Answered step by step

Verified Expert Solution

Question

1 Approved Answer

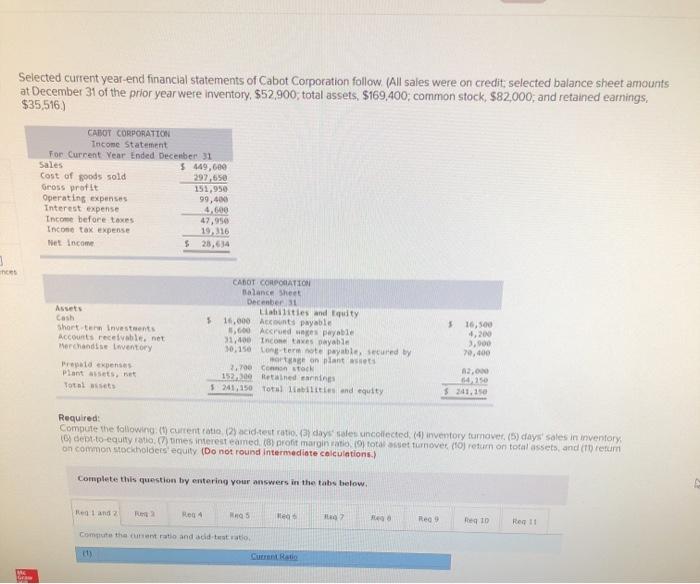

this is all one question Selected current year-end financial statements of Cabot Corporation follow (All sales were on credit, selected balance sheet amounts at December

this is all one question

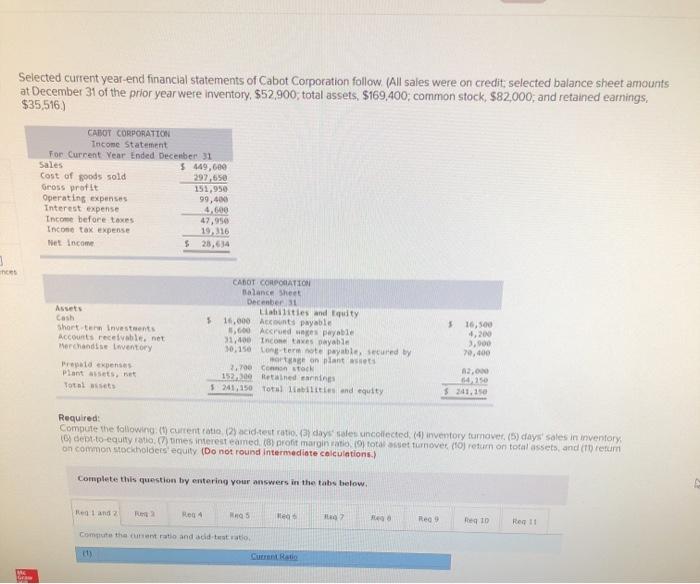

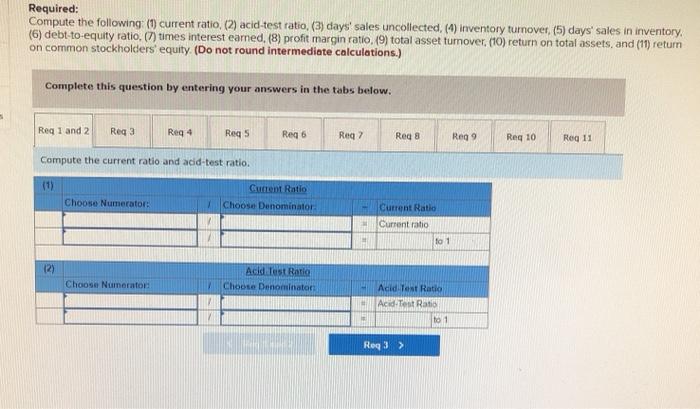

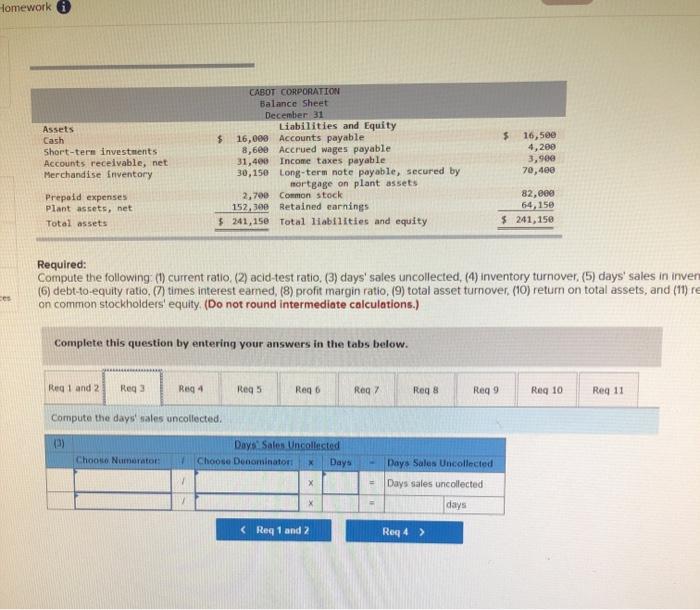

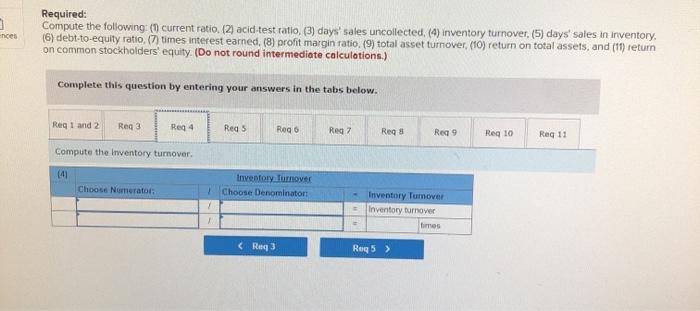

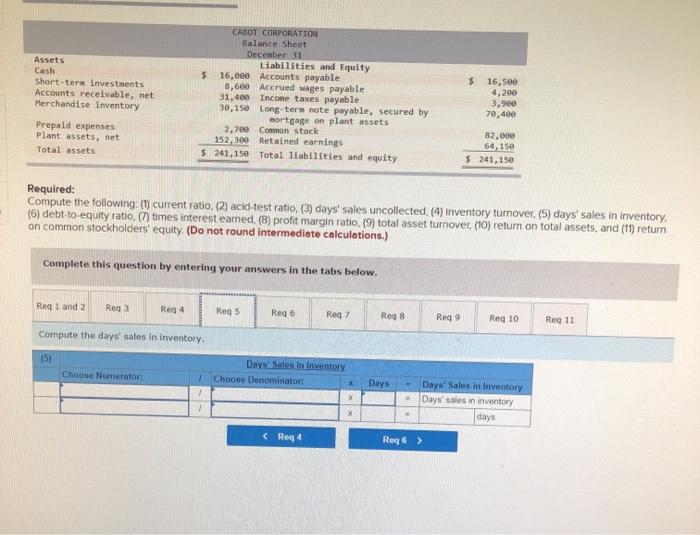

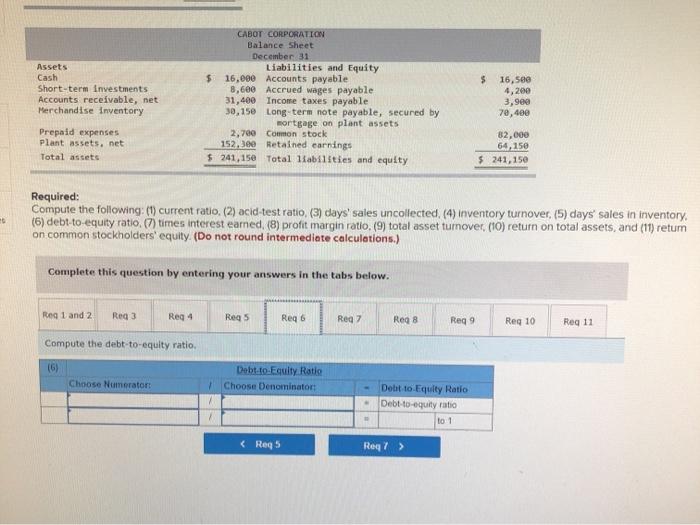

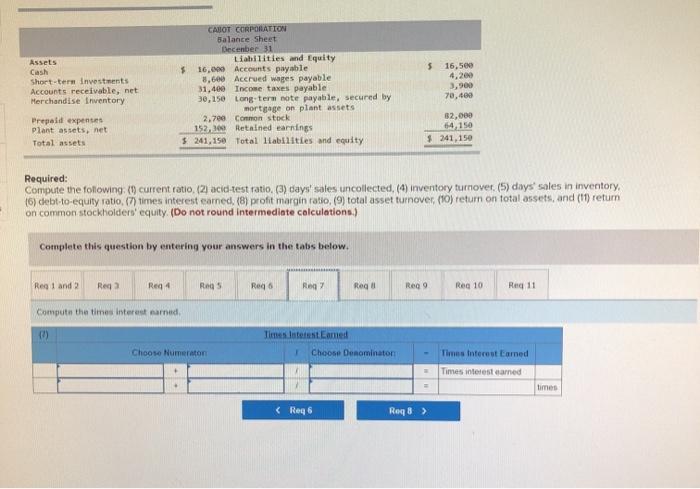

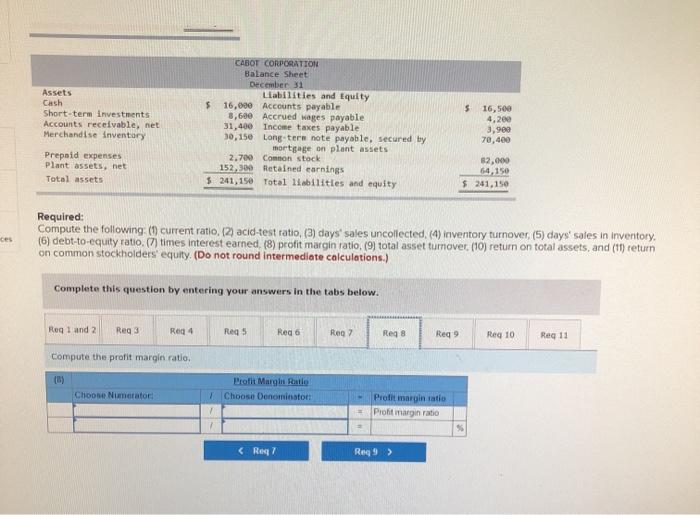

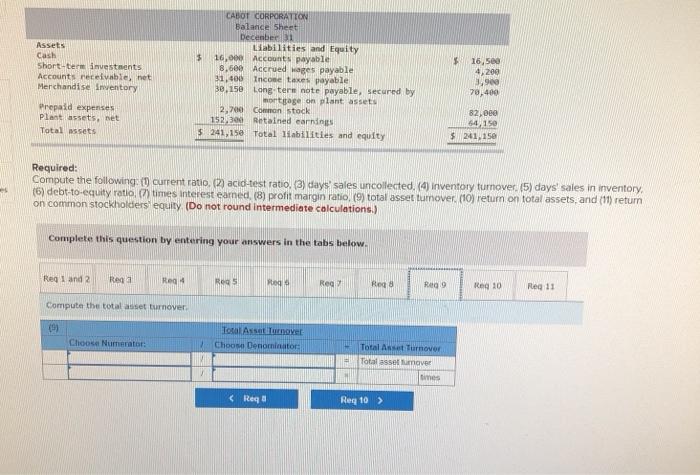

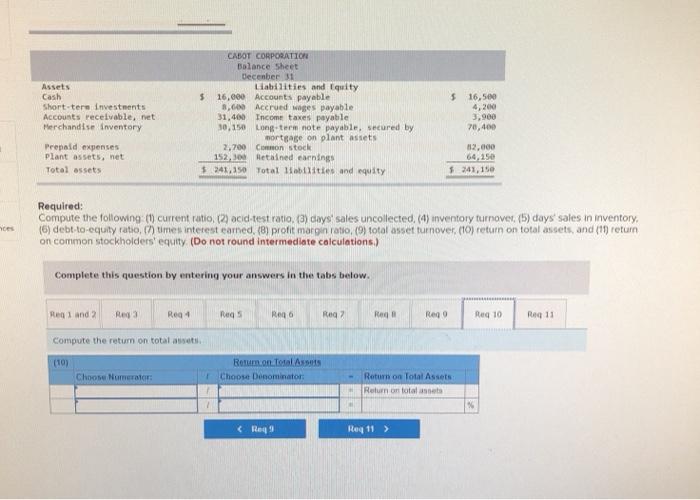

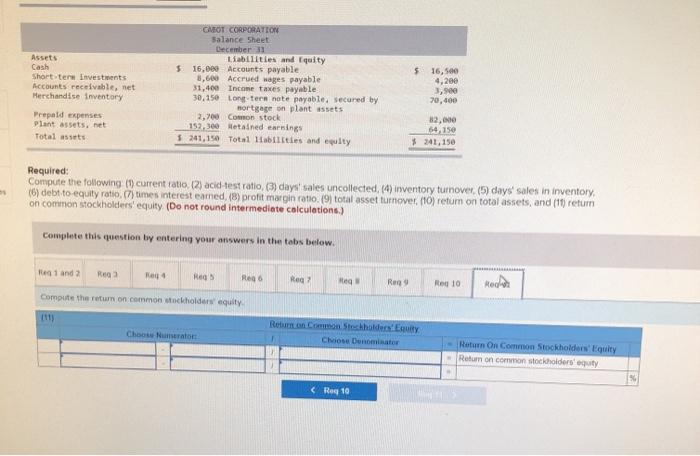

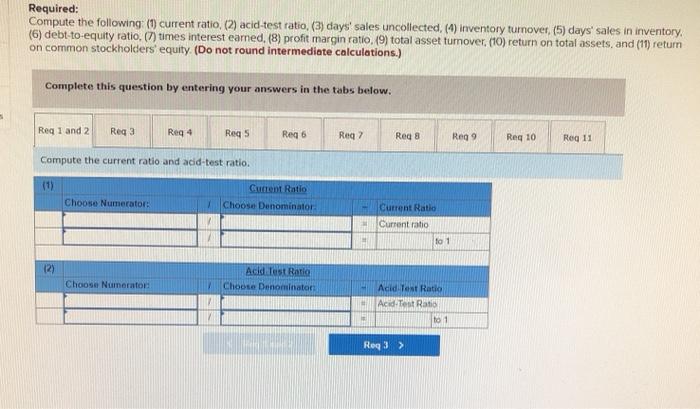

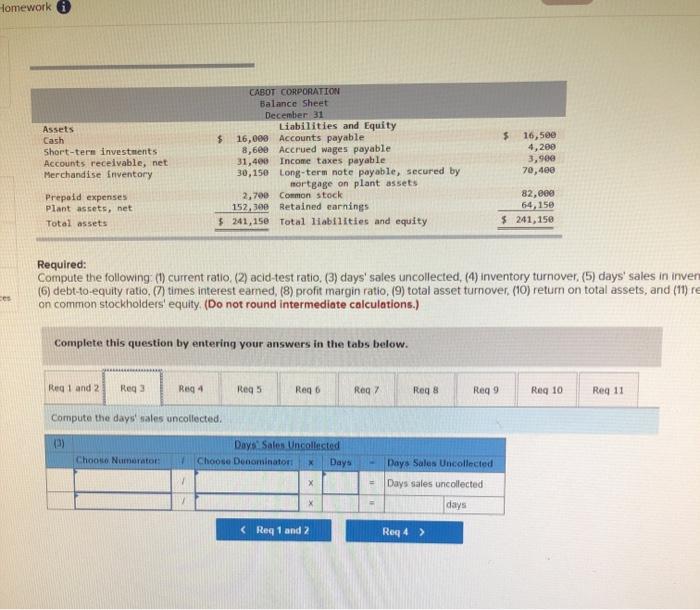

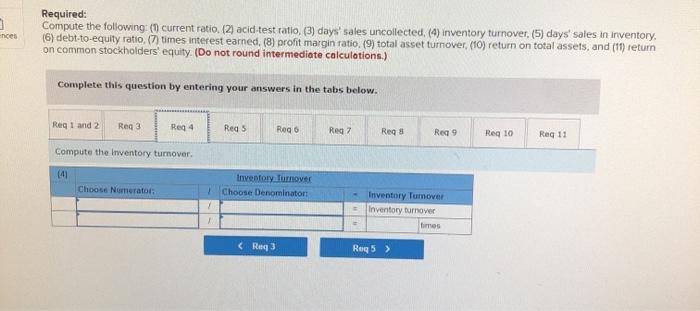

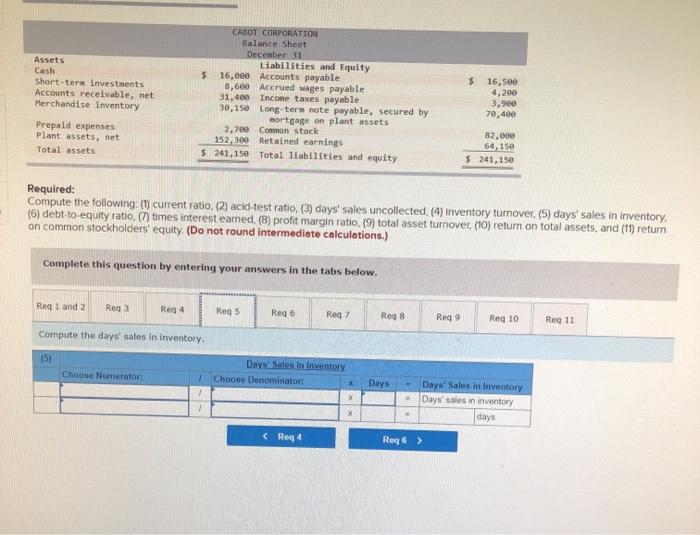

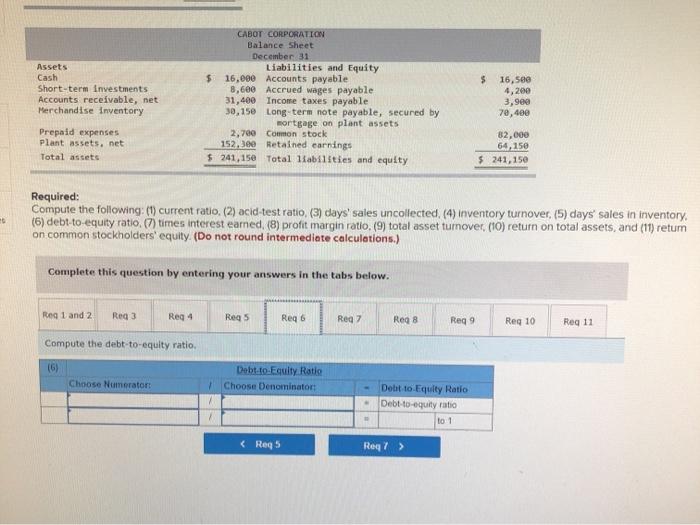

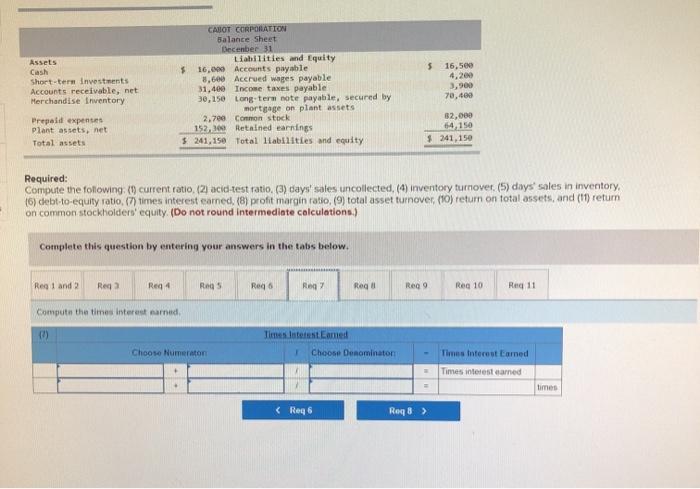

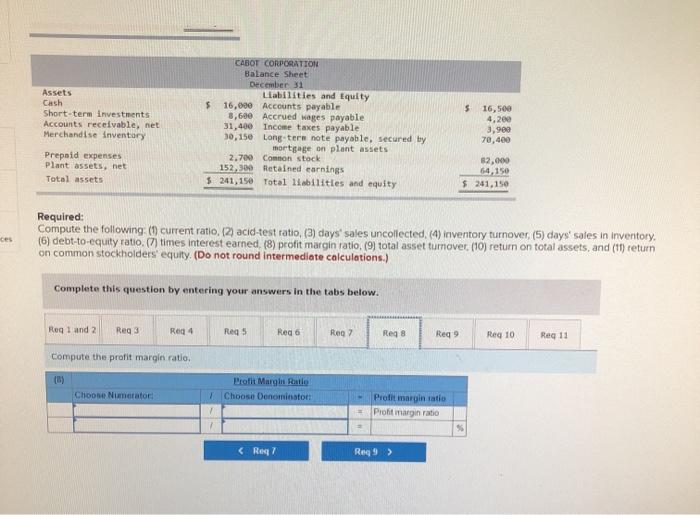

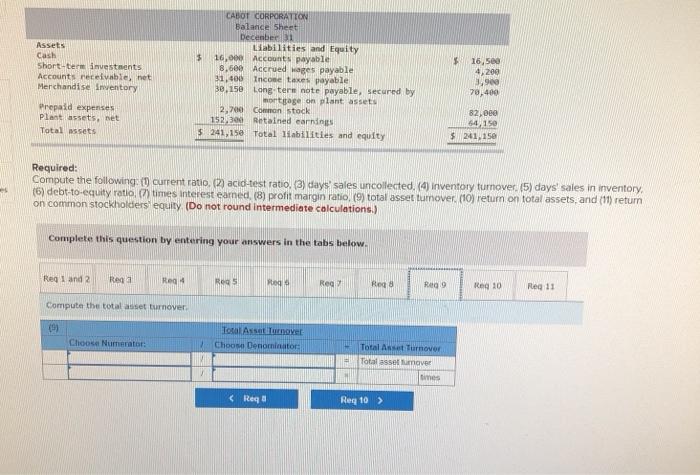

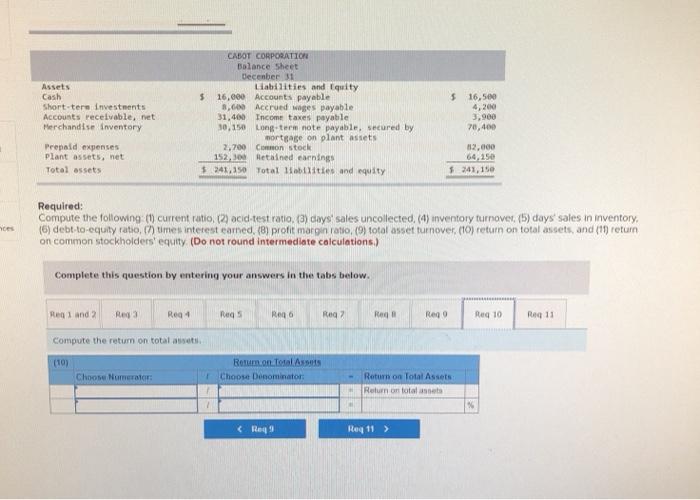

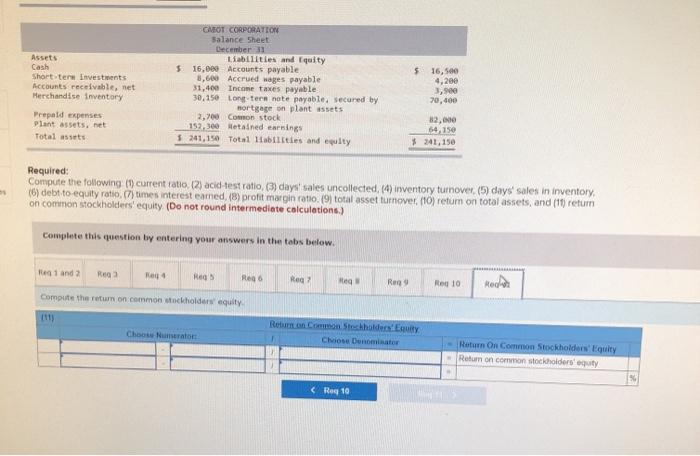

Selected current year-end financial statements of Cabot Corporation follow (All sales were on credit, selected balance sheet amounts at December 31 of the prior year were inventory $52,900 total assets. $169,400; common stock, $82,000, and retained earnings, $35,516.) CABOT CORPORATION Income Statement For Current Year Ended December 31 Sales $ 449,600 Cost of goods sold 292.650 Gross profit 151,950 Operating expenses 99,40 Interest expense Income before taxes 47,950 Income tax expense 19316 Net Income $ 25,634 ces 5 Assets Cash Short te Investrents Accounts receivable.net Merchandise Inventory Prata expenses Plant assets, Total assets CABOT CORPORATION Balance Sheet December 31 Lilities and Equity $ 16,000 Accounts payable 1,600 Accrued as payable 31400 Income the payable 30,150 Long termete payable secured by orgon blant et 2700 Con stock 132.100 Retained an $ 241,150 Total bilities and equity 10.500 4,200 3,900 70,400 12.00 14250 $ 241,150 Required: Compute the following (1) current ratio (2) acid test ratio adays sales uncollected (4) inventory turnover (5) days Sales in inventory detto equity ratio) times interest eamed. (8 profit marginato cotonet turnover (to return on total assets, and (retum on common stockholders equity (Do not round Intermediate calculations.) Complete this question by entering your answers in the tabs below Reland 5 re Reo Reg 10 Reg 11 Com the current ratio and acid-testato Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected. (4) inventory turnover. (5) days' sales in inventory. (6) debt-to-equity ratio (7) times interest earned. (8) profit margin ratio. (9) total asset tumover. (10) return on total assets, and (11) return on common stockholders' equity (Do not round intermediate calculations.) Complete this question by entering your answers in the tabs below. Red 1 and 2 Reg 3 Reg 4 Regs Reg 6 Reg? Reg 8 Reg 9 Reg 10 Reg 11 Compute the current ratio and acid-test ratio. (1) Current Ratio Choose Denominator Choose Numerator Current Ratio Current ratio to 1 (2) Choose Numerator Acid Test Ratio Choose Denominator Acid Test Ratio Acid-Test Ratio to 1 Req3 > Homework i $ Assets Cash Short-term investments Accounts receivable, net Merchandise Inventory CABOT CORPORATION Balance Sheet December 31 Liabilities and Equity $ 16,000 Accounts payable 8,680 Accrued wages payable 31,400 Income taxes payable 30,150 Long-term note payable, secured by mortgage on plant assets 2,700 Common stock 152,30 Retained earnings $ 241,150 Total Habilities and equity 16,500 4,200 3,900 70,400 Prepaid expenses plant assets, net Total assets 82,000 64,150 $ 241,150 Required: Compute the following: (1) current ratio (2) acid-test ratio. (3) days' sales uncollected, (4) inventory turnover. (5) days' sales in inver (6) debt-to-equity ratio. (7) times interest earned, (8) profit margin ratio, (9) total asset turnover (10) return on total assets, and (11) re on common stockholders' equity (Do not round intermediate calculations.) Complete this question by entering your answers in the tabs below. Reg 1 and 2 Reg Reg4 Reg 5 Rego Req Req8 Reg 9 Reg 10 Reg 11 Compute the days sales uncollected, (3) Days Sales Uncollected Choose Denominator X Days Choo Numerator: Days Sales Uncollected X Days sales uncollected X days ences Required: Compute the following (1) current ratio. (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover. (5) days' sales in inventory (6) debt-to-equity ratio (7) times interest earned. (8) profit margin ratio (9) total asset turnover (10) return on total assets, and (11) return on common stockholders' equity. (Do not round intermediate calculations.) Complete this question by entering your answers in the tabs below. Req 1 and 2 Reg 3 Reg 4 Red 5 Rego Reg z Rega Reg 9 Reg 10 Reg 11 Compute the Inventory turnover. 41 Choose Numerator Inventory Turnover Choose Denominator Inventory Turnover Inventory turnover times Assets Cash Short-ters Investments Accounts receivable, net Merchandise Inventory $ CASOT CORPORATION Balance Sheet December 31 Liabilities and Equity $ 16,000 Accounts payable 8,680 Accrued wages payable 31,400 Income taxes payable 30,150 Long-term note payable, secured by mortgage on plant assets 2,700 Common stock 152,309 Retained earnings $241.150 Total liabilities and equity 16,500 4,200 3,900 70,400 Prepaid expenses Plant assets, net Total assets 32,000 64,150 $ 241,150 Required: Compute the following: (1) current ratio. (2) acid-test ratio. (3) days' sales uncollected, (4) inventory turnover (5) days sales in inventory (6) debt-to-equity ratio. (7) times interest earned (8) profit margin ratio (9) total asset turnover (10) return on total assets, and (11) return on common stockholders' equity. (Do not round intermediate calculations.) Complete this question by entering your answers in the tabs below. Reg 1 and 2 Reg 3 Reg4 Reg 5 Reg 6 Req 7 Rog 8 Req9 Reg 10 Reg 11 Compute the days sales in inventory. 15) Choose Numerator Days Sales In Inventory Choose Denominator Days X Days Sales In Inventory Days'sales in inventory days X $ Assets Cash Short-term investments Accounts receivable, net Merchandise Inventory CABOT CORPORATION Balance Sheet December 31 Liabilities and Equity $ 16,000 Accounts payable 8,600 Accrued wages payable 31,400 Income taxes payable 30,150 Long-term note payable, secured by mortgage on plant assets 2,700 Comon stock 152,300 Retained earrings $ 241,150 Total abilities and equity 16,500 4,200 3,900 70,400 Prepaid expenses Plant assets. net Total assets 82,000 64. 150 $ 241,150 Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected. (4) inventory turnover. (5) days' sales in inventory (6) debt to equity ratio (7) times interest earned. (8) profit margin ratio. (9) total asset turnover (10) return on total assets, and (11) retum on common stockholders' equity. (Do not round intermediate calculations.) Complete this question by entering your answers in the tabs below. Reg 1 and 2 Reg 3 Reg4 Reg 5 Req6 Reg 7 Reg 8 Reg 9 Reg 10 Reg 11 Compute the debt-to-equity ratio (6) Choose Numerator Debt to Equity Ratio Choose Denominator Detto Equity Ratio - Debt-to-equity ratio to 1 Assets Cash Short-term investments Accounts receivable, net Merchandise Inventory Prepaid expenses plant assets, net Total assets CAROT CORPORATION Balance Sheet December 31 Liabilities and Equity $ 16.000 Accounts payable 8,600 Accrued wages payable 31,400 Income taxes payable 30,150 Long term note payable, secured by mortgage on plant assets 2.700 Common stock 152, Retained earnings $ 241,150 total liabilities and equity $ 16,500 4.200 3,900 70,000 82,000 64.150 $ 241,150 Required: Compute the following: () current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover. (5) days' sales in inventory (6) debt-to-equity ratio (7) times interest earned. (8) profit margin ratio (9) total asset turnover (10) return on total assets, and (11) retum on common stockholders' equity. (Do not round intermediate calculations.) Complete this question by entering your answers in the tabs below. Ren 1 and 2 Red Reg4 Regs Rego Reg Rogo Regg Reg 10 Red 11 Compute the times interest earned Time interest. Eamed Choose Numeraton 1 Choose Denominator Times Interest Eamed Times interesteamed times $ Assets Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets CABOT CORPORATION Balance Sheet December 31 Liabilities and Equity $ 16,000 Accounts payable 3,600 Accrued wages payable 31,400 Income taxes payable 30,150 Long term note payable, secured by mortgage on plant assets 2.700 Connon stock 152, 300 Retained earnings 5 241, 150 Total abilities and equity 16,500 4.200 3,960 70,400 82,000 $ 241,150 ces Required: Compute the following(1) current ratio, (2) acid-test ratio, (3) days' sales uncollected. (4) inventory turnover (5) days' sales in inventory (6) debt-to-equity ratio. (7) times interest earned, (8) profit margin ratio (9) total asset turnover (10) return on total assets, and (11) return on common stockholders' equity (Do not round intermediate calculations.) Complete this question by entering your answers in the tabs below. Req 1 and 2 Reg 3 Reg4 Reg 5 Rego Reg Req Reg 9 Reg 10 Reg 11 Compute the profit margin ratio. Profit Margit Ratio Choose Denominator Choone Numerator Profit margin ratio Profit margin ratio 7 Assets Cash Short-term investments Accounts receivable net Merchandise fwentory Prepaid expenses Plant assets, bet Total assets CABOT CORPORATION Balance Sheet December abilities and Equity 3 16,000 Accounts payable 8.600 Accrued wages payable 31,400 Income taxes payable 30,150 Long term note payable, secured by mortgage on plant assets 2,70 Common stock 152,30 Betained earnings $ 241,150 Total liabilities and equity 16,500 4,200 3,900 70,400 82,000 64,150 $241.250 Required: Compute the following(1) current ratio, (2) acid-test ratio, 3 days' sales uncollected. (4) Inventory turnover (5) days' sales in inventory (5) debt-to-equity ratio) times interest eamed (8) profit margin ratio, (9) total asset tumover (10) return on total assets, and (11) retum on common stockholders equity (Do not round intermediate calculations.) Complete this question by entering your answers in the tabs below. Reg 1 and 2 Re Reg4 Red Roge Reg Reg 8 Reg 9 Reg 10 Reg 11 Compute the total asset turnover (9) Choose Numerator: Total Assaurnover Choose Denominator 12 Total Aset Turnover Total amover mes V Assets Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses plant assets, net Total assets CABOT CORPORATION Balance Sheet December 31 Liabilities and Equity $ 16,000 Accounts payable 3,600 Accrued wages payable 31,400 Income taxes payable 30,150 Long-term note payable secured by mortgage on plant assets 2.700 Common stock 152,100 Retained earnings $241,150 Total Tibilities and equity $ 16,500 4,200 3,900 70,400 12,000 64,150 $249, 150 Required: Compute the following (1) current ratio, (2) acid-test ratio, (3) cys' sales uncollected, (4) mnventory turnover. (5) days sales in inventory (6) debt-to-equity ratio, cumes interest earned. (B) profit margin ratio (9) total asset turnover (10) return on total assets, and (11) return on common stockholders' equity. (Do not round intermediate calculations.) Complete this question by entering your answers in the tabs below. Real and 2 Reg 3 Reg4 Red Rego Reg2 Reg Rego Raq 10 Reg 11 Compute the return on total asset (10) Return on Total Assets Choose Denominator Choose Numero Return on Total Assets Return on total 5 Assets Cash Short tere Investments Accounts receivable, net Merchandise inventory Prepaid expenses plant assets.net Total assets GEOT CORPORATION Balance Sheet December 31 1.sabilities and Equity $ 16,000 Accounts payable 8,600 Accrued wages payable 31,400 Income taxes payable 30,150 Long term nate payable secured by mortgage on plant sets 2,700 Comon stock 152,300 Hetained earnings 5241,150 Total Habilities and equity 16,500 4,200 3,900 20,400 12,000 64,150 $ 241,150 Required: Compute the following (1) current ratio (2) acid-test ratio (3) days' sales uncollected, (4) inventory turnover (5) days' sales in inventory (6) debt to equity ratio) times interest earned. (8) profit margin ratio (9) total asset turnover (10) return on total assets, and (11) return on common stockholders' equity (Do not round Intermediate calculations.) Complete this question by entering your answers in the tabs below. 1 and 2 Reg RO Res R6 Reg Req Ren Reg 10 Roches Compute the return on common stockholders equity 111) Che | Matt Return on Common Stockholders' Equity Close Denominator - Return On Common Stockholders' Equity - Return on common stockholders equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started