Answered step by step

Verified Expert Solution

Question

1 Approved Answer

THIS IS ALL ONE QUESTION, would appreciate a step by step breakdown of each question X Your answer is incorrect. The Crane Bar & Grill

THIS IS ALL ONE QUESTION,

would appreciate a step by step breakdown of each question

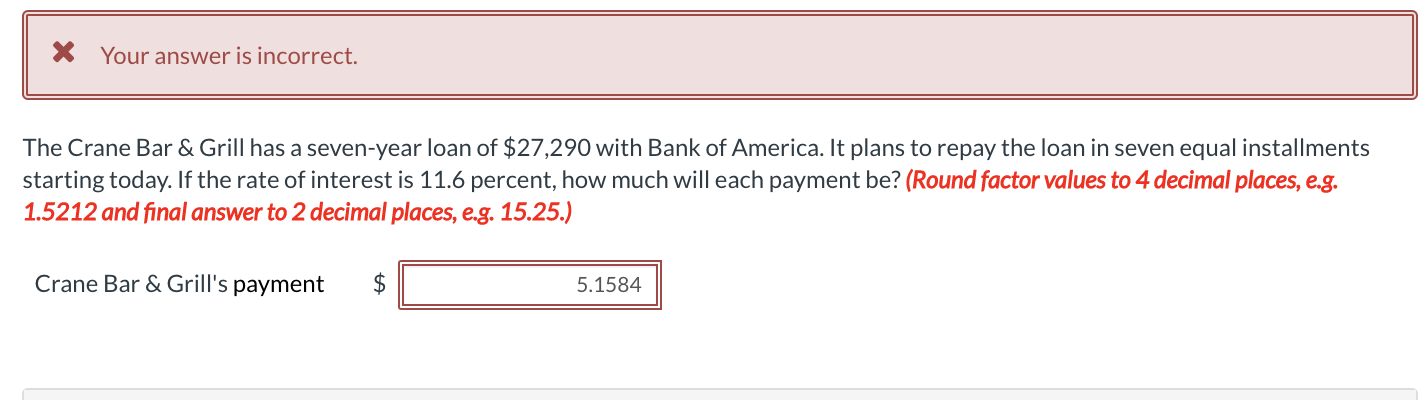

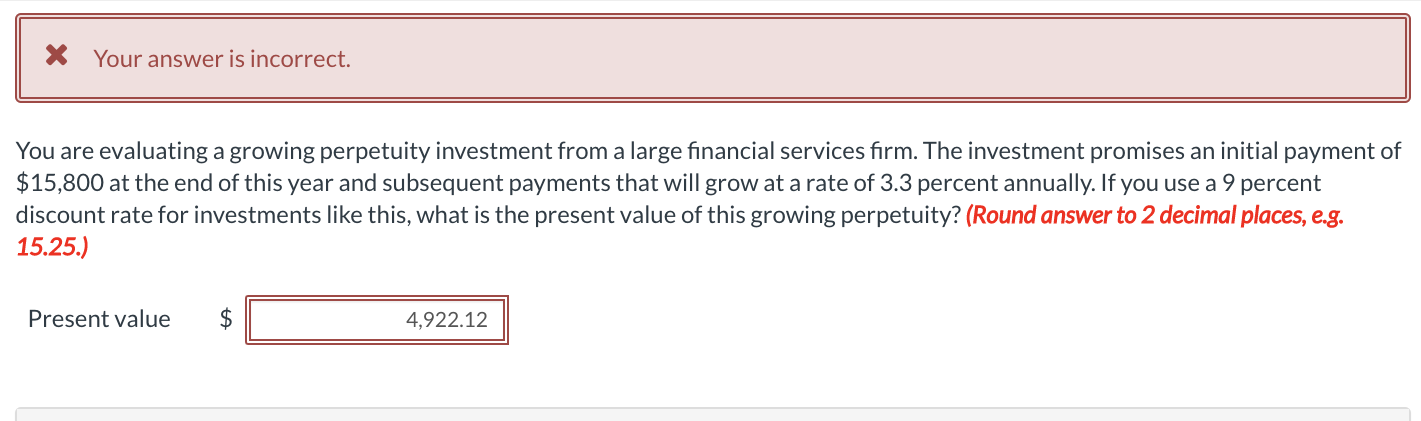

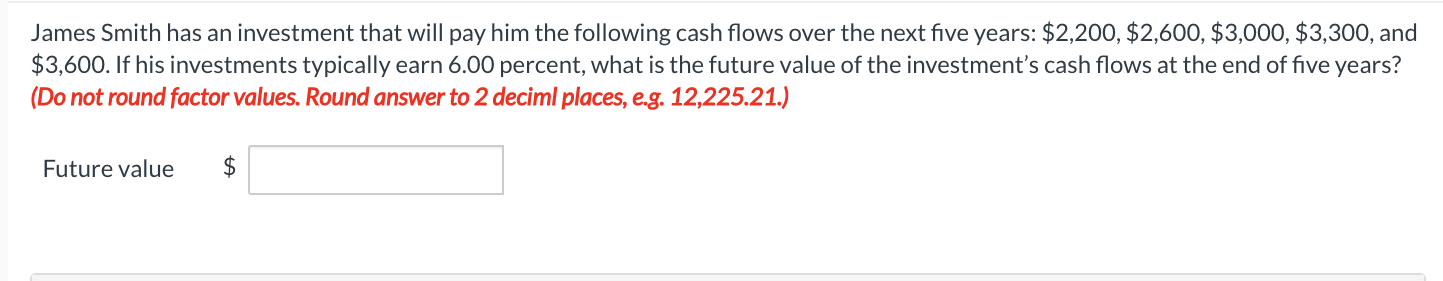

X Your answer is incorrect. The Crane Bar & Grill has a seven-year loan of $27,290 with Bank of America. It plans to repay the loan in seven equal installments starting today. If the rate of interest is 11.6 percent, how much will each payment be? (Round factor values to 4 decimal places, e.g. 1.5212 and final answer to 2 decimal places, e.g. 15.25.) Crane Bar & Grill's payment $ 5.1584 X Your answer is incorrect. You are evaluating a growing perpetuity investment from a large financial services firm. The investment promises an initial payment of $15,800 at the end of this year and subsequent payments that will grow at a rate of 3.3 percent annually. If you use a 9 percent discount rate for investments like this, what is the present value of this growing perpetuity? (Round answer to 2 decimal places, e.g. 15.25.) Present value $ 4,922.12 James Smith has an investment that will pay him the following cash flows over the next five years: $2,200, $2,600, $3,000, $3,300, and $3,600. If his investments typically earn 6.00 percent, what is the future value of the investment's cash flows at the end of five years? (Do not round factor values. Round answer to 2 deciml places, e.g. 12,225.21.) Future value $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started