Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is a more difficult but informative problem. James Brodrick & Sons, Incorporated, is growing rapidly and, if at all possible, would like to

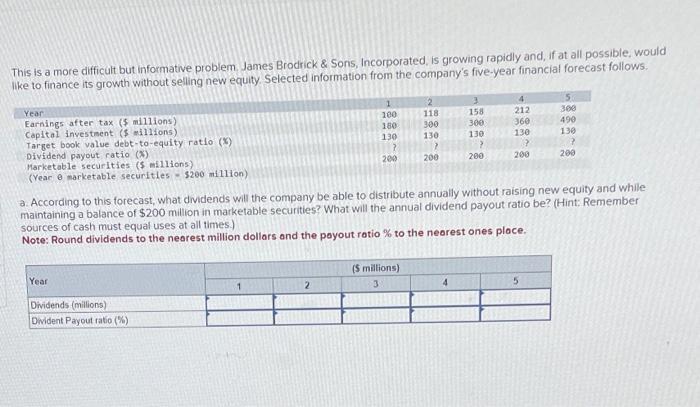

This is a more difficult but informative problem. James Brodrick & Sons, Incorporated, is growing rapidly and, if at all possible, would like to finance its growth without selling new equity. Selected information from the company's five-year financial forecast follows. Year Earnings after tax (5 millions) Capital investment (5 millions) Target book value debt-to-equity ratio (%) Dividend payout ratio (%) Marketable securities ($ millions) (Year 0 marketable securities $200 million) 1 2 4 5 100 118 158 212 300 180 300 300 360 490 130 130 130 130 130 ? ? 200 200 200 200 200 a. According to this forecast, what dividends will the company be able to distribute annually without raising new equity and while maintaining a balance of $200 million in marketable securities? What will the annual dividend payout ratio be? (Hint: Remember sources of cash must equal uses at all times.) Note: Round dividends to the nearest million dollars and the payout ratio % to the nearest ones place. Year Dividends (millions) Divident Payout ratio (%) (5 millions).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To determine the dividends that the company will be able to distribute annually without raising new equity and while maintaining a balance of 200 million in marketable securities we need to cal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started