Question

This is a question related to OPTIONS, a DERIVATIVE in finance. The following questions are related to a short strange strategy for stock SPY. Current

This is a question related to OPTIONS, a DERIVATIVE in finance.

The following questions are related to a short strange strategy for stock SPY.

Current Price as of today: 456.40

Historical volatility of returns: Daily volatility is 0.000997915 and annual is 6.28628E-05

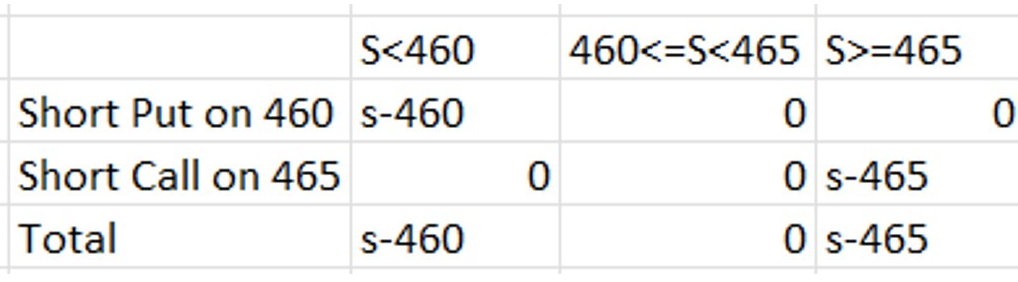

The short strangle will involve selling a short put with a Strike price of $460 with an expiration date April 19th and selling a short call with a strike price of $465 also expiring on April 19.

Both these options are on the money.

Premium from short call = 15.7

Premium from short put = 4.27

This is the payoff table.

Part 1:

- Using prices of options, calculate the cost of the strategy.

- Find the breakeven points for the strategy. This means that you need to calculate the prices of the underlying stock, at which your strategy results in zero profit/loss.

- Find the maximum profit for your strategy and indicate the range of prices at which you can earn this maximum profit.

- Find the maximum loss for your strategy and indicate the range of prices at which the strategy will experience the maximum loss.

- Construct the profit/loss graph for your strategy.

Part 2:

- Use the Black Scholes Option Pricing model to calculate prices of your options, using historical volatility.

- Compare the market prices of your options from above to those obtained by using the Black Scholes Option Pricing Formula.

\begin{tabular}{|c|c|c|c|} \hline & S=465 \\ \hline Short Put on 460 & s460 & 0 & \\ \hline Short Call on 465 & 0 & 0 & s465 \\ \hline Total & s460 & 0 & s465 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started