Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is a explanation in textbook and example with solution as well The following below is the question : Now for question 4 f (iv

This is a explanation in textbook and example with solution as well

This is a explanation in textbook and example with solution as well

The following below is the question :

Now for question 4 f (iv ) i had few questions before that which i already answered them and they are :

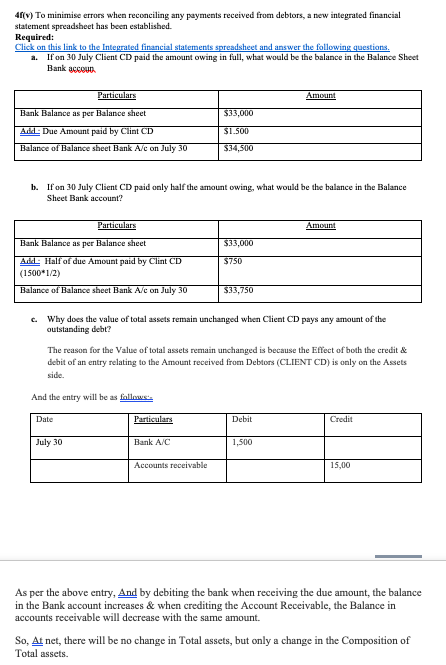

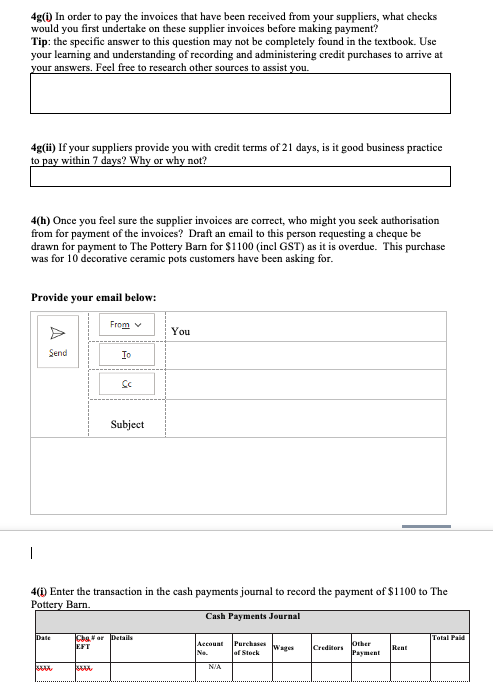

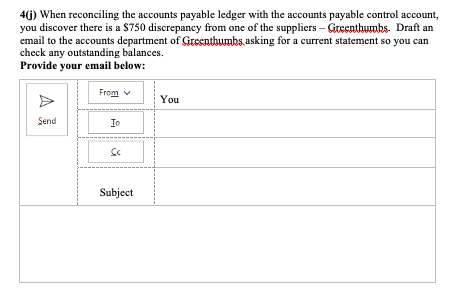

This is the spreadsheet for Q 4 (V) and i already answered a , b and c and the following below are my answered :

This is the spreadsheet for Q 4 (V) and i already answered a , b and c and the following below are my answered :

Comment here if you need more informations /details relate to this questions ,thanks

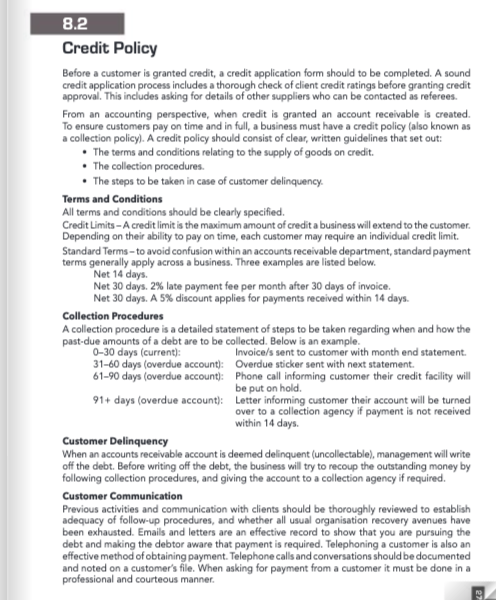

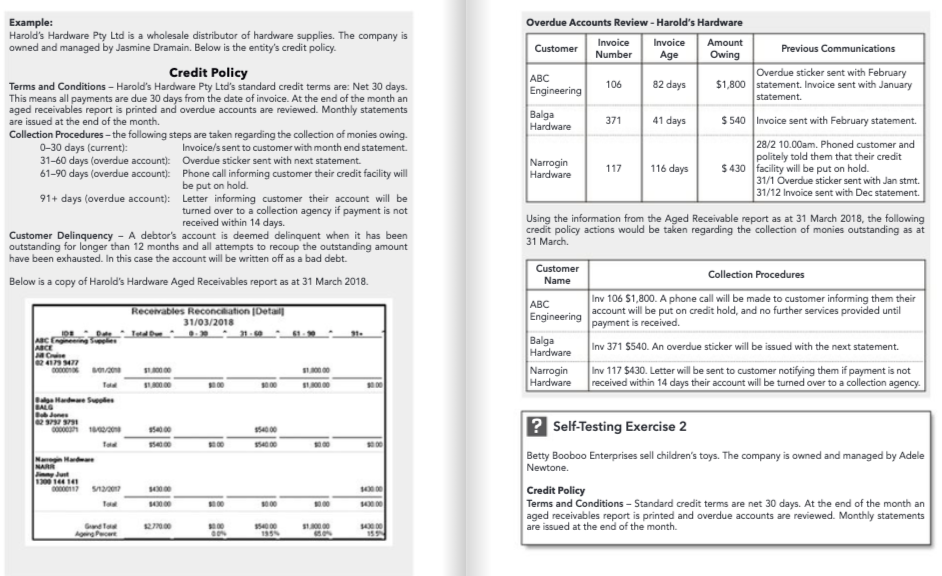

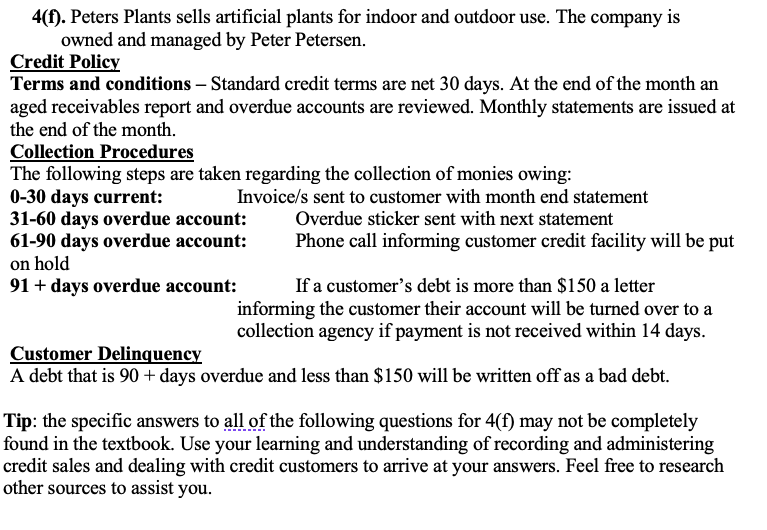

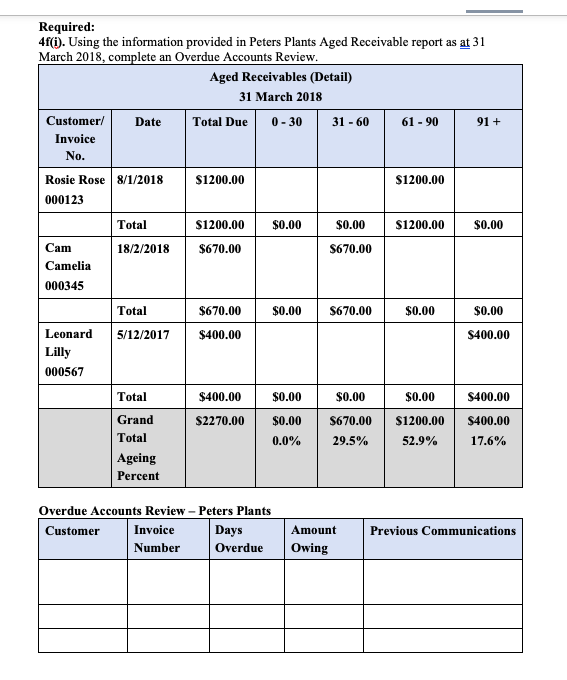

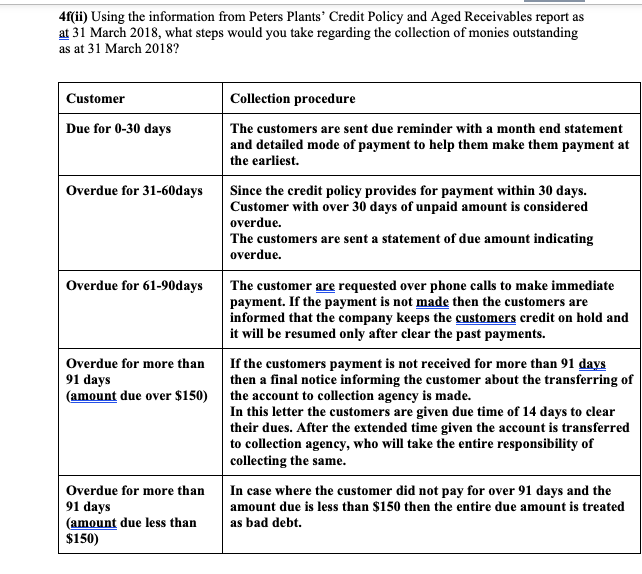

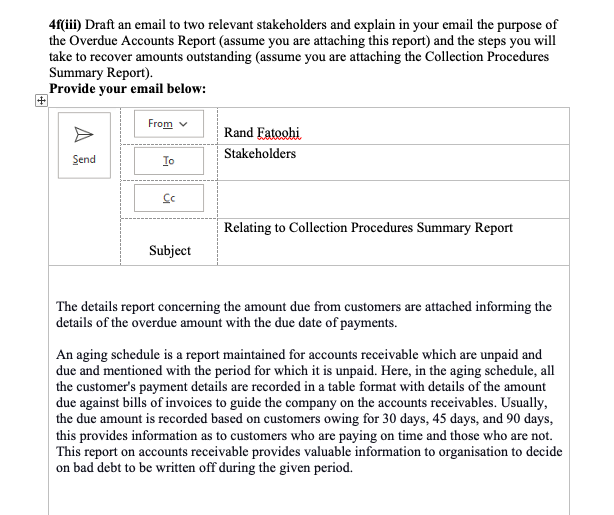

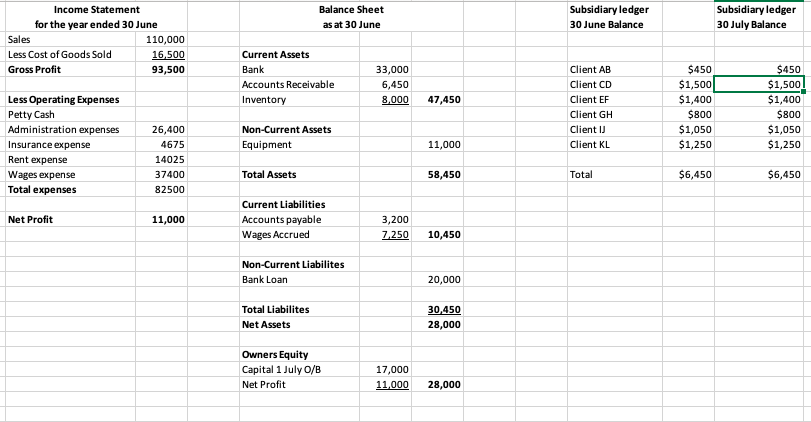

8.2 Credit Policy Before a customer is granted credit, a credit application form should to be completed. A sound credit application process includes a thorough check of client credit ratings before granting credit approval. This includes asking for details of other suppliers who can be contacted as referees. From an accounting perspective, when credit is granted an account receivable is created. To ensure customers pay on time and in full, a business must have a credit policy (also known as a collection policy). A credit policy should consist of clear, written guidelines that set out: The terms and conditions relating to the supply of goods on credit. The collection procedures. The steps to be taken in case of customer delinquency Terms and Conditions All terms and conditions should be clearly specified. Credit Limits-A credit limit is the maximum amount of credit a business will extend to the customer. Depending on their ability to pay on time, each customer may require an individual credit limit. Standard Terms- to avoid confusion within an accounts receivable department, standard payment terms generally apply across a business. Three examples are listed below. Net 14 days Net 30 days. 2% late payment fee per month after 30 days of invoice. Net 30 days. A 5% discount applies for payments received within 14 days. Collection Procedures A collection procedure is a detailed statement of steps to be taken regarding when and how the past-due amounts of a debt are to be collected. Below is an example. 0-30 days (current): Invoice/s sent to customer with month end statement. 31-60 days (overdue account): Overdue sticker sent with next statement. 61-90 days (overdue account): Phone call informing customer their credit facility will be put on hold. 91+ days (overdue account): Letter informing customer their account will be turned over to a collection agency if payment is not received within 14 days. Customer Delinquency When an accounts receivable account is deemed delinquent (uncollectable), management will write off the debt. Before writing off the debt, the business will try to recoup the outstanding money by following collection procedures, and giving the account to a collection agency if required. Customer Communication Previous activities and communication with clients should be thoroughly reviewed to establish adequacy of follow-up procedures, and whether all usual organisation recovery avenues have been exhausted. Emails and letters are an effective record to show that you are pursuing the debt and making the debtor aware that payment is required. Telephoning a customer is also an effective method of obtaining payment. Telephone calls and conversations should be documented and noted on a customer's file. When asking for payment from a customer it must be done in a professional and courteous manner. 82 days 41 days Example: Harold's Hardware Pty Ltd is a wholesale distributor of hardware supplies. The company is owned and managed by Jasmine Dramain. Below is the entity's credit policy Credit Policy Terms and Conditions - Harold's Hardware Pty Ltd's standard credit terms are: Net 30 days. This means all payments are due 30 days from the date of invoice. At the end of the month an aged receivables report is printed and overdue accounts are reviewed. Monthly statements are issued at the end of the month. Collection Procedures - the following steps are taken regarding the collection of monies owing. 0-30 days (current): Invoice/s sent to customer with month end statement. 31-60 days (overdue account): Overdue sticker sent with next statement 61-90 days (overdue account): Phone call informing customer their credit facility will be put on hold. 91+ days (overdue account): Letter informing customer their account will be turned over to a collection agency if payment is not received within 14 days Customer Delinquency - A debtor's account is deemed delinquent when it has been outstanding for longer than 12 months and all attempts to recoup the outstanding amount have been exhausted. In this case the account will be written off as a bad debt. Below is a copy of Harold's Hardware Aged Receivables report as at 31 March 2018. Receivables Reconciliation Detail 31/03/2018 ABC ABCE 2473 Overdue Accounts Review - Harold's Hardware Invoice Customer Invoice Amount Previous Communications Number Age Owing Overdue sticker sent with February ABC 106 Engineering $1,800 statement. Invoice sent with January statement Balga 371 $ 540 Invoice sent with February statement. Hardware 28/2 10.00am. Phoned customer and politely told them that their credit Narrogin 116 days $430 facility will be put on hold. Hardware 31/1 Overdue sticker sent with Jan stmt. 31/12 Invoice sent with Dec statement. Using the information from the Aged Receivable report as at 31 March 2018, the following credit policy actions would be taken regarding the collection of monies outstanding as at 31 March 117 Customer Name ABC Engineering Collection Procedures Inv 106 S1,800. A phone call will be made to customer informing them their account will be put on credit hold, and no further services provided until payment is received Inv 371 $540. An overdue sticker will be issued with the next statement. Inv 117 5430. Letter will be sent to customer notifying them if payment is not received within 14 days their account will be turned over to a collection agency. Balga Hardware Narrogin Hardware To | edge Hadees as BALO 2331 354000 Tod 95000 Name NARI Jul 1200 1641 ? Self-Testing Exercise 2 Betty Booboo Enterprises sell children's toys. The company is owned and managed by Adele Newtone. Credit Policy Terms and Conditions - Standard credit terms are net 30 days. At the end of the month an aged receivables report is printed and overdue accounts are reviewed. Monthly statements are issued at the end of the month. 0000 954000 10000 Ageng Pert 10000 159 4(f). Peters Plants sells artificial plants for indoor and outdoor use. The company is owned and managed by Peter Petersen. Credit Policy Terms and conditions - Standard credit terms are net 30 days. At the end of the month an aged receivables report and overdue accounts are reviewed. Monthly statements are issued at the end of the month. Collection Procedures The following steps are taken regarding the collection of monies owing: 0-30 days current: Invoice/s sent to customer with month end statement 31-60 days overdue account: Overdue sticker sent with next statement 61-90 days overdue account: Phone call informing customer credit facility will be put on hold 91 + days overdue account: If a customer's debt is more than $150 a letter informing the customer their account will be turned over to a collection agency if payment is not received within 14 days. Customer Delinquency A debt that is 90 + days overdue and less than $150 will be written off as a bad debt. Tip: the specific answers to all of the following questions for 4(f) may not be completely found in the textbook. Use your learning and understanding of recording and administering credit sales and dealing with credit customers to arrive at your answers. Feel free to research other sources to assist you. Required: 4f(i). Using the information provided in Peters Plants Aged Receivable report as at 31 March 2018, complete an Overdue Accounts Review. Aged Receivables (Detail) 31 March 2018 Customer/ Date Total Due 0 - 30 31 - 60 61 - 90 91 + Invoice No. Rosie Rose 8/1/2018 $1200.00 $1200.00 000123 Total $1200.00 $0.00 $0.00 $1200.00 $0.00 Cam 18/2/2018 $670.00 $670.00 Camelia 000345 Total $670.00 $0.00 $670.00 $0.00 $0.00 Leonard 5/12/2017 $400.00 $400.00 Lilly 000567 Total $400.00 $0.00 $0.00 $0.00 $400.00 Grand $2270.00 $0.00 $670.00 $1200.00 $400.00 Total 0.0% 29.5% 52.9% 17.6% Ageing Percent Overdue Accounts Review - Peters Plants Customer Invoice Days Number Overdue Previous Communications Amount Owing 4f(ii) Using the information from Peters Plants Credit Policy and Aged Receivables report as at 31 March 2018, what steps would you take regarding the collection of monies outstanding as at 31 March 2018? Customer Collection procedure Due for 0-30 days Overdue for 31-60days Overdue for 61-90days The customers are sent due reminder with a month end statement and detailed mode of payment to help them make them payment at the earliest. Since the credit policy provides for payment within 30 days. Customer with over 30 days of unpaid amount is considered overdue. The customers are sent a statement of due amount indicating overdue. The customer are requested over phone calls to make immediate payment. If the payment is not made then the customers are informed that the company keeps the customers credit on hold and it will be resumed only after clear the past payments. If the customers payment is not received for more than 91 days then a final notice informing the customer about the transferring of the account to collection agency is made. In this letter the customers are given due time of 14 days to clear their dues. After the extended time given the account is transferred to collection agency, who will take the entire responsibility of collecting the same. In case where the customer did not pay for over 91 days and the amount due is less than $150 then the entire due amount is treated as bad debt. Overdue for more than 91 days (amount due over $150) Overdue for more than 91 days (amount due less than $150) 4f(iii) Draft an email to two relevant stakeholders and explain in your email the purpose of the Overdue Accounts Report assume you are attaching this report) and the steps you will take to recover amounts outstanding (assume you are attaching the Collection Procedures Summary Report). Provide your email below: From A Rand Fatoohi Stakeholders Send Relating to Collection Procedures Summary Report Subject The details report concerning the amount due from customers are attached informing the details of the overdue amount with the due date of payments. An aging schedule is a report maintained for accounts receivable which are unpaid and due and mentioned with the period for which it is unpaid. Here, in the aging schedule, all the customer's payment details are recorded in a table format with details of the amount due against bills of invoices to guide the company on the accounts receivables. Usually, the due amount is recorded based on customers owing for 30 days, 45 days, and 90 days, this provides information as to customers who are paying on time and those who are not. This report on accounts receivable provides valuable information to organisation to decide on bad debt to be written off during the given period. The following are the steps to be followed for collection of overdue amount: Customer Collection procedure Due for 0-30 days The customers are sent due reminder with a month end statement and detailed mode of payment to help them make them payment at the earliest. Overdue for 31-60days Since the credit policy provides for payment within 30 days. Customer with over 30 days of unpaid amount is considered overdue. The customers are sent a statement of due amount indicating overdue. Overdue for 61-90days The customer are requested over phone calls to make immediate payment. If the payment is not made then the customers are informed that the company keeps the customers credit on hold and it will be resumed only after clear the past payments. Overdue for more than If the customers payment is not received for more than 91 days 91 days then a final notice informing the customer about the transferring of (amount due over $150) the account to collection agency is made. In this letter the customers are given due time of 14 days to clear their dues. After the extended time given the account is transferred to collection agency, who will take the entire responsibility of collecting the same. Overdue for more than In case where the customer did not pay for over 91 days and the 91 days amount due is less than $150 then the entire due amount is treated (amount due less than as bad debt. $150) 4f(iv) Where would these reports be filed? Balance Sheet as at 30 June Subsidiary ledger 30 June Balance Subsidiary ledger 30 July Balance Income Statement for the year ended 30 June Sales 110,000 Less Cost of Goods Sold 16,500 Gross Profit 93,500 Current Assets Bank Accounts Receivable Inventory 33,000 6,450 8,000 47,450 Less Operating Expenses Petty Cash Administration expenses Insurance expense Rent expense Wages expense Total expenses Client AB Client CD Client EF Client GH Client 1 Client KL $450 $1,500 $1,400 $800 $1,050 $1,250 $450 $1,500 $1,400 $800 $1,050 $1,250 Non-Current Assets Equipment 11,000 26,400 4675 14025 37400 82500 Total Assets 58,450 Total $6,450 $6,450 Net Profit 11,000 Current Liabilities Accounts payable Wages Accrued 3,200 7,250 10,450 Non-Current Liabilites Bank Loan 20,000 Total Liabilites Net Assets 30,450 28,000 Owners Equity Capital 1 July 0/B Net Profit 17,000 11.000 28,000 4f(V) To minimise errors when reconciling any payments received from debtors, a new integrated financial statement spreadsheet has been established. Required: Click on this link to the Integrated financial statements spreadsheet and answer the following questions. a. If on 30 July Client CD paid the amount owing in full, what would be the balance in the Balance Sheet Bank account Particulars Amount Bank Balance as per Balance sheet $33,000 $1.500 Add Due Amount paid by Clint CD Balance of Balance sheet Bank A/c on July 30 $34,500 b. If on 30 July Client CD paid only half the amount owing, what would be the balance in the Balance Sheet Bank account? Particulars Amount $33,000 $750 Bank Balance as per Balance sheet And Hall of due Amount paid by Clint CD (1500*1/2) Balance of Balance sheet Bank Ne on July 30 $33,750 c. Why does the value of total assets remain unchanged when Client CD pays any amount of the outstanding debt? The reason for the Value of total assets remain unchanged is because the Effect of both the credit & debit of an entry relating to the Amount received from Debtors (CLIENT CD) is only on the Assets side. And the entry will be as followers Date Particulars Debit Credit July 30 Bank A/C 1,500 Accounts receivable 15,00 As per the above entry, And by debiting the bank when receiving the due amount, the balance in the Bank account increases & when crediting the Account Receivable, the Balance in accounts receivable will decrease with the same amount. So, At net, there will be no change in Total assets, but only a change in the Composition of Total assets. 4g(1) In order to pay the invoices that have been received from your suppliers, what checks would you first undertake on these supplier invoices before making payment? Tip: the specific answer to this question may not be completely found in the textbook. Use your learning and understanding of recording and administering credit purchases to arrive at your answers. Feel free to research other sources to assist you. 4g(ii) If your suppliers provide you with credit terms of 21 days, is it good business practice to pay within 7 days? Why or why not? 4(h) Once you feel sure the supplier invoices are correct, who might you seek authorisation from for payment of the invoices? Draft an email to this person requesting a cheque be drawn for payment to The Pottery Barn for $1100 (incl GST) as it is overdue. This purchase was for 10 decorative ceramic pots customers have been asking for. Provide your email below: From You Send TO CC Subject | 4 Enter the transaction in the cash payments journal to record the payment of $1100 to The Pottery Barn Cash Payments Journal Date Chyor Details JEFT Total Paid Account N. Purchase of Stock W Creditors Other Payment Rent NA 4(1) When reconciling the accounts payable ledger with the accounts payable control account, you discover there is a $750 discrepancy from one of the suppliers - Greenthumbs. Draft an email to the accounts department of Greenthumbs, asking for a current statement so you can check any outstanding balances. Provide your email below: From You Send TO Subject 8.2 Credit Policy Before a customer is granted credit, a credit application form should to be completed. A sound credit application process includes a thorough check of client credit ratings before granting credit approval. This includes asking for details of other suppliers who can be contacted as referees. From an accounting perspective, when credit is granted an account receivable is created. To ensure customers pay on time and in full, a business must have a credit policy (also known as a collection policy). A credit policy should consist of clear, written guidelines that set out: The terms and conditions relating to the supply of goods on credit. The collection procedures. The steps to be taken in case of customer delinquency Terms and Conditions All terms and conditions should be clearly specified. Credit Limits-A credit limit is the maximum amount of credit a business will extend to the customer. Depending on their ability to pay on time, each customer may require an individual credit limit. Standard Terms- to avoid confusion within an accounts receivable department, standard payment terms generally apply across a business. Three examples are listed below. Net 14 days Net 30 days. 2% late payment fee per month after 30 days of invoice. Net 30 days. A 5% discount applies for payments received within 14 days. Collection Procedures A collection procedure is a detailed statement of steps to be taken regarding when and how the past-due amounts of a debt are to be collected. Below is an example. 0-30 days (current): Invoice/s sent to customer with month end statement. 31-60 days (overdue account): Overdue sticker sent with next statement. 61-90 days (overdue account): Phone call informing customer their credit facility will be put on hold. 91+ days (overdue account): Letter informing customer their account will be turned over to a collection agency if payment is not received within 14 days. Customer Delinquency When an accounts receivable account is deemed delinquent (uncollectable), management will write off the debt. Before writing off the debt, the business will try to recoup the outstanding money by following collection procedures, and giving the account to a collection agency if required. Customer Communication Previous activities and communication with clients should be thoroughly reviewed to establish adequacy of follow-up procedures, and whether all usual organisation recovery avenues have been exhausted. Emails and letters are an effective record to show that you are pursuing the debt and making the debtor aware that payment is required. Telephoning a customer is also an effective method of obtaining payment. Telephone calls and conversations should be documented and noted on a customer's file. When asking for payment from a customer it must be done in a professional and courteous manner. 82 days 41 days Example: Harold's Hardware Pty Ltd is a wholesale distributor of hardware supplies. The company is owned and managed by Jasmine Dramain. Below is the entity's credit policy Credit Policy Terms and Conditions - Harold's Hardware Pty Ltd's standard credit terms are: Net 30 days. This means all payments are due 30 days from the date of invoice. At the end of the month an aged receivables report is printed and overdue accounts are reviewed. Monthly statements are issued at the end of the month. Collection Procedures - the following steps are taken regarding the collection of monies owing. 0-30 days (current): Invoice/s sent to customer with month end statement. 31-60 days (overdue account): Overdue sticker sent with next statement 61-90 days (overdue account): Phone call informing customer their credit facility will be put on hold. 91+ days (overdue account): Letter informing customer their account will be turned over to a collection agency if payment is not received within 14 days Customer Delinquency - A debtor's account is deemed delinquent when it has been outstanding for longer than 12 months and all attempts to recoup the outstanding amount have been exhausted. In this case the account will be written off as a bad debt. Below is a copy of Harold's Hardware Aged Receivables report as at 31 March 2018. Receivables Reconciliation Detail 31/03/2018 ABC ABCE 2473 Overdue Accounts Review - Harold's Hardware Invoice Customer Invoice Amount Previous Communications Number Age Owing Overdue sticker sent with February ABC 106 Engineering $1,800 statement. Invoice sent with January statement Balga 371 $ 540 Invoice sent with February statement. Hardware 28/2 10.00am. Phoned customer and politely told them that their credit Narrogin 116 days $430 facility will be put on hold. Hardware 31/1 Overdue sticker sent with Jan stmt. 31/12 Invoice sent with Dec statement. Using the information from the Aged Receivable report as at 31 March 2018, the following credit policy actions would be taken regarding the collection of monies outstanding as at 31 March 117 Customer Name ABC Engineering Collection Procedures Inv 106 S1,800. A phone call will be made to customer informing them their account will be put on credit hold, and no further services provided until payment is received Inv 371 $540. An overdue sticker will be issued with the next statement. Inv 117 5430. Letter will be sent to customer notifying them if payment is not received within 14 days their account will be turned over to a collection agency. Balga Hardware Narrogin Hardware To | edge Hadees as BALO 2331 354000 Tod 95000 Name NARI Jul 1200 1641 ? Self-Testing Exercise 2 Betty Booboo Enterprises sell children's toys. The company is owned and managed by Adele Newtone. Credit Policy Terms and Conditions - Standard credit terms are net 30 days. At the end of the month an aged receivables report is printed and overdue accounts are reviewed. Monthly statements are issued at the end of the month. 0000 954000 10000 Ageng Pert 10000 159 4(f). Peters Plants sells artificial plants for indoor and outdoor use. The company is owned and managed by Peter Petersen. Credit Policy Terms and conditions - Standard credit terms are net 30 days. At the end of the month an aged receivables report and overdue accounts are reviewed. Monthly statements are issued at the end of the month. Collection Procedures The following steps are taken regarding the collection of monies owing: 0-30 days current: Invoice/s sent to customer with month end statement 31-60 days overdue account: Overdue sticker sent with next statement 61-90 days overdue account: Phone call informing customer credit facility will be put on hold 91 + days overdue account: If a customer's debt is more than $150 a letter informing the customer their account will be turned over to a collection agency if payment is not received within 14 days. Customer Delinquency A debt that is 90 + days overdue and less than $150 will be written off as a bad debt. Tip: the specific answers to all of the following questions for 4(f) may not be completely found in the textbook. Use your learning and understanding of recording and administering credit sales and dealing with credit customers to arrive at your answers. Feel free to research other sources to assist you. Required: 4f(i). Using the information provided in Peters Plants Aged Receivable report as at 31 March 2018, complete an Overdue Accounts Review. Aged Receivables (Detail) 31 March 2018 Customer/ Date Total Due 0 - 30 31 - 60 61 - 90 91 + Invoice No. Rosie Rose 8/1/2018 $1200.00 $1200.00 000123 Total $1200.00 $0.00 $0.00 $1200.00 $0.00 Cam 18/2/2018 $670.00 $670.00 Camelia 000345 Total $670.00 $0.00 $670.00 $0.00 $0.00 Leonard 5/12/2017 $400.00 $400.00 Lilly 000567 Total $400.00 $0.00 $0.00 $0.00 $400.00 Grand $2270.00 $0.00 $670.00 $1200.00 $400.00 Total 0.0% 29.5% 52.9% 17.6% Ageing Percent Overdue Accounts Review - Peters Plants Customer Invoice Days Number Overdue Previous Communications Amount Owing 4f(ii) Using the information from Peters Plants Credit Policy and Aged Receivables report as at 31 March 2018, what steps would you take regarding the collection of monies outstanding as at 31 March 2018? Customer Collection procedure Due for 0-30 days Overdue for 31-60days Overdue for 61-90days The customers are sent due reminder with a month end statement and detailed mode of payment to help them make them payment at the earliest. Since the credit policy provides for payment within 30 days. Customer with over 30 days of unpaid amount is considered overdue. The customers are sent a statement of due amount indicating overdue. The customer are requested over phone calls to make immediate payment. If the payment is not made then the customers are informed that the company keeps the customers credit on hold and it will be resumed only after clear the past payments. If the customers payment is not received for more than 91 days then a final notice informing the customer about the transferring of the account to collection agency is made. In this letter the customers are given due time of 14 days to clear their dues. After the extended time given the account is transferred to collection agency, who will take the entire responsibility of collecting the same. In case where the customer did not pay for over 91 days and the amount due is less than $150 then the entire due amount is treated as bad debt. Overdue for more than 91 days (amount due over $150) Overdue for more than 91 days (amount due less than $150) 4f(iii) Draft an email to two relevant stakeholders and explain in your email the purpose of the Overdue Accounts Report assume you are attaching this report) and the steps you will take to recover amounts outstanding (assume you are attaching the Collection Procedures Summary Report). Provide your email below: From A Rand Fatoohi Stakeholders Send Relating to Collection Procedures Summary Report Subject The details report concerning the amount due from customers are attached informing the details of the overdue amount with the due date of payments. An aging schedule is a report maintained for accounts receivable which are unpaid and due and mentioned with the period for which it is unpaid. Here, in the aging schedule, all the customer's payment details are recorded in a table format with details of the amount due against bills of invoices to guide the company on the accounts receivables. Usually, the due amount is recorded based on customers owing for 30 days, 45 days, and 90 days, this provides information as to customers who are paying on time and those who are not. This report on accounts receivable provides valuable information to organisation to decide on bad debt to be written off during the given period. The following are the steps to be followed for collection of overdue amount: Customer Collection procedure Due for 0-30 days The customers are sent due reminder with a month end statement and detailed mode of payment to help them make them payment at the earliest. Overdue for 31-60days Since the credit policy provides for payment within 30 days. Customer with over 30 days of unpaid amount is considered overdue. The customers are sent a statement of due amount indicating overdue. Overdue for 61-90days The customer are requested over phone calls to make immediate payment. If the payment is not made then the customers are informed that the company keeps the customers credit on hold and it will be resumed only after clear the past payments. Overdue for more than If the customers payment is not received for more than 91 days 91 days then a final notice informing the customer about the transferring of (amount due over $150) the account to collection agency is made. In this letter the customers are given due time of 14 days to clear their dues. After the extended time given the account is transferred to collection agency, who will take the entire responsibility of collecting the same. Overdue for more than In case where the customer did not pay for over 91 days and the 91 days amount due is less than $150 then the entire due amount is treated (amount due less than as bad debt. $150) 4f(iv) Where would these reports be filed? Balance Sheet as at 30 June Subsidiary ledger 30 June Balance Subsidiary ledger 30 July Balance Income Statement for the year ended 30 June Sales 110,000 Less Cost of Goods Sold 16,500 Gross Profit 93,500 Current Assets Bank Accounts Receivable Inventory 33,000 6,450 8,000 47,450 Less Operating Expenses Petty Cash Administration expenses Insurance expense Rent expense Wages expense Total expenses Client AB Client CD Client EF Client GH Client 1 Client KL $450 $1,500 $1,400 $800 $1,050 $1,250 $450 $1,500 $1,400 $800 $1,050 $1,250 Non-Current Assets Equipment 11,000 26,400 4675 14025 37400 82500 Total Assets 58,450 Total $6,450 $6,450 Net Profit 11,000 Current Liabilities Accounts payable Wages Accrued 3,200 7,250 10,450 Non-Current Liabilites Bank Loan 20,000 Total Liabilites Net Assets 30,450 28,000 Owners Equity Capital 1 July 0/B Net Profit 17,000 11.000 28,000 4f(V) To minimise errors when reconciling any payments received from debtors, a new integrated financial statement spreadsheet has been established. Required: Click on this link to the Integrated financial statements spreadsheet and answer the following questions. a. If on 30 July Client CD paid the amount owing in full, what would be the balance in the Balance Sheet Bank account Particulars Amount Bank Balance as per Balance sheet $33,000 $1.500 Add Due Amount paid by Clint CD Balance of Balance sheet Bank A/c on July 30 $34,500 b. If on 30 July Client CD paid only half the amount owing, what would be the balance in the Balance Sheet Bank account? Particulars Amount $33,000 $750 Bank Balance as per Balance sheet And Hall of due Amount paid by Clint CD (1500*1/2) Balance of Balance sheet Bank Ne on July 30 $33,750 c. Why does the value of total assets remain unchanged when Client CD pays any amount of the outstanding debt? The reason for the Value of total assets remain unchanged is because the Effect of both the credit & debit of an entry relating to the Amount received from Debtors (CLIENT CD) is only on the Assets side. And the entry will be as followers Date Particulars Debit Credit July 30 Bank A/C 1,500 Accounts receivable 15,00 As per the above entry, And by debiting the bank when receiving the due amount, the balance in the Bank account increases & when crediting the Account Receivable, the Balance in accounts receivable will decrease with the same amount. So, At net, there will be no change in Total assets, but only a change in the Composition of Total assets. 4g(1) In order to pay the invoices that have been received from your suppliers, what checks would you first undertake on these supplier invoices before making payment? Tip: the specific answer to this question may not be completely found in the textbook. Use your learning and understanding of recording and administering credit purchases to arrive at your answers. Feel free to research other sources to assist you. 4g(ii) If your suppliers provide you with credit terms of 21 days, is it good business practice to pay within 7 days? Why or why not? 4(h) Once you feel sure the supplier invoices are correct, who might you seek authorisation from for payment of the invoices? Draft an email to this person requesting a cheque be drawn for payment to The Pottery Barn for $1100 (incl GST) as it is overdue. This purchase was for 10 decorative ceramic pots customers have been asking for. Provide your email below: From You Send TO CC Subject | 4 Enter the transaction in the cash payments journal to record the payment of $1100 to The Pottery Barn Cash Payments Journal Date Chyor Details JEFT Total Paid Account N. Purchase of Stock W Creditors Other Payment Rent NA 4(1) When reconciling the accounts payable ledger with the accounts payable control account, you discover there is a $750 discrepancy from one of the suppliers - Greenthumbs. Draft an email to the accounts department of Greenthumbs, asking for a current statement so you can check any outstanding balances. Provide your email below: From You Send TO SubjectStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started