Answered step by step

Verified Expert Solution

Question

1 Approved Answer

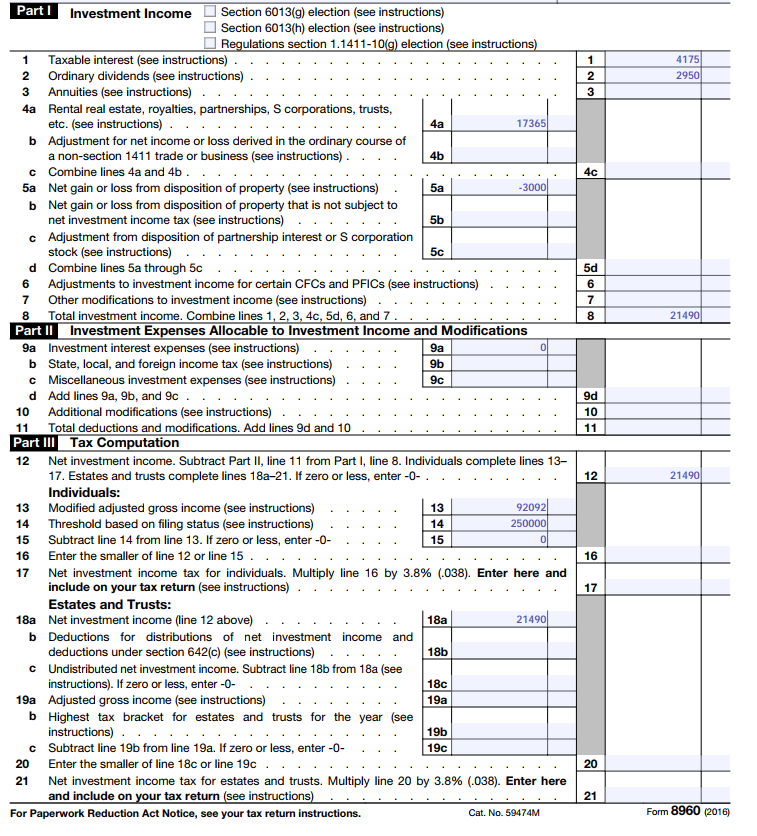

This is a Form 8960 in 2016 How can I get 18b, 18c, and what's deductions under section 642(c) 19a, is this = Gross income-

This is a Form 8960 in 2016

How can I get 18b, 18c, and what's deductions under section 642(c)

19a, is this = Gross income- all deductions for AGI?

19b, tax bracket for estates and trusts. where can I get that infomation every year?

Part l TI Section 6013(g) election(see instructions) Section 6013(h) election (see instructions) egulations section 11411-10(g) election (see i Investment Income 1 Taxable interest (see instructions) . 2 Ordinary dividends (see instructions) 4175 2 3 3 Annuities (see instructions) 4a Rental real estate, royalties, partnerships, S corporations, trusts, 17365 etc. (see instructions) b Adjustment for net income or loss derived in the ordinary course of a non-section 1411 trade or business (see instructions) 4b c Combine lines 4a and 4b. 4c . 5a Net gain or loss from disposition of property (see instructions) b Net gain or loss from disposition of property that is not subject to net investment income tax (see instructions) 5b c Adjustment from disposition of partnership interest or S 5c d Combine lines 5a through 5c 5d 6 Adjustments to investment income for certain CFCs and PFICs (see instructions) 7 Other modifications to investment income (see instructions) . . 8 Total investment income. Combine lines 1, 2, 3, 4c, 5d, 6, and 7 214 Part Il Investment Expenses Allocable to Investment Income and Modifications 9a Investment interest expenses (see instructions) b State, local, and foreign income tax (see instructions) 9b c Miscellaneous investment expenses (see instructions) d Add lines 9a, 9b, and 9c . 10 Additional modifications (see instructions) . . 11 Total deductions and modifications. Add lines 9d and 10 Part III 12 Net investment income. Subtract Part II, line 11 from Part I, line 8. Individuals complete lines 13- 9d Tax Computation 17. Estates and trusts complete lines 18a-21. If zero or less, enter -0- Individuals: 12 214 13 Modified adjusted gross income (see instructions) . . 14 Threshold based on filing status (see instructions). . 15 Subtract line 14 from line 13. If zero or less, enter -0. 16 Enter the smaller of line 12 or line 15 17 Net investment income tax for individuals. Multiply line 16 by 3.8% (.038). Enter here and 13 92092 15 16 include on your tax return (see i Estates and Trusts: 17 214 b Deductions for distributions of net investment income and deductions under section 642(c) (see instructions) . . Undistributed net investment income. Subtract line 18b from 18a (see instructions). If zero or less, enter-0 Adjusted gross income (see instructions) 18b c 18 19a 19a . . b Highest tax bracket for estates and trusts for the year (see 19b 19c c Subtract line 19b from line 19a. If zero or less, enter -0 20 Enter the smaller of line 18c or line 19c Net investment income tax for estates and trusts. Multiply line 20 by 3.8% (.038). Enter here and include on 21 r tax return 21 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 59474M Form 8960 (2016Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started