this is a two part question, 1a,1b, 2a, and 2b

thank you

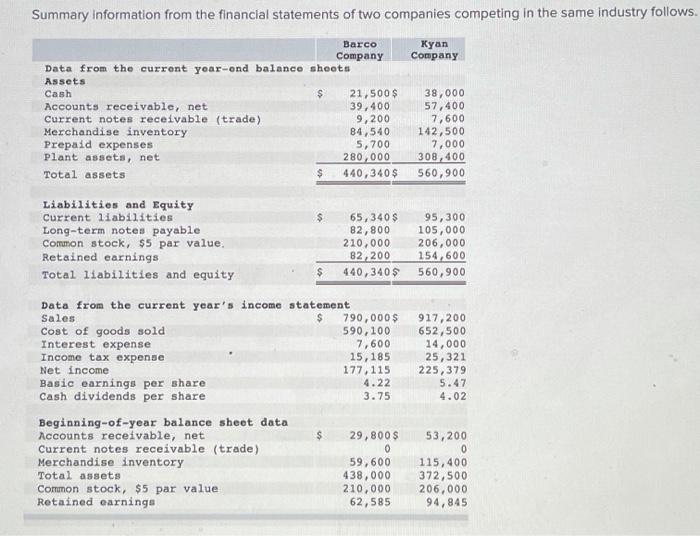

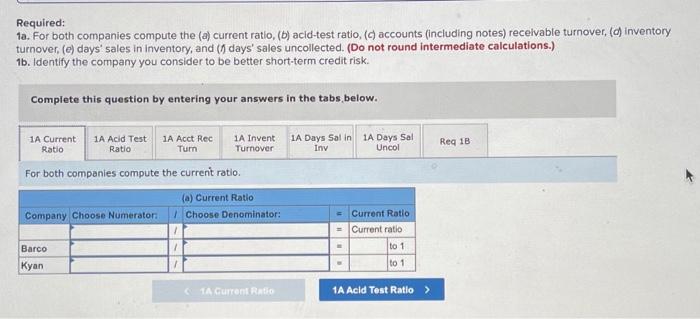

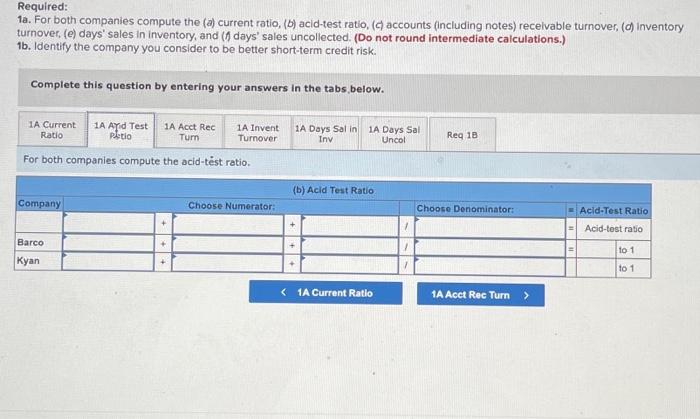

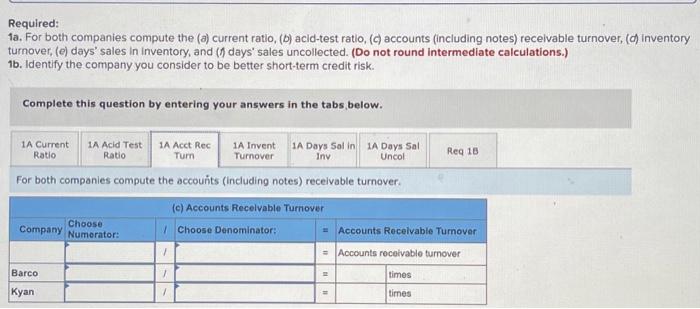

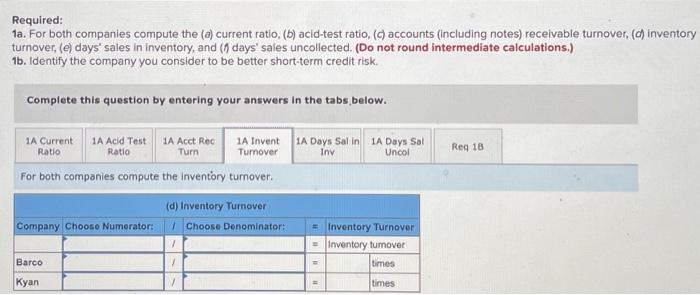

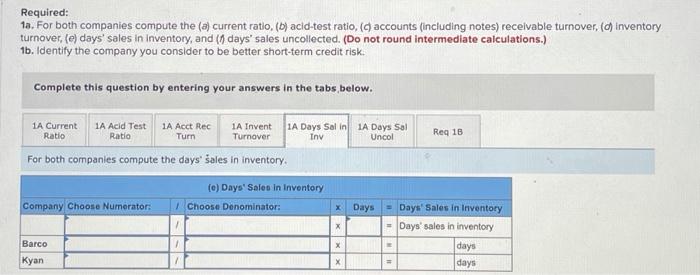

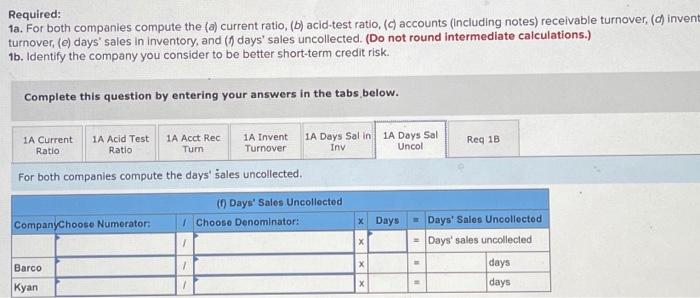

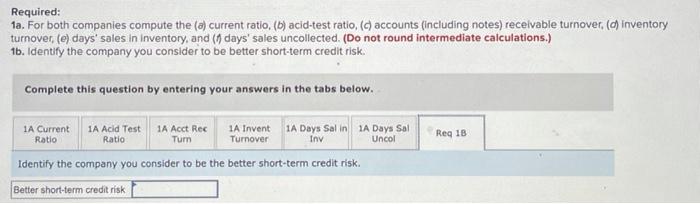

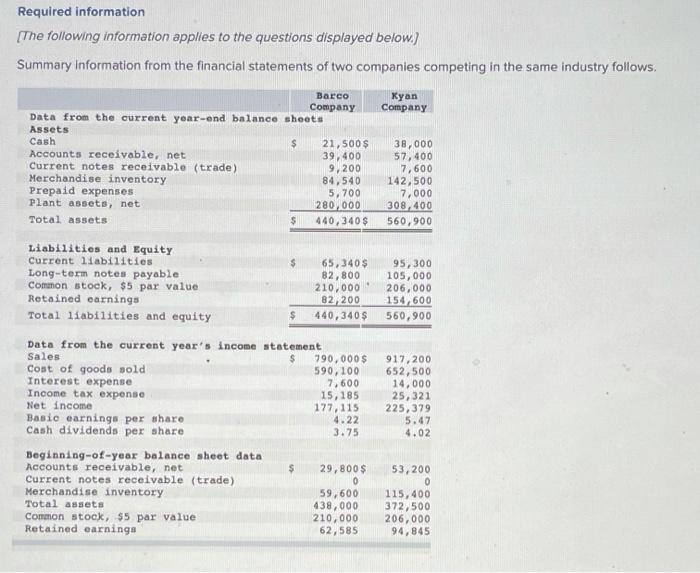

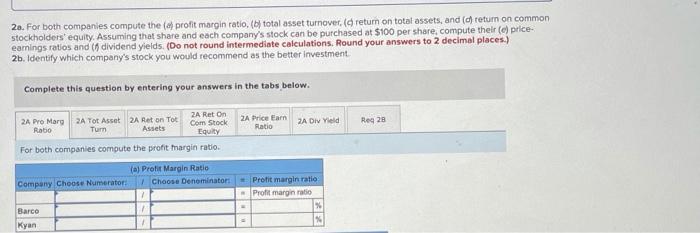

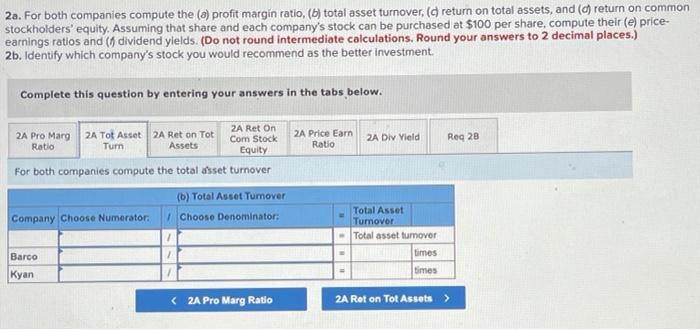

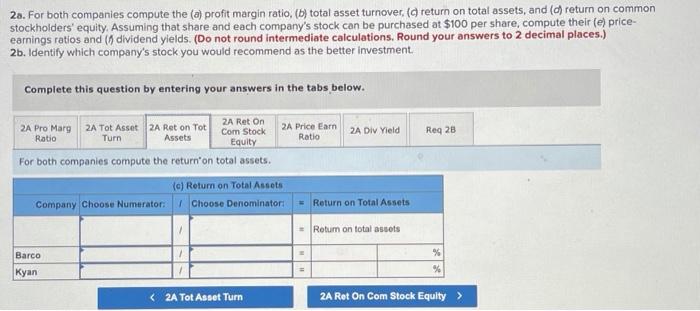

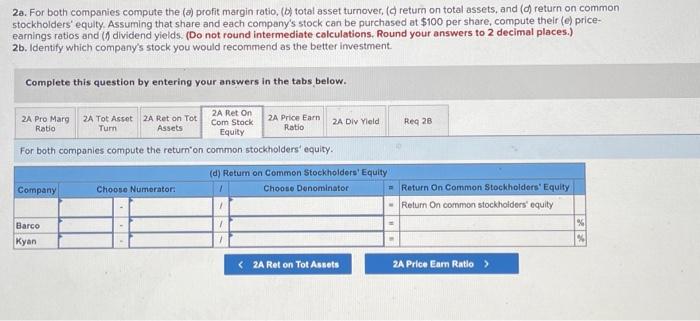

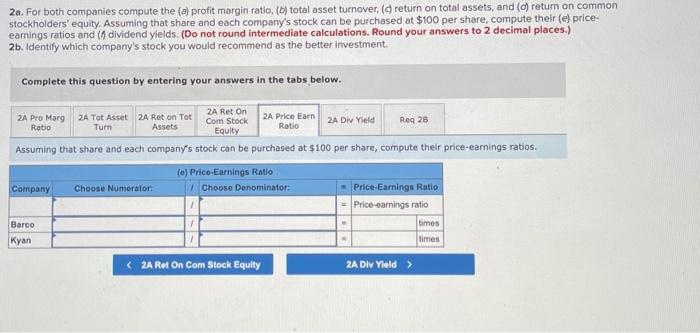

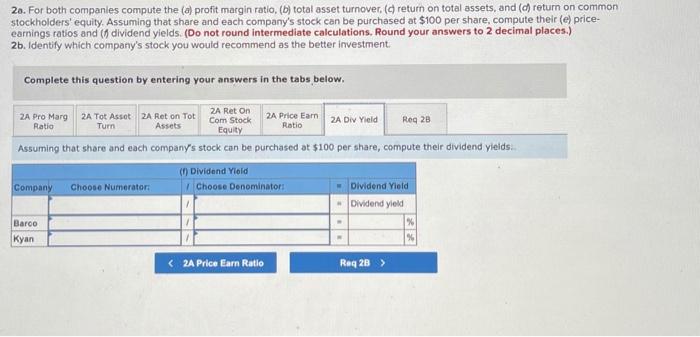

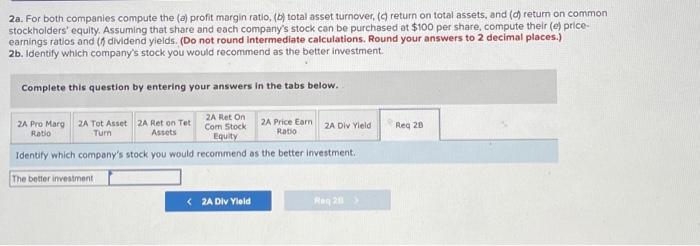

Summary Information from the financial statements of two companies competing in the same industry follows. Kyan Company Barco Company Data from the current your-ond balance sheets Assets Cash $ 21,500 $ Accounts receivable, net 39,400 Current notes receivable (trade) 9,200 Merchandise inventory 84,540 Prepaid expenses 5,700 Plant assets, net 280,000 Total assets $ 440,340 $ 38,000 57,400 7,600 142,500 7,000 308,400 560,900 $ Liabilities and Equity Current liabilities Long-term notes payable Common stock, $5 par value. Retained earnings Total liabilities and equity 65,340 $ 95,300 82,800 105,000 210,000 206,000 82,200 154,600 440,340 $ 560,900 917,200 652,500 14,000 25,321 225,379 5.47 4.02 Data from the current year's income statement Sales $ 790,000$ Cost of goods sold 590,100 Interest expense 7,600 Income tax expense 15,185 Net income 177,115 Basic earnings per share 4.22 Cash dividends per share 3.75 Beginning-of-year balance sheet data Accounts receivable, net $ 29,800 $ Current notes receivable (trade) 0 Merchandise inventory 59,600 Total assets 438,000 Common stock, $5 par value 210,000 Retained earnings 62,585 53,200 0 115,400 372,500 206,000 94,845 Required: 1a. For both companies compute the (a) current ratio, (b) acld-test ratio, (accounts (including notes) receivable turnover, (d) inventory turnover, () days' sales in Inventory, and (y days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be better short-term credit risk. Complete this question by entering your answers in the tabs below. IA Days Sal in 1A Days Sal Reg 1B Inv Uncol 1A Current 1A Acid Test 1A Acct Rec 1A Invent Ratio Ratio Tum Turnover For both companies compute the current ratio. (a) Current Ratio Company Choose Numerator Choose Denominator: Current Ratio = Current ratio Barco Kyan to 1 to 1 1 - 1A Current Ratio 1A Acid Test Ratio > Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (accounts (including notes) receivable turnover, (c) inventory turnover (e) days' sales in inventory, and (days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be better short-term credit risk. Complete this question by entering your answers in the tabs below. 1A Current 1A ayd Test 1A Acct Rec 1A Invent Ratio Pletio Turn Turnover For both companies compute the acid-test ratio. 1A Days Sal in 1A Days Sal Inv Uncol Reg 1B (b) Acid Test Ratio Company Choose Numerator: Choose Denominator: Acid-Test Ratio Acid-test ratio + Barco Kyan 1o 1 + to 1 1A Current Ratio 1A Acct Rec Turn Required: 1a. For both companies compute the (a) current ratio, (b) acld-test ratio, (accounts (including notes) receivable turnover, () Inventory turnover, (e) days' sales In Inventory, and (days' sales uncollected. (Do not round Intermediate calculations.) 1b. Identify the company you consider to be better short-term credit risk. Complete this question by entering your answers in the tabs below. Inv 1A Current 1A Acid Test 1A Acct Rec 1A Invent 1A Days Sol in 1A Days Sal Ratio Ratio Turn Turnover Reg 13 Uncol For both companies compute the accounts (Including notes) receivable turnover (c) Accounts Recevable Turnover Choose Choose Denominator Accounts Recevable Turnover Company Numerator: = Accounts receivablo turnover Barco 1 times Kyan / times Required: 1a. For both companies compute the (a) current ratio. (b) acid-test ratio, (accounts (including notes) receivable turnover, (a) inventory turnover, (e) days' sales in Inventory, and (days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be better short-term credit risk. Complete this question by entering your answers in the tabs below. Reg 16 1A Current 1A Acid Test 1A Acct Rec 1A Invent 1A Days Salin 1A Days Sol Ratio Ratio Turn Turnover Inv Uncol For both companies compute the inventory tumover. Company Choose Numerator: (d) Inventory Turnover Choose Denominator 1 = Inventory Turnover = Inventory turnover Limos Barco Kyan times Required: 19. For both companies compute the (a) current ratio, (b) acid-test ratio, ( accounts (including notes) receivable turnover, (o) inventory turnover, (e) days' sales in Inventory, and (7 days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be better short-term credit risk. Complete this question by entering your answers in the tabs below. 1A Current Ratio 1A Acid Test 1A Acct Rec Ratio Turn 1A Invent Turnover 1A Days Sal in 1A Days Sal Uncol Iny Reg 16 For both companies compute the days' sales in inventory (c) Days' Sales In Inventory Company Choose Numerator: 7 Choose Denominator: x Days Dayu' Sales in Inventory - Days' sales in inventory days = days Barco xxx Kyan Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts (Including notes) receivable turnover, (c) invent turnover , (e) days' sales In Inventory, and (y days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be better short-term credit risk. Complete this question by entering your answers in the tabs below. 1A Current Ratio 1A Acid Test Ratio 1A Acct Rec Turn 1A Invent Turnover IA Days Sal in 1A Days Sal Inv Uncol Reg 1B For both companies compute the days' sales uncollected (Days' Sales Uncollected CompanyChoose Numerator Choose Denominator: x Days Days' Sales Uncollected = Days' sales uncollected x Barco XX ## days days Kyan Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, () accounts (including notes) receivable turnover. (a) inventory turnover (e) days' sales in inventory, and (7 days' sales uncollected. (Do not round Intermediate calculations.) 1b. Identify the company you consider to be better short-term credit risk. Complete this question by entering your answers in the tabs below. Reg 1B 1A Current 1A Acid Test 1A Acct Rec 1A Invent 1A Days Sal in 1A Days Sal Ratio Ratio Tum Turnover Iny Uncol Identify the company you consider to be the better short-term credit risk. Better short-term credit risk Required information [The following information applies to the questions displayed below) Summary Information from the financial statements of two companies competing in the same industry follows. Kyan Company Barco Company Data from the current year-end balance sheets Assets Cash 21,500$ Accounts receivable, net 39,400 Current notes receivable (trade) 9,200 Merchandise inventory 84,540 Prepaid expenses 5, 700 Plant assets, net 280,000 Total assets 440, 340$ 38,000 57,400 7,600 142,500 7,000 308,400 560,900 Liabilities and Equity Current liabilities Long-term notes payable Common stock, $5 par value Retained earnings Total liabilities and equity 65,340$ 82,800 210,000 82,200 440,340$ 95,300 105,000 206,000 154,600 560,900 917,200 652,500 14,000 25,321 225, 379 5.47 4.02 Data from the current year's income statement Sales 790,000 $ Coat of goods sold 590,100 Interest expense 7,600 Income tax expense 15,185 Net Income 177, 115 Basic earnings per share 4.22 Cash dividends per share 3.75 Beginning-of-year balance sheet data Accounts receivable, net 29,800 $ Current notes receivable (trade) 0 Merchandise inventory 59,600 Total assets 438,000 Common stock, $5 par value 210,000 Retained earnings 62,585 53,200 0 115,400 372,500 206,000 94,845 2a. For both companies compute the profit margin ratio. (b) total asset turnover. (return on total assets, and (d) return on common stockholders' equity. Assuming that share and each company's stock can be purchased at $100 per share, compute thelr(e) price earings ratios and (dividend yields. (Do not round intermediate calculations. Round your answers to 2 decimal places.) 2b. Identify which company's stock you would recommend as the better investment Complete this question by entering your answers in the tabs below. ZA Price Earn Ratio 2A DIV Yield Reg 28 2A Reton 2A Pro Marg 2A Tot Asset 2A Reton Tot Rabo Com Stock Tum Assets Equity For both companies compute the profit margin ratio. (a) Profit Margin Ratio Company Choose Numerator: Choose Denominator Profit margin ratio Profit margin ratio Barco Kyan 1 2a. For both companies compute the (8) profit margin ratio, (b) total asset turnover, (return on total assets, and (c) return on common stockholders' equity Assuming that share and each company's stock can be purchased at $100 per share, compute their (e) price- earnings ratios and ( dividend yields. (Do not round intermediate calculations. Round your answers to 2 decimal places.) 2b. Identify which company's stock you would recommend as the better investment. Complete this question by entering your answers in the tabs below. 2A Price Earn Ratio ZA Diy Yield Reg 28 2A Ret On 2A Pro Marg 2A Tot Asset 2A Ret on Tot Com Stock Ratio Turn Assets Equity For both companies compute the total asset turnover (0) Total Aueet Tumover Company Choose Numerator Choose Denominator: Total Asset Tumover Total asset tumover times times Barco Kyan 2a. For both companies compute the (a) profit margin ratio, (b) total asset turnover (return on total assets, and (d) return on common stockholders' equity Assuming that share and each company's stock can be purchased at $100 per share, compute their (e) price- earnings ratios and (dividend yields. (Do not round intermediate calculations, Round your answers to 2 decimal places.) 2b. Identify which company's stock you would recommend as the better investment Complete this question by entering your answers in the tabs below. Reg 28 2A Pro Marg 2A Tot Asset 2A Ret on Tot 2A Ret On 2A Price Earn 2A Div Yield Ratio Turn Com Stock Assets Equity Ratio For both companies compute the return on total assets. (c) Return on Total Assets Company Choose Numerator Choose Denominator + Return on Total Assets Rotum on total assets % Barco Kyan % 28. For both companies compute the () profit margin ratio, () total asset turnover, (a return on total assets, and (d) return on common stockholders' equity. Assuming that share and each company's stock can be purchased at $100 per share, compute their (e) price- earnings ratios and (1) dividend yields. (Do not round intermediate calculations, Round your answers to 2 decimal places.) 2b. Identify which company's stock you would recommend as the better investment Complete this question by entering your answers in the tabs below. Reg 28 2A Pro Marg 2 Tot Asset 2A Ret on Tot 2A Ret On Com Stock 2A Price Earn 2A Div Yield Ratio Turn Assets Equity Ratio For both companies compute the return on common stockholders' equity. Company Choose Numerator (d) Return on Common Stockholders' Equity Choose Denominator - Return On Common Stockholders' Equity - Return On common stockholders equity % Barco Kyan 2a. For both companies compute the (a) profit margin ratio, (b) total asset turnover, (creturn on total assets, and (d) return on common stockholders' equity. Assuming that share and each company's stock can be purchased at $100 per share, compute their (e) price- earnings ratios and (1) dividend yields. (Do not round intermediate calculations. Round your answers to 2 decimal places.) 2b. Identify which company's stock you would recommend as the better investment Complete this question by entering your answers in the tabs below. 2A Pro Marg 2A Tot Asset 2A Ret on Tot 2A Ret On 2A Price Earn 2a Div Yield Turn Com Stock Red 28 Ratio Assets Ratio Equity Assuming that share and each company's stock can be purchased at $100 per share, compute their price-earnings ratios. (0) Price-Earnings Ratio Company Choose Numerator: Choose Denominator: Price-Earnings Ratio Price-carnings ratio Barco times Kyan times 20. For both companies compute the (a) profit margin ratio, (b) total asset turnover (a return on total assets, and (c) return on common stockholders' equity. Assuming that share and each company's stock can be purchased at $100 per share, compute their (e) price- earnings ratios and dividend yields (Do not round Intermediate calculations, Round your answers to 2 decimal places.) 2b. Identify which company's stock you would recommend as the better investment Complete this question by entering your answers in the tabs below. 2A Pro Marg 2A Tot Assot A Ret on Tot 2A Ret On Ratio 2A Price Eam A Di Yield Turn Assets Com Stock Reg 28 Ratio Equity Assuming that share and each company's stock can be purchased at $100 per share, compute their dividend yields (1) Dividend Ylold Company Choose Numerator Choose Denominator - Dividend Yield Dividend yield Baroo % Kyan % 2a. For both companies compute the (a) profit margin ratio, (6) total asset turnover, (a return on total assets, and (c) return on common stockholders' equity. Assuming that share and each company's stock can be purchased at $100 per share, compute their (@) price earnings ratios and (in dividend yields. (Do not round intermediate calculations. Round your answers to 2 decimal places.) 2b. Identify which company's stock you would recommend as the better investment. Complete this question by entering your answers in the tabs below. Reg 20 2A Pro Marg 2A Tot Asset 2A Reton Tet Com Stock 2A Ret On 2A Price Earn 2A Div Yield Ratio Tum Assets Equity Ratio Identity which company's stock you would recommend as the better investment The botter investment Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (accounts (including notes) receivable turnover, (c) inventory turnover (e) days' sales in inventory, and (days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be better short-term credit risk. Complete this question by entering your answers in the tabs below. 1A Current 1A ayd Test 1A Acct Rec 1A Invent Ratio Pletio Turn Turnover For both companies compute the acid-test ratio. 1A Days Sal in 1A Days Sal Inv Uncol Reg 1B (b) Acid Test Ratio Company Choose Numerator: Choose Denominator: Acid-Test Ratio Acid-test ratio + Barco Kyan 1o 1 + to 1 1A Current Ratio 1A Acct Rec Turn Required: 1a. For both companies compute the (a) current ratio, (b) acld-test ratio, (accounts (including notes) receivable turnover, () Inventory turnover, (e) days' sales In Inventory, and (days' sales uncollected. (Do not round Intermediate calculations.) 1b. Identify the company you consider to be better short-term credit risk. Complete this question by entering your answers in the tabs below. Inv 1A Current 1A Acid Test 1A Acct Rec 1A Invent 1A Days Sol in 1A Days Sal Ratio Ratio Turn Turnover Reg 13 Uncol For both companies compute the accounts (Including notes) receivable turnover (c) Accounts Recevable Turnover Choose Choose Denominator Accounts Recevable Turnover Company Numerator: = Accounts receivablo turnover Barco 1 times Kyan / times Required: 1a. For both companies compute the (a) current ratio. (b) acid-test ratio, (accounts (including notes) receivable turnover, (a) inventory turnover, (e) days' sales in Inventory, and (days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be better short-term credit risk. Complete this question by entering your answers in the tabs below. Reg 16 1A Current 1A Acid Test 1A Acct Rec 1A Invent 1A Days Salin 1A Days Sol Ratio Ratio Turn Turnover Inv Uncol For both companies compute the inventory tumover. Company Choose Numerator: (d) Inventory Turnover Choose Denominator 1 = Inventory Turnover = Inventory turnover Limos Barco Kyan times Required: 19. For both companies compute the (a) current ratio, (b) acid-test ratio, ( accounts (including notes) receivable turnover, (o) inventory turnover, (e) days' sales in Inventory, and (7 days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be better short-term credit risk. Complete this question by entering your answers in the tabs below. 1A Current Ratio 1A Acid Test 1A Acct Rec Ratio Turn 1A Invent Turnover 1A Days Sal in 1A Days Sal Uncol Iny Reg 16 For both companies compute the days' sales in inventory (c) Days' Sales In Inventory Company Choose Numerator: 7 Choose Denominator: x Days Dayu' Sales in Inventory - Days' sales in inventory days = days Barco xxx Kyan Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts (Including notes) receivable turnover, (c) invent turnover , (e) days' sales In Inventory, and (y days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be better short-term credit risk. Complete this question by entering your answers in the tabs below. 1A Current Ratio 1A Acid Test Ratio 1A Acct Rec Turn 1A Invent Turnover IA Days Sal in 1A Days Sal Inv Uncol Reg 1B For both companies compute the days' sales uncollected (Days' Sales Uncollected CompanyChoose Numerator Choose Denominator: x Days Days' Sales Uncollected = Days' sales uncollected x Barco XX ## days days Kyan Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, () accounts (including notes) receivable turnover. (a) inventory turnover (e) days' sales in inventory, and (7 days' sales uncollected. (Do not round Intermediate calculations.) 1b. Identify the company you consider to be better short-term credit risk. Complete this question by entering your answers in the tabs below. Reg 1B 1A Current 1A Acid Test 1A Acct Rec 1A Invent 1A Days Sal in 1A Days Sal Ratio Ratio Tum Turnover Iny Uncol Identify the company you consider to be the better short-term credit risk. Better short-term credit risk Required information [The following information applies to the questions displayed below) Summary Information from the financial statements of two companies competing in the same industry follows. Kyan Company Barco Company Data from the current year-end balance sheets Assets Cash 21,500$ Accounts receivable, net 39,400 Current notes receivable (trade) 9,200 Merchandise inventory 84,540 Prepaid expenses 5, 700 Plant assets, net 280,000 Total assets 440, 340$ 38,000 57,400 7,600 142,500 7,000 308,400 560,900 Liabilities and Equity Current liabilities Long-term notes payable Common stock, $5 par value Retained earnings Total liabilities and equity 65,340$ 82,800 210,000 82,200 440,340$ 95,300 105,000 206,000 154,600 560,900 917,200 652,500 14,000 25,321 225, 379 5.47 4.02 Data from the current year's income statement Sales 790,000 $ Coat of goods sold 590,100 Interest expense 7,600 Income tax expense 15,185 Net Income 177, 115 Basic earnings per share 4.22 Cash dividends per share 3.75 Beginning-of-year balance sheet data Accounts receivable, net 29,800 $ Current notes receivable (trade) 0 Merchandise inventory 59,600 Total assets 438,000 Common stock, $5 par value 210,000 Retained earnings 62,585 53,200 0 115,400 372,500 206,000 94,845 2a. For both companies compute the profit margin ratio. (b) total asset turnover. (return on total assets, and (d) return on common stockholders' equity. Assuming that share and each company's stock can be purchased at $100 per share, compute thelr(e) price earings ratios and (dividend yields. (Do not round intermediate calculations. Round your answers to 2 decimal places.) 2b. Identify which company's stock you would recommend as the better investment Complete this question by entering your answers in the tabs below. ZA Price Earn Ratio 2A DIV Yield Reg 28 2A Reton 2A Pro Marg 2A Tot Asset 2A Reton Tot Rabo Com Stock Tum Assets Equity For both companies compute the profit margin ratio. (a) Profit Margin Ratio Company Choose Numerator: Choose Denominator Profit margin ratio Profit margin ratio Barco Kyan 1 2a. For both companies compute the (8) profit margin ratio, (b) total asset turnover, (return on total assets, and (c) return on common stockholders' equity Assuming that share and each company's stock can be purchased at $100 per share, compute their (e) price- earnings ratios and ( dividend yields. (Do not round intermediate calculations. Round your answers to 2 decimal places.) 2b. Identify which company's stock you would recommend as the better investment. Complete this question by entering your answers in the tabs below. 2A Price Earn Ratio ZA Diy Yield Reg 28 2A Ret On 2A Pro Marg 2A Tot Asset 2A Ret on Tot Com Stock Ratio Turn Assets Equity For both companies compute the total asset turnover (0) Total Aueet Tumover Company Choose Numerator Choose Denominator: Total Asset Tumover Total asset tumover times times Barco Kyan 2a. For both companies compute the (a) profit margin ratio, (b) total asset turnover (return on total assets, and (d) return on common stockholders' equity Assuming that share and each company's stock can be purchased at $100 per share, compute their (e) price- earnings ratios and (dividend yields. (Do not round intermediate calculations, Round your answers to 2 decimal places.) 2b. Identify which company's stock you would recommend as the better investment Complete this question by entering your answers in the tabs below. Reg 28 2A Pro Marg 2A Tot Asset 2A Ret on Tot 2A Ret On 2A Price Earn 2A Div Yield Ratio Turn Com Stock Assets Equity Ratio For both companies compute the return on total assets. (c) Return on Total Assets Company Choose Numerator Choose Denominator + Return on Total Assets Rotum on total assets % Barco Kyan % 28. For both companies compute the () profit margin ratio, () total asset turnover, (a return on total assets, and (d) return on common stockholders' equity. Assuming that share and each company's stock can be purchased at $100 per share, compute their (e) price- earnings ratios and (1) dividend yields. (Do not round intermediate calculations, Round your answers to 2 decimal places.) 2b. Identify which company's stock you would recommend as the better investment Complete this question by entering your answers in the tabs below. Reg 28 2A Pro Marg 2 Tot Asset 2A Ret on Tot 2A Ret On Com Stock 2A Price Earn 2A Div Yield Ratio Turn Assets Equity Ratio For both companies compute the return on common stockholders' equity. Company Choose Numerator (d) Return on Common Stockholders' Equity Choose Denominator - Return On Common Stockholders' Equity - Return On common stockholders equity % Barco Kyan 2a. For both companies compute the (a) profit margin ratio, (b) total asset turnover, (creturn on total assets, and (d) return on common stockholders' equity. Assuming that share and each company's stock can be purchased at $100 per share, compute their (e) price- earnings ratios and (1) dividend yields. (Do not round intermediate calculations. Round your answers to 2 decimal places.) 2b. Identify which company's stock you would recommend as the better investment Complete this question by entering your answers in the tabs below. 2A Pro Marg 2A Tot Asset 2A Ret on Tot 2A Ret On 2A Price Earn 2a Div Yield Turn Com Stock Red 28 Ratio Assets Ratio Equity Assuming that share and each company's stock can be purchased at $100 per share, compute their price-earnings ratios. (0) Price-Earnings Ratio Company Choose Numerator: Choose Denominator: Price-Earnings Ratio Price-carnings ratio Barco times Kyan times 20. For both companies compute the (a) profit margin ratio, (b) total asset turnover (a return on total assets, and (c) return on common stockholders' equity. Assuming that share and each company's stock can be purchased at $100 per share, compute their (e) price- earnings ratios and dividend yields (Do not round Intermediate calculations, Round your answers to 2 decimal places.) 2b. Identify which company's stock you would recommend as the better investment Complete this question by entering your answers in the tabs below. 2A Pro Marg 2A Tot Assot A Ret on Tot 2A Ret On Ratio 2A Price Eam A Di Yield Turn Assets Com Stock Reg 28 Ratio Equity Assuming that share and each company's stock can be purchased at $100 per share, compute their dividend yields (1) Dividend Ylold Company Choose Numerator Choose Denominator - Dividend Yield Dividend yield Baroo % Kyan % 2a. For both companies compute the (a) profit margin ratio, (6) total asset turnover, (a return on total assets, and (c) return on common stockholders' equity. Assuming that share and each company's stock can be purchased at $100 per share, compute their (@) price earnings ratios and (in dividend yields. (Do not round intermediate calculations. Round your answers to 2 decimal places.) 2b. Identify which company's stock you would recommend as the better investment. Complete this question by entering your answers in the tabs below. Reg 20 2A Pro Marg 2A Tot Asset 2A Reton Tet Com Stock 2A Ret On 2A Price Earn 2A Div Yield Ratio Tum Assets Equity Ratio Identity which company's stock you would recommend as the better investment The botter investment