Answered step by step

Verified Expert Solution

Question

1 Approved Answer

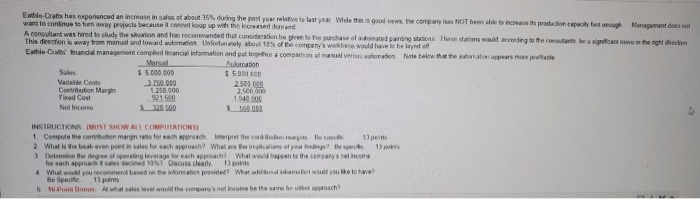

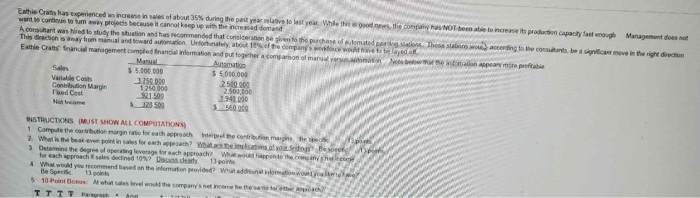

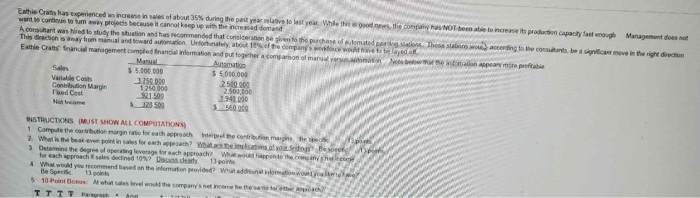

this is a clearer picture Ethe-Cratts has experienced an increase in sales of about 35% during the past year relative to tasty While this is

this is a clearer picture

Ethe-Cratts has experienced an increase in sales of about 35% during the past year relative to tasty While this is gows, the company has NOT been able to increase its production capaclytastrough therapement does not want to continue to unway projects because it cannot koop up with the created domand A coolant was hired to study the shawtion and has recommended that consideration be given to purchase of domated painting stations These would according to the come significant in the right direction This direction is away from manual and toward tomation Unfortunately, about 18% of the company was one would have to be best of Eathie financial management complied financial information and put together comparison of manual verses formation Note below that the formation per more probable Aulation Sales 15.000.000 S 5000 Variable Costs 3.750.000 2.5010 Contribution Margie 1.250.000 2.000000 Ted Cost 92140 Net Income INSTRUCTIONS MIST SHOW AL COMPUTATIONS) 1 Compute the contribution marginio for each approach. Interpret the contre les 1 ports 2. What is the best-wen point in sales for each approach? What we think timely and the specie 13 p. 3 me the degree of operating leverage for each approach what would happen to the compatys net income for each approached 1997 Dacus charly 13 points 4 What would you recommend based on the information provided? What will main would you like to have Be Spec 13 points 510 Point Bonus Awhat sales level would the company's net incontebe their proach? Eathie-Cathas experienced increase in sales of about 3 during the past year lative to see this the comme NOT be able to increase its production capacity fast enough Management does not want to continue to tam wyprojects because it cannot keep up with the increased demand A constant was hired to study the station and has recommended that consideration bethe purchase of comparing The Arcording to the courts be a spicant move in the right direction This deaction is may from manual and toward domain. Unfortunately about 18% te composed blader Ethie Cats Enancial management compiled financial information and put together common propria Automation Sales $ 5.000.000 $ 5.000.000 Variable Contes 3.750 000 2500 000 Contribution Margin 1.250,000 2.500.000 bed Cost $21.500 128.500 INSTRUCTIONS MUST SHOW ALL COMPUTATIONS) 1 Compute the contribution manat for each ach the commune 3 Determine the degree of operating leverage for each approche Wantech for each approach is dedine 10%? Dicas de 13 points 4 What would you recommended on the information provided into Be Speck 5 10 Ponto At whateve the company's TTTT Parol Ethe-Cratts has experienced an increase in sales of about 35% during the past year relative to tasty While this is gows, the company has NOT been able to increase its production capaclytastrough therapement does not want to continue to unway projects because it cannot koop up with the created domand A coolant was hired to study the shawtion and has recommended that consideration be given to purchase of domated painting stations These would according to the come significant in the right direction This direction is away from manual and toward tomation Unfortunately, about 18% of the company was one would have to be best of Eathie financial management complied financial information and put together comparison of manual verses formation Note below that the formation per more probable Aulation Sales 15.000.000 S 5000 Variable Costs 3.750.000 2.5010 Contribution Margie 1.250.000 2.000000 Ted Cost 92140 Net Income INSTRUCTIONS MIST SHOW AL COMPUTATIONS) 1 Compute the contribution marginio for each approach. Interpret the contre les 1 ports 2. What is the best-wen point in sales for each approach? What we think timely and the specie 13 p. 3 me the degree of operating leverage for each approach what would happen to the compatys net income for each approached 1997 Dacus charly 13 points 4 What would you recommend based on the information provided? What will main would you like to have Be Spec 13 points 510 Point Bonus Awhat sales level would the company's net incontebe their proach? Eathie-Cathas experienced increase in sales of about 3 during the past year lative to see this the comme NOT be able to increase its production capacity fast enough Management does not want to continue to tam wyprojects because it cannot keep up with the increased demand A constant was hired to study the station and has recommended that consideration bethe purchase of comparing The Arcording to the courts be a spicant move in the right direction This deaction is may from manual and toward domain. Unfortunately about 18% te composed blader Ethie Cats Enancial management compiled financial information and put together common propria Automation Sales $ 5.000.000 $ 5.000.000 Variable Contes 3.750 000 2500 000 Contribution Margin 1.250,000 2.500.000 bed Cost $21.500 128.500 INSTRUCTIONS MUST SHOW ALL COMPUTATIONS) 1 Compute the contribution manat for each ach the commune 3 Determine the degree of operating leverage for each approche Wantech for each approach is dedine 10%? Dicas de 13 points 4 What would you recommended on the information provided into Be Speck 5 10 Ponto At whateve the company's TTTT Parol

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started