Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is a solved question, but I don't understand the journal entries. Can someone explain the logic of the journal entries (i.e. where the different

This is a solved question, but I don't understand the journal entries. Can someone explain the logic of the journal entries (i.e. where the different numbers come from)?

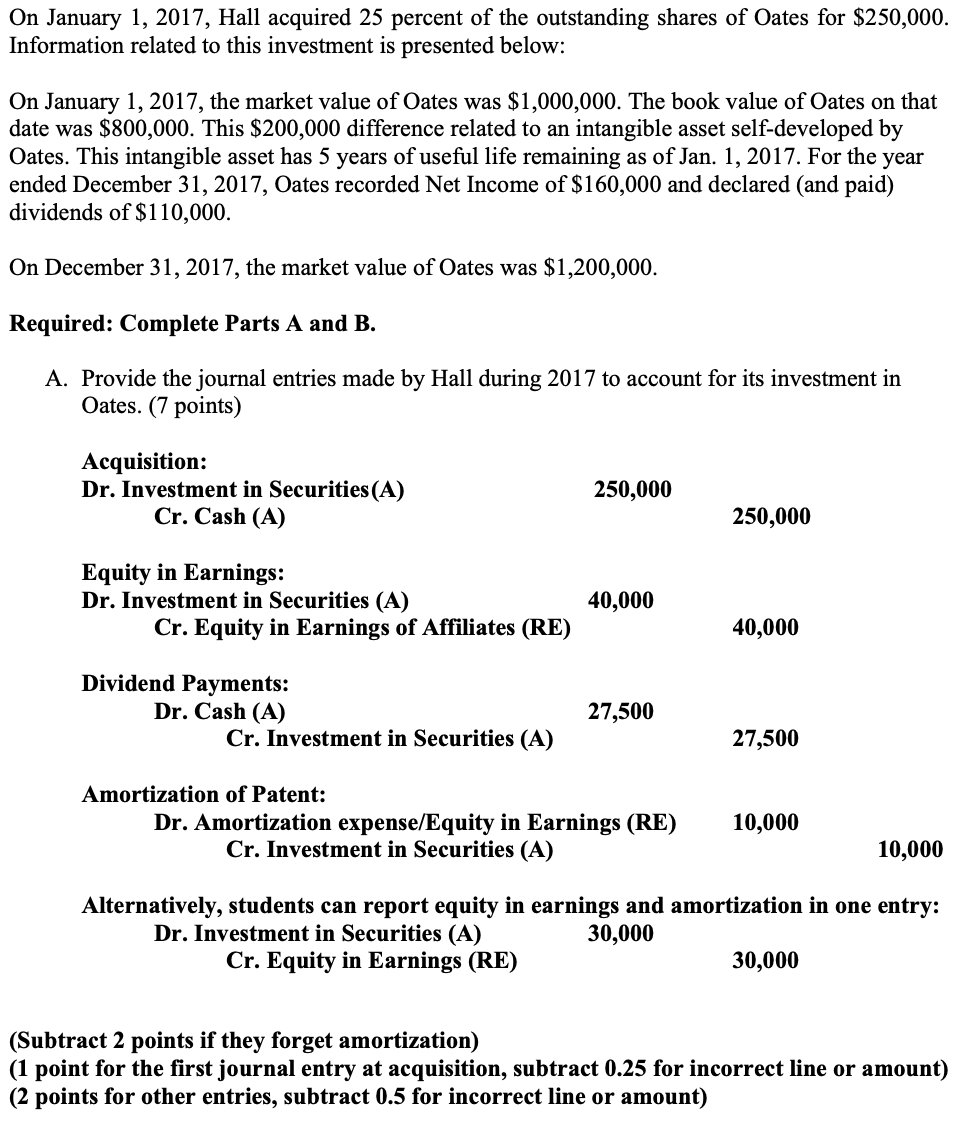

On January 1, 2017, the market value of Oates was $1,000,000. The book value of Oates on that date was $800,000. This $200,000 difference related to an intangible asset self-developed by Oates. This intangible asset has 5 years of useful life remaining as of Jan. 1, 2017. For the year ended December 31, 2017, Oates recorded Net Income of $160,000 and declared (and paid) dividends of $110,000. On December 31, 2017, the market value of Oates was $1,200,000. Required: Complete Parts A and B. A. Provide the journal entries made by Hall during 2017 to account for its investment in Oates. (7 points) Acquisition: Dr. Investment in Securities(A) 250,000 Cr. Cash (A) 250,000 Equity in Earnings: Dr.InvestmentinSecurities(A)Cr.EquityinEarningsofAffiliates(RE)40,00040,000 Dividend Payments: Dr. Cash (A) 27,500 Cr. Investment in Securities (A) 27,500 Amortization of Patent: Dr. Amortization expense/Equity in Earnings (RE) 10,000 Cr. Investment in Securities (A) 10,000 Alternatively, students can report equity in earnings and amortization in one entry: Dr. Investment in Securities (A) 30,000 Cr. Equity in Earnings (RE) 30,000 (Subtract 2 points if they forget amortization) (1 point for the first journal entry at acquisition, subtract 0.25 for incorrect line or amount) ( 2 points for other entries, subtract 0.5 for incorrect line or amount)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started