Answered step by step

Verified Expert Solution

Question

1 Approved Answer

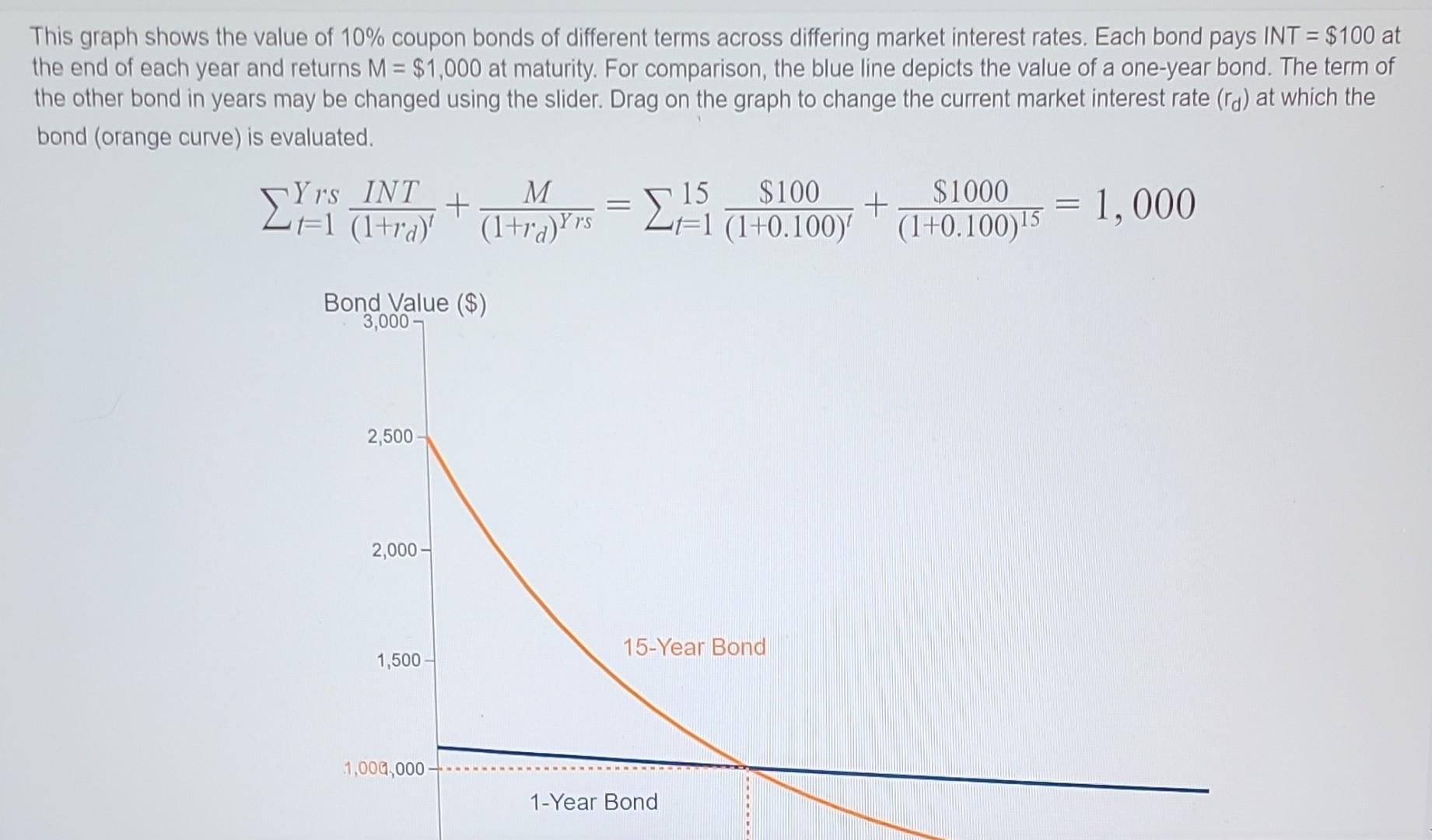

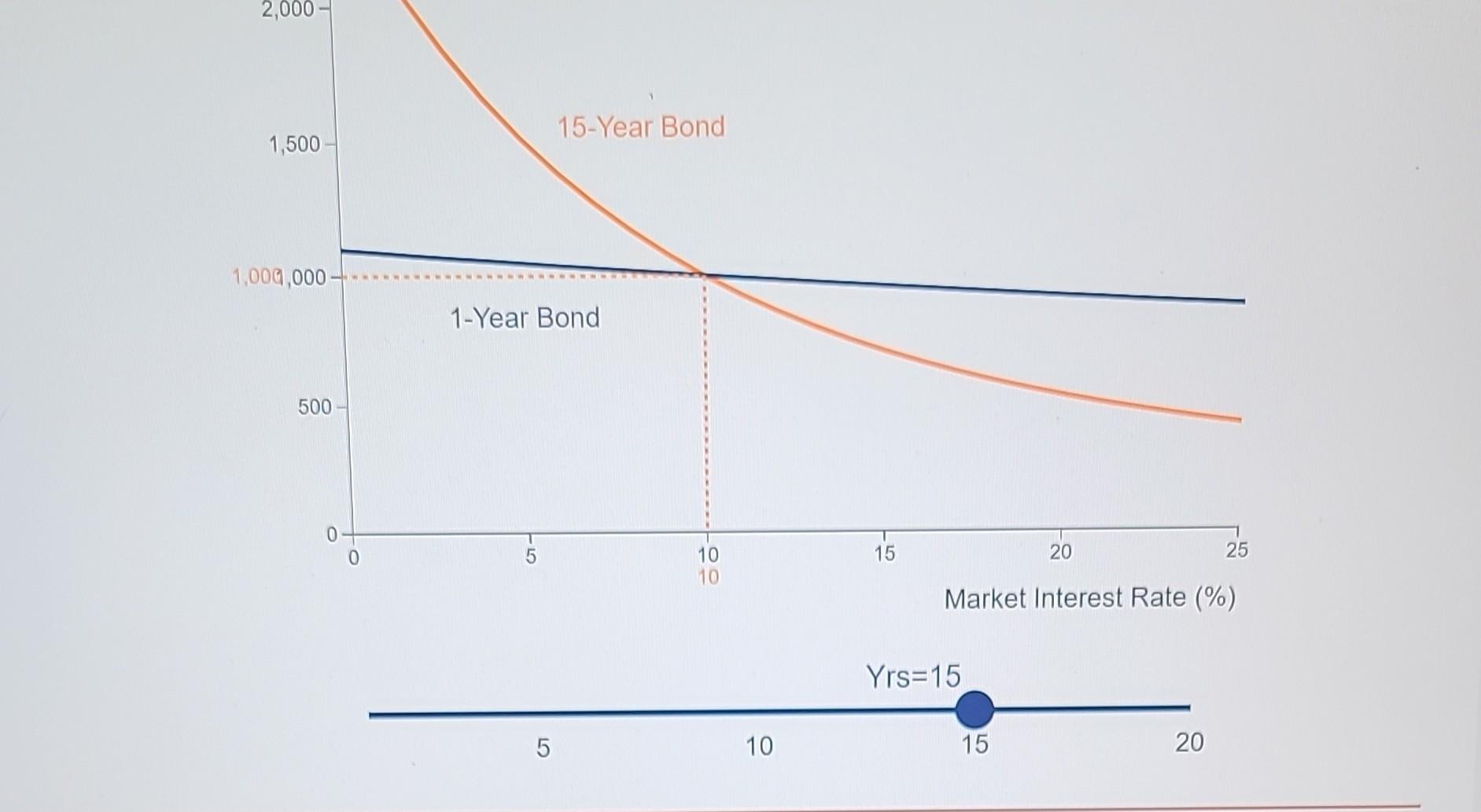

This graph shows the value of 10% coupon bonds of different terms across differing market interest rates. Each bond pays INT =$100 at the end

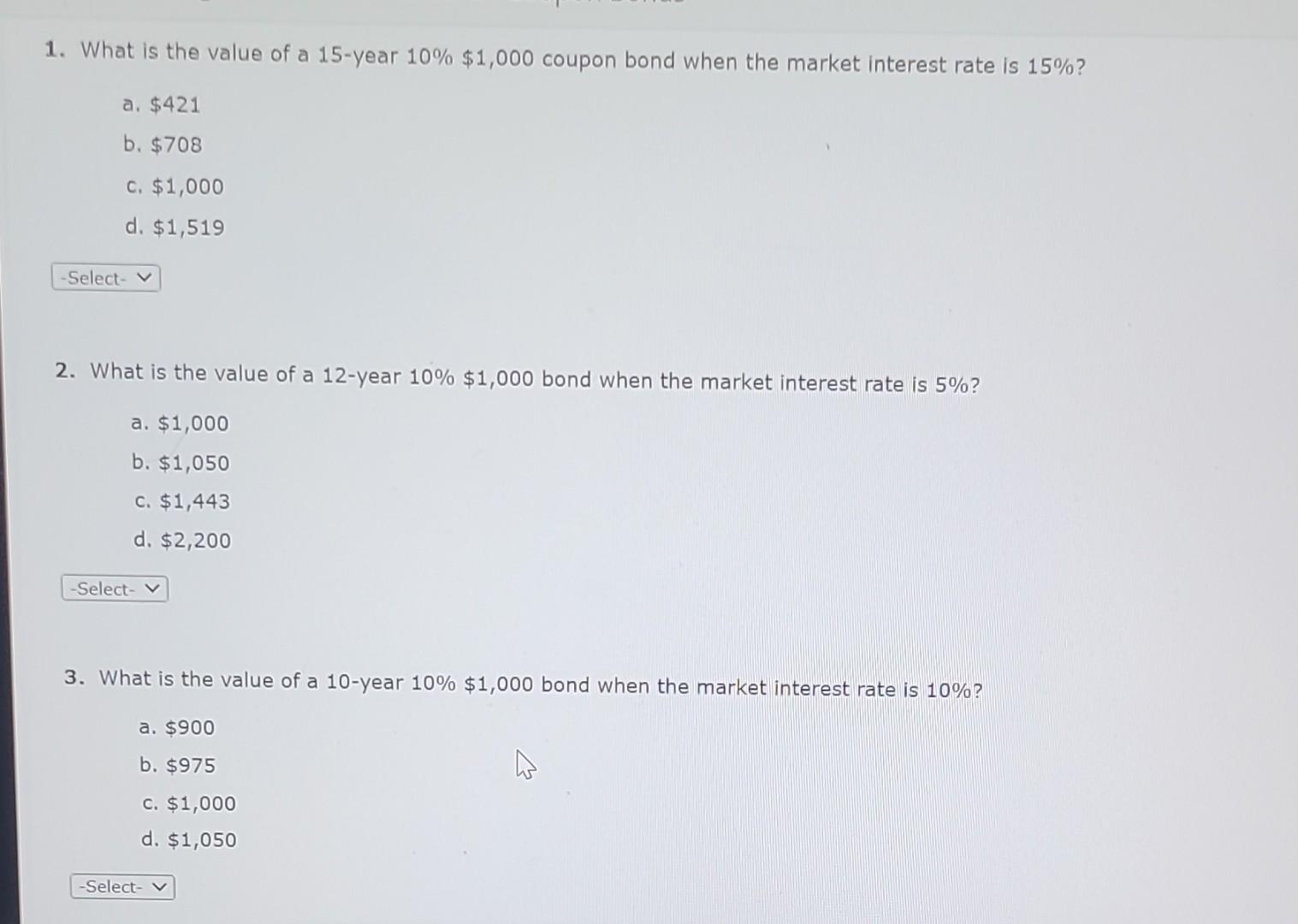

This graph shows the value of 10% coupon bonds of different terms across differing market interest rates. Each bond pays INT =$100 at the end of each year and returns M=$1,000 at maturity. For comparison, the blue line depicts the value of a one-year bond. The term of the other bond in years may be changed using the slider. Drag on the graph to change the current market interest rate (rd) at which the bond (orange curve) is evaluated. t=1Yrs(1+rd)INT+(1+rd)YrsM=t=115(1+0.100)$100+(1+0.100)15$1000=1,000 1. What is the value of a 15 -year 10%$1,000 coupon bond when the market interest rate is 15% ? a. $421 b. $708 c. $1,000 d. $1,519 2. What is the value of a 12 -year 10%$1,000 bond when the market interest rate is 5% ? a. $1,000 b. $1,050 c. $1,443 d. $2,200 3. What is the value of a 10 -year 10%$1,000 bond when the market interest rate is 10% ? a. $900 b. $975 c. $1,000 d. $1,050 4. For a 10%$1,000 coupon bond, when the market interest rate is greater than 10%, the value of the bond: a. Is unaffected and still equals its par value of $1,000. b. Is less than its par value of $1,000. c. Is greater than its par value of $1,000. d. Cannot determine because it depends on the term of the bond in years. 5. For a 10%,$1,000 coupon bond, a longer term bond (say, 15 years) is: a. less affected by changes in the market rate than a 1-year bond. b. affected the same by changes in the market rate than a 1-year bond. c. more affected by changes in the market rate than a 1-year bond. d. Cannot be determined

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started