This is accounting course BUSI 453 advanced accounting.

I need to make intercompany profit/gain and loss schedule for consolidated income

anyone can help please?

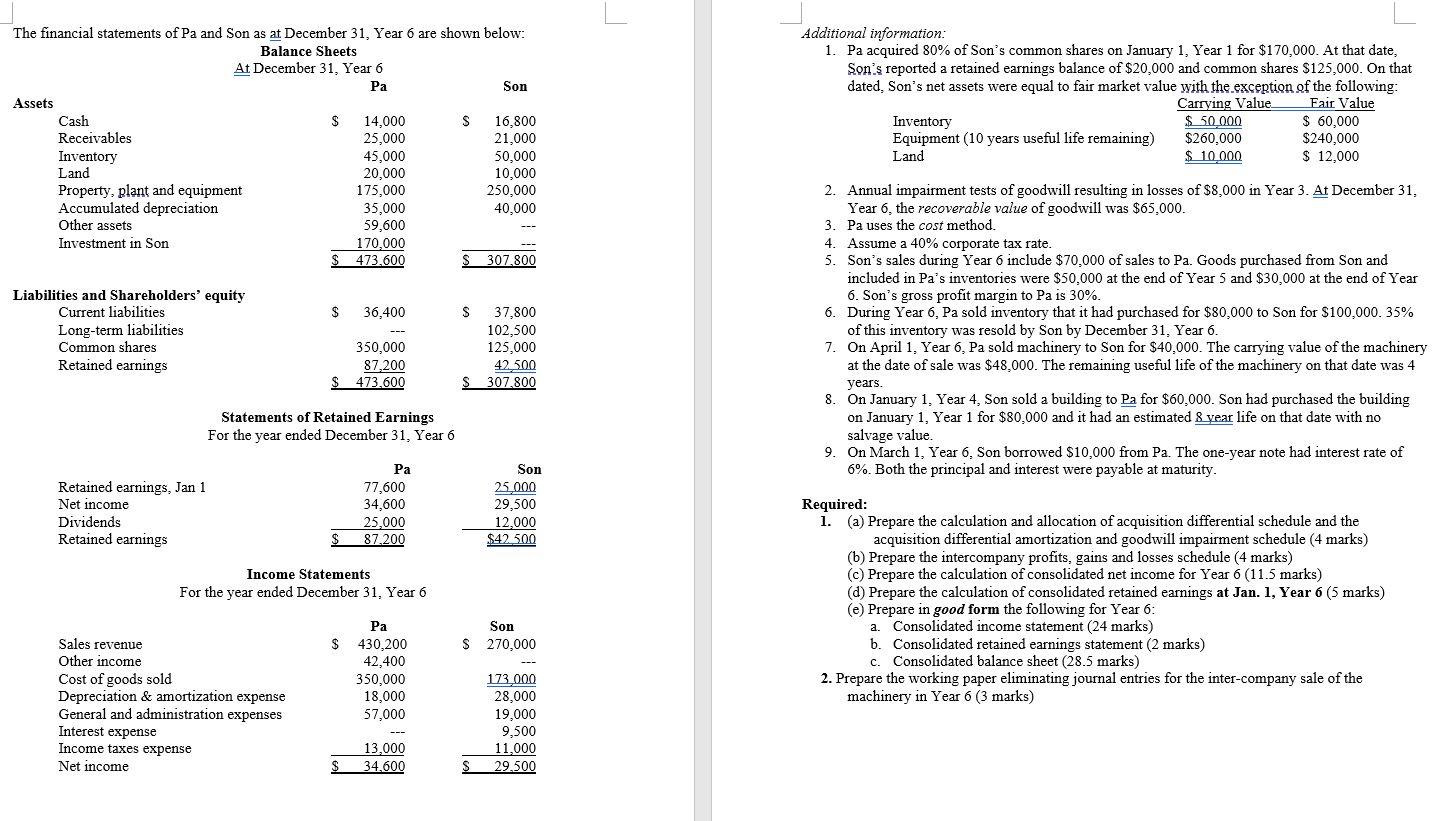

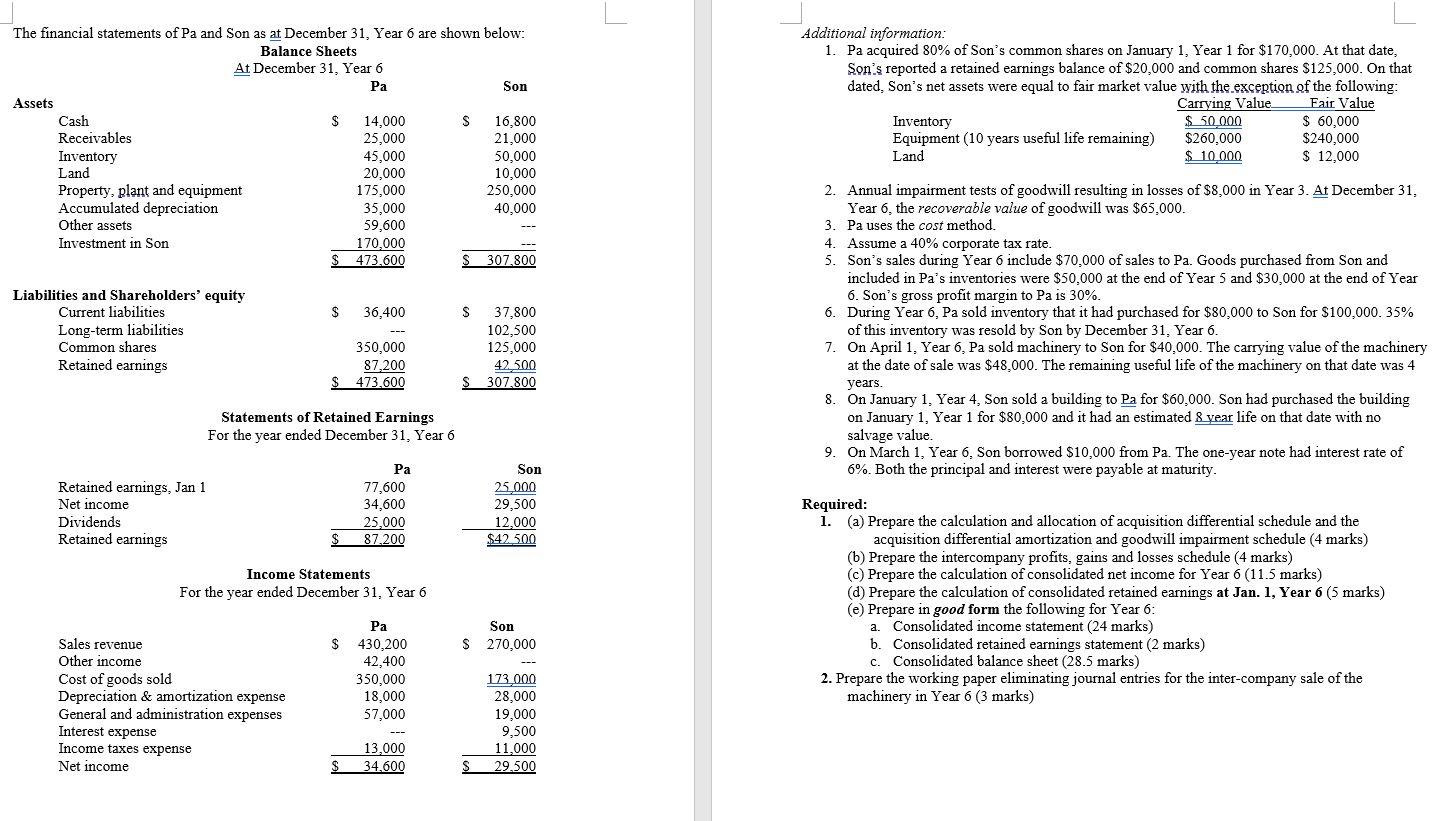

L The financial statements of Pa and Son as at December 31, Year 6 are shown below: Balance Sheets At December 31, Year 6 Pa Son Assets Cash $ 14,000 $ 16,800 Receivables 25,000 21,000 Inventory 45,000 50,000 Land 20,000 10,000 Property, plant and equipment 175,000 250,000 Accumulated depreciation 35,000 40,000 Other assets Investment in Son 170,000 473,600 307.800 Additional information: 1. Pa acquired 80% of Son's common shares on January 1, Year 1 for $170,000. At that date, Son's reported a retained earnings balance of $20,000 and common shares $125,000. On that dated. Son's net assets were equal to fair market value with the exception of the following: Carrying Value Fair Value Inventory $ 50.000 $ 60,000 Equipment (10 years useful life remaining) $260,000 $240,000 Land $ 10.000 $ 12,000 59,600 $ 36,400 $ Liabilities and Shareholders' equity Current liabilities Long-term liabilities Common shares Retained earnings 2. Annual impairment tests of goodwill resulting in losses of $8,000 in Year 3. Af December 31, Year 6. the recoverable value of goodwill was $65.000. 3. Pa uses the cost method. 4. Assume a 40% corporate tax rate. 5. Son's sales during Year 6 include $70,000 of sales to Pa. Goods purchased from Son and included in Pa's inventories were $50,000 at the end of Year 5 and $30,000 at the end of Year 6. Son's gross profit margin to Pa is 30%. 6. During Year 6, Pa sold inventory that it had purchased for $80,000 to Son for $100,000.35% of this inventory was resold by Son by December 31, Year 6. 7. On April 1, Year 6. Pa sold machinery to Son for $40,000. The carrying value of the machinery at the date of sale was $48,000. The remaining useful life of the machinery on that date was 4 years. 8. On January 1, Year 4, Son sold a building to Pa for $60,000. Son had purchased the building on January 1, Year 1 for $80,000 and it had an estimated 8 year life on that date with no salvage value. 9. On March 1, Year 6. Son borrowed $10,000 from Pa. The one-year note had interest rate of 6%. Both the principal and interest were payable at maturity. 37,800 102,500 125,000 42.500 307.800 350,000 87,200 $ 473.600 S Statements of Retained Earnings For the year ended December 31, Year 6 Retained earnings, Jan 1 Net income Dividends Retained earnings Pa 77,600 34,600 25,000 87.200 Son 25,000 29,500 12.000 $42.500 Income Statements For the year ended December 31, Year 6 Required: 1. (a) Prepare the calculation and allocation of acquisition differential schedule and the acquisition differential amortization and goodwill impairment schedule (4 marks) (6) Prepare the intercompany profits, gains and losses schedule (4 marks) (c) Prepare the calculation of consolidated net income for Year 6 (11.5 marks) (d) Prepare the calculation of consolidated retained earnings at Jan. 1, Year 6 (5 marks) (e) Prepare in good form the following for Year 6: a. Consolidated income statement (24 marks) b. Consolidated retained earnings statement (2 marks) C. Consolidated balance sheet (28.5 marks) 2. Prepare the working paper eliminating journal entries for the inter-company sale of the machinery in Year 6 (3 marks) Son $ 270,000 $ Sales revenue Other income Cost of goods sold Depreciation & amortization expense General and administration expenses Interest expense Income taxes expense Net income Pa 430,200 42,400 350,000 18,000 57,000 173,000 28,000 19,000 9,500 11,000 29.500 13,000 34,600 L The financial statements of Pa and Son as at December 31, Year 6 are shown below: Balance Sheets At December 31, Year 6 Pa Son Assets Cash $ 14,000 $ 16,800 Receivables 25,000 21,000 Inventory 45,000 50,000 Land 20,000 10,000 Property, plant and equipment 175,000 250,000 Accumulated depreciation 35,000 40,000 Other assets Investment in Son 170,000 473,600 307.800 Additional information: 1. Pa acquired 80% of Son's common shares on January 1, Year 1 for $170,000. At that date, Son's reported a retained earnings balance of $20,000 and common shares $125,000. On that dated. Son's net assets were equal to fair market value with the exception of the following: Carrying Value Fair Value Inventory $ 50.000 $ 60,000 Equipment (10 years useful life remaining) $260,000 $240,000 Land $ 10.000 $ 12,000 59,600 $ 36,400 $ Liabilities and Shareholders' equity Current liabilities Long-term liabilities Common shares Retained earnings 2. Annual impairment tests of goodwill resulting in losses of $8,000 in Year 3. Af December 31, Year 6. the recoverable value of goodwill was $65.000. 3. Pa uses the cost method. 4. Assume a 40% corporate tax rate. 5. Son's sales during Year 6 include $70,000 of sales to Pa. Goods purchased from Son and included in Pa's inventories were $50,000 at the end of Year 5 and $30,000 at the end of Year 6. Son's gross profit margin to Pa is 30%. 6. During Year 6, Pa sold inventory that it had purchased for $80,000 to Son for $100,000.35% of this inventory was resold by Son by December 31, Year 6. 7. On April 1, Year 6. Pa sold machinery to Son for $40,000. The carrying value of the machinery at the date of sale was $48,000. The remaining useful life of the machinery on that date was 4 years. 8. On January 1, Year 4, Son sold a building to Pa for $60,000. Son had purchased the building on January 1, Year 1 for $80,000 and it had an estimated 8 year life on that date with no salvage value. 9. On March 1, Year 6. Son borrowed $10,000 from Pa. The one-year note had interest rate of 6%. Both the principal and interest were payable at maturity. 37,800 102,500 125,000 42.500 307.800 350,000 87,200 $ 473.600 S Statements of Retained Earnings For the year ended December 31, Year 6 Retained earnings, Jan 1 Net income Dividends Retained earnings Pa 77,600 34,600 25,000 87.200 Son 25,000 29,500 12.000 $42.500 Income Statements For the year ended December 31, Year 6 Required: 1. (a) Prepare the calculation and allocation of acquisition differential schedule and the acquisition differential amortization and goodwill impairment schedule (4 marks) (6) Prepare the intercompany profits, gains and losses schedule (4 marks) (c) Prepare the calculation of consolidated net income for Year 6 (11.5 marks) (d) Prepare the calculation of consolidated retained earnings at Jan. 1, Year 6 (5 marks) (e) Prepare in good form the following for Year 6: a. Consolidated income statement (24 marks) b. Consolidated retained earnings statement (2 marks) C. Consolidated balance sheet (28.5 marks) 2. Prepare the working paper eliminating journal entries for the inter-company sale of the machinery in Year 6 (3 marks) Son $ 270,000 $ Sales revenue Other income Cost of goods sold Depreciation & amortization expense General and administration expenses Interest expense Income taxes expense Net income Pa 430,200 42,400 350,000 18,000 57,000 173,000 28,000 19,000 9,500 11,000 29.500 13,000 34,600