Answered step by step

Verified Expert Solution

Question

1 Approved Answer

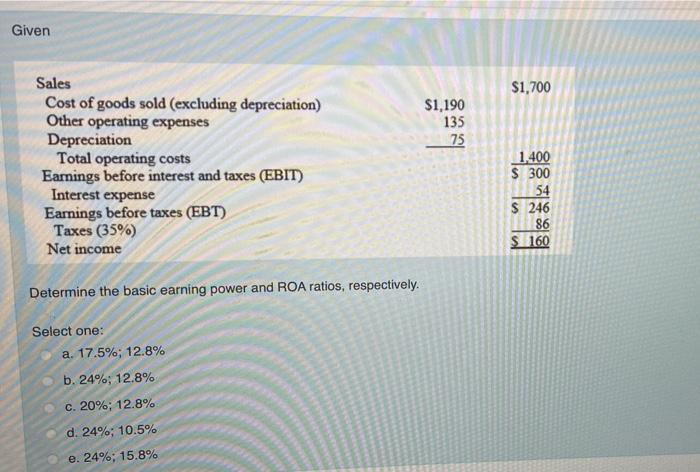

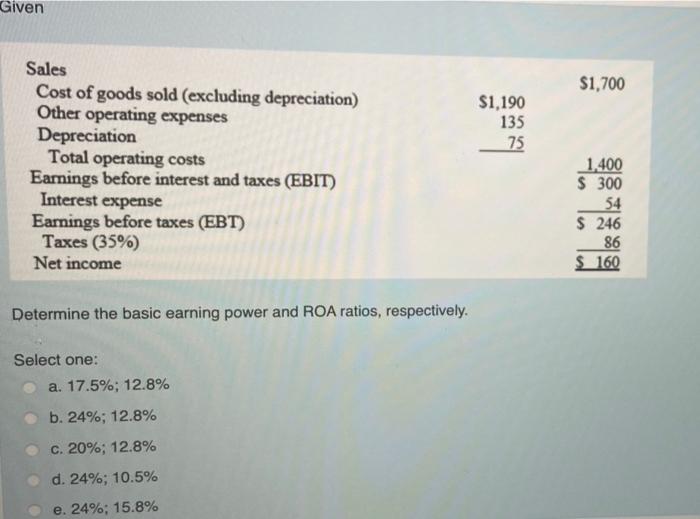

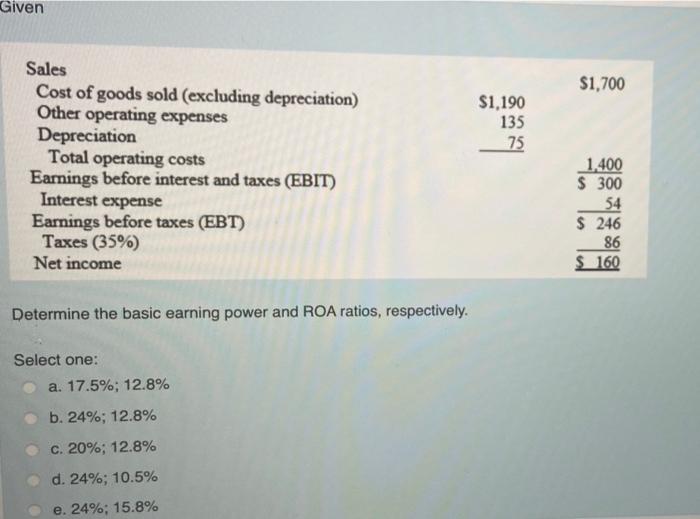

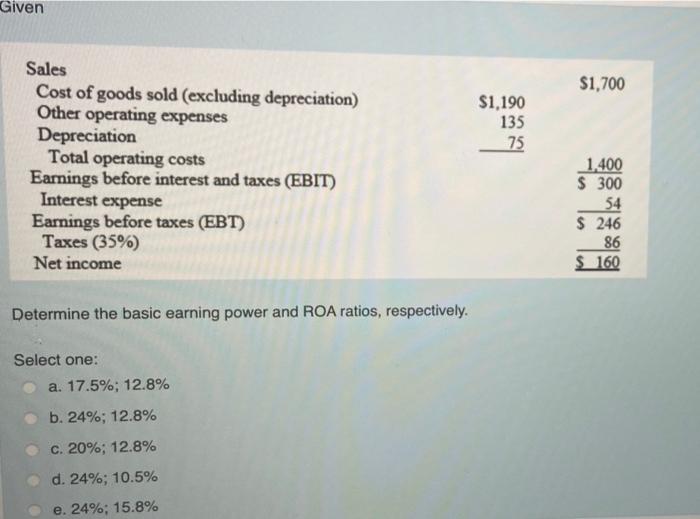

This is all that is given for this question Given Sales Cost of goods sold (excluding depreciation) Other operating expenses Depreciation Total operating costs Earnings

This is all that is given for this question

Given Sales Cost of goods sold (excluding depreciation) Other operating expenses Depreciation Total operating costs Earnings before interest and taxes (EBIT) Interest expense Earnings before taxes (EBT) Taxes (35%) Net income Determine the basic earning power and ROA ratios, respectively. Select one: a. 17.5%; 12.8% b. 24%; 12.8% c. 20%; 12.8% d. 24%; 10.5% e. 24%; 15.8% $1,190 135 75 $1,700 1.400 $ 300 54 $ 246 86 $ 160 Given Sales Cost of goods sold (excluding depreciation) Other operating expenses Depreciation Total operating costs Earnings before interest and taxes (EBIT) Interest expense Earnings before taxes (EBT) Taxes (35%) Net income Determine the basic earning power and ROA ratios, respectively. Select one: a. 17.5%; 12.8% b. 24%; 12.8% c. 20%; 12.8% d. 24%; 10.5% e. 24%; 15.8% $1,190 135 75 $1,700 1,400 $ 300 54 $ 246 86 $ 160 Given Sales Cost of goods sold (excluding depreciation) Other operating expenses Depreciation Total operating costs Earnings before interest and taxes (EBIT) Interest expense Earnings before taxes (EBT) Taxes (35%) Net income Determine the basic earning power and ROA ratios, respectively. Select one: a. 17.5%; 12.8% b. 24%; 12.8% c. 20%; 12.8% d. 24%; 10.5% e. 24%; 15.8% $1,190 135 75 $1,700 1,400 $ 300 54 $ 246 86 $ 160 Given Sales Cost of goods sold (excluding depreciation) Other operating expenses Depreciation Total operating costs Earnings before interest and taxes (EBIT) Interest expense Earnings before taxes (EBT) Taxes (35%) Net income Determine the basic earning power and ROA ratios, respectively. Select one: a. 17.5%; 12.8% b. 24%; 12.8% c. 20%; 12.8% d. 24%; 10.5% e. 24%; 15.8% $1,190 135 75 $1,700 1.400 $ 300 54 $ 246 86 $ 160 Given Sales Cost of goods sold (excluding depreciation) Other operating expenses Depreciation Total operating costs Earnings before interest and taxes (EBIT) Interest expense Earnings before taxes (EBT) Taxes (35%) Net income Determine the basic earning power and ROA ratios, respectively. Select one: a. 17.5%; 12.8% b. 24%; 12.8% c. 20%; 12.8% d. 24%; 10.5% e. 24%; 15.8% $1,190 135 75 $1,700 1,400 $ 300 54 $ 246 86 $ 160 Given Sales Cost of goods sold (excluding depreciation) Other operating expenses Depreciation Total operating costs Earnings before interest and taxes (EBIT) Interest expense Earnings before taxes (EBT) Taxes (35%) Net income Determine the basic earning power and ROA ratios, respectively. Select one: a. 17.5%; 12.8% b. 24%; 12.8% c. 20%; 12.8% d. 24%; 10.5% e. 24%; 15.8% $1,190 135 75 $1,700 1,400 $ 300 54 $ 246 86 $ 160

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started