Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is 1 complete question. ans the all parts plzz Q No.12 The December 31, 2015, balance sheet and income statement for Mayberry Cafeterias, Inc.

this is 1 complete question. ans the all parts plzz

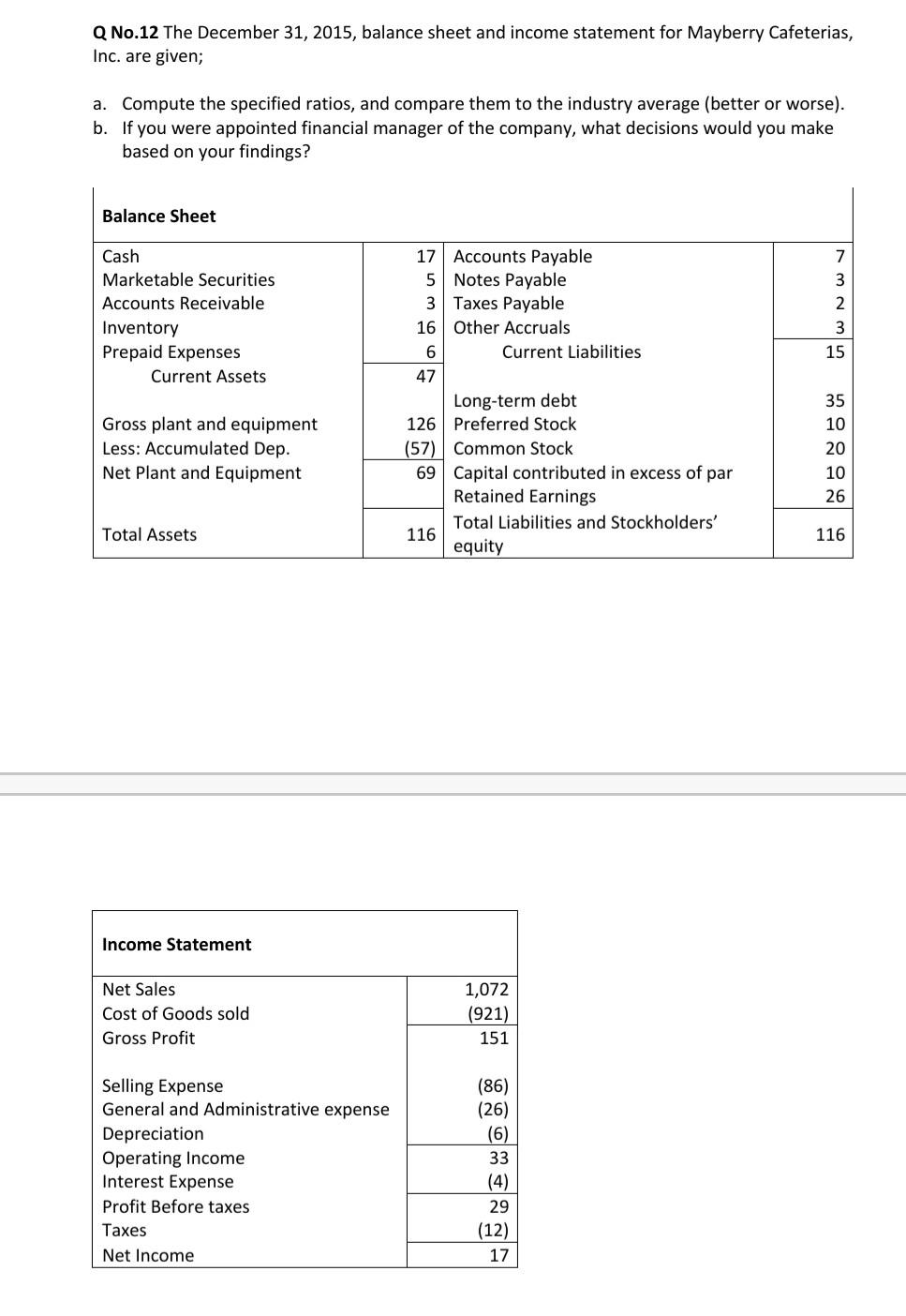

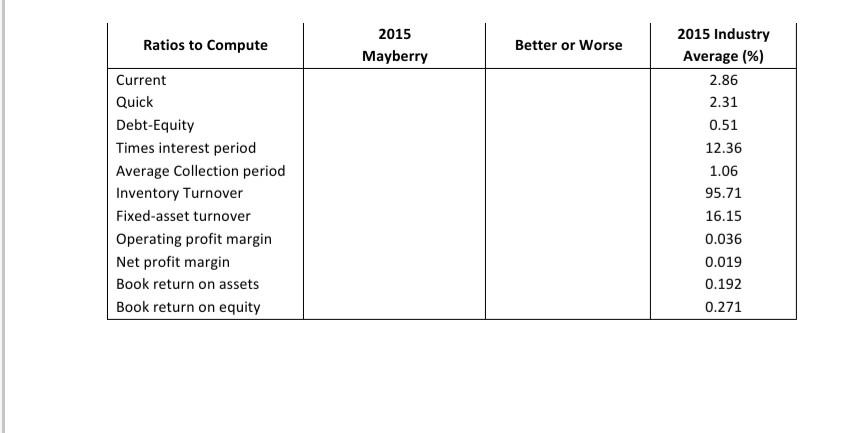

Q No.12 The December 31, 2015, balance sheet and income statement for Mayberry Cafeterias, Inc. are given; a. Compute the specified ratios, and compare them to the industry average (better or worse). b. If you were appointed financial manager of the company, what decisions would you make based on your findings? Balance Sheet 3 2. Cash Marketable Securities Accounts Receivable Inventory Prepaid Expenses Current Assets 3 15 17 Accounts Payable 5 Notes Payable 3 Taxes Payable 16 Other Accruals 6 Current Liabilities 47 Long-term debt 126 Preferred Stock (57) Common Stock 69 Capital contributed in excess of par Retained Earnings Total Liabilities and Stockholders' 116 equity Gross plant and equipment Less: Accumulated Dep. Net Plant and Equipment 35 10 20 10 26 Total Assets 116 Income Statement Net Sales Cost of Goods sold Gross Profit 1,072 (921) 151 Selling Expense General and Administrative expense Depreciation Operating Income Interest Expense Profit Before taxes Taxes Net Income (86) (26) (6) 33 (4) 29 (12) 17 Ratios to Compute 2015 Mayberry Better or worse Current Quick Debt-Equity Times interest period Average Collection period Inventory Turnover Fixed-asset turnover Operating profit margin Net profit margin Book return on assets Book return on equity 2015 Industry Average (%) 2.86 2.31 0.51 12.36 1.06 95.71 16.15 0.036 0.019 0.192 0.271Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started