Answered step by step

Verified Expert Solution

Question

1 Approved Answer

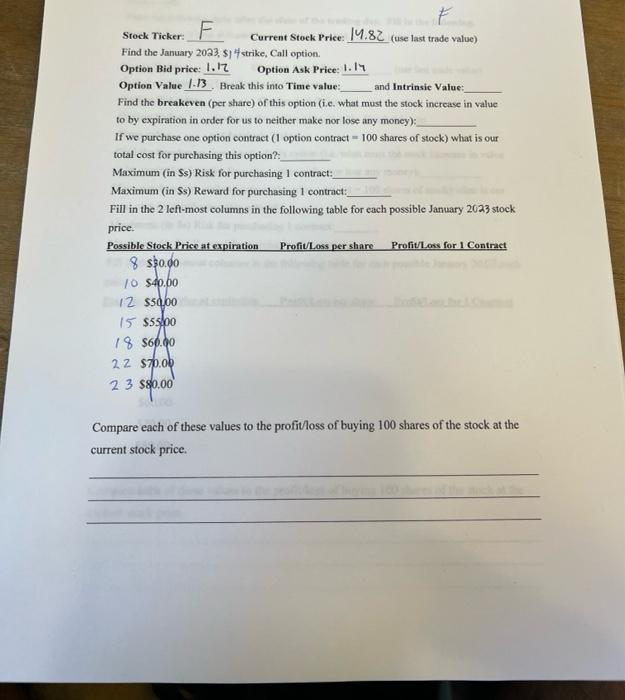

This is a stock market question. Can anyone tell me how to solve for a Call option ? Stock Ticker: F Current Stoek Price: 14.82

This is a stock market question. Can anyone tell me how to solve for a Call option ?

Stock Ticker: F Current Stoek Price: 14.82 (use last trade value) Find the January 2023, \$14 strike, Call option. Option Bid price: 1.12 Option Ask Price: 1.17 Option Value 1.13 Break this into Time value: and Intrinsie Value: Find the breakeven (per share) of this option (i.c. what must the stock increase in value to by expiration in order for us to neither make nor lose any money): If we purchase one option contract ( 1 option contract =100 shares of stock) what is our total cost for purchasing this option?: Maximum (in Ss) Risk for purchasing 1 contract: Maximum (in \$s) Reward for purchasing 1 contract: Fill in the 2 left-most columns in the following table for each possible January 2023 stock price. Compare each of these values to the profitloss of buying 100 shares of the stock at the current stock price

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started