Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is a single question i have attached three photos 15 points Part Question 3 Accounting for Income Taxes Reed Ltd is a manufacturer of

This is a single question i have attached three photos

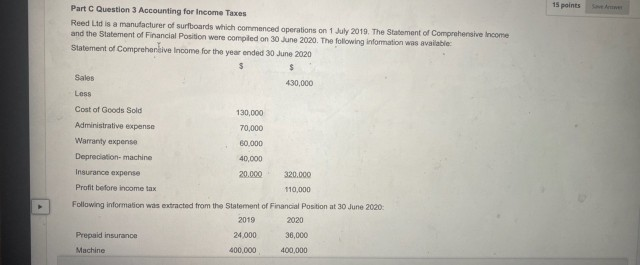

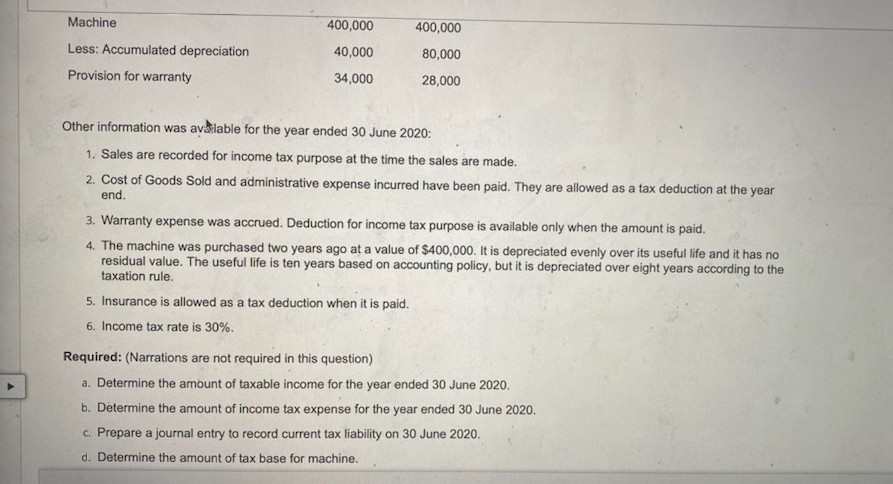

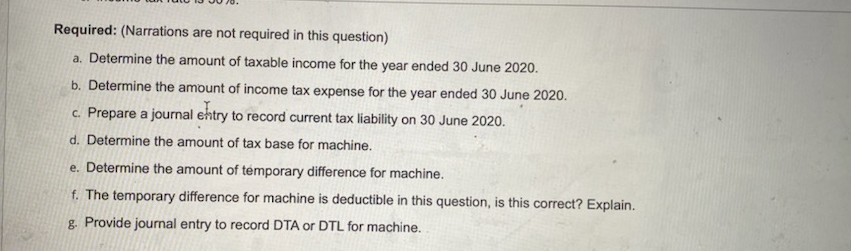

15 points Part Question 3 Accounting for Income Taxes Reed Ltd is a manufacturer of surfboards which commenced operations on 1 July 2019. The Statement of Comprehensive Income and the Statement of Financial Position were compiled on 30 June 2020. The following information was available: Statement of Comprehenkive Income for the year ended 30 June 2020 $ $ Sales 430,000 Less Cost of Goods Sold 130,000 Administrative expense 70,000 Warranty expense 60.000 Depreciation machine 40,000 Insurance expense 20.000 320.000 Profit before income tax 110,000 Following information was extracted from the Statement of Financial Position at 30 June 2020: 2019 2020 Prepaid insurance 24.000 36,000 Machine 400,000 400,000 Machine 400,000 400,000 Less: Accumulated depreciation 40,000 80,000 Provision for warranty 34,000 28,000 Other information was aviable for the year ended 30 June 2020: 1. Sales are recorded for income tax purpose at the time the sales are made. 2. Cost of Goods Sold and administrative expense incurred have been paid. They are allowed as a tax deduction at the year end. 3. Warranty expense was accrued. Deduction for income tax purpose is available only when the amount is paid. 4. The machine was purchased two years ago at a value of $400,000. It is depreciated evenly over its useful life and it has no residual value. The useful life is ten years based on accounting policy, but it is depreciated over eight years according to the taxation rule. 5. Insurance is allowed as a tax deduction when it is paid. 6. Income tax rate is 30%. Required: (Narrations are not required in this question) a. Determine the amount of taxable income for the year ended 30 June 2020. b. Determine the amount of income tax expense for the year ended 30 June 2020. c. Prepare a journal entry to record current tax liability on 30 June 2020. d. Determine the amount of tax base for machine. Required: (Narrations are not required in this question) a. Determine the amount of taxable income for the year ended 30 June 2020. b. Determine the amount of income tax expense for the year ended 30 June 2020. c. Prepare a journal ehtry to record current tax liability on 30 June 2020. d. Determine the amount of tax base for machine. e. Determine the amount of temporary difference for machine. f. The temporary difference for machine is deductible in this question, is this correct? Explain. g. Provide journal entry to record DTA or DTL for machineStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started