This is all one practice question from the book. I need help trying to put this into a tax return form.

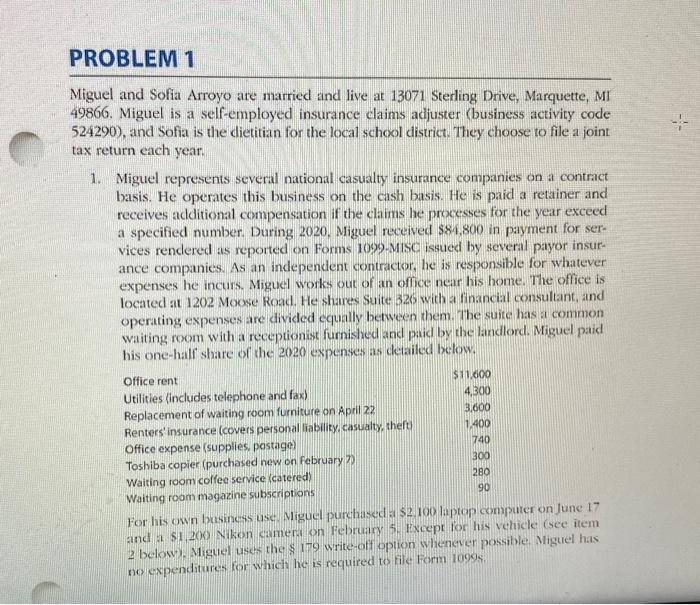

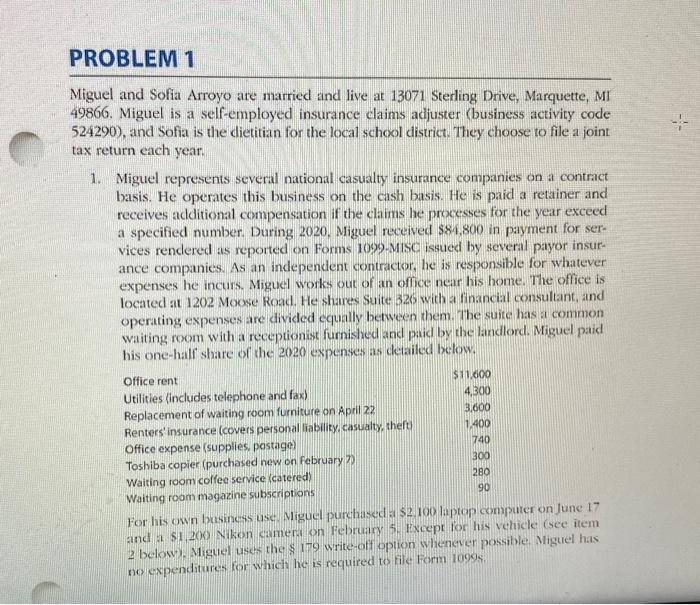

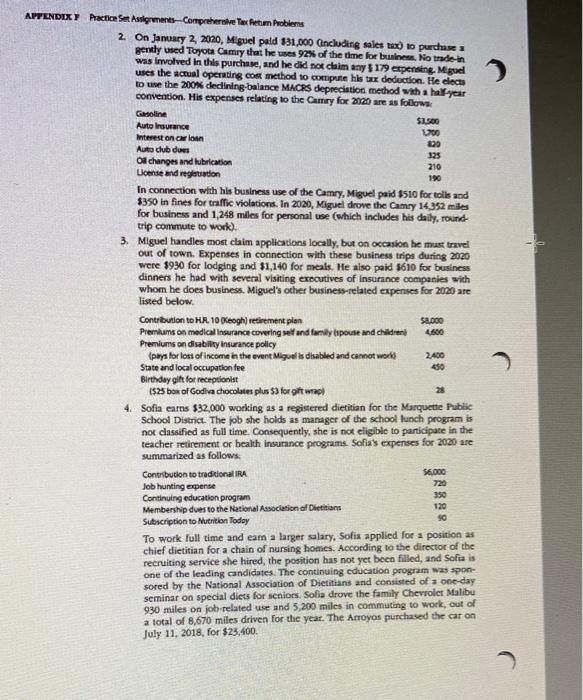

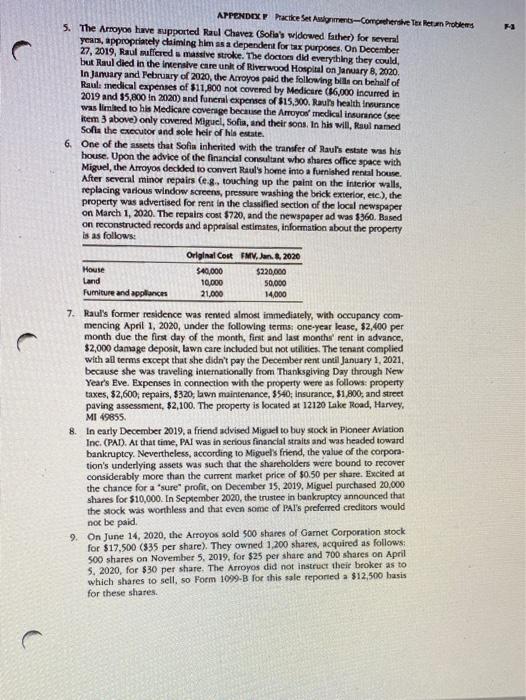

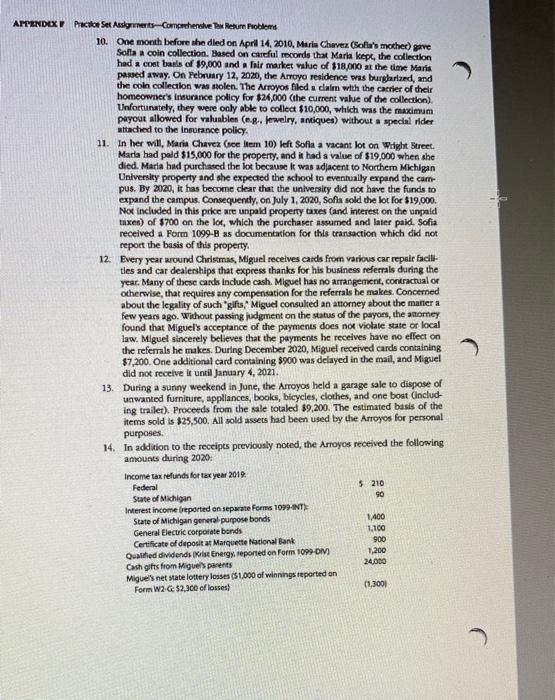

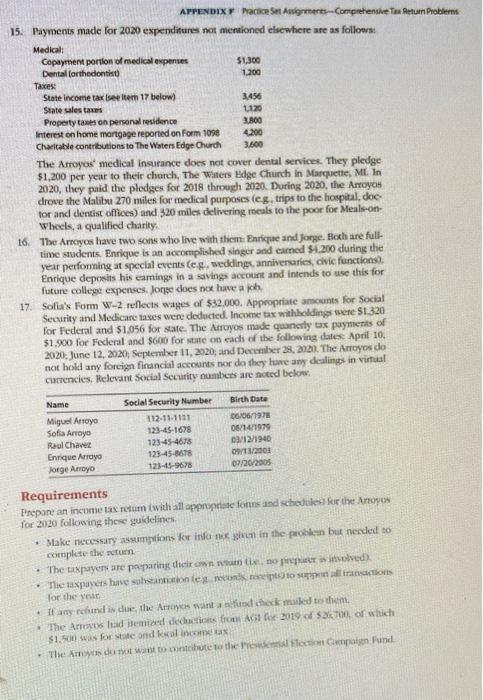

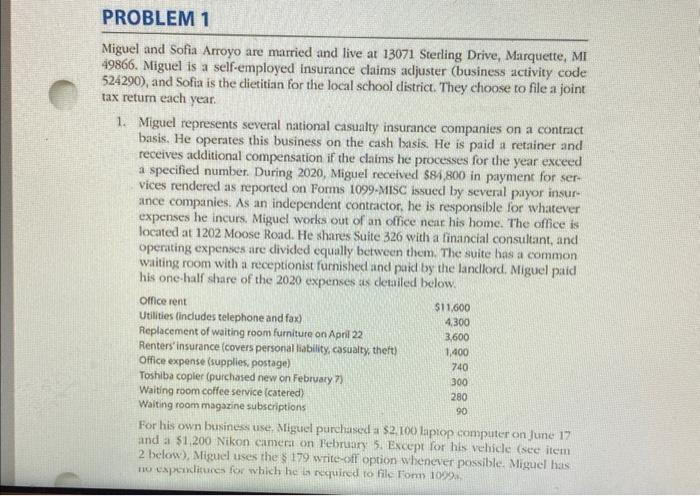

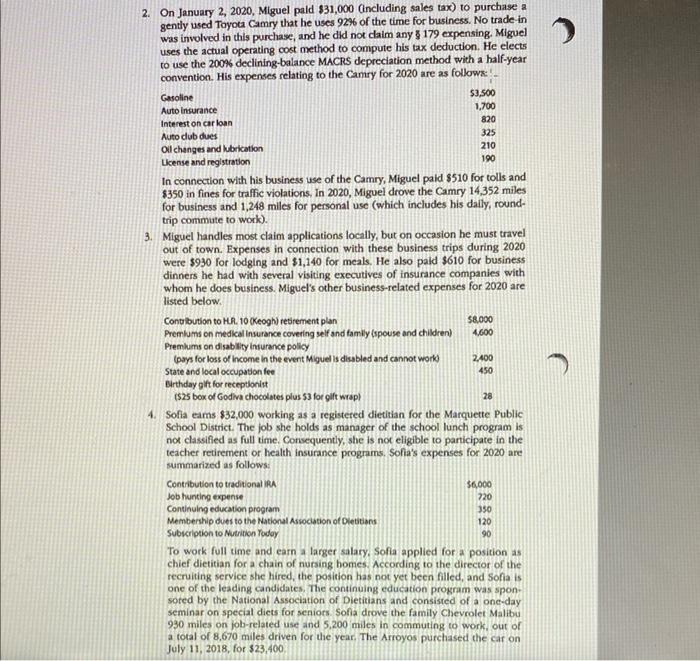

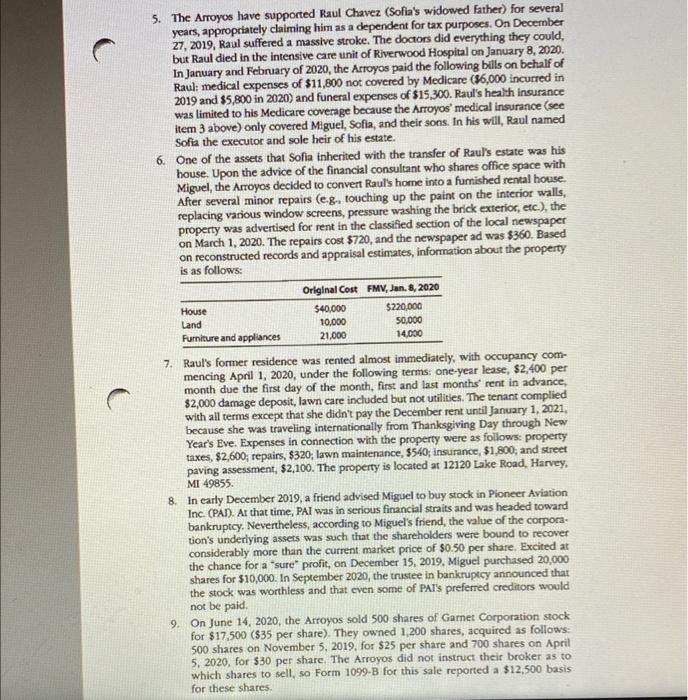

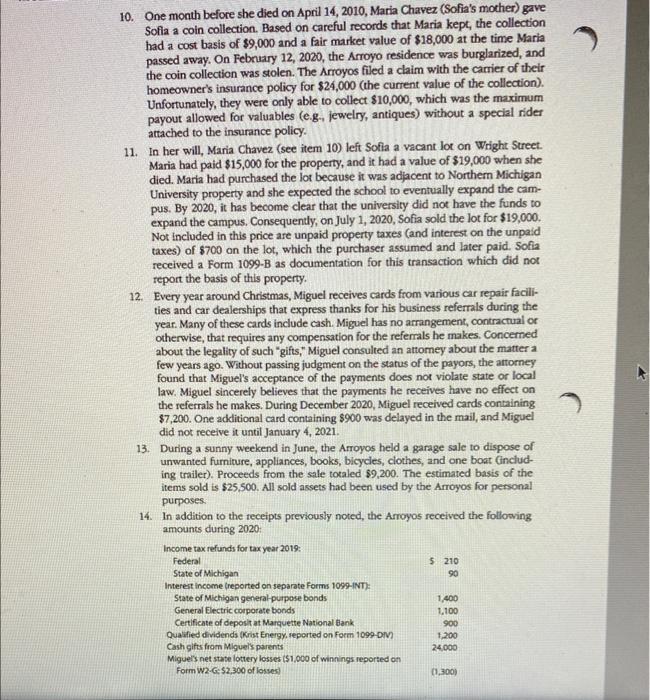

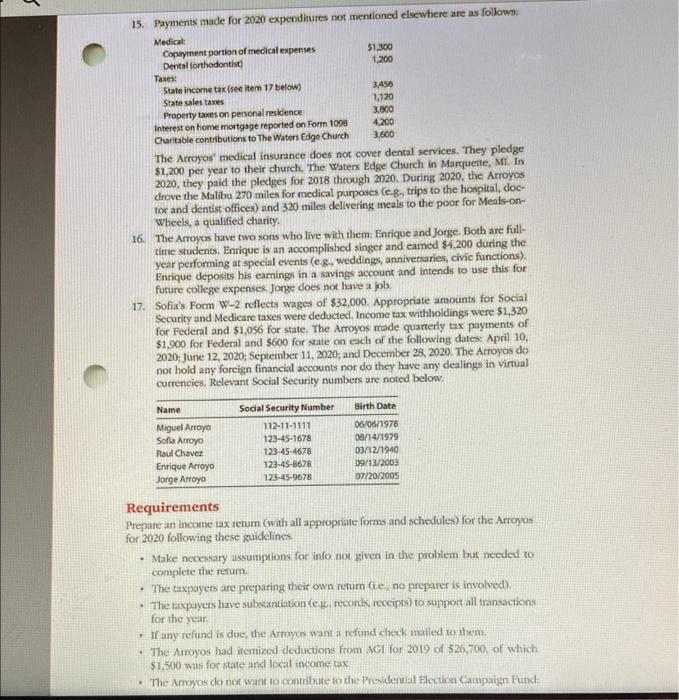

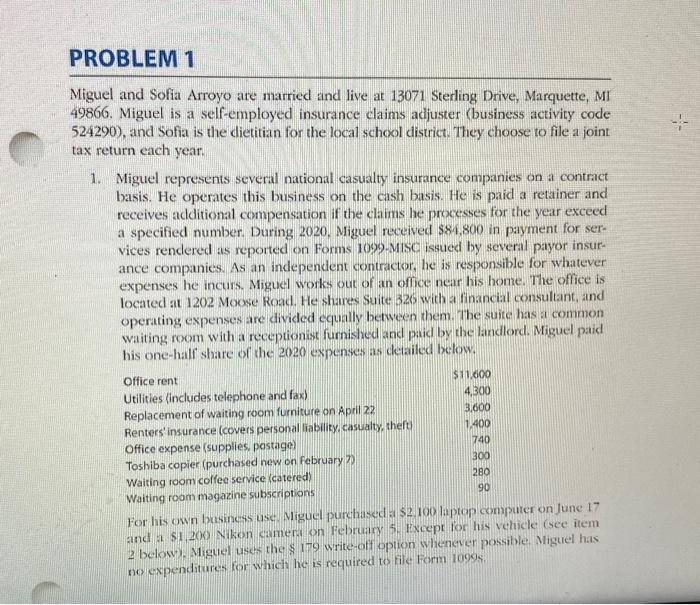

Miguel and Sofia Arroyo are married and live at 13071 Sterling Drive, Marquette, MI 49866. Miguel is a self-employed insurance claims adjuster (business activity code 524290), and Sofia is the dietitian for the local school district. They choose to file a joint tax return each year. 1. Miguel represents several national casualty insurance companies on a contract basis. He operates this business on the cash basis. He is paid a retainer and receives additional compensation if the claims he processes for the year exceed a specified number. During 2020 . Miguel received $84.800 in payment for services rendered as reported on Forms 1099- Mise issued by several payor insurance companies. As an independent contractor, he is responsible for whatever expenses he incurs. Miguel works out of an office near his home. The office is located at 1202 Moose Road. He shares Sulte 326 with a financial consultant, and operating expenses are divided equally between them. The suite has a common waiting room with a receptionist furnisled and paid by the landlord. Miguel paid his one-half share of the 2020 expenses as cletailed below. For his own basiness use: Miguel purchased a $2 100 laptop computer on June 17 and a \$1,200) Nikon cameri on February \$. Fxept for his vehicle (see item 2 betowy. Miguel uses the s 179 write-off option whenever possible Miguel has no expenditures for which he is required to file Form 1099 s. 2. On January 2, 2000, Miguel paid 131,000 (includirg sales tax) to purdhae a genty used Toyota Camry that he uses 920 of the dime for buinees. Wo trade-in was I molved in this purchase, and he did not chim any 3179 erpensing Mrsed uses the actual operating coen method to oompure his tax dodoction. He elects to use the 200% dedining-balance MACRS depreciation method whth a half-year convention. His expenses relating to the Camry for ana0 are as followa: In connection whth his business use of the Camry, Miguel paid $510 for tolls and $350 in fines for traffic violations. In 2020 , Miguel drove the Camry 14,352m3ed for business and 1,248 miles for personal use (which includes his daily, rourdtrip commute to work). 3. Miguel handles most claim applications locally, but on occarion he must travel out of town. Expenses in connection with these business trips during 2020 Were $930 for lodging and $1,140 for meals. He also paid $610 for business dinners he had with several visiting exocutives of insurance companies with whom be does business. Miguel's ocher business-related expenses for 2020 are listed below. School District. The fob she holds as manager of the school hunch program is not classafied as full time. Consequently, she is not elighble to participate in the teacher retirement or health insumnce programs. Sofia's expenses for 2020 are summarized as follows: To pork full time and eaen a larger salary. Sofia applied for a position 25 chief dietitian for a chain of nursing hoases. According to the director of the recruiting service she hired, the position has not yet becn filled, and Sofra is one of the leading candidates. The continuing cducation program was sponsored by the National Association of Dietitians and consisted of a oce-day seminar on special diets for seniors. Sofia drove the family Chevolet Malibu 930 miles on jobrrelated use and 5,200 miles in commuting to work, out of a total of 8,670 miles driven for the year. The Arroyos purchased the car on July 11,2018 , for $23,400. 5. The Arroyoo have supported Racl Chavez (Soliais widorared father) for nevenal Yeans, appropriately chaiming him as a dependent for tax purposes. On Decenber 27, 2019, Raul mifiered a massive strole. The docroes did everyihlng they could, but Raul died in the interatve care unlt of Rlverwood Hospital on January 8, 20n20. In Jamary and Felaruary of 2020 , the Arroyos paid the following bill on behalf of Raul: medical expenses of 911,800 not covered by Mcdicare ( $6,000 lincurred in 2019 and $5,800 in 2020 ) and fancral experses of $15,300. Raurs health innurance was limited to his Medicane covetage bocause the hrroyod' racical irsurance (sce item 3 above) only covered Miguel, Sofia, and their sons. In his will, faul named Soft the executor and sole heir of his extate. 6. One of the assets that Sofin inherited with the transer of Maulis extate was his house. Upon the advice of the financial consultant who shares office space with Miguel, the Arroyos dockded to corvert Raul's home into a futnished renal howas. After several minor nepairs (e.g., touching up the paint on the inderior walls, replacing variots windos screcens, pressure wrashing the brick exterior, etc), the property was advertised for rent in the chassified section of the local newspaper on March 1. 2020. The repairs coet $720, and the newspaper ad oras $360. Bascd on reconstructed records and appralsal estimates, infocmatioe about the property is 15 followst 7. Raul's former residence was rened almost immediately, with occupancy commencing April 1, 2020, under the following terms; one-year lease, \$2,400 per month due the first day of the month, fint and last months' rent in advance, $2,000 danage deposit, lawn care included but not utilities. The tenant complied with all terms except that she didn't pay the December rent unail January 1, 2021, because she was traveling internationally from Thanksgiving Day through New Year's Eve. Expenses in connection with the property were as follows: property taxes, $2,600; repairs, $320; lawn maintenance, $40; insurance, $1,800, and street paving assessment, $2,100. The property is located at 12120 take Road, Harvey, MI 49855. 8. In early December 2019, a friend advised Miguel to buy sock in Pioneer Avlation Inc. (PAD). At that time, PAI was in serious financlal straits and was headed toward bankruptcy. Nevertheless, according to Miguel's friend, the value of the corporation's underlying assets was such that the shartholders were bound to recover considerably more than the current market price of $0.50 per share. Excited at the chance for a saure" profit, on December 15, 2019, Miguel purchased 20,000 shares for $10,000. In September 2020 , the trustee in bankruptcy announced that the stock was worthless and that even some of PAI's preferred creditors would not be paid. 9. On June 14, 2020, the Arroyos sold 500 shares of Gamet Corporation stock for $17,500 ( $35 per share). They owned 1,200 shares, acquired as follows: 500 shares on November 5, 2019, for $25 per share and 700 shares on April 5. 2020, for $30 per share. The Arroyos did not instrucr their beoker as to which shares to sell, so Form 1009 -B for this sale reporied a $12,500 hasis for these shares. 11. In her wil, Maria Chavea (sce liem 10) left Soffa a vacant lot on Wight Streee. Marla had paid $15,000 for the property, and it had a value of $19,000 when she died. Maria had purchated the lot because it was adjacent to Northern Michigan University property and she expected the schook to evenhally expand the campus. By 2020 , it has become clear that the university did not have the funds to expand the campus. Consequently, on July 1, 2020, Sofla sold the lot for $19,000. Nor included in this price are unpald property taxes fand interest on the ungald tuxes) of $700 on the lot, which the purchaser assumed and later paid. Sofia received a Form 1099B ss documentation for this transaction which did not report the basis of this property, 12. Every year around Chistmas, Miguel receives cards from various car repair faclitles and car dealerships that express thanks for his business referrals during the year, Many of these cards include cash. Miguel has no arrangement, contractual or otherwise, that requires any compensation for the referrals he makes. Concerned about the legality of such "gafts," Miguet consulted an attorney about the marter a few years ago. Without passing judgment on the status of the payors, the anorney found that Miguel's acceptance of the payments does not violate sate or local law. Miguel sincerely believes that the payments he receives have no effect on the referrals he makes. During December 2020 , Miguel received cards containing $7,200. One additional card containing $900 was delayed in the mail, and Miguel did not receive it uniil january 4,2021. 13. During a sunny weekend in June, the Arroyos held a garage sale to dispose of unwanted furniture, uppliances, books, bicycles, elothes, and one boat Cincluding trailet). Proceeds from the sale totaled $9,200. The estimated basis of the trems sold is $25,500. All sold assets had been used by the Arroyos for personal purposes. 14. In addition to the receipts previously noted, the Arroyos received the following ambunts during 2020 : 15. Payments made for 2020 expenditures mot meraioned elsewhere are as follows: The Arroyos medical insurance does not coner dental services. They pledge: $1,200 per year to their charch. The Waters Bdge Church in Marguette, M. In 2020 , they paid the pledges for 2018 through 2020 . During 2020 , the Arroyo4 drowe the Malibu 270 miles for tnedical purpases (e g, trips to the horpial, doctor and dentist offices) and 320 miles delivering meals to the poor for Meals-on-: Whecls, a qualified charity. 16: The Arwoyos have two sons who live with thent Parique and Jorge. Boch are fulftime sudents. Enrique is an accomplished singur and earned $1.250 duning the year performing at speclal cycnts (ce., weddings, anniveraries, civic functions). Enrique depceits his eamings in a savings account and intends to use this for future college expenses. Jorge does nox have a jod. 17. Sofia's form W2 reflects wages of $32.000. Appropriate ansants for Social Security athd Medicare taxes were doducted. Incorne tax withholdingr were $1:320 for Ficderal and $1,056 for sate. The Arcyos made quanerly tax paymetts of $1.900 for Federal and $600 for state on each of the fellowing dahac Aprit 10 . 2020; June 12, 2020; Septemler 11, 2020; and Decciller 29, a03). The Arroyes do not hold any foreign financial accounts nor do fhey have any dealings in virrual carrencies, Helevant social Security nuabers are noted bekos: Requirements for 2020 following these guidelines. - Slake mecessity assumptions for infor nox which in the problen but necled to coirnplite-the scturn. for the yest \$1.4ie suid forstite ond kal imorne? as Higuel and Sofia Arroyo are married and live at 13071 Sterling Drive, Marquette, MI 9866. Miguel is a self-employed insurance claims adjuster (business activity code 24290), and Sofia is the dietitian for the local school district. They choose to file a joint ax return each year. 1. Miguel represents several national casualty insurance companies on a contract basis. He operates this business on the cash basis. He is paid a retainer and receives additional compensation if the claims he processes for the year exceed a specified number. During 2020, Miguel received $81,800 in payment for services rendered as reported on Forms 1099 -MISC issued by several palyor insurance companies. As an independent contractor, he is responsible for whatever expenses he incurs. Miguel works out of an office near his home. The office is located at 1202 Moose Road. He shares Suite 326 with a financial consultant, and operating expenses are divided equally between them. The suite has a common waiting room with a receptionist furnished and paid by the lancllord. Miguel paid his one-half share of the 2020 expenses as cletailed below. For his own business use, Miguel purchased a \$2.100 laptop computer on june 17 and a \$1,200 Nikon camera on Tebruary 5. Except for his vehicle (see item 2 below), Miguel uses the $179 write-off option wlenever possible. Miguel hats to cxperditures for which he in required to file Fom 1009. 2. On January 2, 2020, Miguel pald $31,000 (including sales tax) to purchase a gently used Toyota Camry that he uses 926 of the time for business. No trade-in was involved in this purchase, and he did not daim any 8779 expensing. Miguel uses the actual operating cost method to compute his tax deduction. He elects to use the 200\% declining-balance MACRS depreciation method with a half-year convention. His expenses relating to the Camry for 2020 are as followz: - In connection with his business use of the Camry, Miguel paid $510 for tolls and $350 in fines for traffic violations, In 2020, Miguel drove the Camry 14,352 miles for business and 1,248 miles for personal use (which includes his dally, roundtrip commute to work). 3. Miguel handles most claim applications locally, but on occasion he must travel out of town. Expenses in connection with these business trips during 2020 were $930 for lodging and $1,140 for meals. He also paid $610 for business dinners he had with several visiting executives of insurance companies with whom he does besiness. Miguel's other business-related expenses for 2020 are listed below. 4. Solia eams $32,000 working as a registered dietitian for the Marquette Public School District. The job she holds as manager of the school lunch program is not classified as full time. Consequently, she is not eligible to participate in the teacher retirement or health insurance programs. Soffa's expenses for 2020 are summarized as follows: To work full time and earn a larger salary, Sofia applied for a position as chief dietitian for a chain of nursing homes. According to the director of the recruiting service she hired, the position has not yet been filled, and sofia is one of the leading candidates. The continuing education program was sponsored by the National Association of Dietitians and consisted of a one-day seminar on special diets for seniors Sofia drove the family Chevrolet Malibu 930 miles on job-related use and 5,200 miles in commuting to work, out of a total of 8,670 miles driven for the year. The Arroyos purchased the car on July 11, 2018, for $23,400. 5. The Arroyos have supported Raul Chavez (Sofia's widowed Father) for several years, appropriately claiming him as a dependent for tax purposes. On December 27, 2019, Raul suffered a massive stroke. The doctors did everything they could, but Raul died in the intensive care unit of Riverwood Hospital on January 8,2020 . In January and February of 2020 , the Arroyos paid the following bils on behalf of Raul: medical expenses of $11,800 not covered by Medicare ($6,000 incurred in 2019 and $5,800 in 2020) and funeral expenses of $15,300. Raul's healt insurance was limited to his Medicare coverage because the Arroyos' medical insurance (sce item 3 above) only covered Miguel, Sofia, and their sons. In his oril, Raul named Sofia the executor and sole heir of his estate. 6. One of the assets that Sofia inherited with the transfer of Raul's estate was his house. Upon the advice of the financial consultant who shares office space with Miguel, the Arroyos decided to convert Raul's home into a fumished rental house. After several minor repairs (e.g. touching up the paint on the interior walls, replacing various window screens, pressure washing the brick exterioc, efc.), the property was advertised for rent in the classified section of the local newspaper on March 1,2020 . The repairs cost $720, and the newspaper ad was $360. Based on reconstructed records and appraisal estimates, information about the property is as follows: 7. Raul's former residence was rented almost immediately, whth occupancy commencing April 1, 2020, under the following terms: one-year lease, $2,400 per month due the first day of the month, first and last months' rent in advance, $2,000 damage deposit, lawn care included but not utilities. The tenant complied with all terms except that she didn't pay the December rent until January 1, 2021, because she was traveling internationally from Thanksgiving Day through New Year's Eve. Expenses in connection with the property were as follows: property taxes, $2,600; repairs, $320; lawn maintenance, $540; insurance, $1,800; and street paving assessment, $2,100. The property is located at 12120 Lake Road, Harvey. MI 49855. 8. In early December 2019, a friend advised Miguel to buy stock in Pioneer Aviation Inc. (PAD). At that time, PAI was in serious financial straits and was headed toward bankruptcy. Nevertheless, according to Miguel's friend, the value of the corporation's underlying assets was such that the shareholders were bound to recover considerably more than the current market price of $0.50 per share. Excited at the chance for a "sure" profit, on December 15, 2019, Miguel purchased 20,000 shares for $10,000. In September 2020, the trustee in bankrupty announced that the stock was worthless and that even some of PAI's preferred creditors would not be paid. 9. On June 14, 2020, the Arroyos sold 500 shares of Gamet Corporation stock for $17,500 ( $35 per share). They owned 1,200 shares, acquired as follows: 500 shares on November 5, 2019, for \$25 per share and 700 shares on April 5,2020 , for $30 per share. The Arroyos did not instruct their broker as to which shares to sell, so Form 1099-B for this sale reported a $12,500 basis for these shares. 10. One month before she died on April 14, 2010, Maria Chavez (Sofia's mother) gave Sofia a coin collection. Based on careful records that Maria kept, the collection had a cost basis of $9,000 and a fair market value of $18,000 at the time Maria passed away. On February 12, 2020, the Arroyo residence was burglarized, and the coin collection was stolen. The Arroyos filed a claim with the carrier of their homeowner's insurance policy for $24,000 (the current value of the collection). Unfortunately, they were only able to collect $10,000, which was the maximum payout allowed for valuables (e.g., jewelry, antiques) without a special rider attached to the insurance policy. 11. In her will, Maria Chavez (see item 10) left Sofia a vacant lor on Wright Street. Maria had paid $15,000 for the property, and it had a value of $19,000 when she died. Maria had purchased the lot because it was adiacent to Northern Michigan University property and she expected the school to eventually expand the campus. By 2020, it has become clear that the university did not have the funds to expand the campus. Consequendly, on July 1, 2020, Sofia sold the lot for $19,000. Not included in this price are unpaid property taxes (and interest on the unpaid) taxes) of $700 on the lot, which the purchaser assumed and later paid. Sofia received a Form 1099-B as documentation for this transaction which did not report the basis of this property. 12. Every year around Christmas, Miguel receives cards from various car repair facilties and car dealerships that express thanks for his business referrals during the year. Many of these cards include cash. Miguel has no arrangement, contractual or otherwise, that requires any compensation for the referrals he makes. Concerned about the legality of such "gifts," Miguel consulted an attomey about the matter a few years ago. Wathout passing judgment on the status of the payors, the attomey found that Miguel's acceptance of the payments does not violate state or local law. Miguel sincerely believes that the payments he receives have no effect on the referrals he makes. During December 2020, Miguel received cards containing $7,200. One additional card containing $900 was delayed in the mail, and Miguel did not receive it until January 4,2021. 13. During a sunny weekend in June, the Arroyos held a garage sale to dispose of unwanted furniture, appliances, books, bicycles, clothes, and one boat Gincluding trailer). Proceeds from the sale totaled $9,200. The estimated basis of the items sold is $25,500. All sold assets had been used by the Arroyos for personal purposes. 14. In addition to the receipts previously noted, the Arroyos received the following amounts during 2020: 15. Payments made for 2020 expendirures not mentioned elsewhere are as follows: The Arroyos' medical insurance does not cover dental services. They pledge $1,200 per year to their church, The waters Edge Church in Marquette, Mi. In 2020 , they paid the pledges for 2018 through 2020 . During 2020, the Arroyos cirove the Malibu 270 miles for medical purposes (e.g.r trips to the hospital, doctor and dentist offices) and 320 miles delivering meals to the poor for Meals-onWhecls, a qualified charity. 16. The Arroyes have two sons who live with them Enrique and Jorge. Both are fulltime students. Enrique is an accomplished singer and eamed $4.200 during the year performing at specinl events (e.g., weddings, anniversaries, civic functions). Enrique deposits his earnings in a savings account and intends to use this for future college expenses. Jorge does not have a job. 17. Sofia's Form W-2 reflects wages of $32,000. Appropriate amounts for Social Security and Medicare taxes were deducted. Income tax withholdings were $1,320 for Federal and $1,056 for state. The Arroyos made quarterly tax payments of $1,500 for Federal and $600 for state on each of the following dates: April 10 , 2020; June 12, 2020; September 11, 2020; and December 26, 2020. The Arroyos do not hold any foreign financial accounts nor do they have any dealings in virtual currencies. Relevant Social Secunity numbers are noted below. Requirements Prepare an income tax retum (wath all appropriate forms and wchedules) for the Arroyos for 2020 following these guidelines. - Make neccisary issumptions for info nox given in the problem but necded to complete the ruturn. - The taxpayers are prepating their own return (i.e, no preparer is involved). - The takperyers lave sulosiantiation (e.z., recorks, receipes) to supgort all transactions for the year. - If any refund is due, the Arroyco want a refund cheec mated io them. - The Arroyos had itemized deductions from AGI for 2019 of 326,700 , of which \$1.500 was for state and local income tax. - The Arreyos do not want montribuse fo the Presulential Election Campaign Funkt Miguel and Sofia Arroyo are married and live at 13071 Sterling Drive, Marquette, MI 49866. Miguel is a self-employed insurance claims adjuster (business activity code 524290), and Sofia is the dietitian for the local school district. They choose to file a joint tax return each year. 1. Miguel represents several national casualty insurance companies on a contract basis. He operates this business on the cash basis. He is paid a retainer and receives additional compensation if the claims he processes for the year exceed a specified number. During 2020 . Miguel received $84.800 in payment for services rendered as reported on Forms 1099- Mise issued by several payor insurance companies. As an independent contractor, he is responsible for whatever expenses he incurs. Miguel works out of an office near his home. The office is located at 1202 Moose Road. He shares Sulte 326 with a financial consultant, and operating expenses are divided equally between them. The suite has a common waiting room with a receptionist furnisled and paid by the landlord. Miguel paid his one-half share of the 2020 expenses as cletailed below. For his own basiness use: Miguel purchased a $2 100 laptop computer on June 17 and a \$1,200) Nikon cameri on February \$. Fxept for his vehicle (see item 2 betowy. Miguel uses the s 179 write-off option whenever possible Miguel has no expenditures for which he is required to file Form 1099 s. 2. On January 2, 2000, Miguel paid 131,000 (includirg sales tax) to purdhae a genty used Toyota Camry that he uses 920 of the dime for buinees. Wo trade-in was I molved in this purchase, and he did not chim any 3179 erpensing Mrsed uses the actual operating coen method to oompure his tax dodoction. He elects to use the 200% dedining-balance MACRS depreciation method whth a half-year convention. His expenses relating to the Camry for ana0 are as followa: In connection whth his business use of the Camry, Miguel paid $510 for tolls and $350 in fines for traffic violations. In 2020 , Miguel drove the Camry 14,352m3ed for business and 1,248 miles for personal use (which includes his daily, rourdtrip commute to work). 3. Miguel handles most claim applications locally, but on occarion he must travel out of town. Expenses in connection with these business trips during 2020 Were $930 for lodging and $1,140 for meals. He also paid $610 for business dinners he had with several visiting exocutives of insurance companies with whom be does business. Miguel's ocher business-related expenses for 2020 are listed below. School District. The fob she holds as manager of the school hunch program is not classafied as full time. Consequently, she is not elighble to participate in the teacher retirement or health insumnce programs. Sofia's expenses for 2020 are summarized as follows: To pork full time and eaen a larger salary. Sofia applied for a position 25 chief dietitian for a chain of nursing hoases. According to the director of the recruiting service she hired, the position has not yet becn filled, and Sofra is one of the leading candidates. The continuing cducation program was sponsored by the National Association of Dietitians and consisted of a oce-day seminar on special diets for seniors. Sofia drove the family Chevolet Malibu 930 miles on jobrrelated use and 5,200 miles in commuting to work, out of a total of 8,670 miles driven for the year. The Arroyos purchased the car on July 11,2018 , for $23,400. 5. The Arroyoo have supported Racl Chavez (Soliais widorared father) for nevenal Yeans, appropriately chaiming him as a dependent for tax purposes. On Decenber 27, 2019, Raul mifiered a massive strole. The docroes did everyihlng they could, but Raul died in the interatve care unlt of Rlverwood Hospital on January 8, 20n20. In Jamary and Felaruary of 2020 , the Arroyos paid the following bill on behalf of Raul: medical expenses of 911,800 not covered by Mcdicare ( $6,000 lincurred in 2019 and $5,800 in 2020 ) and fancral experses of $15,300. Raurs health innurance was limited to his Medicane covetage bocause the hrroyod' racical irsurance (sce item 3 above) only covered Miguel, Sofia, and their sons. In his will, faul named Soft the executor and sole heir of his extate. 6. One of the assets that Sofin inherited with the transer of Maulis extate was his house. Upon the advice of the financial consultant who shares office space with Miguel, the Arroyos dockded to corvert Raul's home into a futnished renal howas. After several minor nepairs (e.g., touching up the paint on the inderior walls, replacing variots windos screcens, pressure wrashing the brick exterior, etc), the property was advertised for rent in the chassified section of the local newspaper on March 1. 2020. The repairs coet $720, and the newspaper ad oras $360. Bascd on reconstructed records and appralsal estimates, infocmatioe about the property is 15 followst 7. Raul's former residence was rened almost immediately, with occupancy commencing April 1, 2020, under the following terms; one-year lease, \$2,400 per month due the first day of the month, fint and last months' rent in advance, $2,000 danage deposit, lawn care included but not utilities. The tenant complied with all terms except that she didn't pay the December rent unail January 1, 2021, because she was traveling internationally from Thanksgiving Day through New Year's Eve. Expenses in connection with the property were as follows: property taxes, $2,600; repairs, $320; lawn maintenance, $40; insurance, $1,800, and street paving assessment, $2,100. The property is located at 12120 take Road, Harvey, MI 49855. 8. In early December 2019, a friend advised Miguel to buy sock in Pioneer Avlation Inc. (PAD). At that time, PAI was in serious financlal straits and was headed toward bankruptcy. Nevertheless, according to Miguel's friend, the value of the corporation's underlying assets was such that the shartholders were bound to recover considerably more than the current market price of $0.50 per share. Excited at the chance for a saure" profit, on December 15, 2019, Miguel purchased 20,000 shares for $10,000. In September 2020 , the trustee in bankruptcy announced that the stock was worthless and that even some of PAI's preferred creditors would not be paid. 9. On June 14, 2020, the Arroyos sold 500 shares of Gamet Corporation stock for $17,500 ( $35 per share). They owned 1,200 shares, acquired as follows: 500 shares on November 5, 2019, for $25 per share and 700 shares on April 5. 2020, for $30 per share. The Arroyos did not instrucr their beoker as to which shares to sell, so Form 1009 -B for this sale reporied a $12,500 hasis for these shares. 11. In her wil, Maria Chavea (sce liem 10) left Soffa a vacant lot on Wight Streee. Marla had paid $15,000 for the property, and it had a value of $19,000 when she died. Maria had purchated the lot because it was adjacent to Northern Michigan University property and she expected the schook to evenhally expand the campus. By 2020 , it has become clear that the university did not have the funds to expand the campus. Consequently, on July 1, 2020, Sofla sold the lot for $19,000. Nor included in this price are unpald property taxes fand interest on the ungald tuxes) of $700 on the lot, which the purchaser assumed and later paid. Sofia received a Form 1099B ss documentation for this transaction which did not report the basis of this property, 12. Every year around Chistmas, Miguel receives cards from various car repair faclitles and car dealerships that express thanks for his business referrals during the year, Many of these cards include cash. Miguel has no arrangement, contractual or otherwise, that requires any compensation for the referrals he makes. Concerned about the legality of such "gafts," Miguet consulted an attorney about the marter a few years ago. Without passing judgment on the status of the payors, the anorney found that Miguel's acceptance of the payments does not violate sate or local law. Miguel sincerely believes that the payments he receives have no effect on the referrals he makes. During December 2020 , Miguel received cards containing $7,200. One additional card containing $900 was delayed in the mail, and Miguel did not receive it uniil january 4,2021. 13. During a sunny weekend in June, the Arroyos held a garage sale to dispose of unwanted furniture, uppliances, books, bicycles, elothes, and one boat Cincluding trailet). Proceeds from the sale totaled $9,200. The estimated basis of the trems sold is $25,500. All sold assets had been used by the Arroyos for personal purposes. 14. In addition to the receipts previously noted, the Arroyos received the following ambunts during 2020 : 15. Payments made for 2020 expenditures mot meraioned elsewhere are as follows: The Arroyos medical insurance does not coner dental services. They pledge: $1,200 per year to their charch. The Waters Bdge Church in Marguette, M. In 2020 , they paid the pledges for 2018 through 2020 . During 2020 , the Arroyo4 drowe the Malibu 270 miles for tnedical purpases (e g, trips to the horpial, doctor and dentist offices) and 320 miles delivering meals to the poor for Meals-on-: Whecls, a qualified charity. 16: The Arwoyos have two sons who live with thent Parique and Jorge. Boch are fulftime sudents. Enrique is an accomplished singur and earned $1.250 duning the year performing at speclal cycnts (ce., weddings, anniveraries, civic functions). Enrique depceits his eamings in a savings account and intends to use this for future college expenses. Jorge does nox have a jod. 17. Sofia's form W2 reflects wages of $32.000. Appropriate ansants for Social Security athd Medicare taxes were doducted. Incorne tax withholdingr were $1:320 for Ficderal and $1,056 for sate. The Arcyos made quanerly tax paymetts of $1.900 for Federal and $600 for state on each of the fellowing dahac Aprit 10 . 2020; June 12, 2020; Septemler 11, 2020; and Decciller 29, a03). The Arroyes do not hold any foreign financial accounts nor do fhey have any dealings in virrual carrencies, Helevant social Security nuabers are noted bekos: Requirements for 2020 following these guidelines. - Slake mecessity assumptions for infor nox which in the problen but necled to coirnplite-the scturn. for the yest \$1.4ie suid forstite ond kal imorne? as Higuel and Sofia Arroyo are married and live at 13071 Sterling Drive, Marquette, MI 9866. Miguel is a self-employed insurance claims adjuster (business activity code 24290), and Sofia is the dietitian for the local school district. They choose to file a joint ax return each year. 1. Miguel represents several national casualty insurance companies on a contract basis. He operates this business on the cash basis. He is paid a retainer and receives additional compensation if the claims he processes for the year exceed a specified number. During 2020, Miguel received $81,800 in payment for services rendered as reported on Forms 1099 -MISC issued by several palyor insurance companies. As an independent contractor, he is responsible for whatever expenses he incurs. Miguel works out of an office near his home. The office is located at 1202 Moose Road. He shares Suite 326 with a financial consultant, and operating expenses are divided equally between them. The suite has a common waiting room with a receptionist furnished and paid by the lancllord. Miguel paid his one-half share of the 2020 expenses as cletailed below. For his own business use, Miguel purchased a \$2.100 laptop computer on june 17 and a \$1,200 Nikon camera on Tebruary 5. Except for his vehicle (see item 2 below), Miguel uses the $179 write-off option wlenever possible. Miguel hats to cxperditures for which he in required to file Fom 1009. 2. On January 2, 2020, Miguel pald $31,000 (including sales tax) to purchase a gently used Toyota Camry that he uses 926 of the time for business. No trade-in was involved in this purchase, and he did not daim any 8779 expensing. Miguel uses the actual operating cost method to compute his tax deduction. He elects to use the 200\% declining-balance MACRS depreciation method with a half-year convention. His expenses relating to the Camry for 2020 are as followz: - In connection with his business use of the Camry, Miguel paid $510 for tolls and $350 in fines for traffic violations, In 2020, Miguel drove the Camry 14,352 miles for business and 1,248 miles for personal use (which includes his dally, roundtrip commute to work). 3. Miguel handles most claim applications locally, but on occasion he must travel out of town. Expenses in connection with these business trips during 2020 were $930 for lodging and $1,140 for meals. He also paid $610 for business dinners he had with several visiting executives of insurance companies with whom he does besiness. Miguel's other business-related expenses for 2020 are listed below. 4. Solia eams $32,000 working as a registered dietitian for the Marquette Public School District. The job she holds as manager of the school lunch program is not classified as full time. Consequently, she is not eligible to participate in the teacher retirement or health insurance programs. Soffa's expenses for 2020 are summarized as follows: To work full time and earn a larger salary, Sofia applied for a position as chief dietitian for a chain of nursing homes. According to the director of the recruiting service she hired, the position has not yet been filled, and sofia is one of the leading candidates. The continuing education program was sponsored by the National Association of Dietitians and consisted of a one-day seminar on special diets for seniors Sofia drove the family Chevrolet Malibu 930 miles on job-related use and 5,200 miles in commuting to work, out of a total of 8,670 miles driven for the year. The Arroyos purchased the car on July 11, 2018, for $23,400. 5. The Arroyos have supported Raul Chavez (Sofia's widowed Father) for several years, appropriately claiming him as a dependent for tax purposes. On December 27, 2019, Raul suffered a massive stroke. The doctors did everything they could, but Raul died in the intensive care unit of Riverwood Hospital on January 8,2020 . In January and February of 2020 , the Arroyos paid the following bils on behalf of Raul: medical expenses of $11,800 not covered by Medicare ($6,000 incurred in 2019 and $5,800 in 2020) and funeral expenses of $15,300. Raul's healt insurance was limited to his Medicare coverage because the Arroyos' medical insurance (sce item 3 above) only covered Miguel, Sofia, and their sons. In his oril, Raul named Sofia the executor and sole heir of his estate. 6. One of the assets that Sofia inherited with the transfer of Raul's estate was his house. Upon the advice of the financial consultant who shares office space with Miguel, the Arroyos decided to convert Raul's home into a fumished rental house. After several minor repairs (e.g. touching up the paint on the interior walls, replacing various window screens, pressure washing the brick exterioc, efc.), the property was advertised for rent in the classified section of the local newspaper on March 1,2020 . The repairs cost $720, and the newspaper ad was $360. Based on reconstructed records and appraisal estimates, information about the property is as follows: 7. Raul's former residence was rented almost immediately, whth occupancy commencing April 1, 2020, under the following terms: one-year lease, $2,400 per month due the first day of the month, first and last months' rent in advance, $2,000 damage deposit, lawn care included but not utilities. The tenant complied with all terms except that she didn't pay the December rent until January 1, 2021, because she was traveling internationally from Thanksgiving Day through New Year's Eve. Expenses in connection with the property were as follows: property taxes, $2,600; repairs, $320; lawn maintenance, $540; insurance, $1,800; and street paving assessment, $2,100. The property is located at 12120 Lake Road, Harvey. MI 49855. 8. In early December 2019, a friend advised Miguel to buy stock in Pioneer Aviation Inc. (PAD). At that time, PAI was in serious financial straits and was headed toward bankruptcy. Nevertheless, according to Miguel's friend, the value of the corporation's underlying assets was such that the shareholders were bound to recover considerably more than the current market price of $0.50 per share. Excited at the chance for a "sure" profit, on December 15, 2019, Miguel purchased 20,000 shares for $10,000. In September 2020, the trustee in bankrupty announced that the stock was worthless and that even some of PAI's preferred creditors would not be paid. 9. On June 14, 2020, the Arroyos sold 500 shares of Gamet Corporation stock for $17,500 ( $35 per share). They owned 1,200 shares, acquired as follows: 500 shares on November 5, 2019, for \$25 per share and 700 shares on April 5,2020 , for $30 per share. The Arroyos did not instruct their broker as to which shares to sell, so Form 1099-B for this sale reported a $12,500 basis for these shares. 10. One month before she died on April 14, 2010, Maria Chavez (Sofia's mother) gave Sofia a coin collection. Based on careful records that Maria kept, the collection had a cost basis of $9,000 and a fair market value of $18,000 at the time Maria passed away. On February 12, 2020, the Arroyo residence was burglarized, and the coin collection was stolen. The Arroyos filed a claim with the carrier of their homeowner's insurance policy for $24,000 (the current value of the collection). Unfortunately, they were only able to collect $10,000, which was the maximum payout allowed for valuables (e.g., jewelry, antiques) without a special rider attached to the insurance policy. 11. In her will, Maria Chavez (see item 10) left Sofia a vacant lor on Wright Street. Maria had paid $15,000 for the property, and it had a value of $19,000 when she died. Maria had purchased the lot because it was adiacent to Northern Michigan University property and she expected the school to eventually expand the campus. By 2020, it has become clear that the university did not have the funds to expand the campus. Consequendly, on July 1, 2020, Sofia sold the lot for $19,000. Not included in this price are unpaid property taxes (and interest on the unpaid) taxes) of $700 on the lot, which the purchaser assumed and later paid. Sofia received a Form 1099-B as documentation for this transaction which did not report the basis of this property. 12. Every year around Christmas, Miguel receives cards from various car repair facilties and car dealerships that express thanks for his business referrals during the year. Many of these cards include cash. Miguel has no arrangement, contractual or otherwise, that requires any compensation for the referrals he makes. Concerned about the legality of such "gifts," Miguel consulted an attomey about the matter a few years ago. Wathout passing judgment on the status of the payors, the attomey found that Miguel's acceptance of the payments does not violate state or local law. Miguel sincerely believes that the payments he receives have no effect on the referrals he makes. During December 2020, Miguel received cards containing $7,200. One additional card containing $900 was delayed in the mail, and Miguel did not receive it until January 4,2021. 13. During a sunny weekend in June, the Arroyos held a garage sale to dispose of unwanted furniture, appliances, books, bicycles, clothes, and one boat Gincluding trailer). Proceeds from the sale totaled $9,200. The estimated basis of the items sold is $25,500. All sold assets had been used by the Arroyos for personal purposes. 14. In addition to the receipts previously noted, the Arroyos received the following amounts during 2020: 15. Payments made for 2020 expendirures not mentioned elsewhere are as follows: The Arroyos' medical insurance does not cover dental services. They pledge $1,200 per year to their church, The waters Edge Church in Marquette, Mi. In 2020 , they paid the pledges for 2018 through 2020 . During 2020, the Arroyos cirove the Malibu 270 miles for medical purposes (e.g.r trips to the hospital, doctor and dentist offices) and 320 miles delivering meals to the poor for Meals-onWhecls, a qualified charity. 16. The Arroyes have two sons who live with them Enrique and Jorge. Both are fulltime students. Enrique is an accomplished singer and eamed $4.200 during the year performing at specinl events (e.g., weddings, anniversaries, civic functions). Enrique deposits his earnings in a savings account and intends to use this for future college expenses. Jorge does not have a job. 17. Sofia's Form W-2 reflects wages of $32,000. Appropriate amounts for Social Security and Medicare taxes were deducted. Income tax withholdings were $1,320 for Federal and $1,056 for state. The Arroyos made quarterly tax payments of $1,500 for Federal and $600 for state on each of the following dates: April 10 , 2020; June 12, 2020; September 11, 2020; and December 26, 2020. The Arroyos do not hold any foreign financial accounts nor do they have any dealings in virtual currencies. Relevant Social Secunity numbers are noted below. Requirements Prepare an income tax retum (wath all appropriate forms and wchedules) for the Arroyos for 2020 following these guidelines. - Make neccisary issumptions for info nox given in the problem but necded to complete the ruturn. - The taxpayers are prepating their own return (i.e, no preparer is involved). - The takperyers lave sulosiantiation (e.z., recorks, receipes) to supgort all transactions for the year. - If any refund is due, the Arroyco want a refund cheec mated io them. - The Arroyos had itemized deductions from AGI for 2019 of 326,700 , of which \$1.500 was for state and local income tax. - The Arreyos do not want montribuse fo the Presulential Election Campaign Funkt