this gives us:

question:

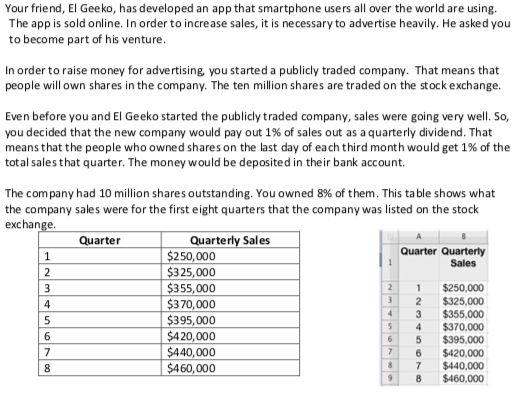

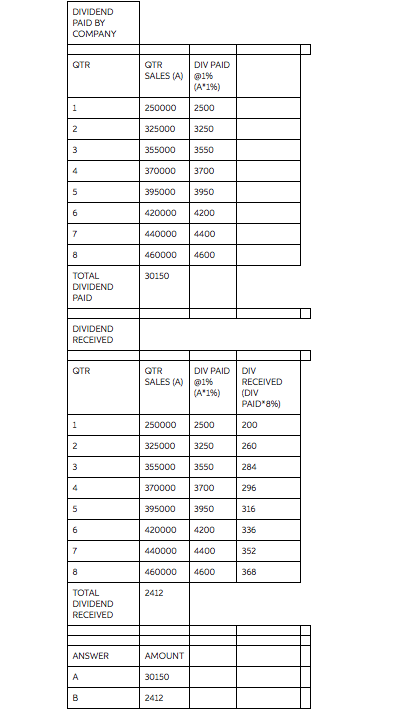

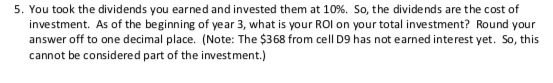

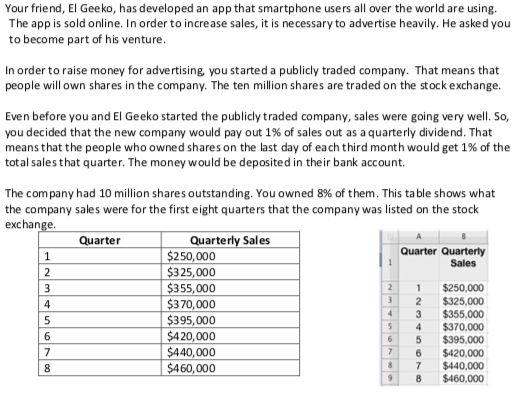

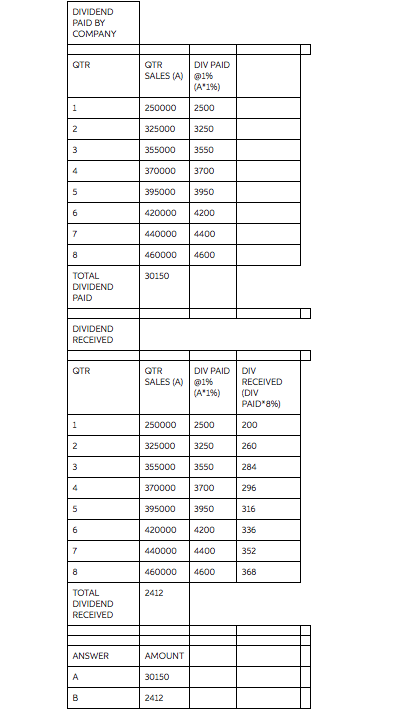

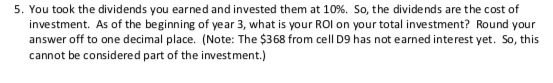

Your friend, El Geeko, has developed an app that smartphone users all over the world are using. The app is sold online. In order to increase sales, it is necessary to advertise heavily. He asked you to become part of his venture. In order to raise money for advertising you started a publicly traded company. That means that people will own shares in the company. The ten million shares are traded on the stock exchange. Even before you and El Geeko started the publicly traded company, sales were going very well. So, you decided that the new company would pay out 1% of sales out as a quarterly dividend. That means that the people who owned shares on the last day of each third month wou total sales that quarter. The money would be deposited in their bank account. The company had 10 million shares outstanding. You owned 8% of them. This table shows what the company sales were for the first eight quarters that the company was listed on the stock exchange. Quarter Quarterly Sales 1 250 000 Quarter Quarterly Sales 2 $325,000 3 $355,000 1 $250.000 $370,000 $325,000 5 $395,000 $355,000 $370.000 $420,000 $395,000 $440,000 $420,000 $460,000 7 $440,000 8 $460,000 3 DIVIDEND PAID BY COMPANY QTR SALES (A) DIV PAID 1% (A'1%) 250000 2500 325000 3250 355000 370000 395000 420000 440000 460000 3550 3700 3950 200 4400 4600 30150 TOTAL DIVIDEND PAID DIVIDEND RECEIVED DIV GTR SALES (A) DIV PAID @1% (A'196) RECEIVED (DIV PAID 896) 200 260 250000 325000 355000 370000 2500 3250 3550 3700 284 395000 3950 296 316 336 352 420000 440000 4200 4400 460000 4600 368 2412 TOTAL DIVIDEND RECEIVED ANSWER AMOUNT 30150 2412 5. You took the dividends you earned and invested them at 10%. So, the dividends are the cost of investment. As of the beginning of year 3, what is your ROI on your total investment? Round your answer off to one decimal place. (Note: The $368 from cell D9 has not earned interest yet. So, this cannot be considered part of the investment.) Your friend, El Geeko, has developed an app that smartphone users all over the world are using. The app is sold online. In order to increase sales, it is necessary to advertise heavily. He asked you to become part of his venture. In order to raise money for advertising you started a publicly traded company. That means that people will own shares in the company. The ten million shares are traded on the stock exchange. Even before you and El Geeko started the publicly traded company, sales were going very well. So, you decided that the new company would pay out 1% of sales out as a quarterly dividend. That means that the people who owned shares on the last day of each third month wou total sales that quarter. The money would be deposited in their bank account. The company had 10 million shares outstanding. You owned 8% of them. This table shows what the company sales were for the first eight quarters that the company was listed on the stock exchange. Quarter Quarterly Sales 1 250 000 Quarter Quarterly Sales 2 $325,000 3 $355,000 1 $250.000 $370,000 $325,000 5 $395,000 $355,000 $370.000 $420,000 $395,000 $440,000 $420,000 $460,000 7 $440,000 8 $460,000 3 DIVIDEND PAID BY COMPANY QTR SALES (A) DIV PAID 1% (A'1%) 250000 2500 325000 3250 355000 370000 395000 420000 440000 460000 3550 3700 3950 200 4400 4600 30150 TOTAL DIVIDEND PAID DIVIDEND RECEIVED DIV GTR SALES (A) DIV PAID @1% (A'196) RECEIVED (DIV PAID 896) 200 260 250000 325000 355000 370000 2500 3250 3550 3700 284 395000 3950 296 316 336 352 420000 440000 4200 4400 460000 4600 368 2412 TOTAL DIVIDEND RECEIVED ANSWER AMOUNT 30150 2412 5. You took the dividends you earned and invested them at 10%. So, the dividends are the cost of investment. As of the beginning of year 3, what is your ROI on your total investment? Round your answer off to one decimal place. (Note: The $368 from cell D9 has not earned interest yet. So, this cannot be considered part of the investment.)