Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is a sample problem: Based on the sample I need a new one created based on these requirements. Company Info: The carnmetarbor production will

This is a sample problem:

Based on the sample I need a new one created based on these requirements.

Company Info:

- The carnmetarbor production will require the company to purchase additional fixed assets that will cost $1,000,000 at t = 0. For tax purposes the facility will be depreciated on a straight-line basis to zero over 3 years.

- At the end of three years, the company will exit the business and will sell the fixed assets at an estimated value of $275,000.

- The project will require a $65,000 increase in current assets, and a $30,000 increase in accounts payable at t = 0.

- The InvestEd's marginal tax rate is 25%.

- The new line of business is expected to generate an additional $1,750,000 in annual sales. The operating costs excluding depreciation are expected to be $1,350,000 per year.

- The projects cost of capital is 12%.

Requirements:

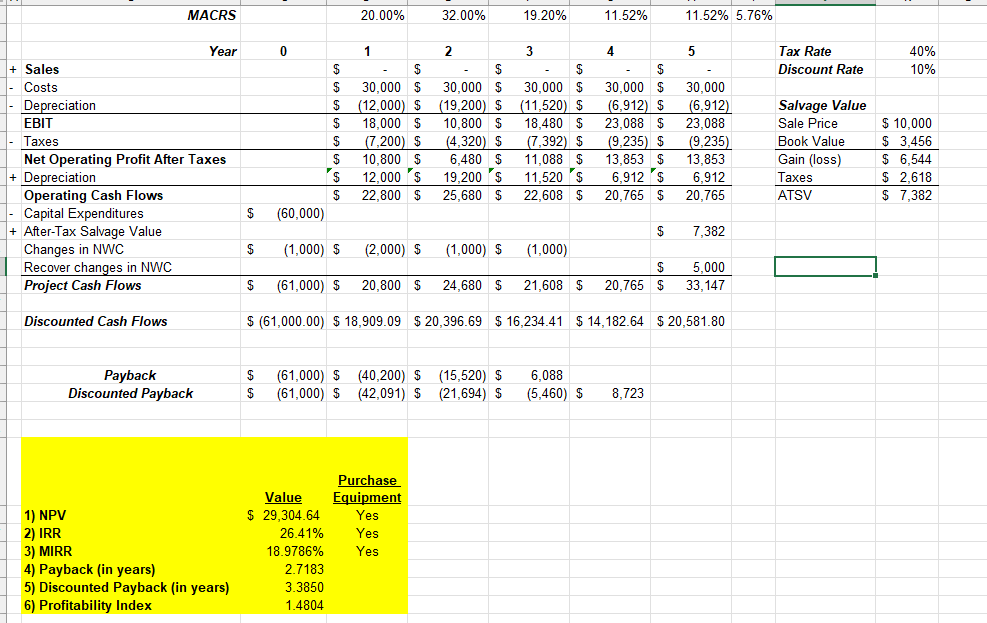

- calculate the projects' cash flows (free cash flows),

- calculate the criteria for evaluating the proposed projects,

- graph the NPV profile for each project so the company can see the range of rates in which each project is worth, and

- finally, based on the information in the proposals, you need to advise InvestEd on which proposal they should select and explain why they should select it.

Five-Year MACRS depreciation schedule

| Year | Depr |

| 1 | 20.00% |

| 2 | 32.00% |

| 3 | 19.20% |

| 4 | 11.52% |

| 5 | 11.52% |

| 6 | 5.76% |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started