this is all that shows im not sure how to figure it out

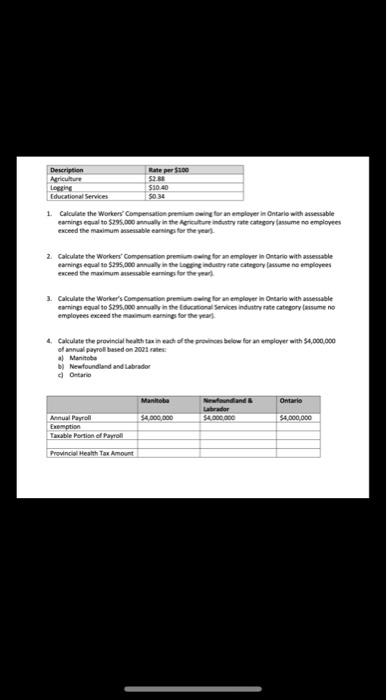

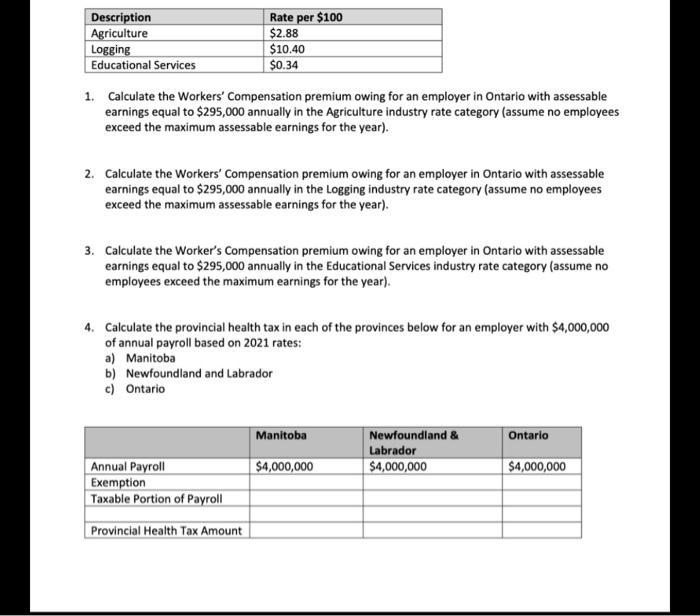

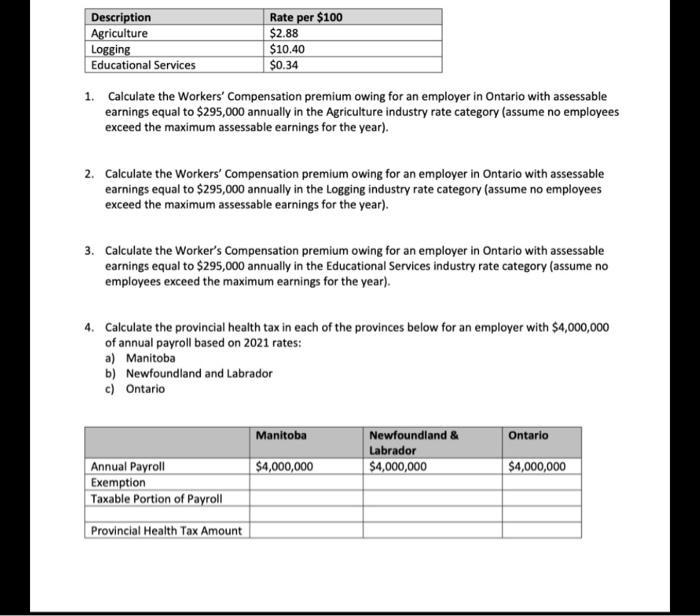

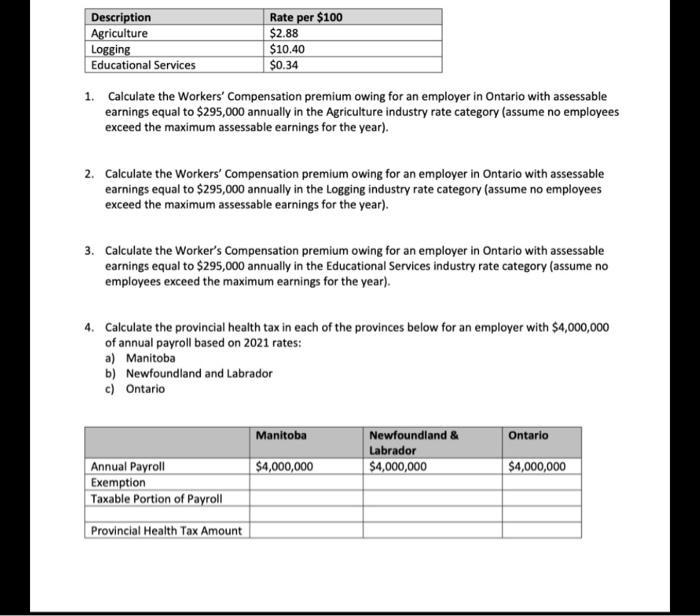

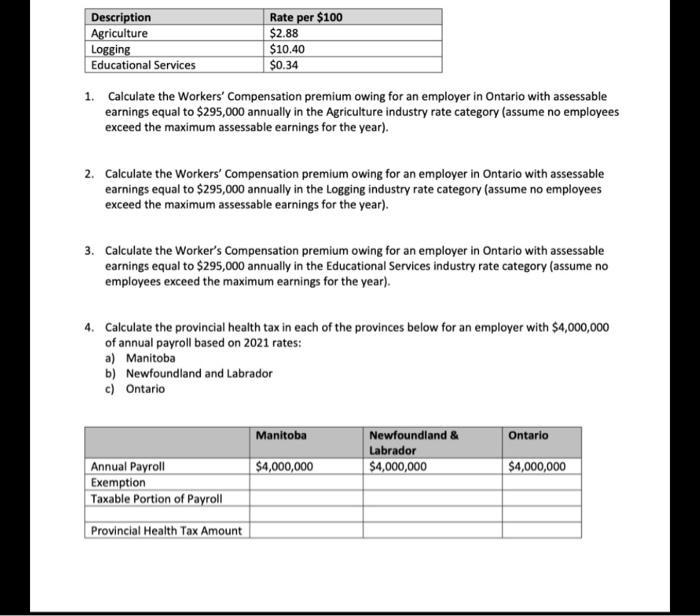

Description Barte per $100 Agriculture Login 510.40 Educational Services 5038 1. Calculate the Workers Compensation preming for an employer in Ontario with essable samnings equal to $295.000 in the groundstry rate Category assumere employees exceed the maximum essable eating for the years 2 Calculate the Workers' Compensation premiingforan employer in Ontario with assessable earnings equal to $295.000 in the industry try sume ne employees 1. Calculate the Worker's Compensation premissing for an employer in Ontario with assable eaming equal to $295.000 annually in the locational Seces industry rate category assumere employees exceed the maximum earnings for the years cokulete the prendencial health beness of the proces below for an employer with 34.000.000 of annual based on 2001 Manitoba Newfoundland and Labrador Ontario Manitob Ontario Newand Labrador S4.000.000 S4,000,000 58.000.000 Annual Payroll Exemption Taxable Portion of Pawoll Provincial Health Tax Amount Description Agriculture Logging Educational Services Rate per $100 $2.88 $10.40 $0.34 1. Calculate the Workers' Compensation premium owing for an employer in Ontario with assessable earnings equal to $295,000 annually in the Agriculture industry rate category (assume no employees exceed the maximum assessable earnings for the year). 2. Calculate the Workers' compensation premium owing for an employer in Ontario with assessable earnings equal to $295,000 annually in the Logging industry rate category (assume no employees exceed the maximum assessable earnings for the year). 3. Calculate the Worker's Compensation premium owing for an employer in Ontario with assessable earnings equal to $295,000 annually in the Educational Services industry rate category (assume no employees exceed the maximum earnings for the year). 4. Calculate the provincial health tax in each of the provinces below for an employer with $4,000,000 of annual payroll based on 2021 rates: a) Manitoba b) Newfoundland and Labrador c) Ontario Manitoba Ontario Newfoundland & Labrador $4,000,000 $4,000,000 $4,000,000 Annual Payroll Exemption Taxable Portion of Payroll Provincial Health Tax Amount Description Agriculture Logging Educational Services Rate per $100 $2.88 $10.40 $0.34 1. Calculate the Workers' Compensation premium owing for an employer in Ontario with assessable earnings equal to $295,000 annually in the Agriculture industry rate category (assume no employees exceed the maximum assessable earnings for the year). 2. Calculate the Workers' Compensation premium owing for an employer in Ontario with assessable earnings equal to $295,000 annually in the Logging industry rate category (assume no employees exceed the maximum assessable earnings for the year). 3. Calculate the Worker's Compensation premium owing for an employer in Ontario with assessable earnings equal to $295,000 annually in the Educational Services industry rate category (assume no employees exceed the maximum earnings for the year). 4. Calculate the provincial health tax in each of the provinces below for an employer with $4,000,000 of annual payroll based on 2021 rates: a) Manitoba b) Newfoundland and Labrador c) Ontario Manitoba Ontario Newfoundland & Labrador $4,000,000 $4,000,000 $4,000,000 Annual Payroll Exemption Taxable Portion of Payroll Provincial Health Tax Amount Description Barte per $100 Agriculture Login 510.40 Educational Services 5038 1. Calculate the Workers Compensation preming for an employer in Ontario with essable samnings equal to $295.000 in the groundstry rate Category assumere employees exceed the maximum essable eating for the years 2 Calculate the Workers' Compensation premiingforan employer in Ontario with assessable earnings equal to $295.000 in the industry try sume ne employees 1. Calculate the Worker's Compensation premissing for an employer in Ontario with assable eaming equal to $295.000 annually in the locational Seces industry rate category assumere employees exceed the maximum earnings for the years cokulete the prendencial health beness of the proces below for an employer with 34.000.000 of annual based on 2001 Manitoba Newfoundland and Labrador Ontario Manitob Ontario Newand Labrador S4.000.000 S4,000,000 58.000.000 Annual Payroll Exemption Taxable Portion of Pawoll Provincial Health Tax Amount Description Agriculture Logging Educational Services Rate per $100 $2.88 $10.40 $0.34 1. Calculate the Workers' Compensation premium owing for an employer in Ontario with assessable earnings equal to $295,000 annually in the Agriculture industry rate category (assume no employees exceed the maximum assessable earnings for the year). 2. Calculate the Workers' compensation premium owing for an employer in Ontario with assessable earnings equal to $295,000 annually in the Logging industry rate category (assume no employees exceed the maximum assessable earnings for the year). 3. Calculate the Worker's Compensation premium owing for an employer in Ontario with assessable earnings equal to $295,000 annually in the Educational Services industry rate category (assume no employees exceed the maximum earnings for the year). 4. Calculate the provincial health tax in each of the provinces below for an employer with $4,000,000 of annual payroll based on 2021 rates: a) Manitoba b) Newfoundland and Labrador c) Ontario Manitoba Ontario Newfoundland & Labrador $4,000,000 $4,000,000 $4,000,000 Annual Payroll Exemption Taxable Portion of Payroll Provincial Health Tax Amount Description Agriculture Logging Educational Services Rate per $100 $2.88 $10.40 $0.34 1. Calculate the Workers' Compensation premium owing for an employer in Ontario with assessable earnings equal to $295,000 annually in the Agriculture industry rate category (assume no employees exceed the maximum assessable earnings for the year). 2. Calculate the Workers' Compensation premium owing for an employer in Ontario with assessable earnings equal to $295,000 annually in the Logging industry rate category (assume no employees exceed the maximum assessable earnings for the year). 3. Calculate the Worker's Compensation premium owing for an employer in Ontario with assessable earnings equal to $295,000 annually in the Educational Services industry rate category (assume no employees exceed the maximum earnings for the year). 4. Calculate the provincial health tax in each of the provinces below for an employer with $4,000,000 of annual payroll based on 2021 rates: a) Manitoba b) Newfoundland and Labrador c) Ontario Manitoba Ontario Newfoundland & Labrador $4,000,000 $4,000,000 $4,000,000 Annual Payroll Exemption Taxable Portion of Payroll Provincial Health Tax Amount