Answered step by step

Verified Expert Solution

Question

1 Approved Answer

this is a tax t1 return please put the information provided in the t1 return! Claim the maximum CCA (business and property) in order to

this is a tax t1 return please put the information provided in the t1 return!

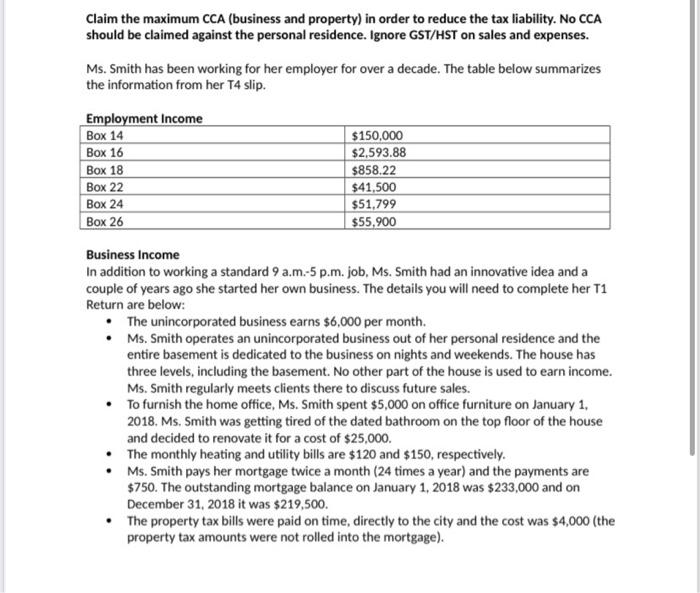

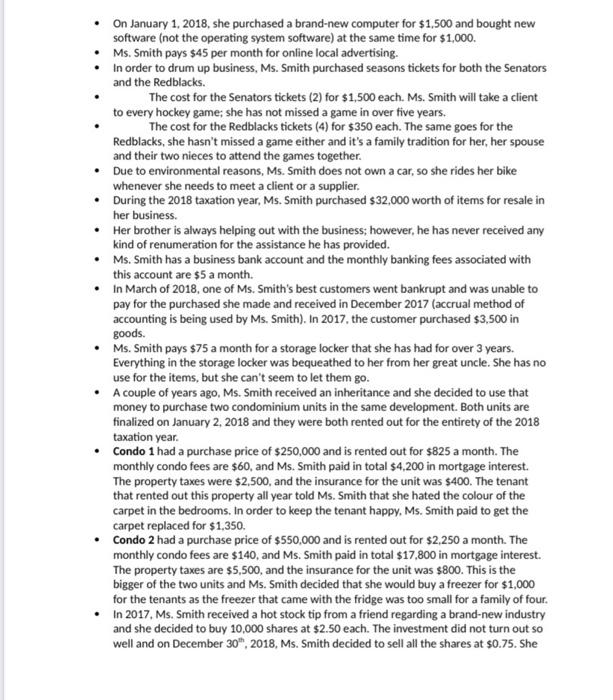

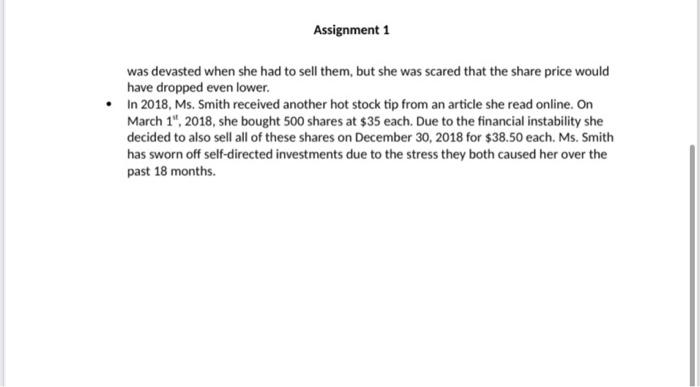

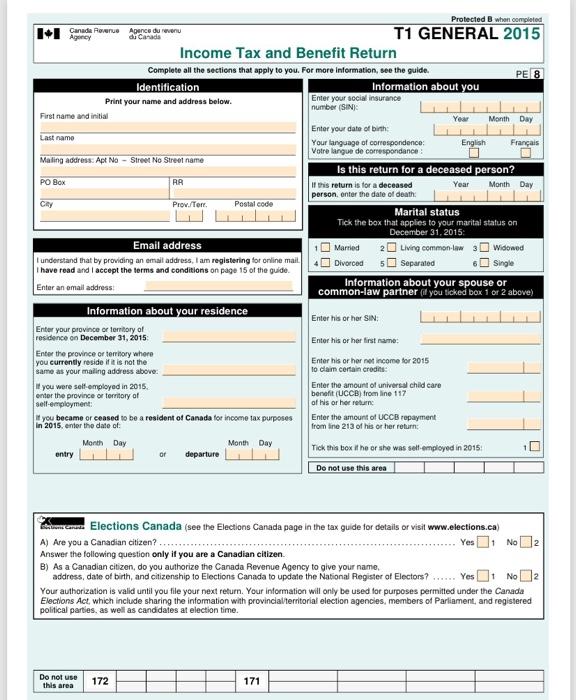

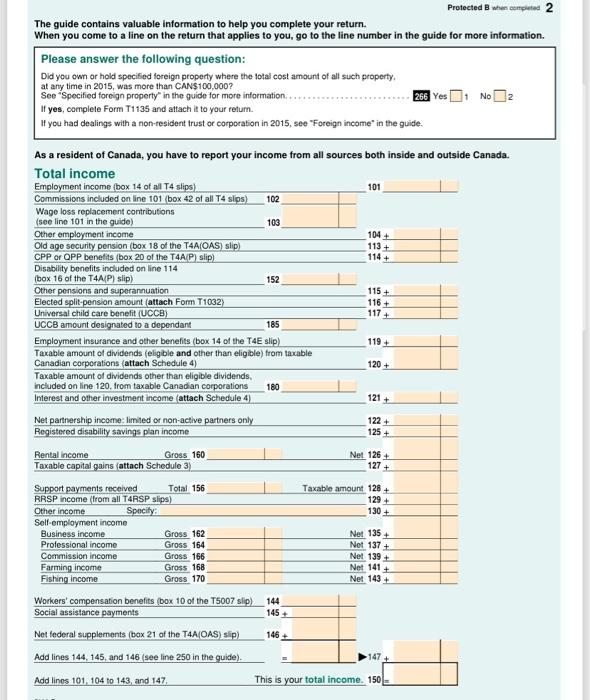

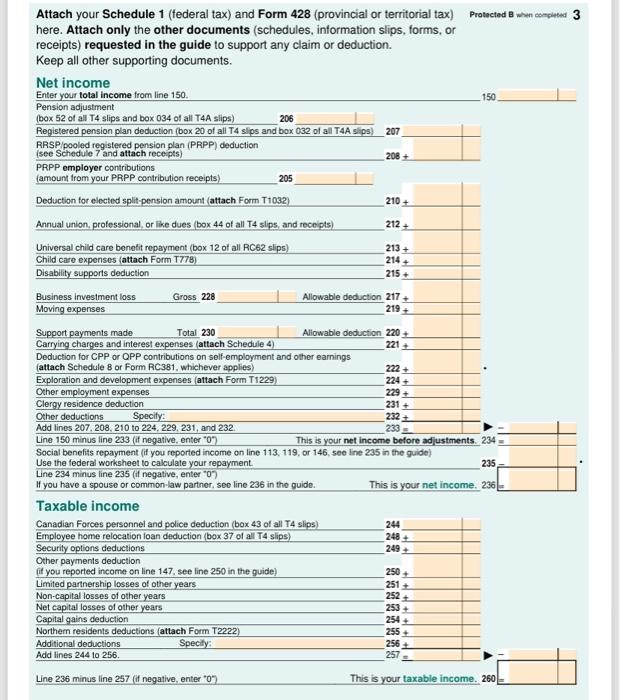

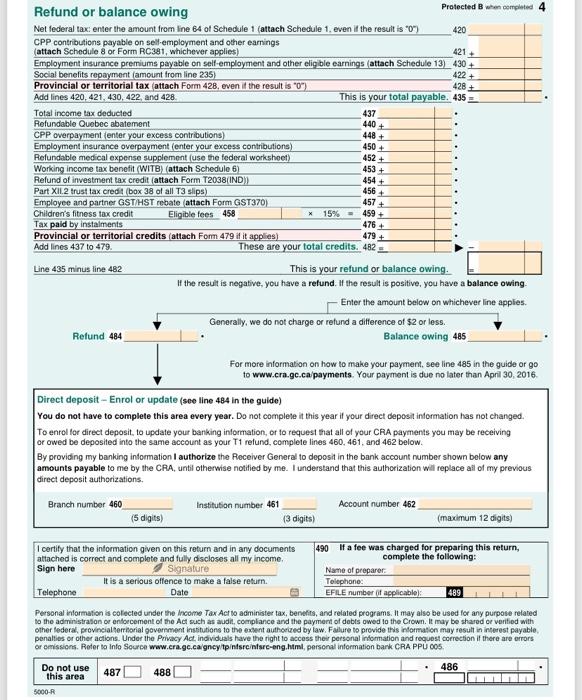

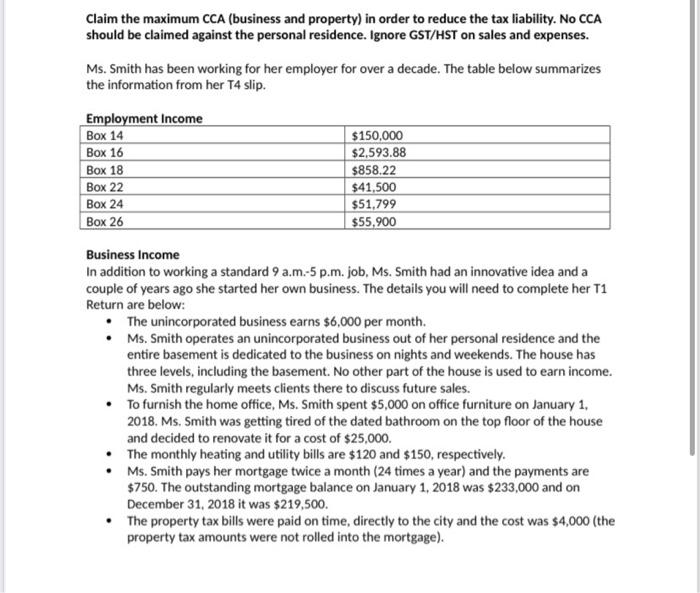

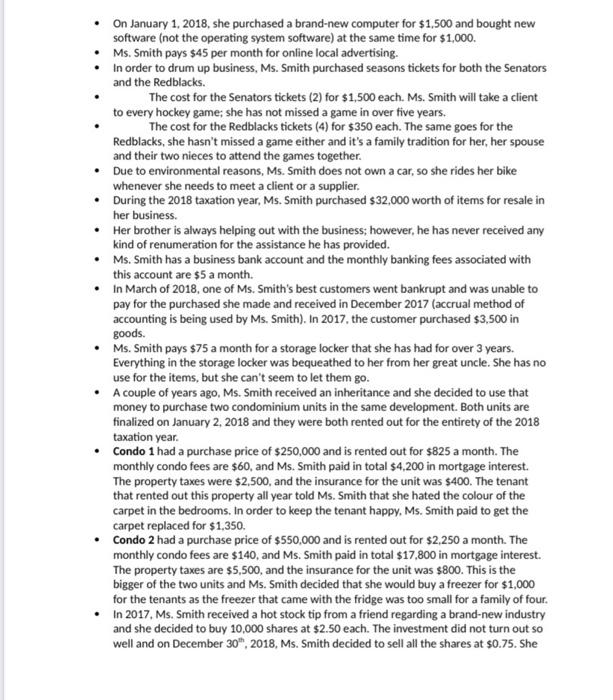

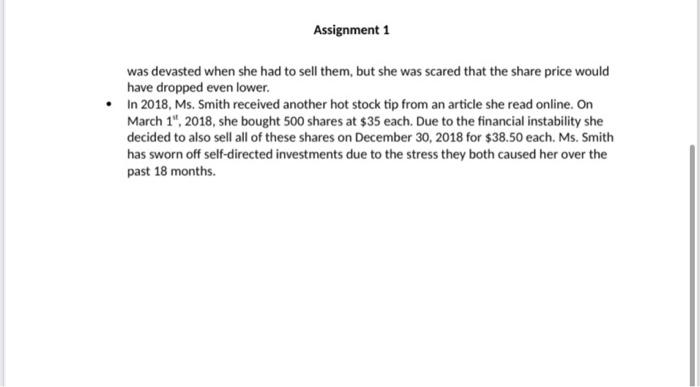

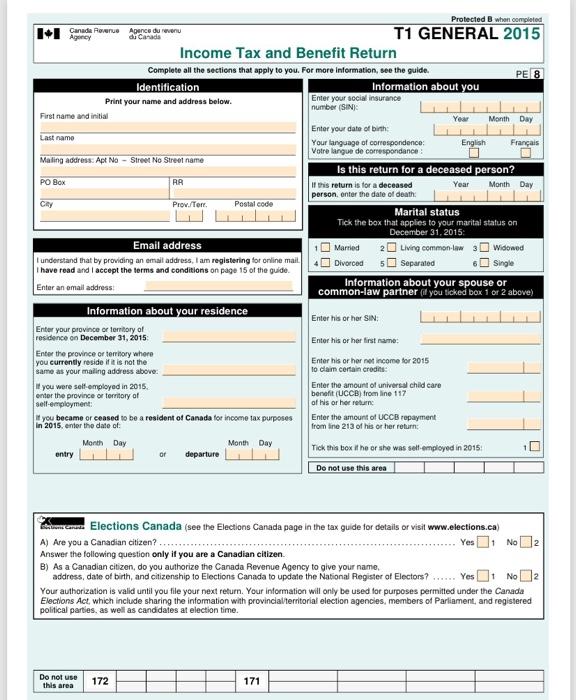

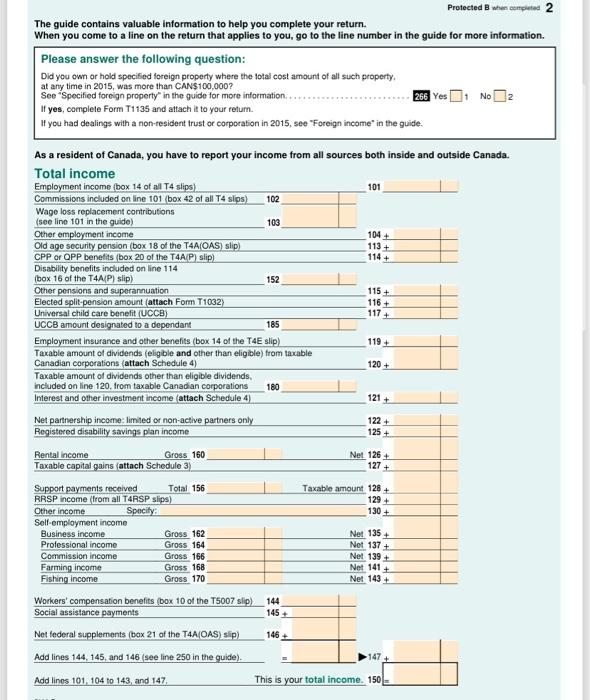

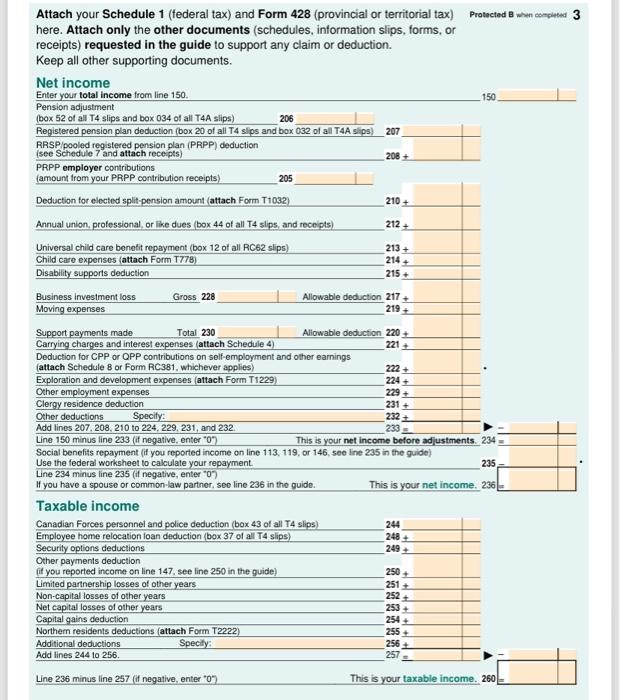

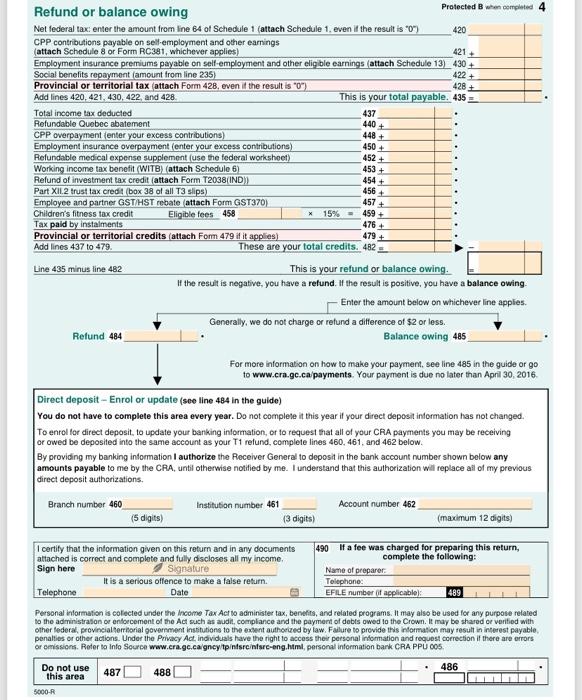

Claim the maximum CCA (business and property) in order to reduce the tax liability. No CCA should be claimed against the personal residence. Ignore GST/HST on sales and expenses. Ms. Smith has been working for her employer for over a decade. The table below summarizes the information from her T4 slip. Business Income In addition to working a standard 9 a.m. 5 p.m. job, Ms. Smith had an innovative idea and a couple of years ago she started her own business. The details you will need to complete her T1 Return are below: - The unincorporated business earns $6,000 per month. - Ms. Smith operates an unincorporated business out of her personal residence and the entire basement is dedicated to the business on nights and weekends. The house has three levels, including the basement. No other part of the house is used to earn income. Ms. Smith regularly meets clients there to discuss future sales. - To furnish the home office, Ms. Smith spent $5,000 on office furniture on January 1 , 2018. Ms. Smith was getting tired of the dated bathroom on the top floor of the house and decided to renovate it for a cost of $25,000. - The monthly heating and utility bills are $120 and $150, respectively. - Ms. Smith pays her mortgage twice a month (24 times a year) and the payments are $750. The outstanding mortgage balance on January 1, 2018 was $233,000 and on December 31,2018 it was $219,500. - The property tax bills were paid on time, directly to the city and the cost was $4,000 (the property tax amounts were not rolled into the mortgage). - On January 1, 2018, she purchased a brand-new computer for $1,500 and bought new software (not the operating system software) at the same time for $1,000. - Ms. Smith pays $45 per month for online local advertising. - In order to drum up business, Ms. Smith purchased seasons tickets for both the Senators and the Redblacks. - The cost for the Senators tickets (2) for $1,500 each. Ms. Smith will take a client to every hockey game; she has not missed a game in over five years. The cost for the Redblacks tickets (4) for $350 each. The same goes for the Redblacks, she hasn't missed a game either and it's a family tradition for her, her spouse and their two nieces to attend the games together. - Due to environmental reasons, Ms. Smith does not own a car, so she rides her bike whenever she needs to meet a client or a supplier. - During the 2018 taxation year, Ms. Smith purchased $32,000 worth of items for resale in her business. - Her brother is always helping out with the business; however, he has never received any kind of renumeration for the assistance he has provided. - Ms. Smith has a business bank account and the monthly banking fees associated with this account are $5 a month. - In March of 2018, one of Ms. Smith's best customers went bankrupt and was unable to pay for the purchased she made and received in December 2017 (accrual method of accounting is being used by Ms. Smith). In 2017, the customer purchased $3,500 in goods. - Ms. Smith pays $75 a month for a storage locker that she has had for over 3 years. Everything in the storage locker was bequeathed to her from her great uncle. She has no use for the items, but she can't seem to let them go. - A couple of years ago, Ms. Smith received an inheritance and she decided to use that money to purchase two condominium units in the same development. Both units are finalized on January 2, 2018 and they were both rented out for the entirety of the 2018 taxation year. - Condo 1 had a purchase price of $250,000 and is rented out for $825 a month. The monthly condo fees are $60, and Ms. Smith paid in total $4,200 in mortgage interest. The property taxes were $2,500, and the insurance for the unit was $400. The tenant that rented out this property all year told Ms. Smith that she hated the colour of the carpet in the bedrooms. In order to keep the tenant happy. Ms. Smith paid to get the carpet replaced for $1,350. - Condo 2 had a purchase price of $550,000 and is rented out for $2,250 a month. The monthly condo fees are $140, and Ms. Smith paid in total $17,800 in mortgage interest. The property taxes are $5,500, and the insurance for the unit was $800. This is the bigger of the two units and Ms. Smith decided that she would buy a freezer for $1,000 for the tenants as the freezer that came with the fridge was too small for a family of four. - In 2017, Ms. Smith received a hot stock tip from a friend regarding a brand-new industry and she decided to buy 10,000 shares at $2.50 each. The investment did not turn out so well and on December 30th,2018,Ms. Smith decided to sell all the shares at $0.75. She was devasted when she had to sell them, but she was scared that the share price would have dropped even lower. In 2018, Ms. Smith received another hot stock tip from an article she read online. On March 1t,2018, she bought 500 shares at $35 each. Due to the financial instability she decided to also sell all of these shares on December 30,2018 for $38.50 each. Ms. Smith has sworn off self-directed investments due to the stress they both caused her over the past 18 months. Elections Canada (see the Elections Canada page in the tax guide for details of visit www.elections.ca) A) Are you a Canadian citizen? Yes 1 No 2 Answer the following question only if you are a Canadian citizen. B) As a Canadian citizen, do you authorize tho Canada Revenue Agency to give your name, address, date of bith, and citizenship to Elections Canada to update the National Register of Electors? Yes 1 No 2 Your authorization is valid until you file your next return. Your information will only be used for purposes permitted under the Canada Elections Act, which include sharing the information with provincialterritorial election agencies, members of Parliament, and registered political parties, as well as candidates at election time. Protected B when conplited 2 The guide contains valuable information to help you complete your return. When you come to a line on the return that applies to you, go to the line number in the guide for more information. Please answer the following question: Did you own or hold specified toreign property where the total cost amount of all such property. at any time in 2015, was more than CAN\$100,000? See "Specified foreign property" in the guide for more information. 266 Yes 1 No 2 If yes, complele Form T1135 and attach it to your relum. If you had dealings with a non-resident trust or corporation in 2015 , see "Foreign income" in the guide. Attach your Schedule 1 (federal tax) and Form 428 (provincial or territorial tax) Protocted a men complend 3 here. Attach only the other documents (schedules, information slips, forms, or receipts) requested in the guide to support any claim or deduction. Keep all other supporting documents. Net income Enter your total income from line 150. Pension adjustment (box 52 of all T4 slips and box 034 of all T4A slips) \begin{tabular}{l} Registered pension plan deduction (box 20 of all T4 slips and box \\ \hline RRSP. os of all T4A slips) \end{tabular} (see Schodule 7 and and attach receceipts) PRPP employer contributions (amount from your PRPP contribution receipts) Deduction for elected splitepension amount (attach Form T1032) Annual union, protessional, or like dues (box 44 of all T4 slips, and reccipts) Universal child care benotit repary Child caso expenses (attach For Disablity supports deduction 207 Taxable income For more information on how to make your payment, see line 485 in the guide or go to www.cra.gc.cajpayments. Your payment is due no later than April 30, 2016. Direct deposit - Enrol or update (see line 484 in the guide) You do not have to complete this area every year. Do not complete it this year if your direct deposit information has not changed. To enrol tor direct deposit, to update your banking information, or to request that all of your CRA payments you may be receiving or owed be deposited into the same account as your T1 refurnd, complete lines 460,461 , and 462 below. By providing my banking information I authorize the Receiver General to deposit in the bank account number shown below any amounts payable to me by the CRA, until otherwise notified by me. I understand that this authorization will replace all of my previous direct deposit authorizations. \begin{tabular}{|llll} Branch number 460 & & Institution number 461 & Account number 462 \\ & (5 digits) & (3 digits) & (maximum 12 digits) \\ \hline \end{tabular} Personal inlormation is colected under the Income Tax Act to administer tax, benefits, and related programs. II may also be used for any purpose related to the administrason of entoecement of the Act such as audit. complance and the paymert of dobls owed to the Crown. It may be shared or veritied with other tedera, provincialseritorial goverment inststutions to the expent authored by law. Fallure to provide this information may result in interest payable, penalies or other actions. Under the Privacy Act, individuals have the right to accoss their personal intomation and request correction if there are orrors or emissions. Roder to info Source waw.cra.gc.ca gncy tpintsreintsre-eng.html, personal information bark CRA PPU 005 . Claim the maximum CCA (business and property) in order to reduce the tax liability. No CCA should be claimed against the personal residence. Ignore GST/HST on sales and expenses. Ms. Smith has been working for her employer for over a decade. The table below summarizes the information from her T4 slip. Business Income In addition to working a standard 9 a.m. 5 p.m. job, Ms. Smith had an innovative idea and a couple of years ago she started her own business. The details you will need to complete her T1 Return are below: - The unincorporated business earns $6,000 per month. - Ms. Smith operates an unincorporated business out of her personal residence and the entire basement is dedicated to the business on nights and weekends. The house has three levels, including the basement. No other part of the house is used to earn income. Ms. Smith regularly meets clients there to discuss future sales. - To furnish the home office, Ms. Smith spent $5,000 on office furniture on January 1 , 2018. Ms. Smith was getting tired of the dated bathroom on the top floor of the house and decided to renovate it for a cost of $25,000. - The monthly heating and utility bills are $120 and $150, respectively. - Ms. Smith pays her mortgage twice a month (24 times a year) and the payments are $750. The outstanding mortgage balance on January 1, 2018 was $233,000 and on December 31,2018 it was $219,500. - The property tax bills were paid on time, directly to the city and the cost was $4,000 (the property tax amounts were not rolled into the mortgage). - On January 1, 2018, she purchased a brand-new computer for $1,500 and bought new software (not the operating system software) at the same time for $1,000. - Ms. Smith pays $45 per month for online local advertising. - In order to drum up business, Ms. Smith purchased seasons tickets for both the Senators and the Redblacks. - The cost for the Senators tickets (2) for $1,500 each. Ms. Smith will take a client to every hockey game; she has not missed a game in over five years. The cost for the Redblacks tickets (4) for $350 each. The same goes for the Redblacks, she hasn't missed a game either and it's a family tradition for her, her spouse and their two nieces to attend the games together. - Due to environmental reasons, Ms. Smith does not own a car, so she rides her bike whenever she needs to meet a client or a supplier. - During the 2018 taxation year, Ms. Smith purchased $32,000 worth of items for resale in her business. - Her brother is always helping out with the business; however, he has never received any kind of renumeration for the assistance he has provided. - Ms. Smith has a business bank account and the monthly banking fees associated with this account are $5 a month. - In March of 2018, one of Ms. Smith's best customers went bankrupt and was unable to pay for the purchased she made and received in December 2017 (accrual method of accounting is being used by Ms. Smith). In 2017, the customer purchased $3,500 in goods. - Ms. Smith pays $75 a month for a storage locker that she has had for over 3 years. Everything in the storage locker was bequeathed to her from her great uncle. She has no use for the items, but she can't seem to let them go. - A couple of years ago, Ms. Smith received an inheritance and she decided to use that money to purchase two condominium units in the same development. Both units are finalized on January 2, 2018 and they were both rented out for the entirety of the 2018 taxation year. - Condo 1 had a purchase price of $250,000 and is rented out for $825 a month. The monthly condo fees are $60, and Ms. Smith paid in total $4,200 in mortgage interest. The property taxes were $2,500, and the insurance for the unit was $400. The tenant that rented out this property all year told Ms. Smith that she hated the colour of the carpet in the bedrooms. In order to keep the tenant happy. Ms. Smith paid to get the carpet replaced for $1,350. - Condo 2 had a purchase price of $550,000 and is rented out for $2,250 a month. The monthly condo fees are $140, and Ms. Smith paid in total $17,800 in mortgage interest. The property taxes are $5,500, and the insurance for the unit was $800. This is the bigger of the two units and Ms. Smith decided that she would buy a freezer for $1,000 for the tenants as the freezer that came with the fridge was too small for a family of four. - In 2017, Ms. Smith received a hot stock tip from a friend regarding a brand-new industry and she decided to buy 10,000 shares at $2.50 each. The investment did not turn out so well and on December 30th,2018,Ms. Smith decided to sell all the shares at $0.75. She was devasted when she had to sell them, but she was scared that the share price would have dropped even lower. In 2018, Ms. Smith received another hot stock tip from an article she read online. On March 1t,2018, she bought 500 shares at $35 each. Due to the financial instability she decided to also sell all of these shares on December 30,2018 for $38.50 each. Ms. Smith has sworn off self-directed investments due to the stress they both caused her over the past 18 months. Elections Canada (see the Elections Canada page in the tax guide for details of visit www.elections.ca) A) Are you a Canadian citizen? Yes 1 No 2 Answer the following question only if you are a Canadian citizen. B) As a Canadian citizen, do you authorize tho Canada Revenue Agency to give your name, address, date of bith, and citizenship to Elections Canada to update the National Register of Electors? Yes 1 No 2 Your authorization is valid until you file your next return. Your information will only be used for purposes permitted under the Canada Elections Act, which include sharing the information with provincialterritorial election agencies, members of Parliament, and registered political parties, as well as candidates at election time. Protected B when conplited 2 The guide contains valuable information to help you complete your return. When you come to a line on the return that applies to you, go to the line number in the guide for more information. Please answer the following question: Did you own or hold specified toreign property where the total cost amount of all such property. at any time in 2015, was more than CAN\$100,000? See "Specified foreign property" in the guide for more information. 266 Yes 1 No 2 If yes, complele Form T1135 and attach it to your relum. If you had dealings with a non-resident trust or corporation in 2015 , see "Foreign income" in the guide. Attach your Schedule 1 (federal tax) and Form 428 (provincial or territorial tax) Protocted a men complend 3 here. Attach only the other documents (schedules, information slips, forms, or receipts) requested in the guide to support any claim or deduction. Keep all other supporting documents. Net income Enter your total income from line 150. Pension adjustment (box 52 of all T4 slips and box 034 of all T4A slips) \begin{tabular}{l} Registered pension plan deduction (box 20 of all T4 slips and box \\ \hline RRSP. os of all T4A slips) \end{tabular} (see Schodule 7 and and attach receceipts) PRPP employer contributions (amount from your PRPP contribution receipts) Deduction for elected splitepension amount (attach Form T1032) Annual union, protessional, or like dues (box 44 of all T4 slips, and reccipts) Universal child care benotit repary Child caso expenses (attach For Disablity supports deduction 207 Taxable income For more information on how to make your payment, see line 485 in the guide or go to www.cra.gc.cajpayments. Your payment is due no later than April 30, 2016. Direct deposit - Enrol or update (see line 484 in the guide) You do not have to complete this area every year. Do not complete it this year if your direct deposit information has not changed. To enrol tor direct deposit, to update your banking information, or to request that all of your CRA payments you may be receiving or owed be deposited into the same account as your T1 refurnd, complete lines 460,461 , and 462 below. By providing my banking information I authorize the Receiver General to deposit in the bank account number shown below any amounts payable to me by the CRA, until otherwise notified by me. I understand that this authorization will replace all of my previous direct deposit authorizations. \begin{tabular}{|llll} Branch number 460 & & Institution number 461 & Account number 462 \\ & (5 digits) & (3 digits) & (maximum 12 digits) \\ \hline \end{tabular} Personal inlormation is colected under the Income Tax Act to administer tax, benefits, and related programs. II may also be used for any purpose related to the administrason of entoecement of the Act such as audit. complance and the paymert of dobls owed to the Crown. It may be shared or veritied with other tedera, provincialseritorial goverment inststutions to the expent authored by law. Fallure to provide this information may result in interest payable, penalies or other actions. Under the Privacy Act, individuals have the right to accoss their personal intomation and request correction if there are orrors or emissions. Roder to info Source waw.cra.gc.ca gncy tpintsreintsre-eng.html, personal information bark CRA PPU 005

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started