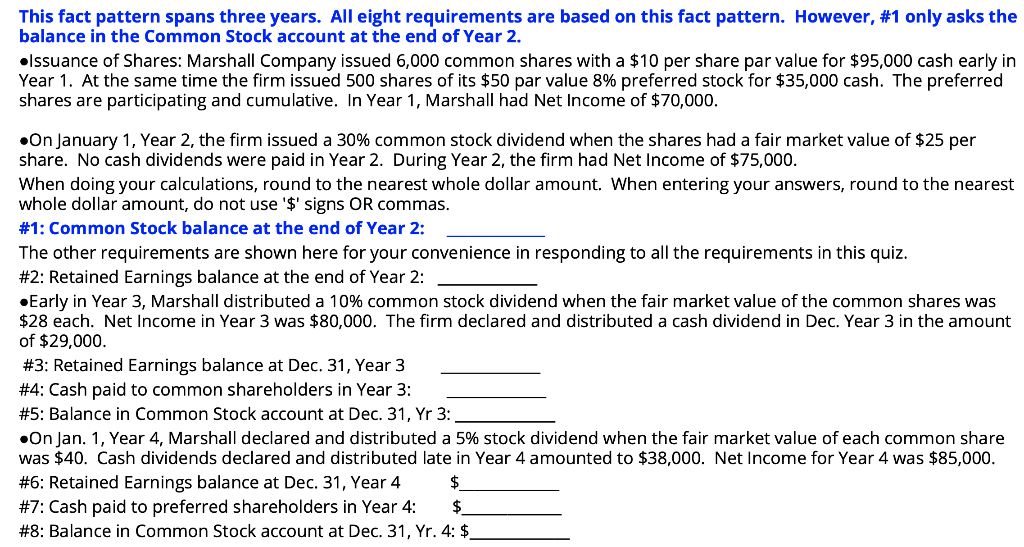

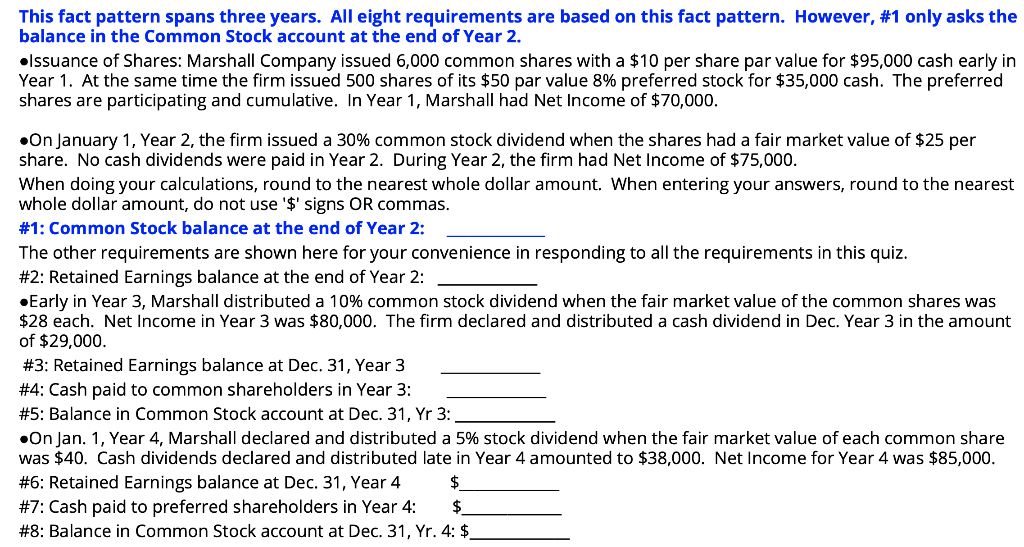

This fact pattern spans three years. All eight requirements are based on this fact pattern. However, #1 only asks the balance in the Common Stock account at the end of Year 2. Issuance of Shares: Marshall Company issued 6,000 common shares with a $10 per share par value for $95,000 cash early in Year 1. At the same time the firm issued 500 shares of its $50 par value 8% preferred stock for $35,000 cash. The preferred shares are participating and cumulative. In Year 1, Marshall had Net Income of $70,000. On January 1, Year 2, the firm issued a 30% common stock dividend when the shares had a fair market value of $25 per share. No cash dividends were paid in Year 2. During Year 2, the firm had Net Income of $75,000. When doing your calculations, round to the nearest whole dollar amount. When entering your answers, round to the nearest whole dollar amount, do not use '$' signs OR commas. #1: Common Stock balance at the end of Year 2: The other requirements are shown here for your convenience in responding to all the requirements in this quiz. #2: Retained Earnings balance at the end of Year 2: _ Early in Year 3, Marshall distributed a 10% common stock dividend when the fair market value of the common shares was $28 each. Net Income in Year 3 was $80,000. The firm declared and distributed a cash dividend in Dec. Year 3 in the amount of $29,000. #3: Retained Earnings balance at Dec. 31, Year 3 #4: Cash paid to common shareholders in Year 3: #5: Balance in Common Stock account at Dec. 31, Yr 3: On Jan. 1, Year 4, Marshall declared and distributed a 5% stock dividend when the fair market value of each common share was $40. Cash dividends declared and distributed late in Year 4 amounted to $38,000. Net Income for Year 4 was $85,000. #6: Retained Earnings balance at Dec. 31, Year 4 $ #7: Cash paid to preferred shareholders in Year 4: $_ #8: Balance in Common Stock account at Dec. 31, Yr. 4: $ This fact pattern spans three years. All eight requirements are based on this fact pattern. However, #1 only asks the balance in the Common Stock account at the end of Year 2. Issuance of Shares: Marshall Company issued 6,000 common shares with a $10 per share par value for $95,000 cash early in Year 1. At the same time the firm issued 500 shares of its $50 par value 8% preferred stock for $35,000 cash. The preferred shares are participating and cumulative. In Year 1, Marshall had Net Income of $70,000. On January 1, Year 2, the firm issued a 30% common stock dividend when the shares had a fair market value of $25 per share. No cash dividends were paid in Year 2. During Year 2, the firm had Net Income of $75,000. When doing your calculations, round to the nearest whole dollar amount. When entering your answers, round to the nearest whole dollar amount, do not use '$' signs OR commas. #1: Common Stock balance at the end of Year 2: The other requirements are shown here for your convenience in responding to all the requirements in this quiz. #2: Retained Earnings balance at the end of Year 2: _ Early in Year 3, Marshall distributed a 10% common stock dividend when the fair market value of the common shares was $28 each. Net Income in Year 3 was $80,000. The firm declared and distributed a cash dividend in Dec. Year 3 in the amount of $29,000. #3: Retained Earnings balance at Dec. 31, Year 3 #4: Cash paid to common shareholders in Year 3: #5: Balance in Common Stock account at Dec. 31, Yr 3: On Jan. 1, Year 4, Marshall declared and distributed a 5% stock dividend when the fair market value of each common share was $40. Cash dividends declared and distributed late in Year 4 amounted to $38,000. Net Income for Year 4 was $85,000. #6: Retained Earnings balance at Dec. 31, Year 4 $ #7: Cash paid to preferred shareholders in Year 4: $_ #8: Balance in Common Stock account at Dec. 31, Yr. 4: $