Answered step by step

Verified Expert Solution

Question

1 Approved Answer

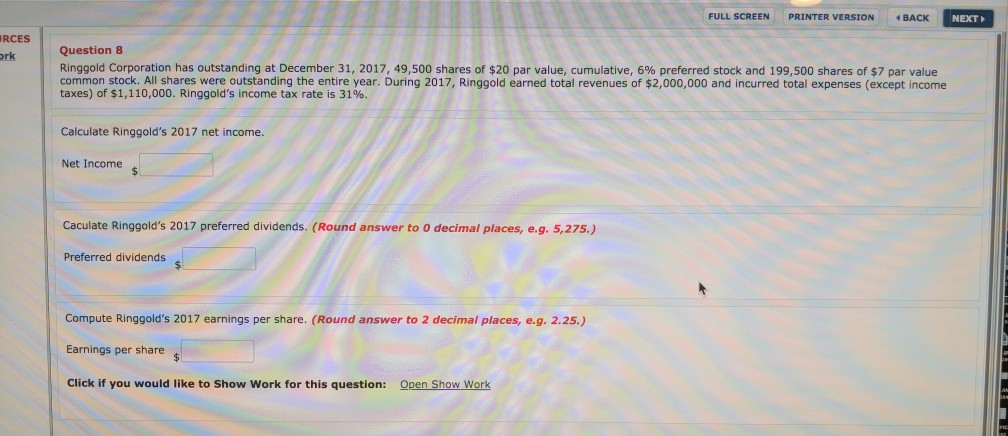

this is a better picture of the question FULL SCREEN PRINTER VERSION NEXT BACK RCES Question 8 ork Ringgold Corporation has outstanding at December 31,

this is a better picture of the question

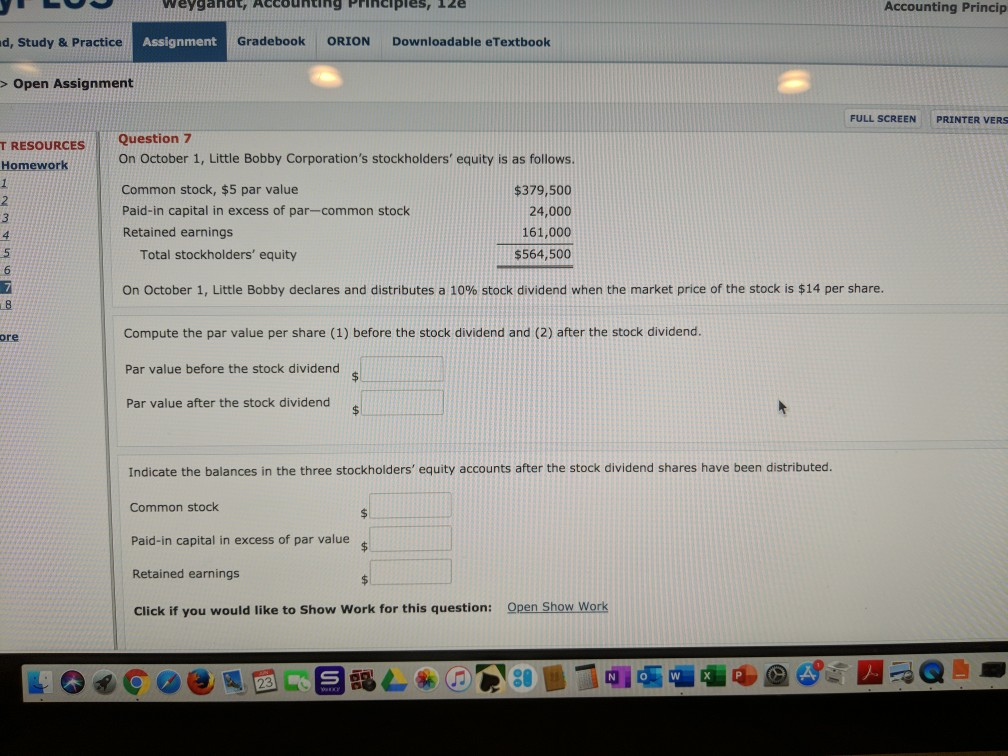

FULL SCREEN PRINTER VERSION NEXT BACK RCES Question 8 ork Ringgold Corporation has outstanding at December 31, 2017, 49,500 shares of $20 par value, cumulative, 6 % preferred stock and 199,500 shares of $7 par value ar. During 2017, Ringgold earned total revenues of $2,000,000 and incurred total expenses (except income taxes) of $1,110,000. Ringgold's income tax rate is 31%. Calculate Ringgold's 2017 net income. Net Income Caculate Ringgold's 2017 preferred dividends. (Round answer to 0 decimal places, e.g. 5,275.) Preferred dividends Compute Ringgold's 2017 earnings per share. (Round answer to 2 decimal places, e.g. 2.25.) Earnings per share Click if you would like to Show Work for this question: Open Show Work weygandt AccOunting Principles, 12e Accounting Princip Assignment Gradebook ORION d, Study & Practice Downloadable eTextbook > Open Assignment FULL SCREEN PRINTER VERS Question 7 T RESOURCES On October 1, Little Bobby Corporation's stockholders' equity is as follows. Homework 1 Common stock, $5 par value $379,500 2 Paid-in capital in excess of par-common stock 24,000 3 Retained earnings 161,000 4 Total stockholders' equity $564,500 6 On October 1, Little Bobby declares and distributes a 10% stock dividend when the market price of the stock is $14 per share. 8 Compute the par value per share (1) before the stock dividend and (2) after the stock dividend. ore Par value before the stock dividend Par value after the stock dividend $ Indicate the balances in the three stockholders' equity accounts after the stock dividend shares have been distributed. Common stock Paid-in capital in excess of par value $ Retained earnings Open Show Work Click if you would like to Show Work for this question: P S o N WStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started