this is 1 question that consist of multiple PLEASE answer with correct answers only

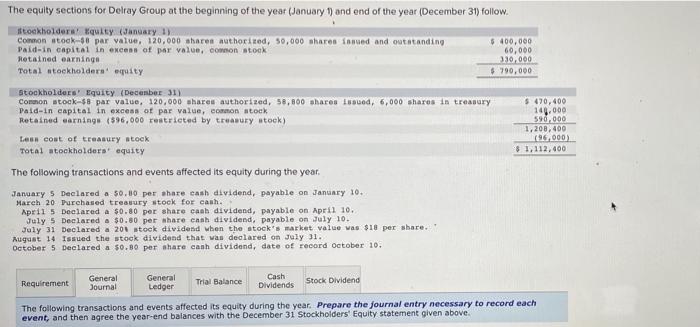

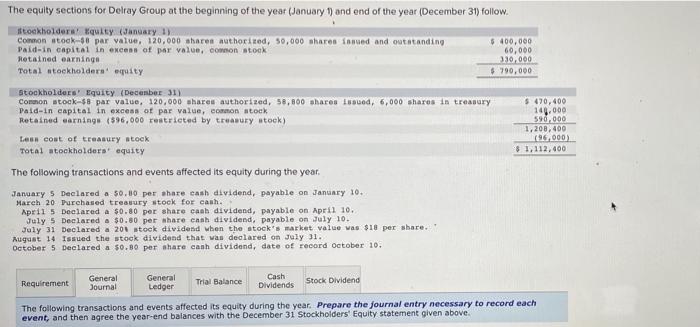

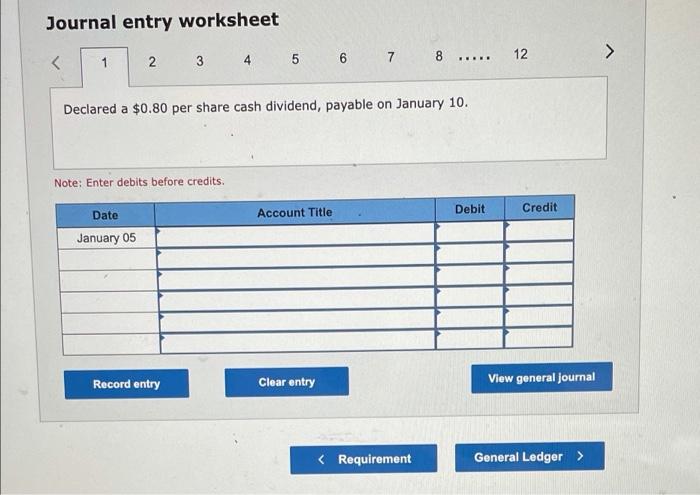

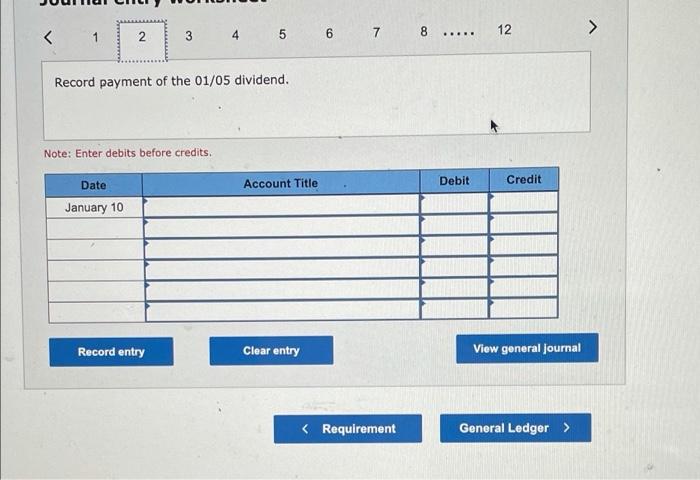

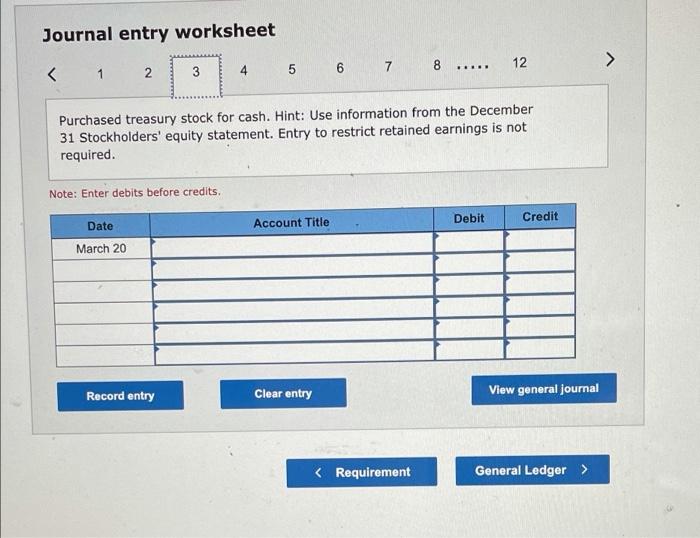

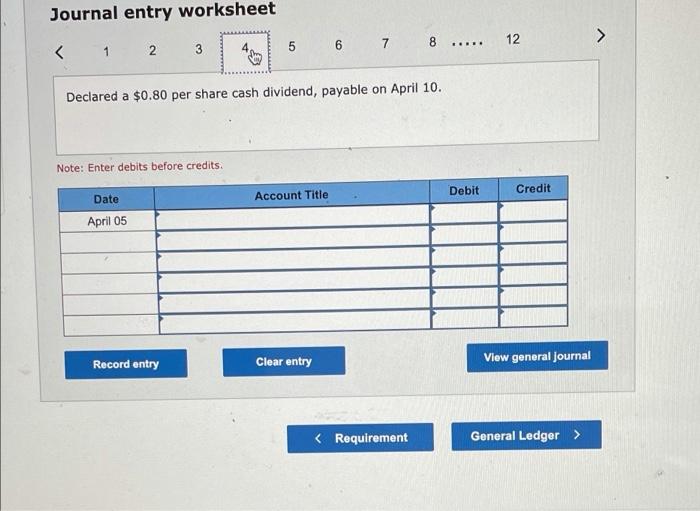

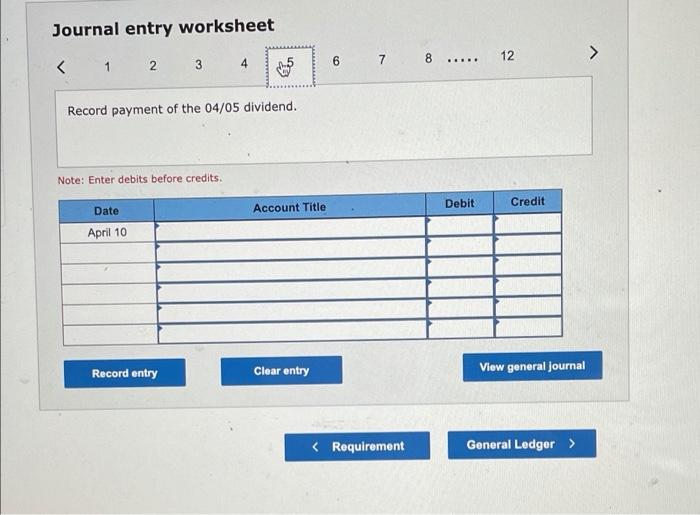

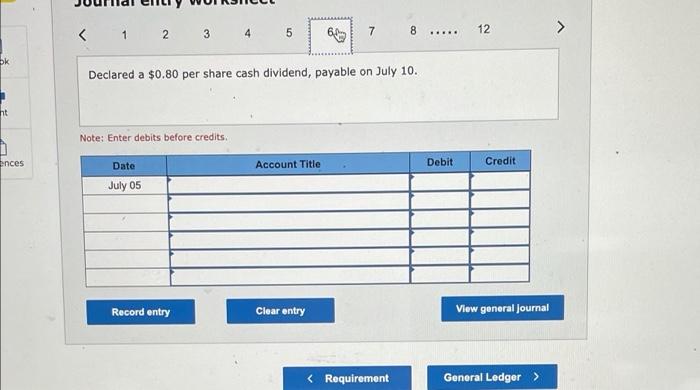

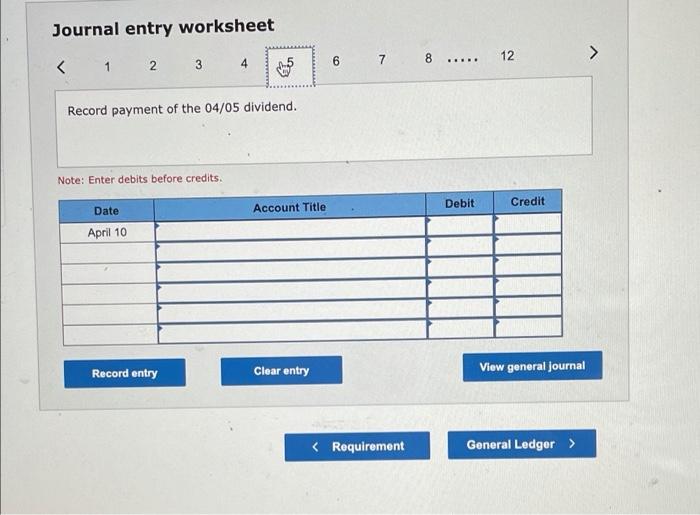

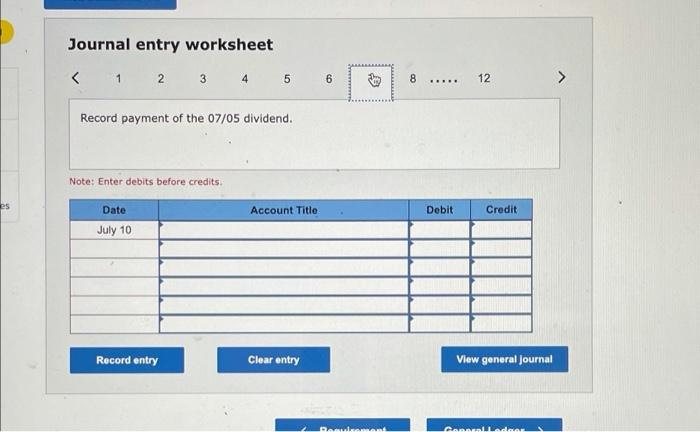

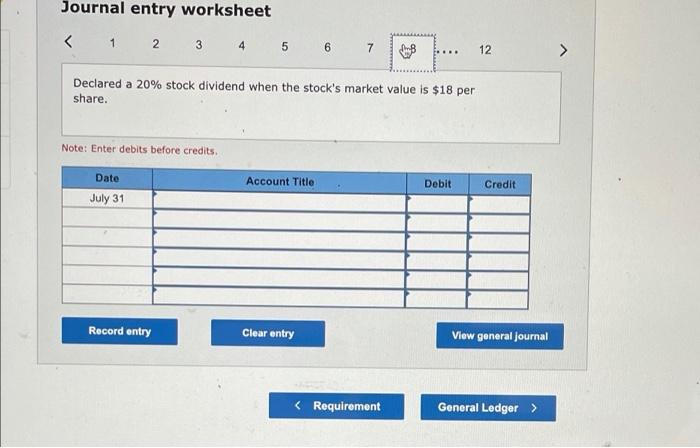

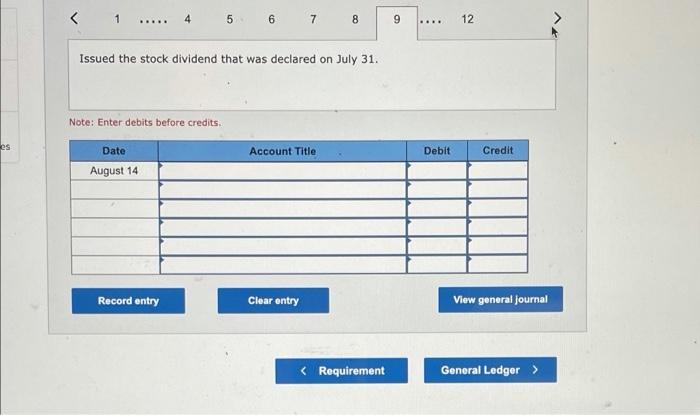

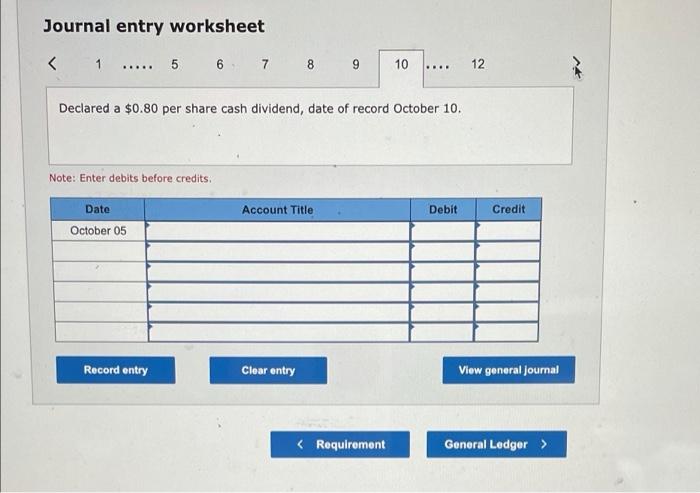

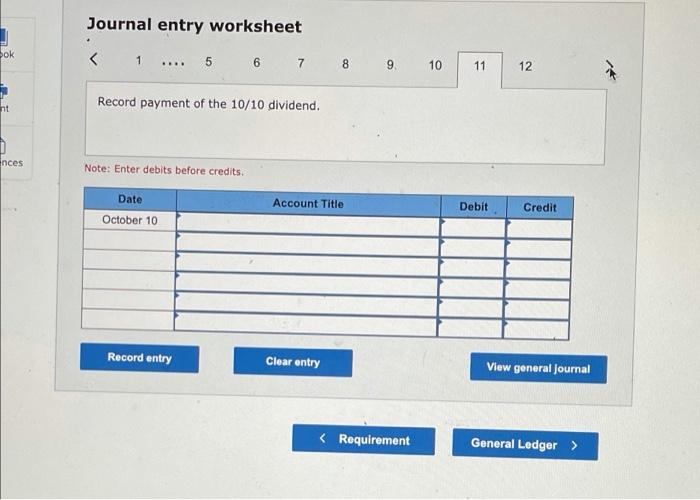

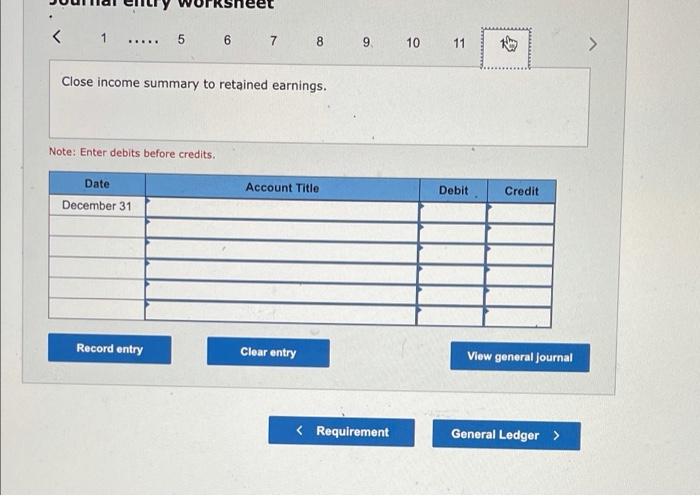

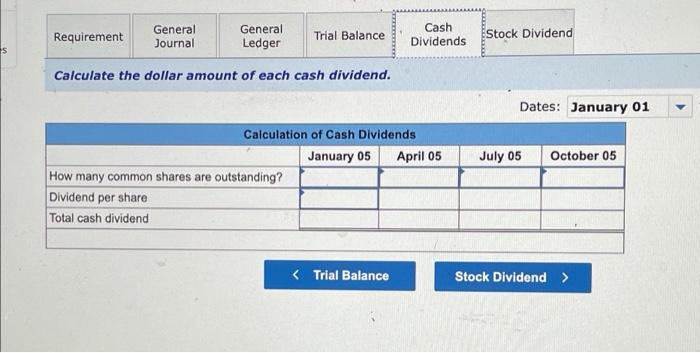

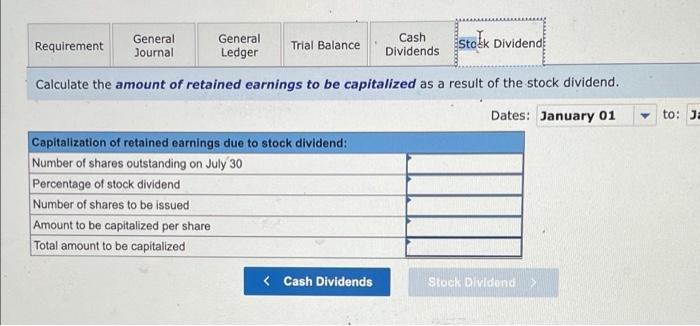

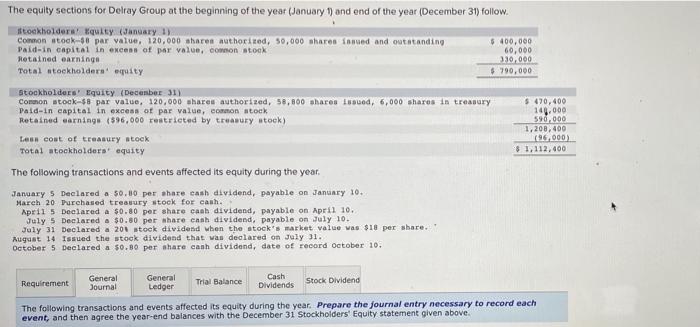

The equity sections for Delray Group at the beginning of the year (January 1) and end of the year (December 31) follow. stockholders quity (January 1) Common stocks par value. 120.000 shares authorited, 50,000 shares ined and outstanding $400,000 Paid-in capital in excess of par value, common stock 60,000 Retained earnings 310,000 Total stockholders' equity $ 790,000 stockholders' Equity (December 31 Common stock 8 par value, 120,000 shares authorized, 58,800 shares issued, 6,000 shares in treasury Paid-in capital in excess of par value, common stock Retained earnings (596,000 restricted by treasury stock) Les cost of treasury stock Total stockholders' equity The following transactions and events affected its equity during the year. $ 470,400 140.000 590,000 1,200,400 (96,000) $ 1,112,400 January 5 Declared a 50.00 per share cash dividend, payable on January 10. March 20 Purchased treasury stock for cash. April 5 Declared a $0.80 per share cash dividend, payable on April 10. July 5 Declared a $0.80 per whare cash dividend, payable on July 10. July 31 Declared a 200 stock dividend when the stock market value was $18 per share. August 14 Issued the stock dividend that was declared on July 31. October 5 Declared a $0.0 per share canh dividend, date of record October 10. General Requirement General Ledger Cash Dividends Journal Trial Balance Stock Dividend The following transactions and events affected its equity during the year. Prepare the journal entry necessary to record each event, and then agree the year-end balances with the December 31 Stockholders' Equity statement given above. Journal entry worksheet 12 1 > 2 3 4 .... 5 6 7 8 Declared a $0.80 per share cash dividend, payable on January 10. Note: Enter debits before credits. Debit Credit Account Title Date January 05 Record entry Clear entry View general journal 12 1 > 2 3 4 5 6 7 8 ..... Record payment of the 01/05 dividend. Note: Enter debits before credits. Account Title Debit Credit Date January 10 Record entry Clear entry View general Journal Journal entry worksheet 12 Journal entry worksheet 5 3 6 12 4 5 7 8 00 12 ..... k Declared a $0.80 per share cash dividend, payable on July 10. ht Note: Enter debits before credits ences Date Account Title Debit Credit July 05 Record entry Clear entry View general Journal Journal entry worksheet > 3 6 12 4 Journal entry worksheet Record payment of the 07/05 dividend. Note: Enter debits before credits es Account Title Debit Credit Date July 10 Record entry Clear entry View general Journal und Con Leder Journal entry worksheet Declared a 20% stock dividend when the stock's market value is $18 per share. Note: Enter debits before credits Date Account Title Debit Credit July 31 Record entry Clear entry View general Journal 5 6 7 8 ### 12 9 Issued the stock dividend that was declared on July 31. Note: Enter debits before credits es Date Account Title Debit Credit August 14 Record entry Clear entry View general journal Journal entry worksheet Journal entry worksheet Sok Requirement General Journal General Ledger Trial Balance Cash Dividends Stock Dividend s Calculate the dollar amount of each cash dividend. Dates: January 01 July 05 October 05 Calculation of Cash Dividends January 05 April 05 How many common shares are outstanding? Dividend per share Total cash dividend Requirement General Journal General Ledger Trial Balance Cash Dividends Stolk Dividend to: JE Calculate the amount of retained earnings to be capitalized as a result of the stock dividend. Dates: January 01 Capitalization of retained earnings due to stock dividend: Number of shares outstanding on July 30 Percentage of stock dividend Number of shares to be issued Amount to be capitalized per share Total amount to be capitalized