THIS IS A CONNECT PRACTICE ASSIGNMENT, I just need some help with these in order to complete the rest of the exercise. And be ready for my test! Thanks!!

THIS IS ALL THE DATA AND FIGURES I HAVE FOR THIS EXERCISE! Thanks! Please help!

THIS QUESTION IS NOT INCOMPLETE!!! I literally screenshoot it from the beg to the end.

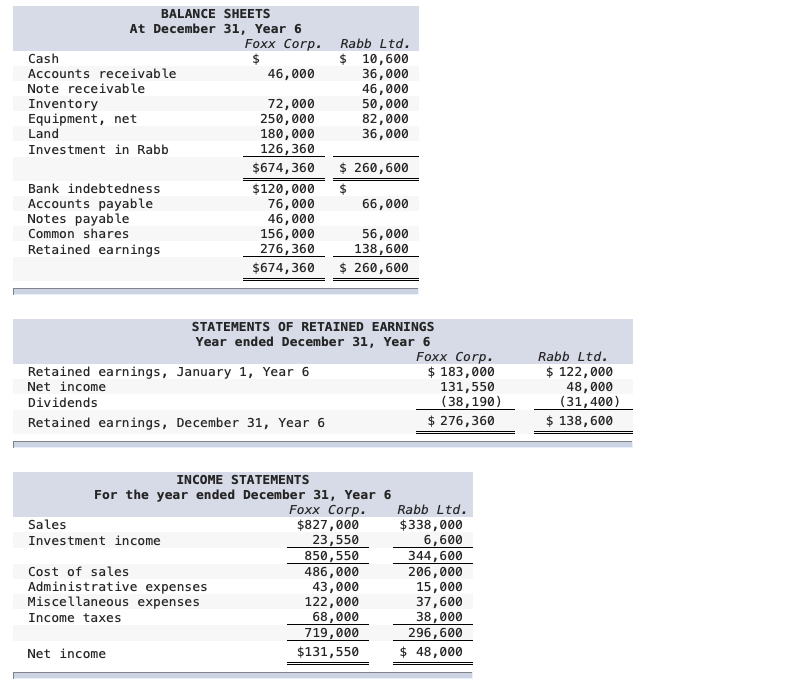

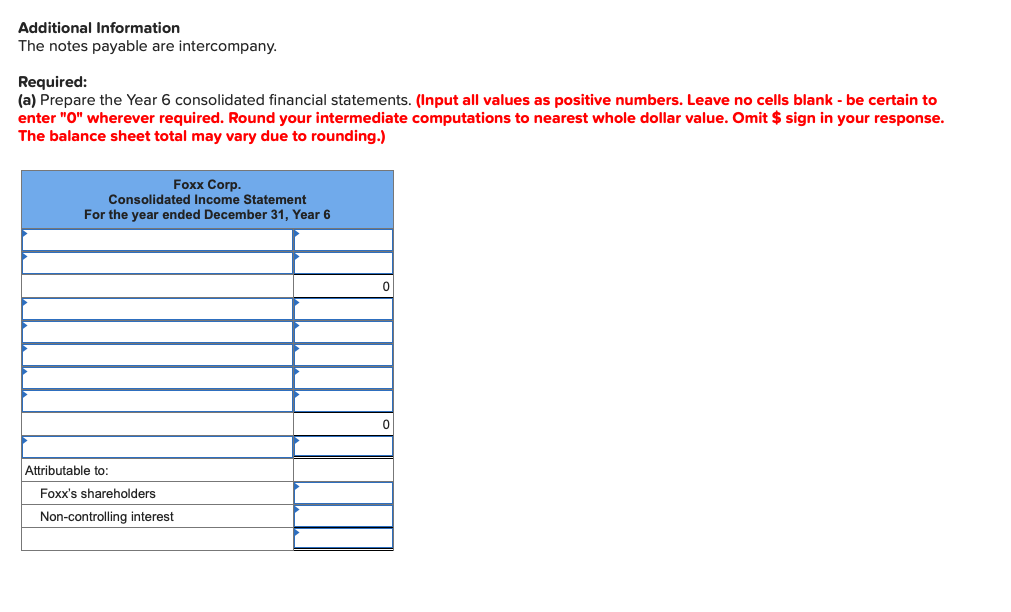

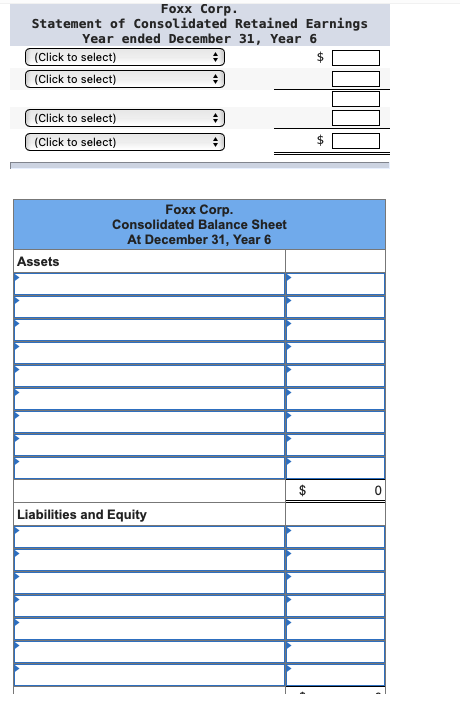

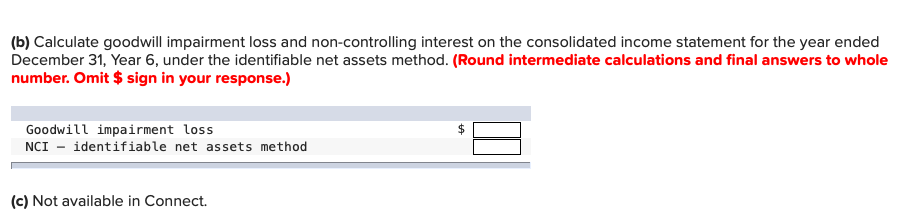

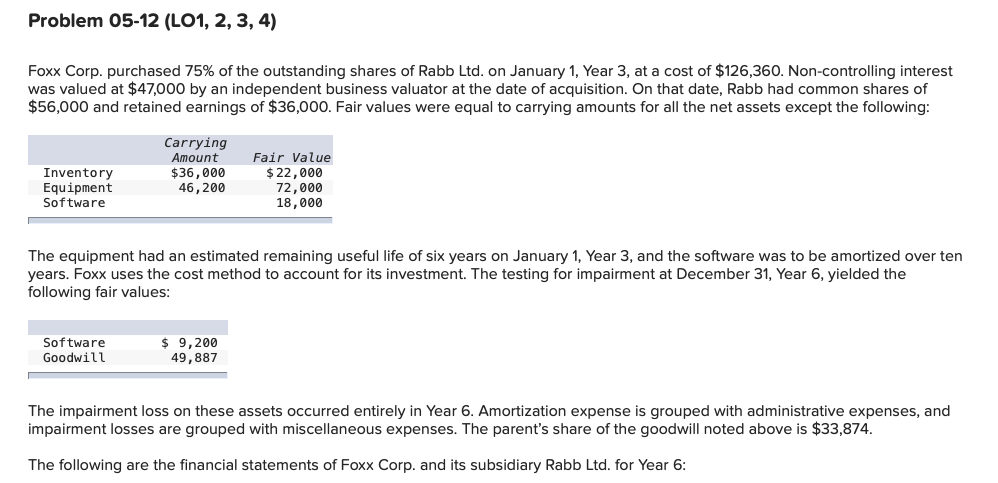

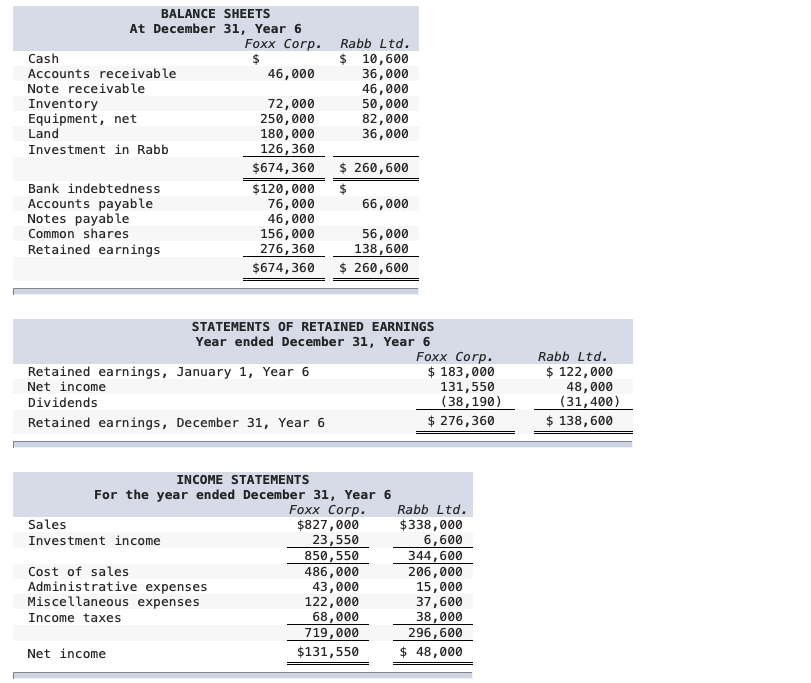

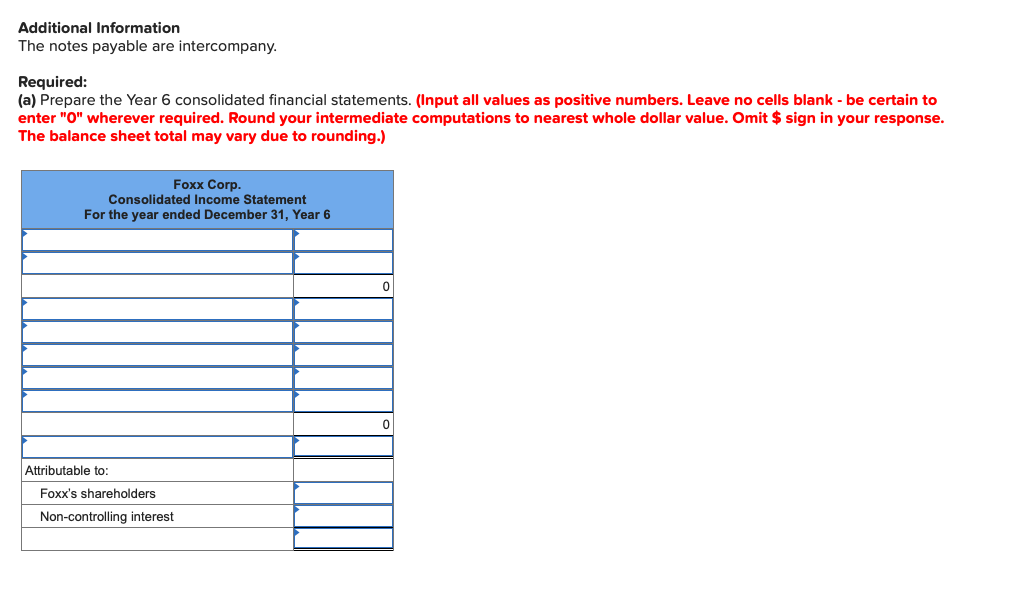

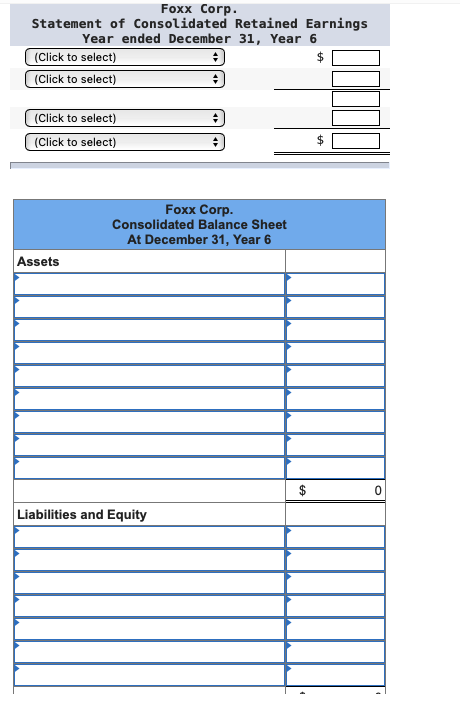

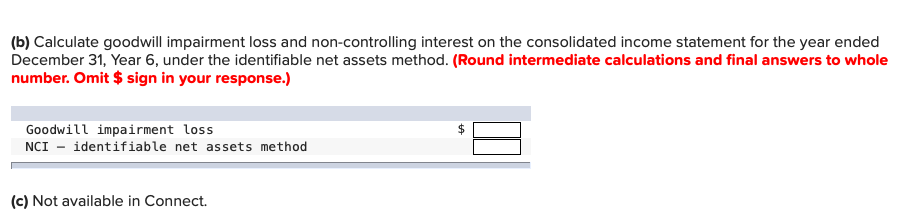

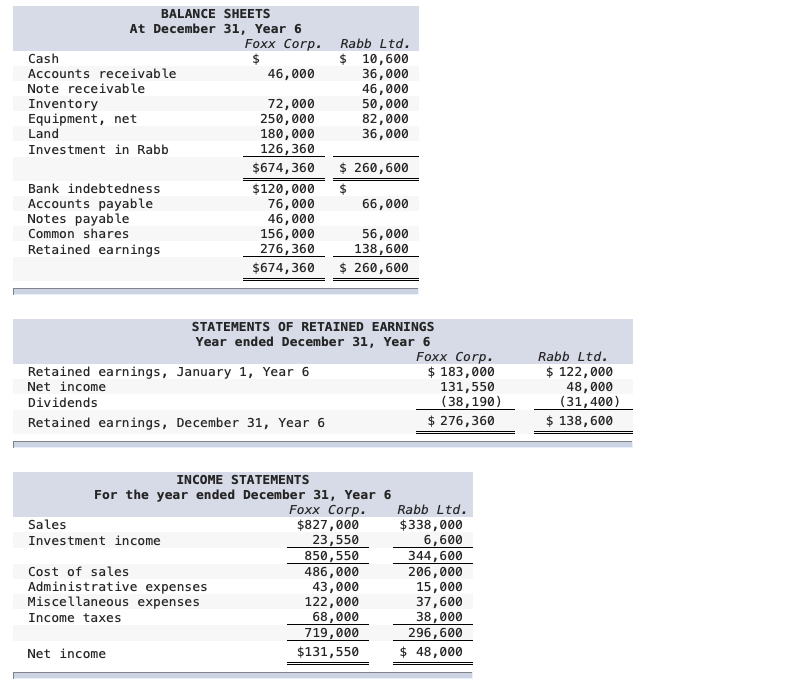

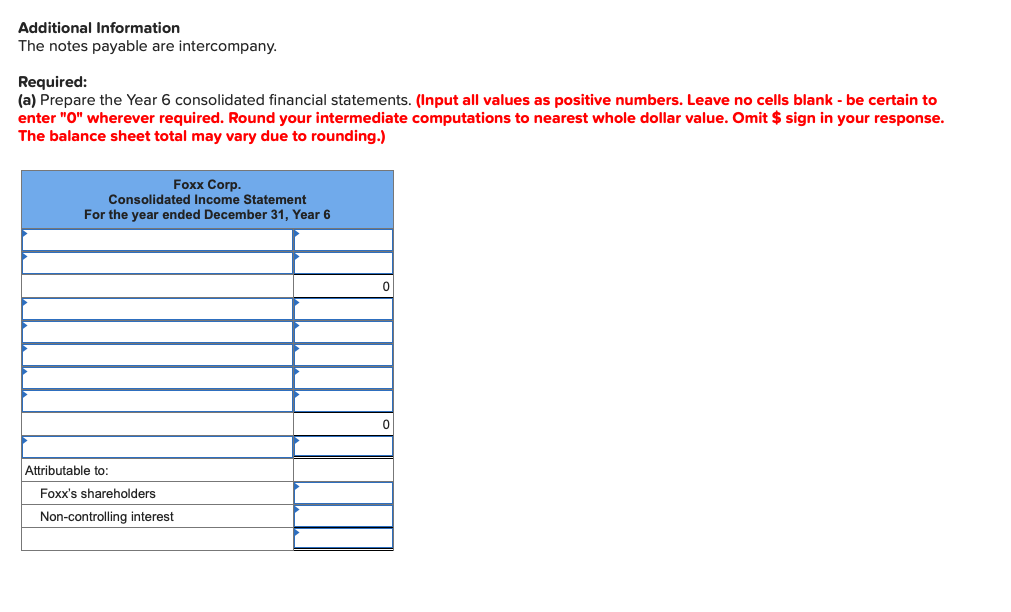

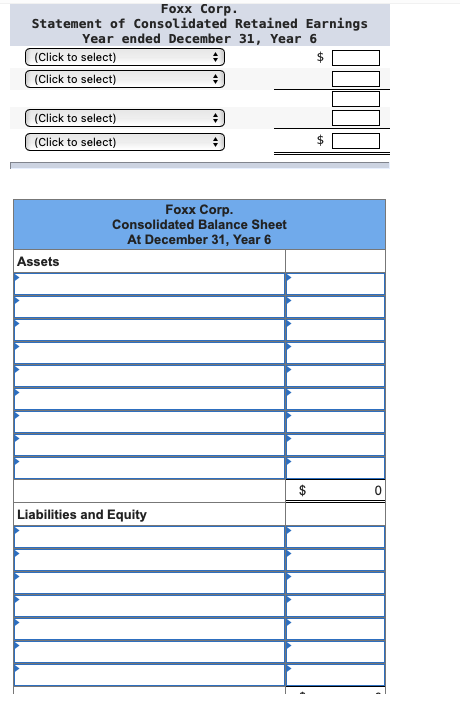

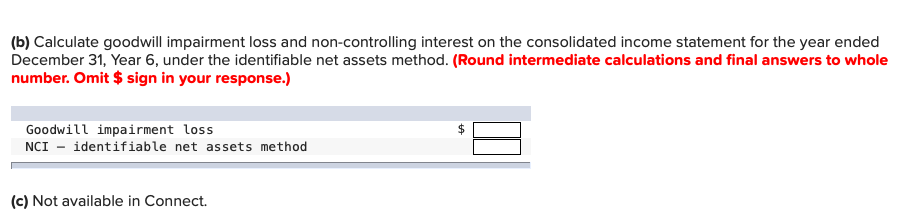

Problem 05-12 (L01, 2, 3, 4) Foxx Corp. purchased 75% of the outstanding shares of Rabb Ltd. on January 1. Year 3, at a cost of $126,360. Non-controlling interest was valued at $47,000 by an independent business valuator at the date of acquisition. On that date. Rabb had common shares of $56,000 and retained earnings of $36,000. Fair values were equal to carrying amounts for all the net assets except the following: Carying Amount Fair Value Inventory $35,886 $22,008 Equipment 46,239 12,993 Software 18,993 [ The equipment had an estimated remaining useful life of six years on January 1, Year 3, and the software was to be amortized over ten years. Foxx uses the cost method to account for its investment. The testing for impairment at December 31, Year 5, yielded the following fair values: Software $ 9,200 Goodwill 49,88? [ The impairment loss on these assets occurred entirely in Year 5. Amortization expense is grouped with administrative expenses, and impairment losses are grouped with miscellaneous expenses. The parent's share of the goodwill noted above is $33,874. The following are the nancial statements of Foxx Corp. and its subsidiary Rabb Ltd. for Year 5: BALANCE SHEETS At December 31, Year 6 Foxx Corp. Rabb Ltd. Cash $ 10,606 Accounts receivable 46, 000 36,000 Note receivable 16,000 Inventory 72, 000 50, 000 Equipment, net 250, 000 82, 000 Land 180, 000 36, 000 Investment in Rabb 126, 360 $674, 360 $ 260, 600 Bank indebtedness $120, 000 $ Accounts payable 76, 000 66, 900 Notes payable 46, 000 Common shares 156, 000 56, 090 Retained earnings 276, 360 138, 600 $674, 360 $ 260,600 STATEMENTS OF RETAINED EARNINGS Year ended December 31, Year 6 Foxx Corp. Rabb Ltd. Retained earnings, January 1, Year 6 $ 183, 090 $ 122, 000 Net income 131, 550 48, 006 Dividends (38, 190) (31, 400) Retained earnings, December 31, Year 6 $ 276, 360 $ 138, 600 INCOME STATEMENTS For the year ended December 31, Year 6 Foxx Corp. Rabb Ltd. Sales $827, 000 $338, 000 Investment income 23,550 6,600 850,550 344, 600 Cost of sales 486,060 206,000 Administrative expenses 43,000 15, 090 Miscellaneous expenses 122, 000 37, 600 Income taxes 68,000 38, 000 719,000 296, 600 Net income $131, 550 $ 48,000Additional Information The notes payable are intercompany. Required: (a) Prepare the Year 6 consolidated financial statements. (Input all values as positive numbers. Leave no cells blank - be certain to enter "O" wherever required. Round your intermediate computations to nearest whole dollar value. Omit $ sign in your response. The balance sheet total may vary due to rounding.) Foxx Corp. Consolidated Income Statement For the year ended December 31, Year 6 0 Attributable to: Foxx's shareholders Non-controlling interestFoxx Corp. Statement of Consolidated Retained Earnings Year ended December 31, Year 6 (Click to select) (Click to select) (Click to select) (Click to select) $ Foxx Corp. Consolidated Balance Sheet At December 31, Year 6 Assets Liabilities and Equity(b) Calculate goodwill impairment loss and non-controlling interest on the consolidated income statement for the year ended December 31, Year 6, under the identifiable net assets method. (Round intermediate calculations and final answers to whole number. Omit $ sign in your response.) Goodwill impairment loss NCI - identifiable net assets method (c) Not available in Connect