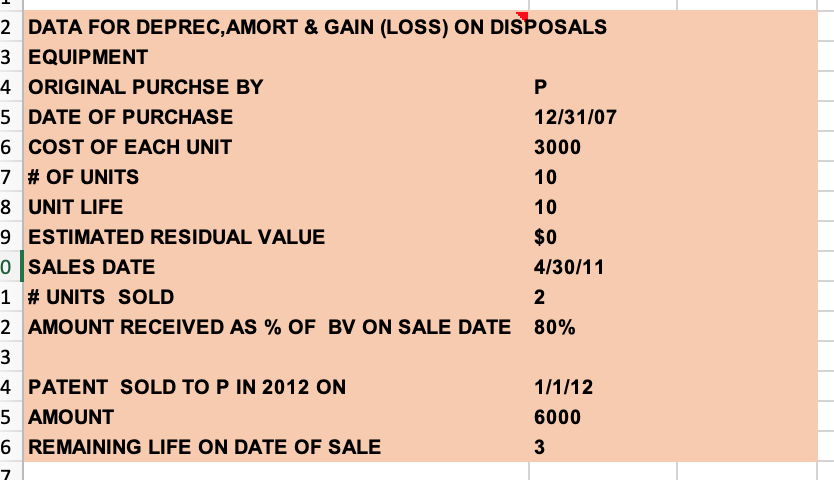

The next below panel provides detail on long-lived assets needed for annual depreciation, and in 2012, amortization. Finally, the financial stament format, which also serves as a chart of accounts is at bottom.

Requirements:

1. Journalize data 2 set up full set of T-Accounts to serve as lesgerand post jpurnal entries to acccounts, 3. ledger balances, and 4. enter balances in financial statements. Repeat for 2012.

Remenber that balance sheet accounts continue from year-to-year, income statements cacts close tp $0.

For this assignment, you do not have to use formulas, not even links. Here and here only, having the correct amounts is sufficent. Future assignments will require correct use of basic fiormulas. Mostly addition, subtraction, multiplication, diviison, and linking cells. Anything more compex will be covered in class. However, Exce;l exists for a reaoon ( it makes our lives easier), so sbetter to start now.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started