Answered step by step

Verified Expert Solution

Question

1 Approved Answer

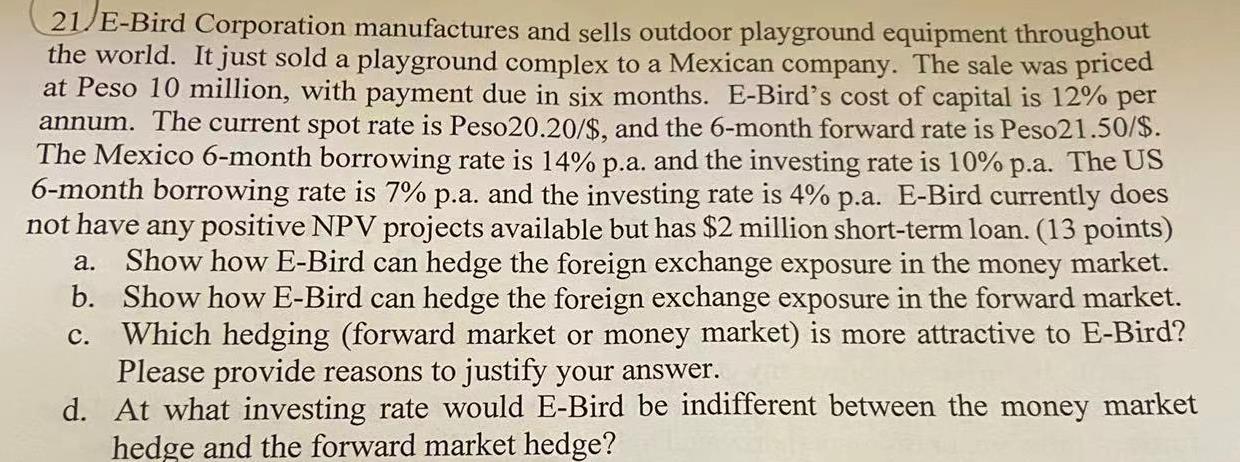

This is a calculation problem. This is a calculation problem. 21/E-Bird Corporation manufactures and sells outdoor playground equipment throughout the world. It just sold a

This is a calculation problem.

This is a calculation problem.

21/E-Bird Corporation manufactures and sells outdoor playground equipment throughout the world. It just sold a playground complex to a Mexican company. The sale was priced at Peso 10 million, with payment due in six months. E-Bird's cost of capital is 12% per annum. The current spot rate is Peso 20.20/$, and the 6-month forward rate is Peso21.50/$. The Mexico 6-month borrowing rate is 14%p.a. and the investing rate is 10%p.a. The US 6-month borrowing rate is 7% p.a. and the investing rate is 4% p.a. E-Bird currently does not have any positive NPV projects available but has $2 million short-term loan. (13 points) a. Show how E-Bird can hedge the foreign exchange exposure in the money market. b. Show how E-Bird can hedge the foreign exchange exposure in the forward market. Which hedging (forward market or money market) is more attractive to E-Bird? Please provide reasons to justify your answer. d. At what investing rate would E-Bird be indifferent between the money market hedge and the forward market hedge? cStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started