This is a new manufacturing corporation that issued $50000 common stock for cash on the first day. All overhead expenses are paid immediately by

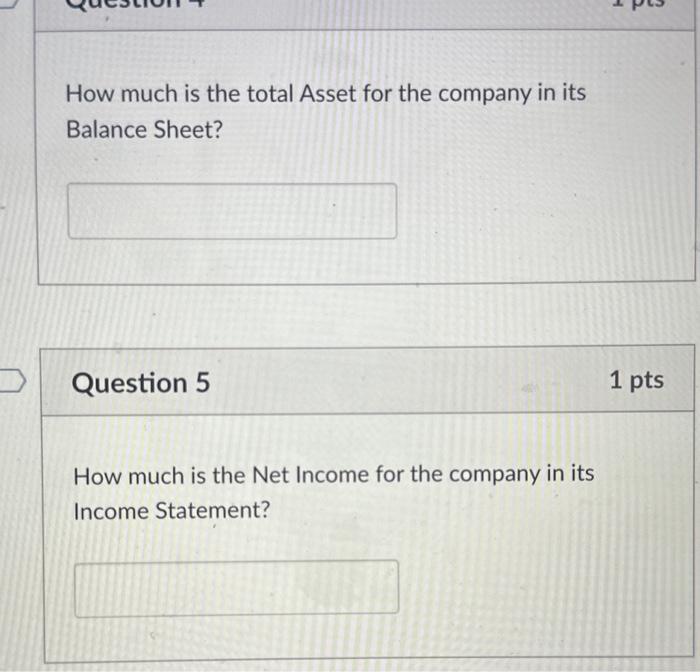

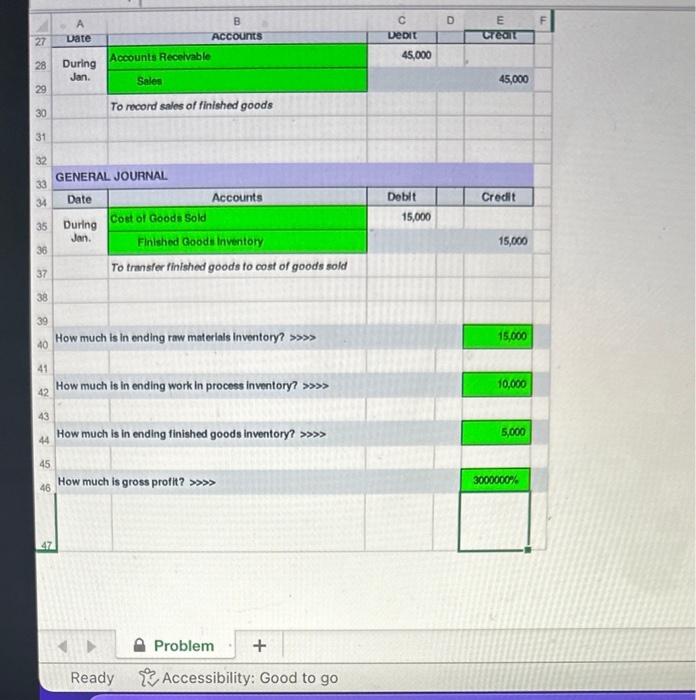

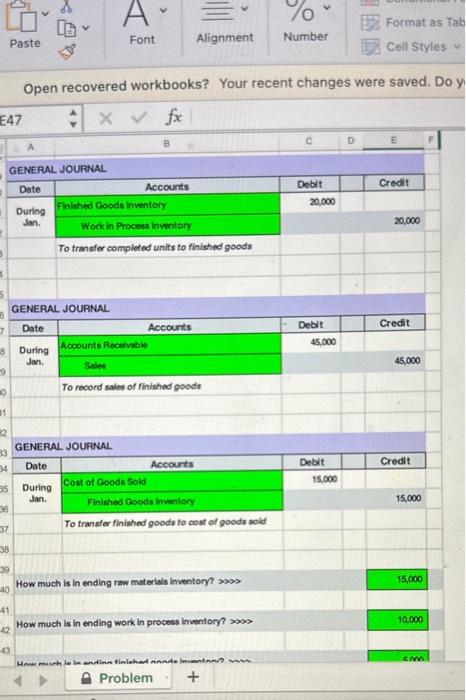

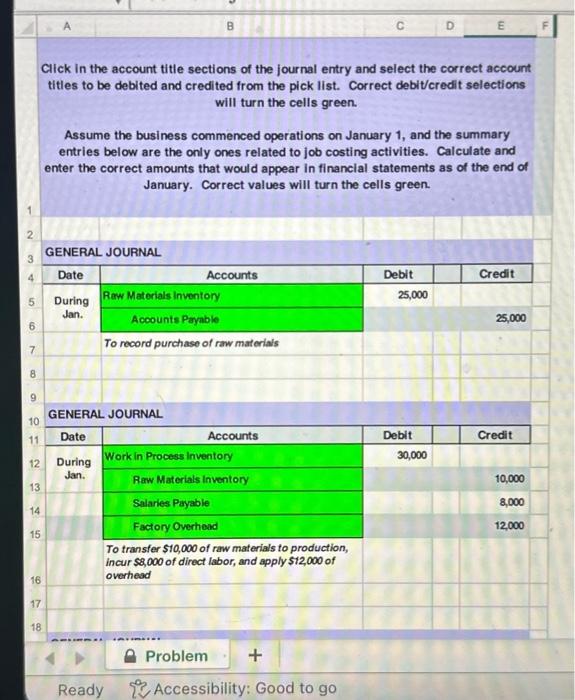

This is a new manufacturing corporation that issued $50000 common stock for cash on the first day. All overhead expenses are paid immediately by cash. To make it easy, there are no other operating expenses and no income tax. No Dividend is declared for the year. Post all journal entries in the General Ledger T-accounts and using their respective balances prepare an Income Statment and Balance Sheet for the first month of the operation. Use a blank paper for posting into General Ledger and preparation of the financial statements. How much is the total Asset for the company in its Balance Sheet? Question 5 How much is the Net Income for the company in its Income Statement? 4 2 1 pts 27 28 29 30 31 32 33 34 42 Date During Jan. 45 46 Accounts Receivable GENERAL JOURNAL Date 35 During Cost of Goods Sold Jan. 36 37 38 39 Sales To record sales of finished goods B Accounts Accounts Finished Goods Inventory To transfer finished goods to cost of goods sold How much is in ending raw materials inventory? >>>> How much is in ending work in process inventory? >>>> How much is in ending finished goods inventory? >>>> 44 Ready How much is gross profit? >>>> Problem + Accessibility: Good to go Debit 45,000 Debit 15,000 D E Creat 45,000 Credit 15,000 15,000 10,000 5,000 3000000% F TI E47 1 5 7 9 20 11 32 83 34 Paste 35 36 37 Open recovered A GENERAL JOURNAL Date During Jan. During Jan. A Font GENERAL JOURNAL Date During Jan. X x fx V GENERAL JOURNAL Date Finished Goods inventory workbooks? Your recent changes were saved. Do y B Accounts Work in Process Inventory To transfer completed units to finished goods Cost of Goods Sold E Alignment Accounts Accounts Receivable Salee To record sales of finished goods Accounts Finished Goods inventory To transfer finished goods to cost of goods sold 38 39 How much is in ending raw materials inventory? >>>> 40 41 42 How much is in ending work in process inventory? >>>> 43 % Number How much is in andinn finished annde innton? Problem + Debit 20,000 Debit 45,000 Debit Format as Tab Cell Styles 15.000 Credit 20,000 Credit 45,000 Credit 15,000 15,000 10,000 cm 2 3 4 5 6 7 8 9 16 10 11 345 13 14 15 12 During Jan. Click in the account title sections of the journal entry and select the correct account titles to be debited and credited from the pick list. Correct debit/credit selections will turn the cells green. 16 17 18 GENERAL JOURNAL Date During Jan. Assume the business commenced operations on January 1, and the summary entries below are the only ones related to job costing activities. Calculate and enter the correct amounts that would appear in financial statements as of the end of January. Correct values will turn the cells green. GENERAL JOURNAL Date B Raw Materials Inventory Accounts Payable To record purchase of raw materials Accounts Ready Work in Process Inventory Accounts Raw Materials Inventory Salaries Payable Factory Overhead To transfer $10,000 of raw materials to production, incur $8,000 of direct labor, and apply $12,000 of overhead Problem + Accessibility: Good to go Debit 25,000 D Debit E 30,000 Credit 25,000 Credit 10,000 8,000 12,000 F

Step by Step Solution

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To answer your questions lets go through the transactions prepare the necessary journal entries post ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started