Answered step by step

Verified Expert Solution

Question

1 Approved Answer

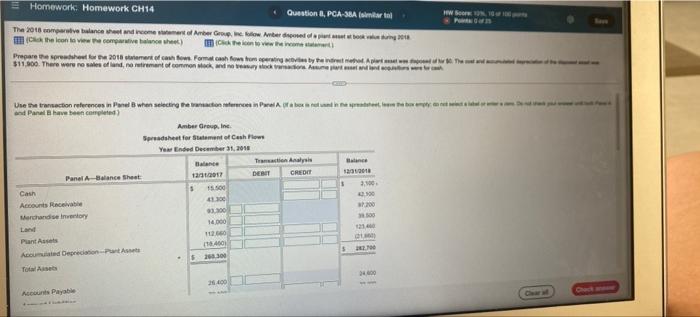

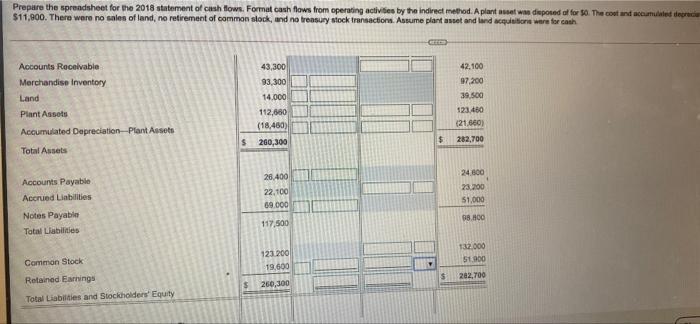

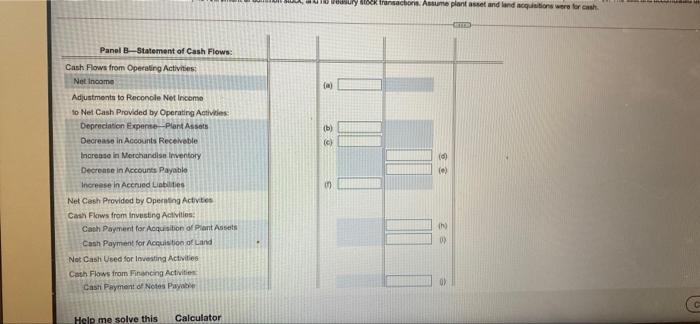

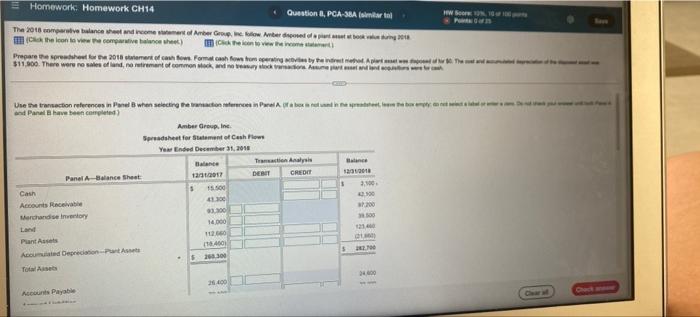

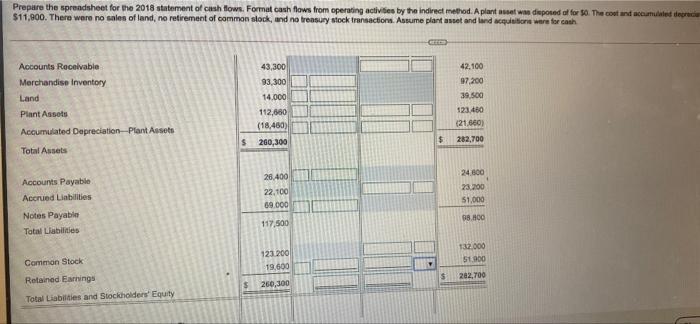

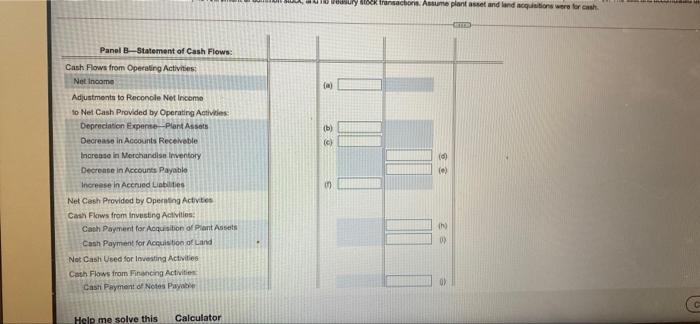

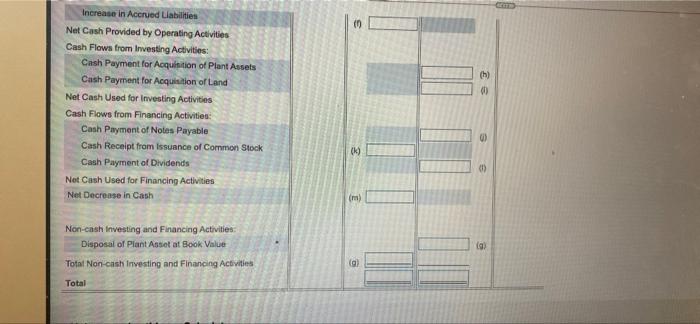

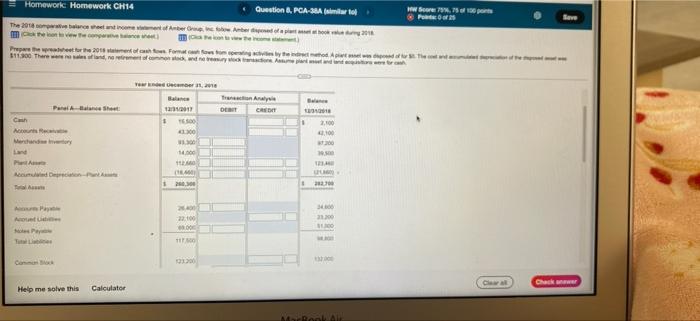

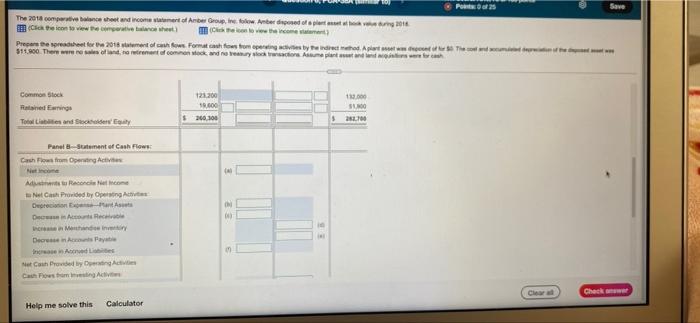

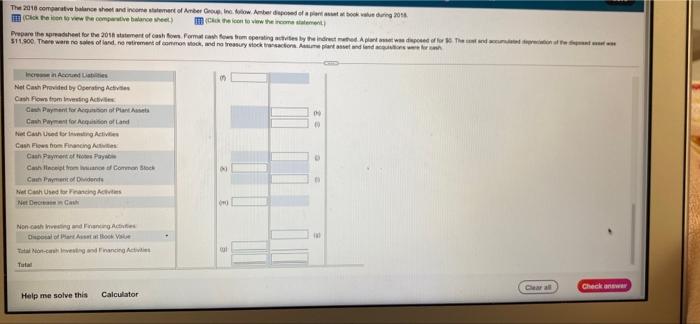

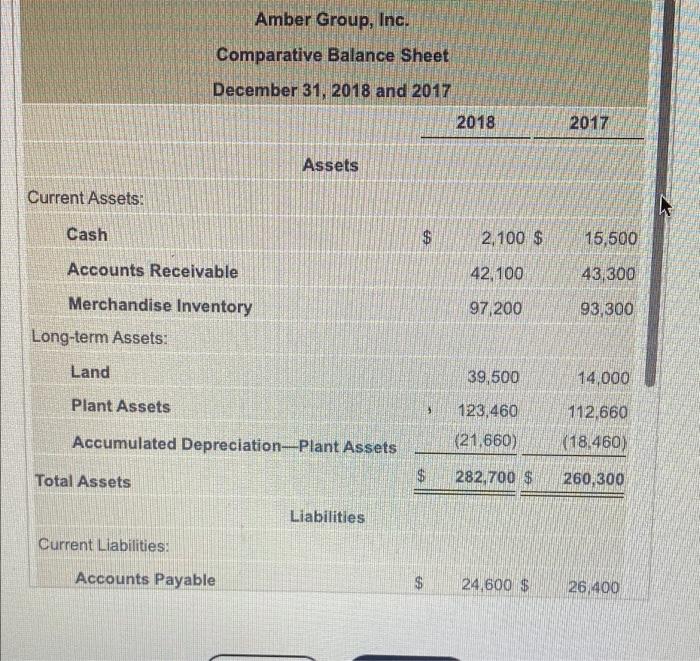

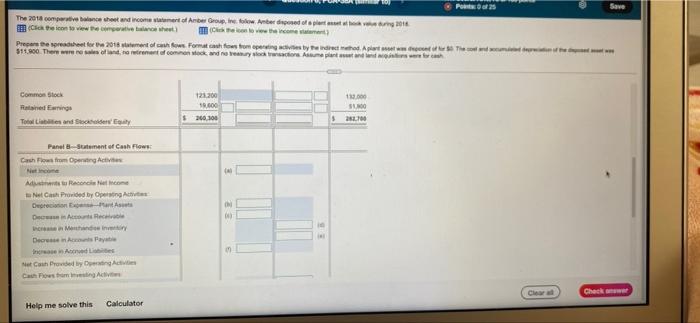

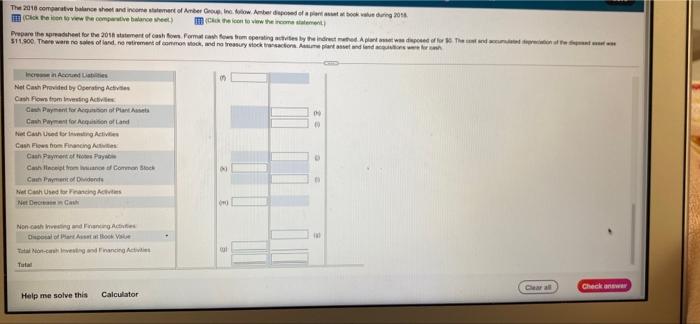

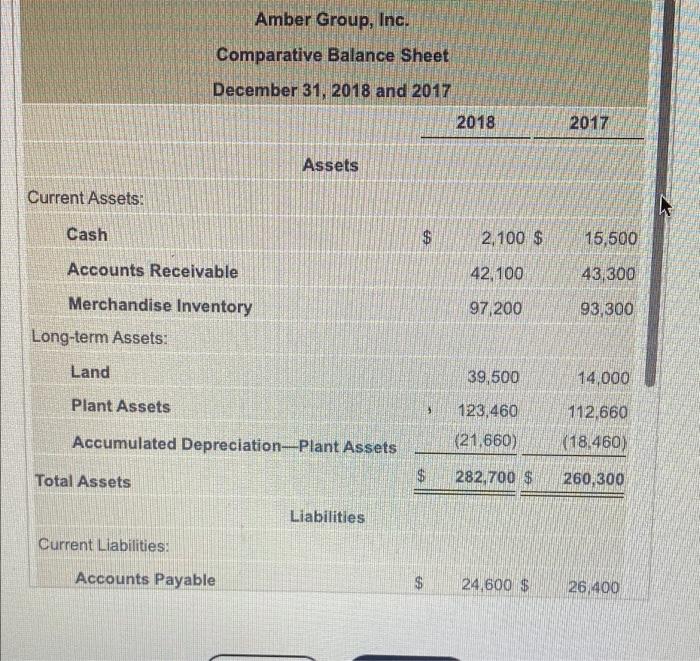

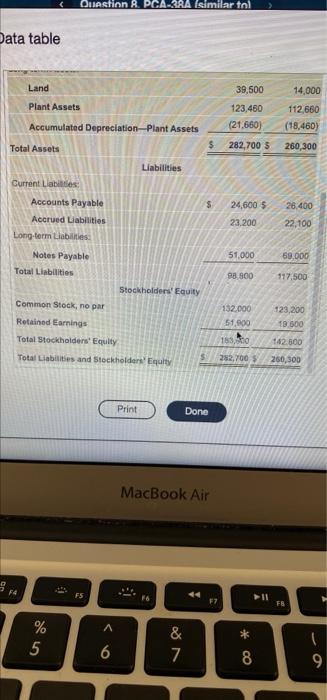

this is all one question! please answer it all. thanks in advance please help asap!!!!!!!! IW SUN 11 Homework: Homework CH14 Question, PCA-S (skartel The

this is all one question! please answer it all. thanks in advance

please help asap!!!!!!!!

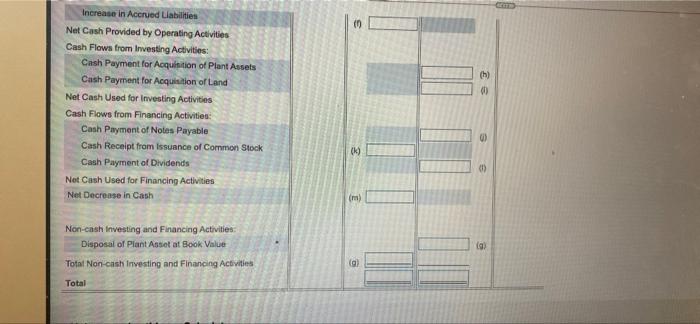

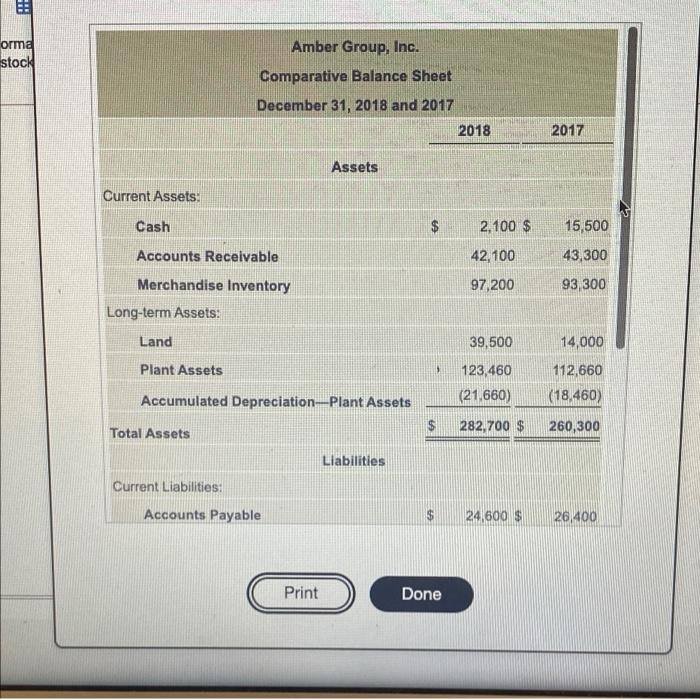

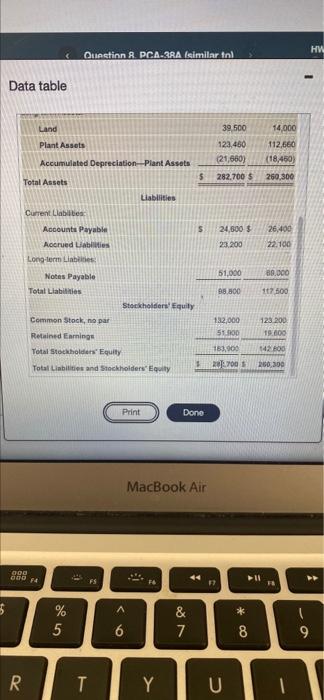

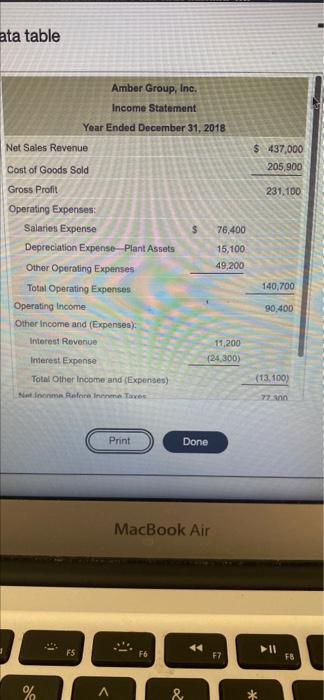

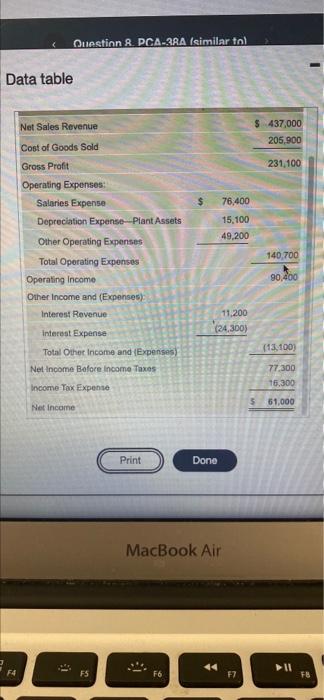

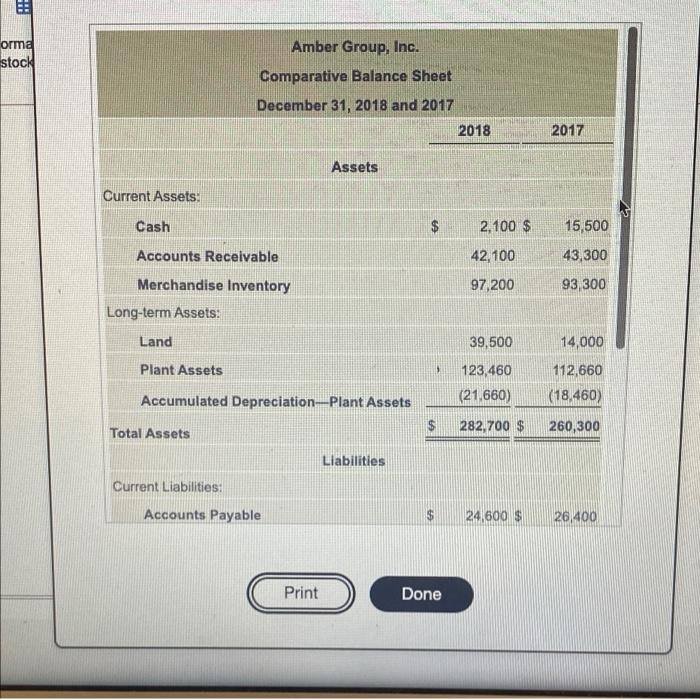

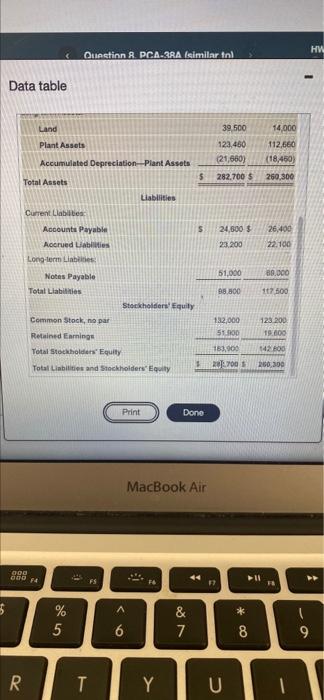

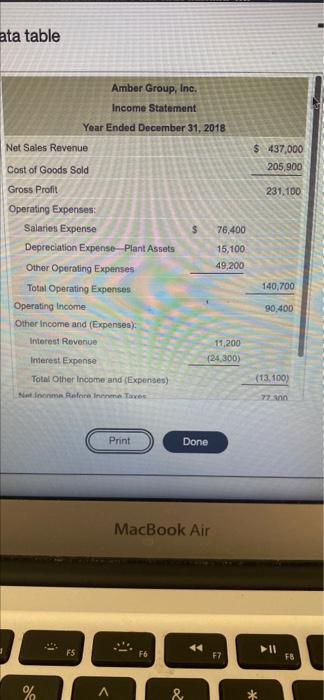

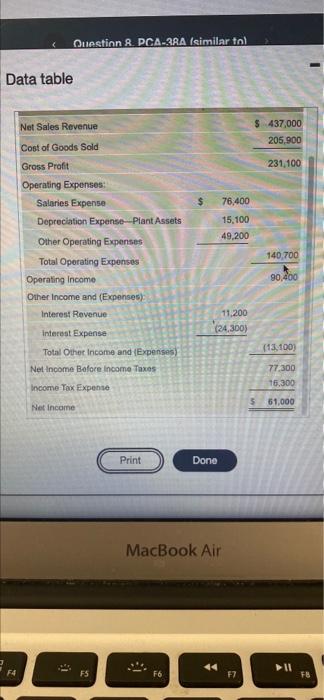

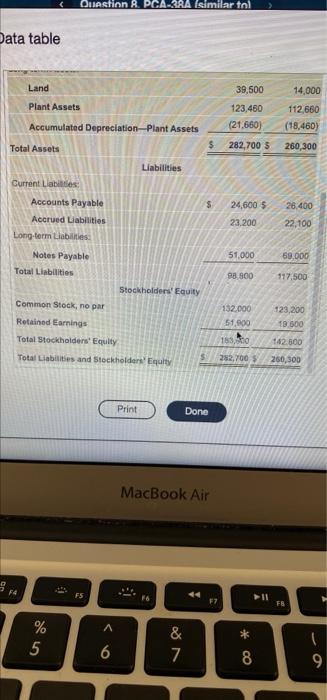

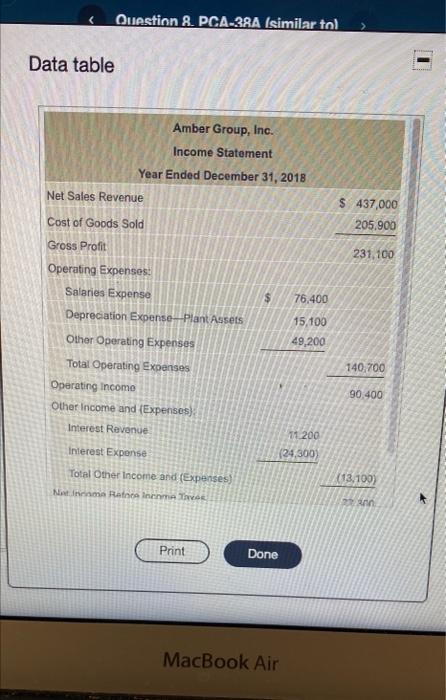

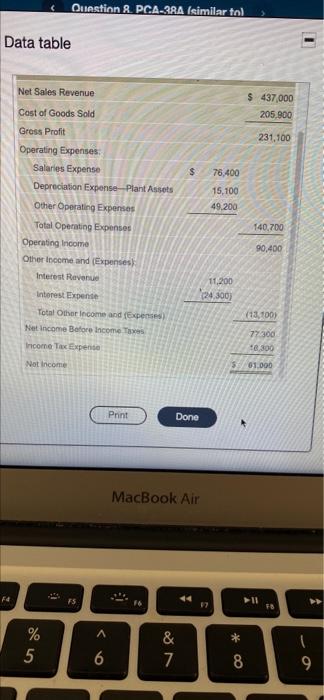

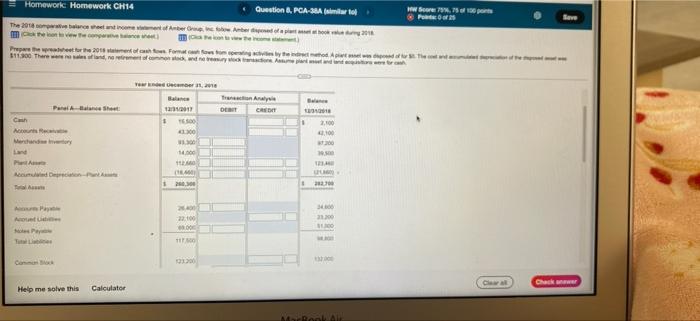

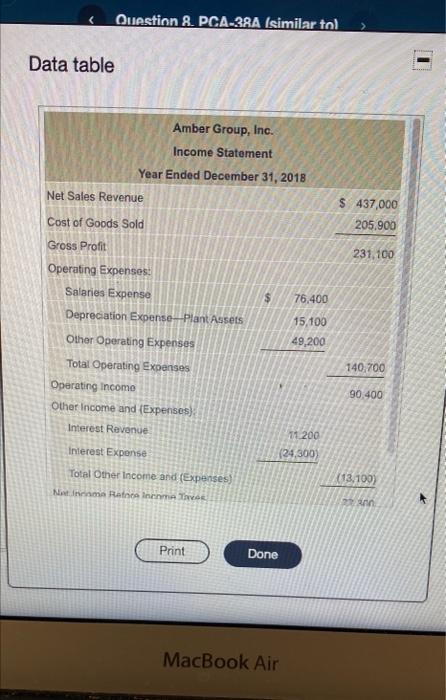

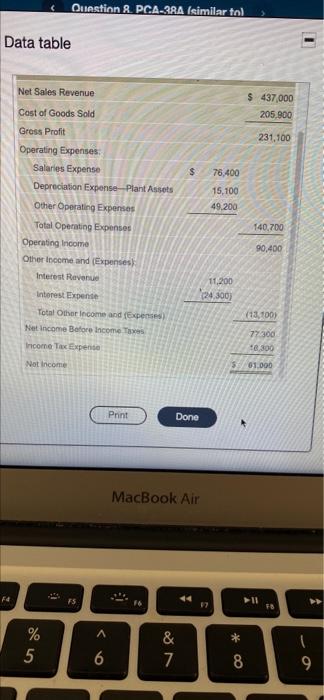

IW SUN 11 Homework: Homework CH14 Question, PCA-S (skartel The 2016 compartive lance sheet and come werer Gew. Aber dapat book the contine compartive che) contowwe come Prepare the preth 2018 eart of confo. Format cashows from perting by the rest $11.900. There were no sales and retirement of common work and the worst Une the transaction raterences in Panel B when selecting the nation afternoon in Penal Aboxeunt here and Parall have been completed Amber Group, Inc Spreadsheet forment of Cashow You Ended December 31, 2018 Tome Analyse Batinee Panel Balance Sheet 1 DEBIT CREDIT 2018 Cash 2,10 Accounts Receivable 200 3:00 Merchandise Inventory 10 Land 14.000 21 Pant Assets 20 Acad Depreciations 200 300 To 18500 180 $ 400 2600 Accounts Payable be Prepare the spreadsheet for the 2018 statement of cash flows. Format cash flows from operating activities by the indred method. A plant ametwa diwposed of for so. The cool and accumulated derece $11,000. There were no sales of land, no retirement of common slock, and no treasury stock transaction. Assume plant asset and land acquisitions were for cash Accounts Receivable Merchandise Inventory Land Plant Assets Accumulated Depreciation Plant Assot Total Assets 42.100 97,200 39 50g 43,300 93,300 14.000 112,660 (18,450) 260,300 ELU 123.480 (21.060) 282,700 $ $ 26.400 24 800 23. 200 51.000 Accounts Payable Accrued Liabilities Notes Payable Total Liabilities 22.100 69.000 38.800 117,500 121 200 19.600 132.000 SE300 s 262,700 Common Stock Retained Earnings Total Liabilities and Stockholders' Equity 260,300 Wyk fransactions. Assume plant asset and land acquisitions were forces CTD Panel Statement of Cash Flows: Cash Flows from Operating Activities Net Income (a) (b) Adjustments to Reconole Net Income to Net Cash Provided by Operating Activities: Depreciation Expert-Plant Assets Decrease in Accounts Receivable Increase in Merchandise Inventory Decrease in Accounts Payablo Increase in Acchied Liabilities Net Cash Provided by Operating Activities Cash Flows from investing Advies Cath Payment for Acquisition of PantAssets Cash Payment for Acquistion of Land Net Cash Used for Investing Activities Cash Flows from Financing Activities Casti Payment of Notes Payable G Help me solve this Calculator 00 (h) 00 Increase in Accrued Liabilities Net Cash Provided by Operating Activities Cash Flows from Investing Activities: Cash Payment for Acquisition of Plant Assets Cash Payment for Acquisition of Land Net Cash Used for investing Activities Cash Flows from Financing Activities: Cash Payment of Notes Payable Cash Receipt from Issuance of Common Stock Cash Payment of Dividends Net Cash Used for Financing Activities Net Decrease in Cash (k) (m) Non-cash investing and Financing Activities Disposal of Plant Asset at Book Value (g) Total Non-cash investing and Financing Activities ca Total ER orma stock Amber Group, Inc. Comparative Balance Sheet December 31, 2018 and 2017 2018 2017 Assets Current Assets Cash $ 2,100 $ 15,500 42, 100 43,300 Accounts Receivable Merchandise Inventory Long-term Assets: 97,200 93,300 Land 39,500 14,000 Plant Assets 123,460 (21.660) 112,660 (18.460) Accumulated Depreciation-Plant Assets $ Total Assets 282,700 $ 260,300 Liabilities Current Liabilities: Accounts Payable 24.600 $ 26,400 Print Done HW Question RPCA.BRA (similar tol Data table Land Plant Assets 39,500 123,450 (21,660) 282.700 $ 14.000 112,660 (18.450 Accumulated Depreciation--Plant Assets Total Assets $ 250.300 Liabilities Current Liabilities Accounts Payable 5 26,400 24,500 $ 23.200 Accrued Liables 22.100 Long-term Liables 51,000 89.000 08.300 117.500 Notes Payable Total Liabilities Stockholders' Equity Common Stock, no par Retained Earnings Total Stockholders' Equity 1 Total Liabilities and Stockholders' Equity 192,000 51.300 123 200 19.000 1400 153,000 2.700 250.300 Print Dono MacBook Air 000 60 74 IN FS $ A * % 5 & 7 6 8 9 ON R T Y U ata table $ 437,000 205,900 231, 100 Amber Group, Inc. Income Statement Year Ended December 31, 2018 Net Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses Salaries Expense $ 76,400 Depreciation Expense- Plant Assets 15,100 Other Operating Expenses 49,200 Total Operating Expenses Operating Income Other Income and (Expenses): Interest Revenue 11,200 Interest Expense (24.300) 140,700 90.400 (13.100) Total Other Income and (Expenses) Nato Refore in Tavs Print Done MacBook Air II F5 F6 F7 FB % A & Question & PCA-3RA (similar tol Data table Net Sales Revenue $ 437,000 205,900 Cost of Goods Sold Gross Profit 231,100 $ 76,400 15,100 49,200 140,700 Operating Expenses Salaries Expense Depreciation Expense Plant Assets Other Operating Expenses Total Operating Expenses Operating Income Other Income and (Expenses) Interest Revenue Interest Expense Total Other Income and (Expenses) Net Income Before Income Taxes 90,400 11.200 (24.300) (13.100) 77.300 16.300 Income Tax Expense 5 51,000 Net Income Print Done MacBook Air 4 IL F4 FS F6 F7 eve Homework Homework CH14 Question, PGA-milar to WS 79.750 The 2016 settembre. Aber 2014 Other he Prepare the better the 2018 cm Formats om by the 11100 There , , Tan Anale CR C 2001 # 10 00 12.00 1.100 14.00 code- . 200 2020 22.00 Tu 93200 Care Chack Help me solve this Calculator MacBook AL GP25 Save The 2018 comparative and shoot and income werf of Amber Group, Infolow Aberdedos 2011 the icon to where the Prepare a spreadsheet for 2018 metalows.Format shows from perces by the indretted. Aplant www 514.00. There were and more common and very low Asune plante 123.00 10.600 Common Stock Rathering Tool Cables and Story 12.000 SUO 2010 $260.00 5 Panel B-Stent of Cash Flows Cash Flows from Opening Nutcome E A concen Net Provided by Open Acts Depreciate Die Deri Paya Increase in Net Cow Provided by Act Com Com Check Help me solve this Calculator The 2016 come balance sheet and incontestatement of Arbeinfow. Amber died of the during 2018 Con low he comparative balance sheet) Prepare the readsheet for the 2011 set of cash to Formatostomperting by the indrettet of The $11.900 There were no oesofand, retirement of convocad ng suy vick consumed and Incin Acords Net Ch Provided by Operating Active Cash Flows from being de Cash Payment for Argo Pants Cash Payment for an Land Net Can Used Borg Active Custom Pancing Can Payment of Pay Cash Comman Cantofident NetCan Used for Fascing Acts Net DC Non chien Act Part Thanh Nin - H Vy | 4 | writing Activiting Tuta Cena Check Help me solve this Calculator Amber Group, Inc. Comparative Balance Sheet December 31, 2018 and 2017 2018 2017 Assets Current Assets: Cash $ 2,100 $ 15,500 Accounts Receivable 42.100 43 300 97 200 93,300 Merchandise Inventory Long-term Assets: Land 39,500 14,000 Plant Assets 112,660 123,460 (21.660) Accumulated Depreciation Plant Assets (18.460) Total Assets $ 282,700 $ 260,300 Liabilities Current Liabilities: Accounts Payable $ 24,600 $ 26,400 Question APCASIRA (similar tol Data table Land 39,500 14,000 Plant Assets 123,450 112,660 Accumulated Depreciation-Plant Assets (21,660) (18,460) $ Total Assets 282,700 5 260,300 Liabilities Current Liabilities Accounts Payable $ 24,600 5 26.400 Accrued Liabilities 23.200 22,100 Long-term Liabilities Notes Payable 51.000 69,000 Total Liabilities 98 900 117.500 Stockholders' Equity Common Stock, no par 132.000 123,200 Retained Earnings 51.000 13.600 Total Stockholders' Equity 165,500 182.500 Total Liabilities and Stockholders' Equity S282,7005 250,500 Print Done MacBook Air F4 FS 11 FS % 5 * Data table $ 437,000 205.900 231,100 Amber Group, Inc. Income Statement Year Ended December 31, 2018 Net Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses: Salaries Expense $ 76,400 Depreciation Expense- Plant Assets 15.100 Other Operating Expenses 49,200 Total Operating Expenses Operating Income Other Income and (Expenses) Interest Revenue 11.200 Interest Expense (24.300) Total Other Income and (Expenses) Not Income Rance Inma TE 140,700 90.400 (13.100) Print Done MacBook Air Question & PCA 3RA (similar to Data table Net Sales Revenue Cast of Goods Sold $ 437,000 205.900 Gross Profit 231,100 $ 76,400 15,100 49.200 Operating Expenses Salaries Expense Depreciation Exponse Plant Assets Other Operating Expenses Total Operating Expenses Operating Income Other come and (Expenses Interest Revenue 140.700 90,400 11,200 2.300) Interest Expense Total Other Income and expenses Net Income Before Income Taxes Income Tax Expert 113,700) 77300 -6300 Not Income 61.000 Print Done MacBook Air fa 4 & 11 17 FB A * % 5 on & 7 6 8 9 IW SUN 11 Homework: Homework CH14 Question, PCA-S (skartel The 2016 compartive lance sheet and come werer Gew. Aber dapat book the contine compartive che) contowwe come Prepare the preth 2018 eart of confo. Format cashows from perting by the rest $11.900. There were no sales and retirement of common work and the worst Une the transaction raterences in Panel B when selecting the nation afternoon in Penal Aboxeunt here and Parall have been completed Amber Group, Inc Spreadsheet forment of Cashow You Ended December 31, 2018 Tome Analyse Batinee Panel Balance Sheet 1 DEBIT CREDIT 2018 Cash 2,10 Accounts Receivable 200 3:00 Merchandise Inventory 10 Land 14.000 21 Pant Assets 20 Acad Depreciations 200 300 To 18500 180 $ 400 2600 Accounts Payable be Prepare the spreadsheet for the 2018 statement of cash flows. Format cash flows from operating activities by the indred method. A plant ametwa diwposed of for so. The cool and accumulated derece $11,000. There were no sales of land, no retirement of common slock, and no treasury stock transaction. Assume plant asset and land acquisitions were for cash Accounts Receivable Merchandise Inventory Land Plant Assets Accumulated Depreciation Plant Assot Total Assets 42.100 97,200 39 50g 43,300 93,300 14.000 112,660 (18,450) 260,300 ELU 123.480 (21.060) 282,700 $ $ 26.400 24 800 23. 200 51.000 Accounts Payable Accrued Liabilities Notes Payable Total Liabilities 22.100 69.000 38.800 117,500 121 200 19.600 132.000 SE300 s 262,700 Common Stock Retained Earnings Total Liabilities and Stockholders' Equity 260,300 Wyk fransactions. Assume plant asset and land acquisitions were forces CTD Panel Statement of Cash Flows: Cash Flows from Operating Activities Net Income (a) (b) Adjustments to Reconole Net Income to Net Cash Provided by Operating Activities: Depreciation Expert-Plant Assets Decrease in Accounts Receivable Increase in Merchandise Inventory Decrease in Accounts Payablo Increase in Acchied Liabilities Net Cash Provided by Operating Activities Cash Flows from investing Advies Cath Payment for Acquisition of PantAssets Cash Payment for Acquistion of Land Net Cash Used for Investing Activities Cash Flows from Financing Activities Casti Payment of Notes Payable G Help me solve this Calculator 00 (h) 00 Increase in Accrued Liabilities Net Cash Provided by Operating Activities Cash Flows from Investing Activities: Cash Payment for Acquisition of Plant Assets Cash Payment for Acquisition of Land Net Cash Used for investing Activities Cash Flows from Financing Activities: Cash Payment of Notes Payable Cash Receipt from Issuance of Common Stock Cash Payment of Dividends Net Cash Used for Financing Activities Net Decrease in Cash (k) (m) Non-cash investing and Financing Activities Disposal of Plant Asset at Book Value (g) Total Non-cash investing and Financing Activities ca Total ER orma stock Amber Group, Inc. Comparative Balance Sheet December 31, 2018 and 2017 2018 2017 Assets Current Assets Cash $ 2,100 $ 15,500 42, 100 43,300 Accounts Receivable Merchandise Inventory Long-term Assets: 97,200 93,300 Land 39,500 14,000 Plant Assets 123,460 (21.660) 112,660 (18.460) Accumulated Depreciation-Plant Assets $ Total Assets 282,700 $ 260,300 Liabilities Current Liabilities: Accounts Payable 24.600 $ 26,400 Print Done HW Question RPCA.BRA (similar tol Data table Land Plant Assets 39,500 123,450 (21,660) 282.700 $ 14.000 112,660 (18.450 Accumulated Depreciation--Plant Assets Total Assets $ 250.300 Liabilities Current Liabilities Accounts Payable 5 26,400 24,500 $ 23.200 Accrued Liables 22.100 Long-term Liables 51,000 89.000 08.300 117.500 Notes Payable Total Liabilities Stockholders' Equity Common Stock, no par Retained Earnings Total Stockholders' Equity 1 Total Liabilities and Stockholders' Equity 192,000 51.300 123 200 19.000 1400 153,000 2.700 250.300 Print Dono MacBook Air 000 60 74 IN FS $ A * % 5 & 7 6 8 9 ON R T Y U ata table $ 437,000 205,900 231, 100 Amber Group, Inc. Income Statement Year Ended December 31, 2018 Net Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses Salaries Expense $ 76,400 Depreciation Expense- Plant Assets 15,100 Other Operating Expenses 49,200 Total Operating Expenses Operating Income Other Income and (Expenses): Interest Revenue 11,200 Interest Expense (24.300) 140,700 90.400 (13.100) Total Other Income and (Expenses) Nato Refore in Tavs Print Done MacBook Air II F5 F6 F7 FB % A & Question & PCA-3RA (similar tol Data table Net Sales Revenue $ 437,000 205,900 Cost of Goods Sold Gross Profit 231,100 $ 76,400 15,100 49,200 140,700 Operating Expenses Salaries Expense Depreciation Expense Plant Assets Other Operating Expenses Total Operating Expenses Operating Income Other Income and (Expenses) Interest Revenue Interest Expense Total Other Income and (Expenses) Net Income Before Income Taxes 90,400 11.200 (24.300) (13.100) 77.300 16.300 Income Tax Expense 5 51,000 Net Income Print Done MacBook Air 4 IL F4 FS F6 F7 eve Homework Homework CH14 Question, PGA-milar to WS 79.750 The 2016 settembre. Aber 2014 Other he Prepare the better the 2018 cm Formats om by the 11100 There , , Tan Anale CR C 2001 # 10 00 12.00 1.100 14.00 code- . 200 2020 22.00 Tu 93200 Care Chack Help me solve this Calculator MacBook AL GP25 Save The 2018 comparative and shoot and income werf of Amber Group, Infolow Aberdedos 2011 the icon to where the Prepare a spreadsheet for 2018 metalows.Format shows from perces by the indretted. Aplant www 514.00. There were and more common and very low Asune plante 123.00 10.600 Common Stock Rathering Tool Cables and Story 12.000 SUO 2010 $260.00 5 Panel B-Stent of Cash Flows Cash Flows from Opening Nutcome E A concen Net Provided by Open Acts Depreciate Die Deri Paya Increase in Net Cow Provided by Act Com Com Check Help me solve this Calculator The 2016 come balance sheet and incontestatement of Arbeinfow. Amber died of the during 2018 Con low he comparative balance sheet) Prepare the readsheet for the 2011 set of cash to Formatostomperting by the indrettet of The $11.900 There were no oesofand, retirement of convocad ng suy vick consumed and Incin Acords Net Ch Provided by Operating Active Cash Flows from being de Cash Payment for Argo Pants Cash Payment for an Land Net Can Used Borg Active Custom Pancing Can Payment of Pay Cash Comman Cantofident NetCan Used for Fascing Acts Net DC Non chien Act Part Thanh Nin - H Vy | 4 | writing Activiting Tuta Cena Check Help me solve this Calculator Amber Group, Inc. Comparative Balance Sheet December 31, 2018 and 2017 2018 2017 Assets Current Assets: Cash $ 2,100 $ 15,500 Accounts Receivable 42.100 43 300 97 200 93,300 Merchandise Inventory Long-term Assets: Land 39,500 14,000 Plant Assets 112,660 123,460 (21.660) Accumulated Depreciation Plant Assets (18.460) Total Assets $ 282,700 $ 260,300 Liabilities Current Liabilities: Accounts Payable $ 24,600 $ 26,400 Question APCASIRA (similar tol Data table Land 39,500 14,000 Plant Assets 123,450 112,660 Accumulated Depreciation-Plant Assets (21,660) (18,460) $ Total Assets 282,700 5 260,300 Liabilities Current Liabilities Accounts Payable $ 24,600 5 26.400 Accrued Liabilities 23.200 22,100 Long-term Liabilities Notes Payable 51.000 69,000 Total Liabilities 98 900 117.500 Stockholders' Equity Common Stock, no par 132.000 123,200 Retained Earnings 51.000 13.600 Total Stockholders' Equity 165,500 182.500 Total Liabilities and Stockholders' Equity S282,7005 250,500 Print Done MacBook Air F4 FS 11 FS % 5 * Data table $ 437,000 205.900 231,100 Amber Group, Inc. Income Statement Year Ended December 31, 2018 Net Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses: Salaries Expense $ 76,400 Depreciation Expense- Plant Assets 15.100 Other Operating Expenses 49,200 Total Operating Expenses Operating Income Other Income and (Expenses) Interest Revenue 11.200 Interest Expense (24.300) Total Other Income and (Expenses) Not Income Rance Inma TE 140,700 90.400 (13.100) Print Done MacBook Air Question & PCA 3RA (similar to Data table Net Sales Revenue Cast of Goods Sold $ 437,000 205.900 Gross Profit 231,100 $ 76,400 15,100 49.200 Operating Expenses Salaries Expense Depreciation Exponse Plant Assets Other Operating Expenses Total Operating Expenses Operating Income Other come and (Expenses Interest Revenue 140.700 90,400 11,200 2.300) Interest Expense Total Other Income and expenses Net Income Before Income Taxes Income Tax Expert 113,700) 77300 -6300 Not Income 61.000 Print Done MacBook Air fa 4 & 11 17 FB A * % 5 on & 7 6 8 9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started