Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is a capsim simulation question Calculating the Ideal Spot To calculate where the ideal spot is in each round, start with the segment center

This is a capsim simulation question

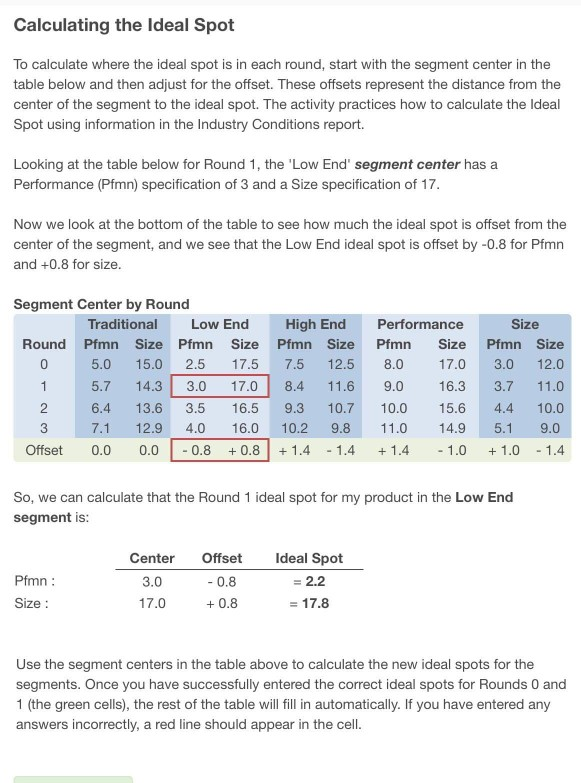

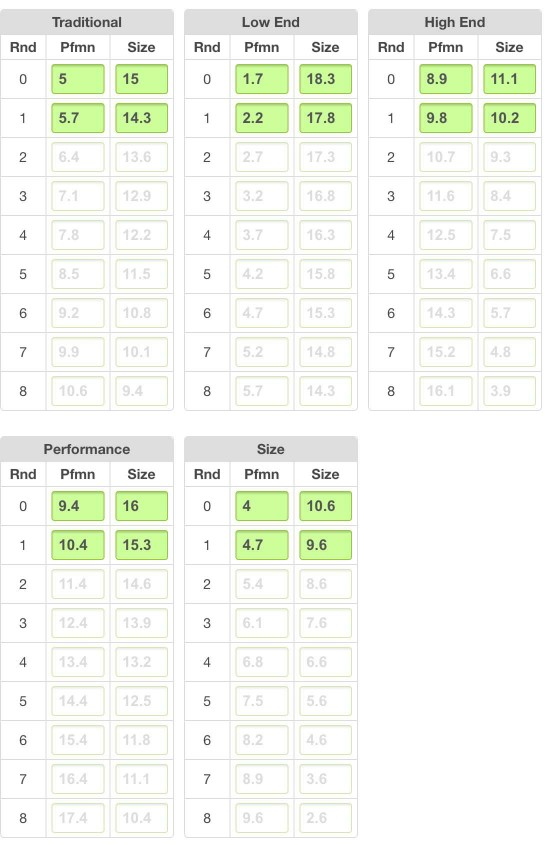

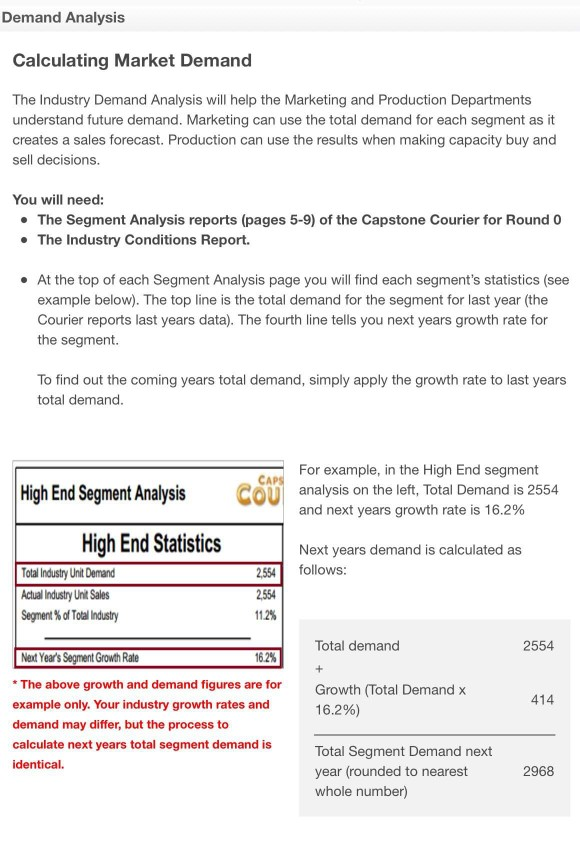

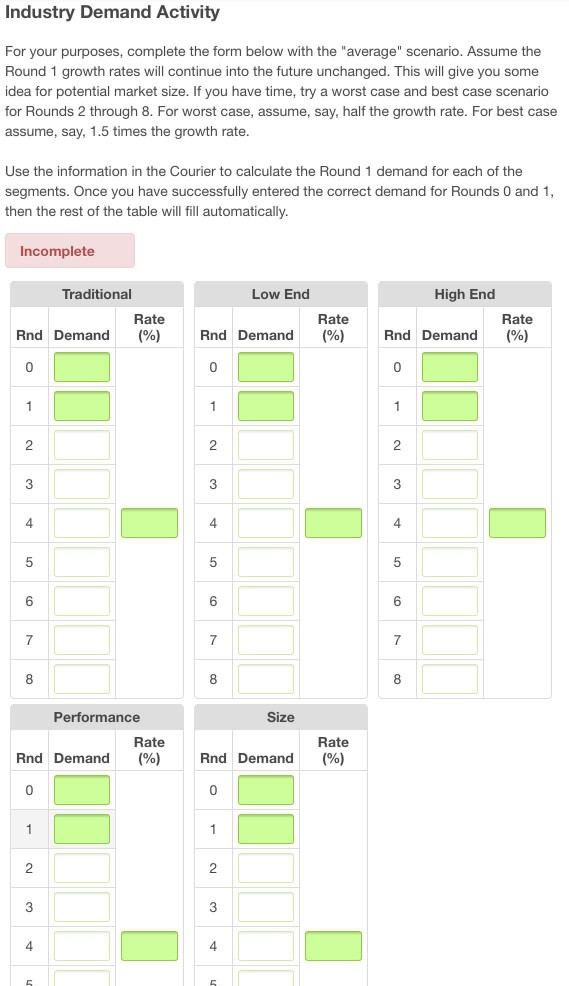

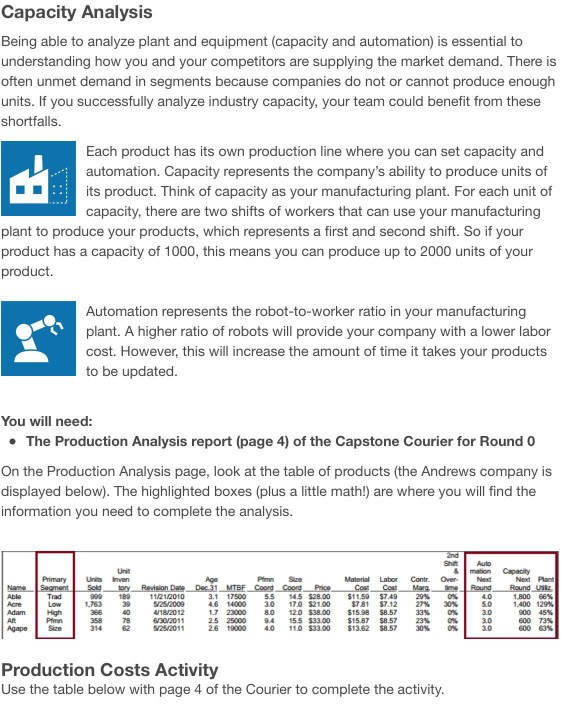

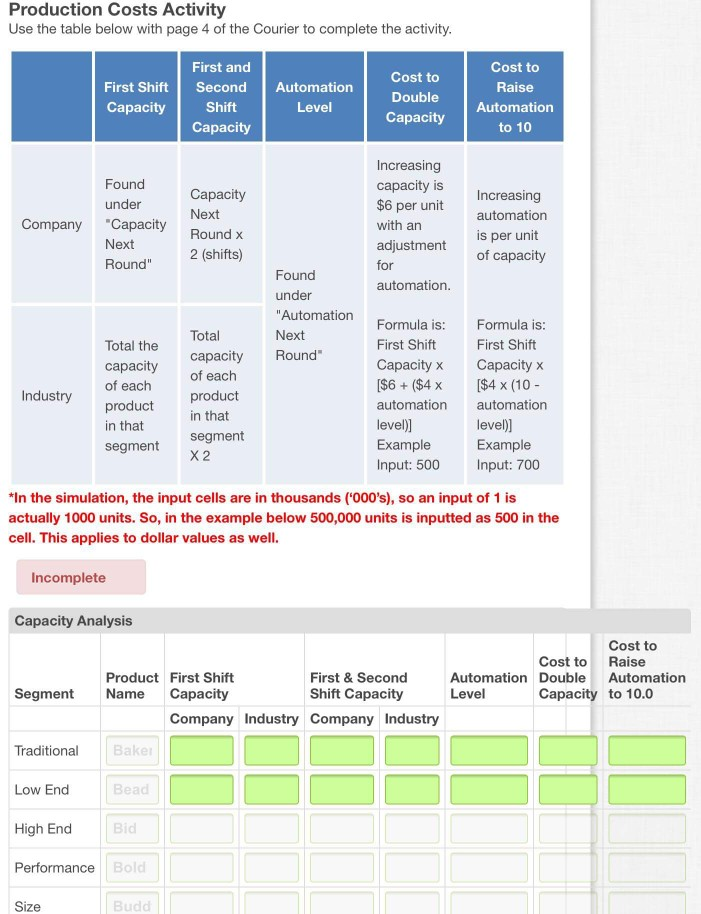

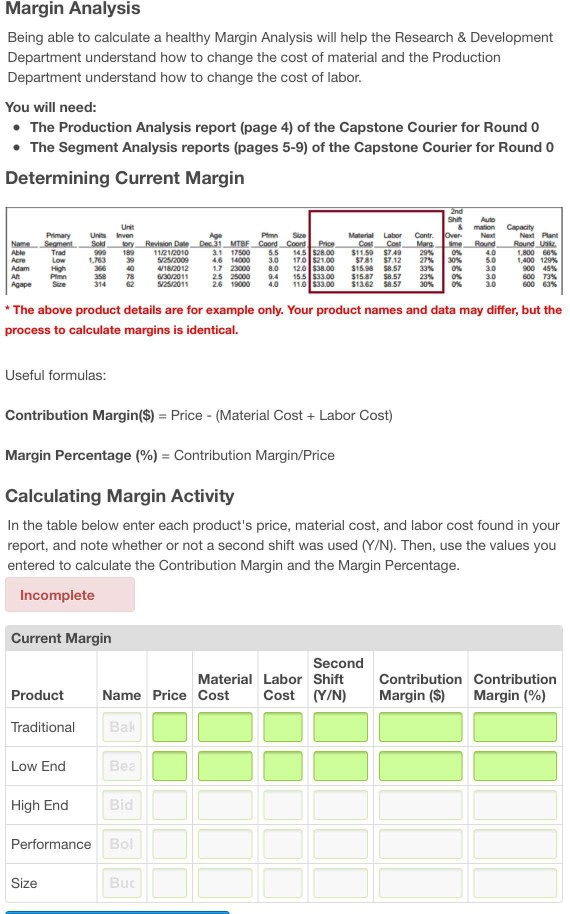

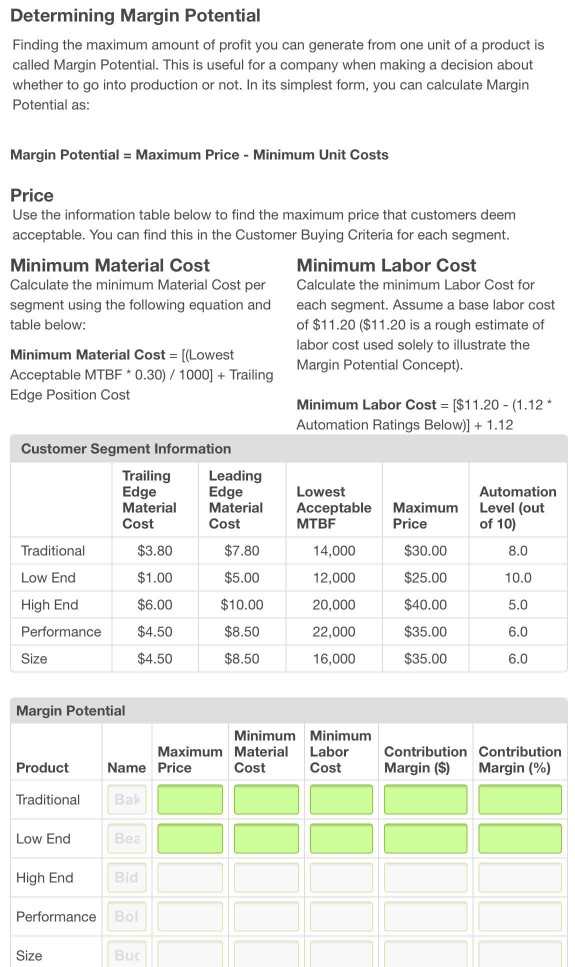

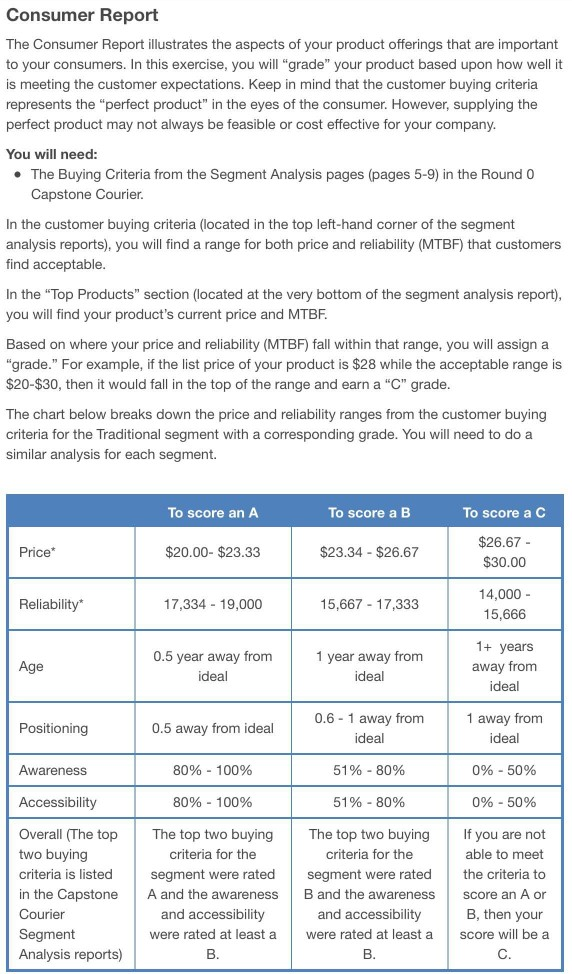

Calculating the Ideal Spot To calculate where the ideal spot is in each round, start with the segment center in the table below and then adjust for the offset. These offsets represent the distance from the center of the segment to the ideal spot. The activity practices how to calculate the ldeal Spot using information in the Industry Conditions report. Looking at the table below for Round 1, the 'Low End' segment center hasa Performance (Pfmn) specification of 3 and a Size specification of 17 Now we look at the bottom of the table to see how much the ideal spot is offset from the center of the segment, and we see that the Low End ideal spot is offset by -0.8 for Pfmn and +0.8 for size Segment Center by Round Traditional Low End High End Performance Size Round Pfmn Size Pfmn Size Pfmn Size Pfmn Size Pfmn Size 5.0 15.0 2.5 17.5 7.5 12.5 8.0 17.0 3.0 12.0 5.7 14.3 3.0 17.0 8.4 11.6 9.0 16.3 3.7 11.0 6.4 13.6 3.5 16.5 9.3 10.7 10.0 15.6 4.4 10.0 7.1 12.9 4.0 16.0 10.2 9.8 11.0 14.9 5.1 9.0 Offset 0.0 0.00.8 +0.8+1.4 1.4 1.4 1.0 1.0 1.4 0 So, we can calculate that the Round 1 ideal spot for my product in the Low End segment is Center Offset Ideal Spot Pfmn: 3.0 17.0 0.8 2.2 Size +0.8 17.8 Use the segment centers in the table above to calculate the new ideal spots for the segments. Once you have successfully entered the correct ideal spots for Rounds 0 and 1 (the green cells), the rest of the table wi in automatically. If you have entered any answers incorrectly, a red line should appear in the cell. Traditional Low End High End Rnd Pfmn SizeRnd Pfmn Size Rnd Pfmn Size 0 8.9 11.1 10.2 15 14.3 13.6 12.9 12.2 18.3 17.8 17.3 3.2 16.8 16.3 15.8 15.3 14.8 14.3 0 1.7 15.7 1 2.2 1 9.8 6.4 2.7 7.8 8.511.5 9.2 9.9 10.69.4 10.7 9.3 11.68.4 12.57.5 3.46.6 14.3 5.7 5.2 4 16.13.9 3.7 4.2 4.7 4 10.8 10.1 5.2 5.7 Performance Size Rnd Pfmn SizeRnd Pfmn Size 16 10.6 9.6 8.6 7.6 6.6 5.6 0 9.4 1 10.4 15.3 1.4 14.6 12.413.9 3.4 13.2 4.4 12.5 1 4.7 5.4 6.8 7.5 82 4.6 8.9 9.6 16.411. 3.6 74 10.4 2.6 Demand Analysis Calculating Market Demand The Industry Demand Analysis will help the Marketing and Production Departments understand future demand. Marketing can use the total demand for each segment as it creates a sales forecast. Production can use the results when making capacity buy and sell decisions You will need: The Segment Analysis reports (pages 5-9) of the Capstone Courier for Round 0 The Industry Conditions Report. At the top of each Segment Analysis page you will find each segment's statistics (see example below). The top line is the total demand for the segment for last year (the Courier reports last years data). The fourth line tells you next years growth rate for the segment To find out the coming years total demand, simply apply the growth rate to last years total demand For example, in the High End segment and next years Next years demand is calculated as A P High End Segment Analysis Canalysis on the left, Total Demand is 2554 growth rate is 16.2% High End Statistics Total Industry Unit Demand Actuall Industry Unit Sales Segment % of Total Industry 554 follows: 2,554 11.2% Total demand 2554 Next Year's Segment Growth Rate 162% The above growth and demand figures are for Growth 16.2%) (Total Demand x 414 example only. Your industry growth rates and demand may differ, but the process to calculate next years total segment demand is identical. Total Segment Demand next year (rounded to nearest whole number) 2968 Industry Demand Activity For your purposes, complete the form below with the "average" scenario. Assume the Round 1 growth rates will continue into the future unchanged. This will give you some idea for potential market size. If you have time, try a worst case and best case scenario for Rounds 2 through 8. For worst case, assume, say, half the growth rate. For best case assume, say, 1.5 times the growth rate Use the information in the Courier to calculate the Round 1 demand for each of the segments. Once you have successfully entered the correct demand for Rounds 0 and 1 then the rest of the table will fill automaticallv Incomplete Traditional Low End High End Rate Rate Rate Rnd Demand (%) Rnd Demand (%) Rnd Demand (%) 0 Performance Size Rate Rnd Demand (%) Rate Rnd Demand (%) 0 0 3 3 6 6 8 8 The Round 0 Capstone Courier While you can calculate the demand for Round 1 from the information on hand, future growth rates are unknown. Can you predict the market size for Rounds 2 to 8? No. On the other hand, you need something for planning purposes to address critical questions like How much production capacity will we need in the future? How much money do we need to raise? Which segments are most attractive for investment? Planners address this type of issue with scenarios. Typically there are three: worst case, average case, and best case. The average case assumes that the current growth continues indefinitely into the future Worst case assumes a lower growth rate. Best case a higher growth rate. The truth will unfold as the simulation progresses. Next year's growth rate is published in the Courier on each Segment page in the Statistics Box. Previous Next Determining Margin Potential Finding the maximum amount of profit you can generate from one unit of a product is called Margin Potential. This is useful for a company when making a decision about whether to go into production or not. In its simplest form, you can calculate Margin Potential as Margin Potential = Maximum Price-Minimum Unit Costs Price Use the information table below to find the maximum price that customers deem acceptable. You can find this in the Customer Buying Criteria for each segment Minimum Material Cost Calculate the minimum Material Cost per segment using the following equation and table below: Minimum Labor Cos Calculate the minimum Labor Cost for each segment. Assume a base labor cost of $11.20 ($11.20 is a rough estimate of labor cost used solely to illustrate the Margin Potential Concept) Minimum Material Cost = (Lowest Acceptable MTBF* 0.30)/1000Trailing Edge Position Cost Minimum Labor Cost $11.20 1.12 Automation Ratings Below)]1.12 Customer Segment Information Trailing Edge Leading Edge Lowest Automation Material Matera Acceptable Maximum Level (out 14,000 12,000 20,000 22,000 16,000 Cost Cost MTBF Price of 10) Traditional Low End High End Performance Size $3.80 $1.00 $6.00 $4.50 $4.50 $7.80 $5.00 $10.00 $8.50 $8.50 $30.00 $25.00 $40.00 $35.00 $35.00 8.0 10.0 5.0 6.0 6.0 Margin Potential Minimum Minimum Maximum Material Labor Contribution Contribution Margin (S) Margin (%) Product Traditional Low End High End Performance Name Price Cost Cost Bea Bid Bol Size Buc Consumer Report The Consumer Report illustrates the aspects of your product offerings that are important to your consumers. In this exercise, you will "grade" your product based upon how well it is meeting the customer expectations. Keep in mind that the customer buying criteria represents the "perfect product" in the eyes of the consumer. However, supplying the perfect product may not always be feasible or cost effective for your company You will need: The Buying Criteria from the Segment Analysis pages (pages 5-9) in the Round 0 Capstone Courier. In the customer buying criteria (located in the top left-hand corner of the segment analysis reports), you will find a range for both price and reliability (MTBF) that customers find acceptable In the "Top Products" section (located at the very bottom of the segment analysis report) you will find your product's current price and MTBF Based on where your price and reliability (MTBF) fall within that range, you will assign a "grade." For example, if the list price of your product is $28 while the acceptable range is $20-$30, then it would fall in the top of the range and earn a "C" grade The chart below breaks down the price and reliability ranges from the customer buying criteria for the Traditional segment with a corresponding grade. You will need to do a similar analysis for each segment. To score an A To score a B score a C $26.67 Price* $20.00- $23.33 $23.34 $26.67 $30.00 Reliability 14,000 15,666 17,334 19,000 15,667-17,333 0.5 year away from ideal 1 year away from ideal 1+ years away fronm ideal 0.6 1 away from 1 away from ideal Positioning 0.5 away from ideal 80%-100% 80%-100% ideal 51%-80% 51%-80% Awareness 0%-50% Accessibility 0%-50% Overall (The topThe top two buying The top two buying If you are not two buying criteria is listed in the CapstoneA and the awareness B and the awareness score an A or Courier Segment Analysis reports) criteria for the criteria for the able to meet segment were rated segment were ratedthe criteria to B, then your were rated at least a were rated at least a score will be a and accessibility and accessibility Calculating the Ideal Spot To calculate where the ideal spot is in each round, start with the segment center in the table below and then adjust for the offset. These offsets represent the distance from the center of the segment to the ideal spot. The activity practices how to calculate the ldeal Spot using information in the Industry Conditions report. Looking at the table below for Round 1, the 'Low End' segment center hasa Performance (Pfmn) specification of 3 and a Size specification of 17 Now we look at the bottom of the table to see how much the ideal spot is offset from the center of the segment, and we see that the Low End ideal spot is offset by -0.8 for Pfmn and +0.8 for size Segment Center by Round Traditional Low End High End Performance Size Round Pfmn Size Pfmn Size Pfmn Size Pfmn Size Pfmn Size 5.0 15.0 2.5 17.5 7.5 12.5 8.0 17.0 3.0 12.0 5.7 14.3 3.0 17.0 8.4 11.6 9.0 16.3 3.7 11.0 6.4 13.6 3.5 16.5 9.3 10.7 10.0 15.6 4.4 10.0 7.1 12.9 4.0 16.0 10.2 9.8 11.0 14.9 5.1 9.0 Offset 0.0 0.00.8 +0.8+1.4 1.4 1.4 1.0 1.0 1.4 0 So, we can calculate that the Round 1 ideal spot for my product in the Low End segment is Center Offset Ideal Spot Pfmn: 3.0 17.0 0.8 2.2 Size +0.8 17.8 Use the segment centers in the table above to calculate the new ideal spots for the segments. Once you have successfully entered the correct ideal spots for Rounds 0 and 1 (the green cells), the rest of the table wi in automatically. If you have entered any answers incorrectly, a red line should appear in the cell. Traditional Low End High End Rnd Pfmn SizeRnd Pfmn Size Rnd Pfmn Size 0 8.9 11.1 10.2 15 14.3 13.6 12.9 12.2 18.3 17.8 17.3 3.2 16.8 16.3 15.8 15.3 14.8 14.3 0 1.7 15.7 1 2.2 1 9.8 6.4 2.7 7.8 8.511.5 9.2 9.9 10.69.4 10.7 9.3 11.68.4 12.57.5 3.46.6 14.3 5.7 5.2 4 16.13.9 3.7 4.2 4.7 4 10.8 10.1 5.2 5.7 Performance Size Rnd Pfmn SizeRnd Pfmn Size 16 10.6 9.6 8.6 7.6 6.6 5.6 0 9.4 1 10.4 15.3 1.4 14.6 12.413.9 3.4 13.2 4.4 12.5 1 4.7 5.4 6.8 7.5 82 4.6 8.9 9.6 16.411. 3.6 74 10.4 2.6 Demand Analysis Calculating Market Demand The Industry Demand Analysis will help the Marketing and Production Departments understand future demand. Marketing can use the total demand for each segment as it creates a sales forecast. Production can use the results when making capacity buy and sell decisions You will need: The Segment Analysis reports (pages 5-9) of the Capstone Courier for Round 0 The Industry Conditions Report. At the top of each Segment Analysis page you will find each segment's statistics (see example below). The top line is the total demand for the segment for last year (the Courier reports last years data). The fourth line tells you next years growth rate for the segment To find out the coming years total demand, simply apply the growth rate to last years total demand For example, in the High End segment and next years Next years demand is calculated as A P High End Segment Analysis Canalysis on the left, Total Demand is 2554 growth rate is 16.2% High End Statistics Total Industry Unit Demand Actuall Industry Unit Sales Segment % of Total Industry 554 follows: 2,554 11.2% Total demand 2554 Next Year's Segment Growth Rate 162% The above growth and demand figures are for Growth 16.2%) (Total Demand x 414 example only. Your industry growth rates and demand may differ, but the process to calculate next years total segment demand is identical. Total Segment Demand next year (rounded to nearest whole number) 2968 Industry Demand Activity For your purposes, complete the form below with the "average" scenario. Assume the Round 1 growth rates will continue into the future unchanged. This will give you some idea for potential market size. If you have time, try a worst case and best case scenario for Rounds 2 through 8. For worst case, assume, say, half the growth rate. For best case assume, say, 1.5 times the growth rate Use the information in the Courier to calculate the Round 1 demand for each of the segments. Once you have successfully entered the correct demand for Rounds 0 and 1 then the rest of the table will fill automaticallv Incomplete Traditional Low End High End Rate Rate Rate Rnd Demand (%) Rnd Demand (%) Rnd Demand (%) 0 Performance Size Rate Rnd Demand (%) Rate Rnd Demand (%) 0 0 3 3 6 6 8 8 The Round 0 Capstone Courier While you can calculate the demand for Round 1 from the information on hand, future growth rates are unknown. Can you predict the market size for Rounds 2 to 8? No. On the other hand, you need something for planning purposes to address critical questions like How much production capacity will we need in the future? How much money do we need to raise? Which segments are most attractive for investment? Planners address this type of issue with scenarios. Typically there are three: worst case, average case, and best case. The average case assumes that the current growth continues indefinitely into the future Worst case assumes a lower growth rate. Best case a higher growth rate. The truth will unfold as the simulation progresses. Next year's growth rate is published in the Courier on each Segment page in the Statistics Box. Previous Next Determining Margin Potential Finding the maximum amount of profit you can generate from one unit of a product is called Margin Potential. This is useful for a company when making a decision about whether to go into production or not. In its simplest form, you can calculate Margin Potential as Margin Potential = Maximum Price-Minimum Unit Costs Price Use the information table below to find the maximum price that customers deem acceptable. You can find this in the Customer Buying Criteria for each segment Minimum Material Cost Calculate the minimum Material Cost per segment using the following equation and table below: Minimum Labor Cos Calculate the minimum Labor Cost for each segment. Assume a base labor cost of $11.20 ($11.20 is a rough estimate of labor cost used solely to illustrate the Margin Potential Concept) Minimum Material Cost = (Lowest Acceptable MTBF* 0.30)/1000Trailing Edge Position Cost Minimum Labor Cost $11.20 1.12 Automation Ratings Below)]1.12 Customer Segment Information Trailing Edge Leading Edge Lowest Automation Material Matera Acceptable Maximum Level (out 14,000 12,000 20,000 22,000 16,000 Cost Cost MTBF Price of 10) Traditional Low End High End Performance Size $3.80 $1.00 $6.00 $4.50 $4.50 $7.80 $5.00 $10.00 $8.50 $8.50 $30.00 $25.00 $40.00 $35.00 $35.00 8.0 10.0 5.0 6.0 6.0 Margin Potential Minimum Minimum Maximum Material Labor Contribution Contribution Margin (S) Margin (%) Product Traditional Low End High End Performance Name Price Cost Cost Bea Bid Bol Size Buc Consumer Report The Consumer Report illustrates the aspects of your product offerings that are important to your consumers. In this exercise, you will "grade" your product based upon how well it is meeting the customer expectations. Keep in mind that the customer buying criteria represents the "perfect product" in the eyes of the consumer. However, supplying the perfect product may not always be feasible or cost effective for your company You will need: The Buying Criteria from the Segment Analysis pages (pages 5-9) in the Round 0 Capstone Courier. In the customer buying criteria (located in the top left-hand corner of the segment analysis reports), you will find a range for both price and reliability (MTBF) that customers find acceptable In the "Top Products" section (located at the very bottom of the segment analysis report) you will find your product's current price and MTBF Based on where your price and reliability (MTBF) fall within that range, you will assign a "grade." For example, if the list price of your product is $28 while the acceptable range is $20-$30, then it would fall in the top of the range and earn a "C" grade The chart below breaks down the price and reliability ranges from the customer buying criteria for the Traditional segment with a corresponding grade. You will need to do a similar analysis for each segment. To score an A To score a B score a C $26.67 Price* $20.00- $23.33 $23.34 $26.67 $30.00 Reliability 14,000 15,666 17,334 19,000 15,667-17,333 0.5 year away from ideal 1 year away from ideal 1+ years away fronm ideal 0.6 1 away from 1 away from ideal Positioning 0.5 away from ideal 80%-100% 80%-100% ideal 51%-80% 51%-80% Awareness 0%-50% Accessibility 0%-50% Overall (The topThe top two buying The top two buying If you are not two buying criteria is listed in the CapstoneA and the awareness B and the awareness score an A or Courier Segment Analysis reports) criteria for the criteria for the able to meet segment were rated segment were ratedthe criteria to B, then your were rated at least a were rated at least a score will be a and accessibility and accessibility

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started