Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are finishing up your first year of work in the real world. Budgeting is becoming second nature. You've budgeted for regular maintenance for

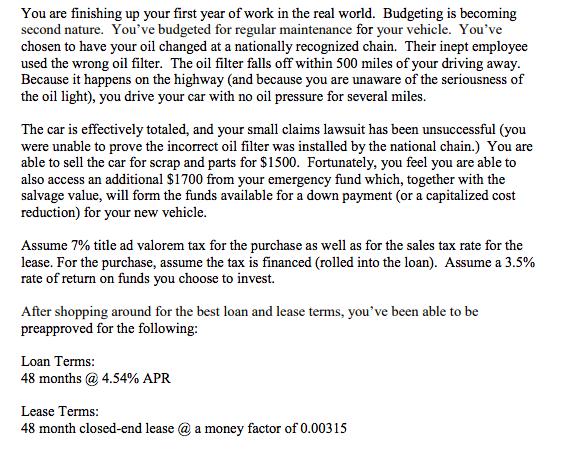

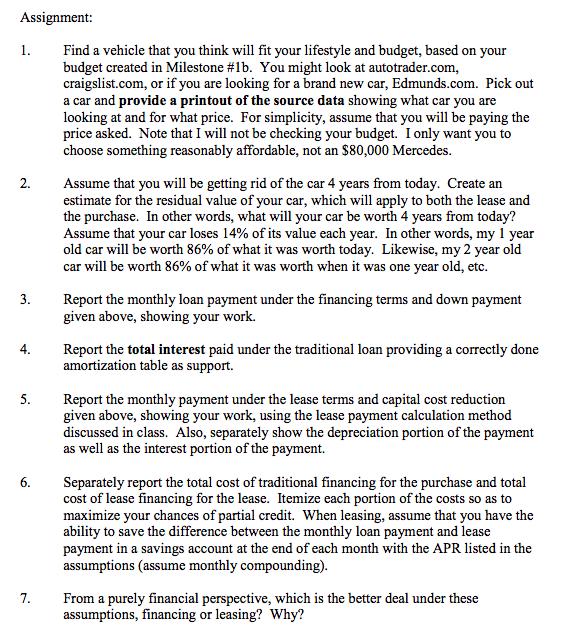

You are finishing up your first year of work in the real world. Budgeting is becoming second nature. You've budgeted for regular maintenance for your vehicle. You've chosen to have your oil changed at a nationally recognized chain. Their inept employee used the wrong oil filter. The oil filter falls off within 500 miles of your driving away. Because it happens on the highway (and because you are unaware of the seriousness of the oil light), you drive your car with no oil pressure for several miles. The car is effectively totaled, and your small claims lawsuit has been unsuccessful (you were unable to prove the incorrect oil filter was installed by the national chain.) You are able to sell the car for scrap and parts for $1500. Fortunately, you feel you are able to also access an additional $1700 from your emergency fund which, together with the salvage value, will form the funds available for a down payment (or a capitalized cost reduction) for your new vehicle. Assume 7% title ad valorem tax for the purchase as well as for the sales tax rate for the lease. For the purchase, assume the tax is financed (rolled into the loan). Assume a 3.5% rate of return on funds you choose to invest. After shopping around for the best loan and lease terms, you've been able to be preapproved for the following: Loan Terms: 48 months @ 4.54% APR Lease Terms: 48 month closed-end lease @ a money factor of 0.00315 Assignment: Find a vehicle that you think will fit your lifestyle and budget, based on your budget created in Milestone # 1b. You might look at autotrader.com, craigslist.com, or if you are looking for a brand new car, Edmunds.com. Pick out a car and provide a printout of the source data showing what car you are looking at and for what price. For simplicity, assume that you will be paying the price asked. Note that I will not be checking your budget. I only want you to choose something reasonably affordable, not an $80,000 Mercedes. 1. 2. 3. 4. 5. 6. 7. Assume that you will be getting rid of the car 4 years from today. Create an estimate for the residual value of your car, which will apply to both the lease and the purchase. In other words, what will your car be worth 4 years from today? Assume that your car loses 14% of its value each year. In other words, my 1 year old car will be worth 86% of what it was worth today. Likewise, my 2 year old car will be worth 86% of what it was worth when it was one year old, etc. Report the monthly loan payment under the financing terms and down payment given above, showing your work. Report the total interest paid under the traditional loan providing a correctly done amortization table as support. Report the monthly payment under the lease terms and capital cost reduction given above, showing your work, using the lease payment calculation method discussed in class. Also, separately show the depreciation portion of the payment as well as the interest portion of the payment. Separately report the total cost of traditional financing for the purchase and total cost of lease financing for the lease. Itemize each portion of the costs so as to maximize your chances of partial credit. When leasing, assume that you have the ability to save the difference between the monthly loan payment and lease payment in a savings account at the end of each month with the APR listed in the assumptions (assume monthly compounding). From a purely financial perspective, which is the better deal under these assumptions, financing or leasing? Why?

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 After shopping around for a suitable car I decided on a 2020 Honda Accord Sport with the 20T engine The car has a MSRP of 32420 but I managed to negotiate a price of 29000 I have included a printout ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started