Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is a case study two part question Your client owns a restaurant She has decided that she wishes to purchase another building to open

This is a case study two part question

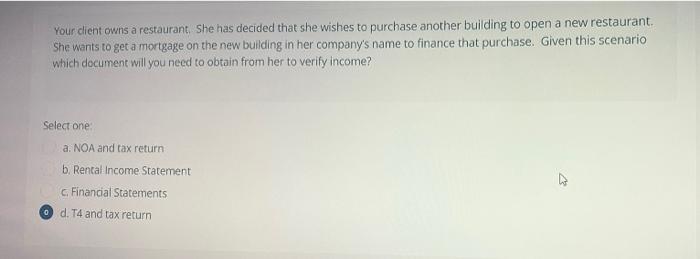

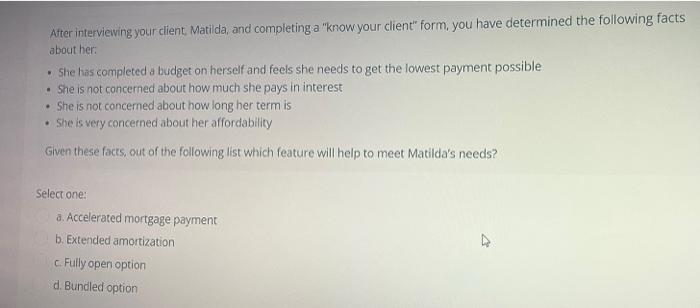

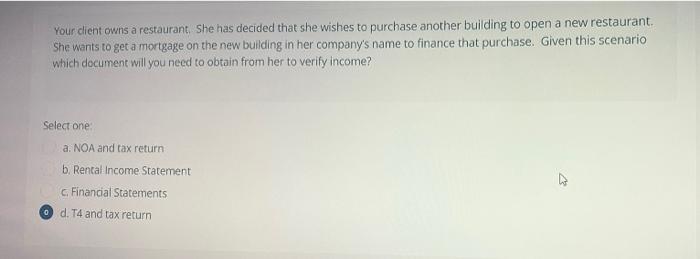

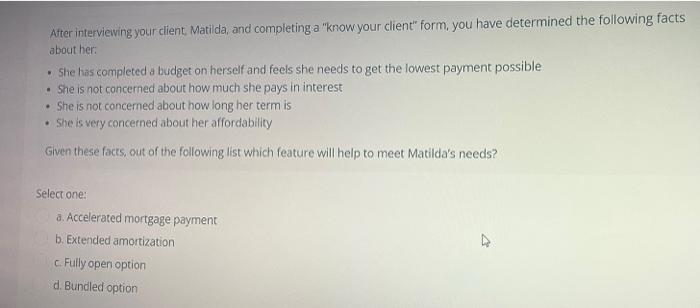

Your client owns a restaurant She has decided that she wishes to purchase another building to open a new restaurant. She wants to get a mortgage on the new building in her company's name to finance that purchase. Given this scenario which document will you need to obtain from her to verify income? Select one a. NOA and tax return b. Rental Income Statement c. Financial Statements a d. 14 and tax return After interviewing your client Matilda, and completing a "know your client" form, you have determined the following facts about her: . She has completed a budget on herself and feels she needs to get the lowest payment possible . She is not concerned about how much she pays in interest . She is not concerned about how long her term is She is very concerned about her affordability Given these facts, out of the following list which feature will help to meet Matilda's needs? Select one: a. Accelerated mortgage payment b. Extended amortization c. Fully open option d. Bundled option

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started