Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is a taxation question QUESTION 1 (22 marks) 1.1. Mowbray Boksburg bought a home in February 2009 for R 1 500 000. As the

This is a taxation question

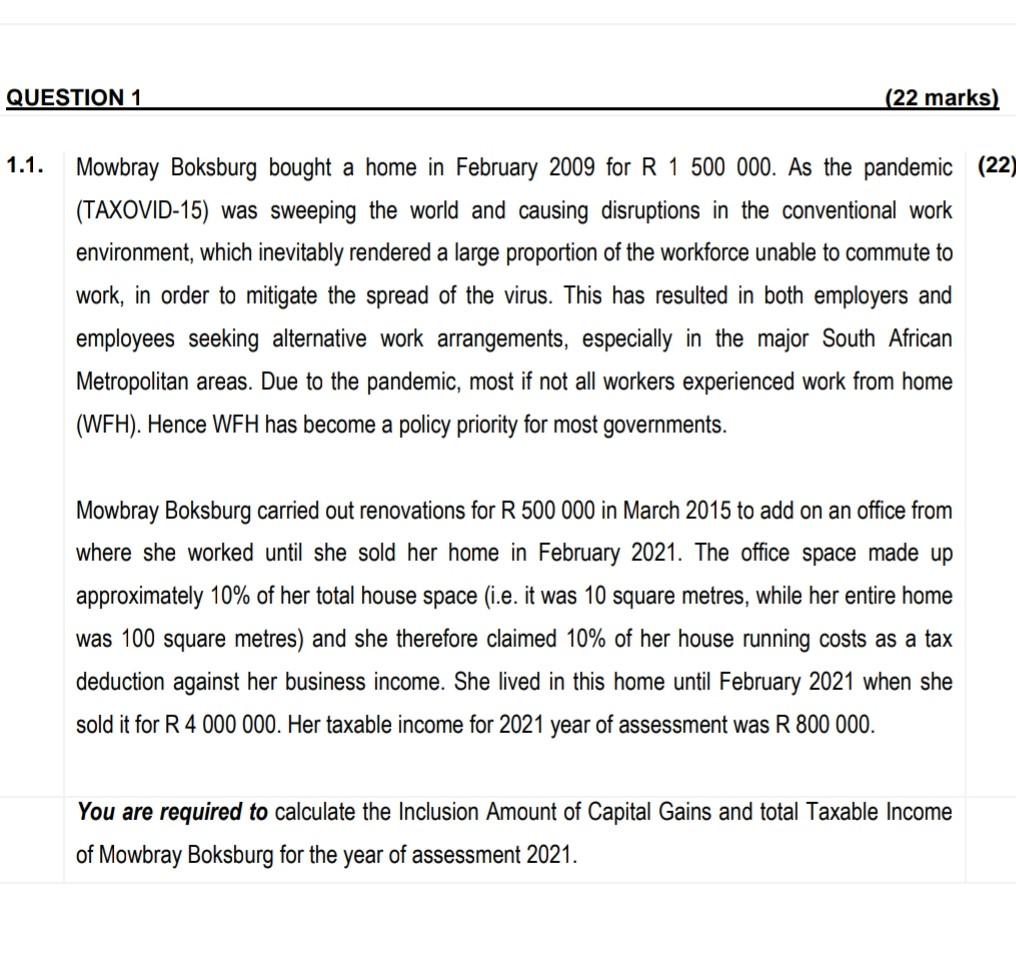

QUESTION 1 (22 marks) 1.1. Mowbray Boksburg bought a home in February 2009 for R 1 500 000. As the pandemic (22) (TAXOVID-15) was sweeping the world and causing disruptions in the conventional work environment, which inevitably rendered a large proportion of the workforce unable to commute to work, in order to mitigate the spread of the virus. This has resulted in both employers and employees seeking alternative work arrangements, especially in the major South African Metropolitan areas. Due to the pandemic, most if not all workers experienced work from home (WFH). Hence WFH has become a policy priority for most governments. Mowbray Boksburg carried out renovations for R 500 000 in March 2015 to add on an office from where she worked until she sold her home in February 2021. The office space made up approximately 10% of her total house space (i.e. it was 10 square metres, while her entire home was 100 square metres) and she therefore claimed 10% of her house running costs as a tax deduction against her business income. She lived in this home until February 2021 when she sold it for R 4 000 000. Her taxable income for 2021 year of assessment was R 800 000. You are required to calculate the Inclusion Amount of Capital Gains and total Taxable Income of Mowbray Boksburg for the year of assessment 2021Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started