Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is a Walmart Mini Case for Advanced Corporate Finance and Modeling; help much needed, thanks so much! See Images for Problem / Questions. Mini

This is a Walmart Mini Case for Advanced Corporate Finance and Modeling; help much needed, thanks so much! See Images for Problem / Questions.

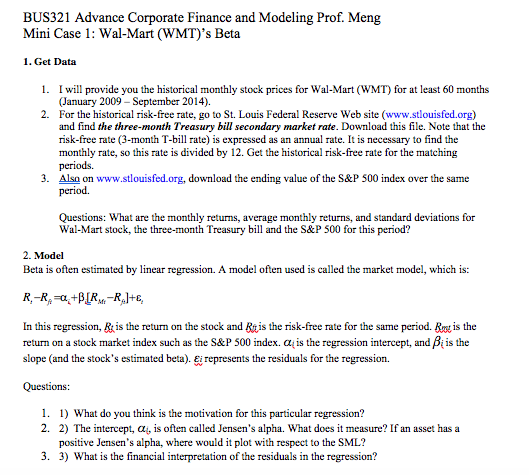

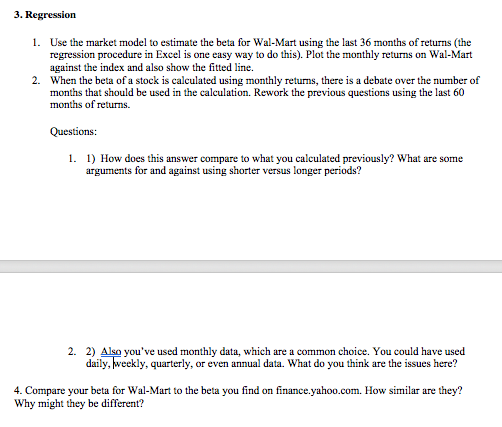

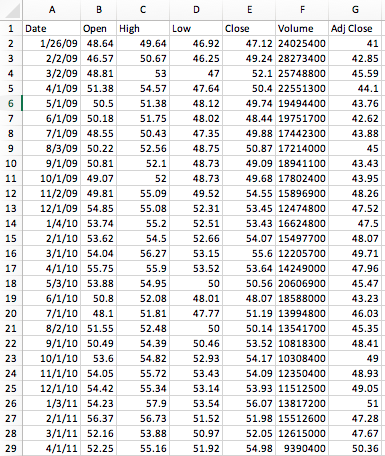

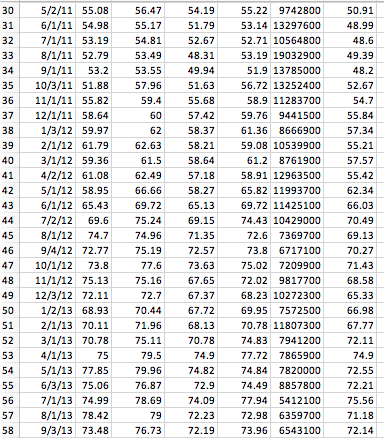

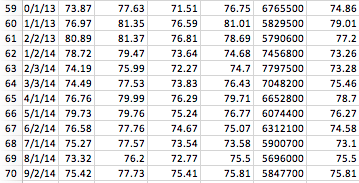

Mini Case 1: Wal-Mart (WMT)'s Beta 1. Get Dat:a 1. I will provide you the historical monthly stock prices for Wal-Mart (WMT) for at least 60 months (January 2009 September 2014). 2. For the historical risk-free rate, go to St. Louis Federal Reserve Web site (www.stlouisfed.org) and find the three-month Treasury bill secondary market rate. Download this file. Note that the risk-free rate (3-month T-bill rate) is expressed as an annual rate. It is necessary to find the monthly rate, so this rate is divided by 12. Get the historical risk-free rate for the matching periods. 3. Alsa on www.stlouisfed.org, download the ending value of the S&P 500 index over the same period. Questions: What are the monthly returns, average monthly returns, and standard deviations for Wal-Mart stock, the three-month Treasury bill and the S&P 500 for this period? 2. Model Beta is often estimated by linear regression. A model often used is called the market model, which is: In this regression, Ris the return on the stock and Ris the risk-free rate for the same period. R is the return on a stock market index such as the S&P 500 index. aus the regression intercept, and A is the slope (and the stock's estimated beta). e represents the residuals for the regression. Questions 1. 1) What do you think is the motivation for this particular regression? 2. 2) The intercept, a, is often called Jensen's alpha. What does it measure? If an asset has a positive Jensen's alpha, where would it plot with respect to the SML? 3. 3) What is the financial interpretation of the residuals in the regression

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started