Question

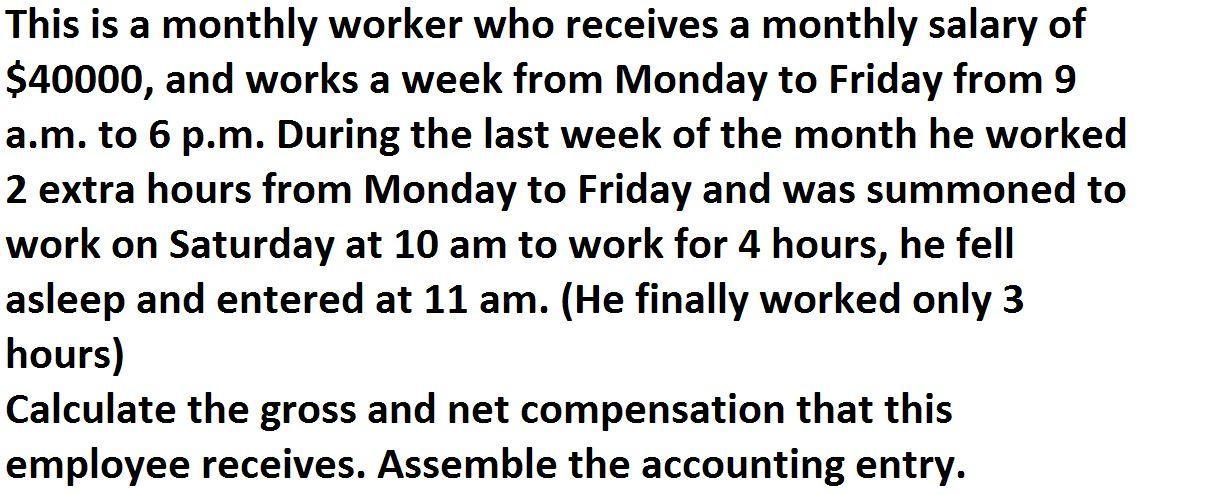

This is a monthly worker who receives a monthly salary of $40000, and works a week from Monday to Friday from 9 a.m. to

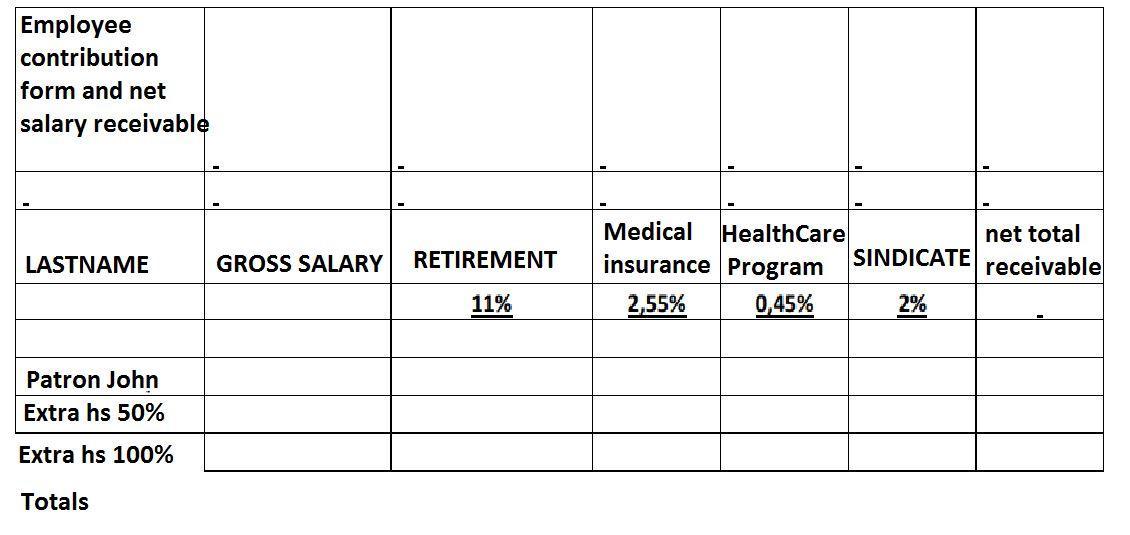

This is a monthly worker who receives a monthly salary of $40000, and works a week from Monday to Friday from 9 a.m. to 6 p.m. During the last week of the month he worked 2 extra hours from Monday to Friday and was summoned to work on Saturday at 10 am to work for 4 hours, he fell asleep and entered at 11 am. (He finally worked only 3 hours) Calculate the gross and net compensation that this employee receives. Assemble the accounting entry. Employee contribution form and net salary receivable Medical HealthCare insurance Program net total SINDICATE receivable LASTNAME GROSS SALARY RETIREMENT 11% 2,55% 0,45% 2% Patron John Extra hs 50% Extra hs 100% Totals

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Last Name Gross Salary Retirement Medical insurance Heal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Economics

Authors: R. Glenn Hubbard

6th edition

978-0134797731, 134797736, 978-0134106243

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App