Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is a question on Management Accounting Please show all work. 1. The US Division of Zenith Pharma manufactures drugs for treating depression. It is

This is a question on Management Accounting

Please show all work.

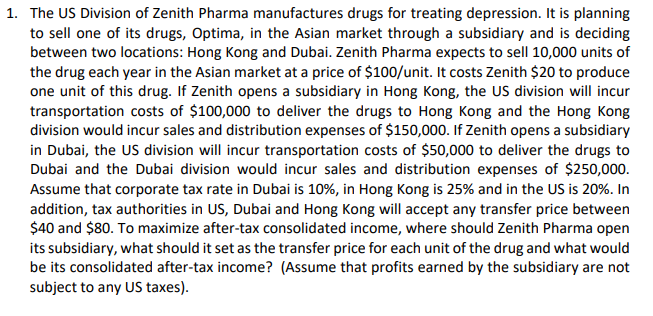

1. The US Division of Zenith Pharma manufactures drugs for treating depression. It is planning to sell one of its drugs, Optima, in the Asian market through a subsidiary and is deciding between two locations: Hong Kong and Dubai. Zenith Pharma expects to sell 10,000 units of the drug each year in the Asian market at a price of $100/unit. It costs Zenith $20 to produce one unit of this drug. If Zenith opens a subsidiary in Hong Kong, the US division will incur transportation costs of $100,000 to deliver the drugs to Hong Kong and the Hong Kong division would incur sales and distribution expenses of $150,000. If Zenith opens a subsidiary in Dubai, the US division will incur transportation costs of $50,000 to deliver the drugs to Dubai and the Dubai division would incur sales and distribution expenses of $250,000 Assume that corporate tax rate in Dubai is 10%, in Hong Kong is 25% and in the US is 20%. In addition, tax authorities in US, Dubai and Hong Kong will accept any transfer price between $40 and $80. To maximize after-tax consolidated income, where should Zenith Pharma open its subsidiary, what should it set as the transfer price for each unit of the drug and what would be its consolidated after-tax income? (Assume that profits earned by the subsidiary are not subject to any US taxes)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started