Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is a case study two part question You have been approached by a borrower seeking advice. He has told you that he is currently

This is a case study two part question

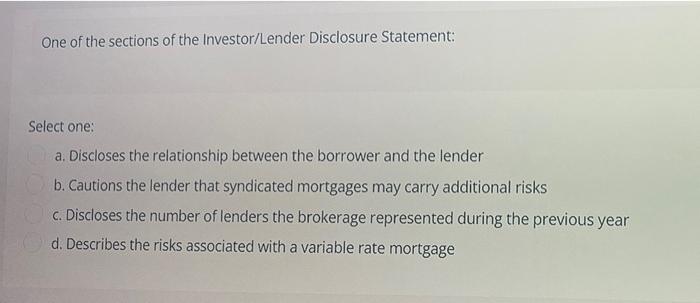

You have been approached by a borrower seeking advice. He has told you that he is currently under power of sale on his first mortgage, which is up for renewal in another two years, because he is two months in arrears. His lender has told him that he must pay the entire outstanding balance of the mortgage or the lender will evict him and sell his house. In reviewing the loan to value of this mortgage you have determined that the borrower has enough equity in his house for you to assist him. Given this scenario, what advice should you give him? Select one: a. You must pay off the first mortgage and replace it with a new private first mortgage that will likely have a high interest rate b. You may be able to get him a private second mortgage and bring the first mortgage into good standing by paying the arrears and associated costs c. You must pay off the first mortgage but no institutional tender will finance him since he is under a Power of Sale due to missed payments d. You must pay off the first mortgage and may be able to replace it with a new institutional first mortgage as long as he is creditworthy One of the sections of the Investor/Lender Disclosure Statement: Select one: a. Discloses the relationship between the borrower and the lender b. Cautions the lender that syndicated mortgages may carry additional risks c. Discloses the number of lenders the brokerage represented during the previous year d. Describes the risks associated with a variable rate mortgage a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started