Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is all the info I can provide Varneena plc is a stock market-quoted UK company that specialises in researching and developing new pharmaceutical compounds.

This is all the info I can provide

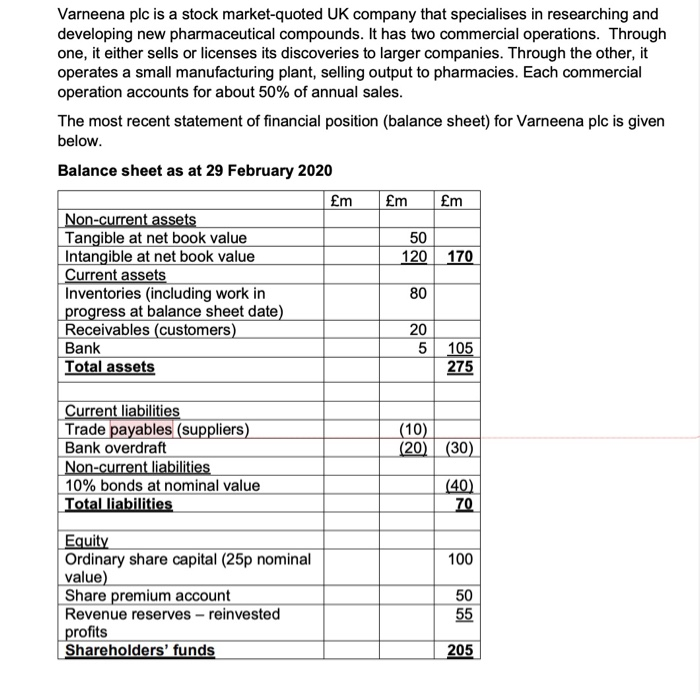

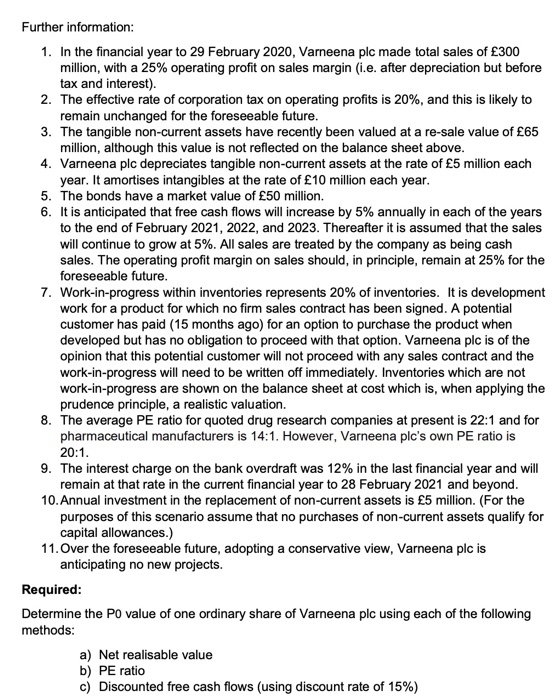

Varneena plc is a stock market-quoted UK company that specialises in researching and developing new pharmaceutical compounds. It has two commercial operations. Through one, it either sells or licenses its discoveries to larger companies. Through the other, it operates a small manufacturing plant, selling output to pharmacies. Each commercial operation accounts for about 50% of annual sales. The most recent statement of financial position (balance sheet) for Varneena plc is given below. Balance sheet as at 29 February 2020 m Non-current assets Tangible at net book value 50 Intangible at net book value 120 170 Current assets Inventories (including work in 80 progress at balance sheet date) Receivables (customers) 20 Bank 5 105 Total assets 275 m m Current liabilities Trade payables (suppliers) Bank overdraft Non-current liabilities 10% bonds at nominal value Total liabilities (10) (20) (30) (40) 70 100 Equity Ordinary share capital (25p nominal value) Share premium account Revenue reserves - reinvested profits Shareholders' funds 50 55 205 Further information: 1. In the financial year to 29 February 2020, Varneena plc made total sales of 300 million, with a 25% operating profit on sales margin (i.e. after depreciation but before tax and interest). 2. The effective rate of corporation tax on operating profits is 20%, and this is likely to remain unchanged for the foreseeable future. 3. The tangible non-current assets have recently been valued at a re-sale value of 65 million, although this value is not reflected on the balance sheet above. 4. Varneena plc depreciates tangible non-current assets at the rate of 5 million each year. It amortises intangibles at the rate of 10 million each year. 5. The bonds have a market value of 50 million. 6. It is anticipated that free cash flows will increase by 5% annually in each of the years to the end of February 2021, 2022, and 2023. Thereafter it is assumed that the sales will continue to grow at 5%. All sales are treated by the company as being cash sales. The operating profit margin on sales should, in principle, remain at 25% for the foreseeable future. 7. Work-in-progress within inventories represents 20% of inventories. It is development work for a product for which no firm sales contract has been signed. A potential customer has paid (15 months ago) for an option to purchase the product when developed but has no obligation to proceed with that option. Varneena plc is of the opinion that this potential customer will not proceed with any sales contract and the work-in-progress will need to be written off immediately. Inventories which are not work-in-progress are shown on the balance sheet at cost which is, when applying the prudence principle, a realistic valuation. 8. The average PE ratio for quoted drug research companies at present is 22:1 and for pharmaceutical manufacturers is 14:1. However, Varneena plc's own PE ratio is 20:1. 9. The interest charge on the bank overdraft was 12% in the last financial year and will remain at that rate in the current financial year to 28 February 2021 and beyond. 10.Annual investment in the replacement of non-current assets is 5 million. (For the purposes of this scenario assume that no purchases of non-current assets qualify for capital allowances.) 11. Over the foreseeable future, adopting a conservative view, Varneena plc is anticipating no new projects. Required: Determine the PO value of one ordinary share of Varneena plc using each of the following methods: a) Net realisable value b) PE ratio c) Discounted free cash flows (using discount rate of 15%) Varneena plc is a stock market-quoted UK company that specialises in researching and developing new pharmaceutical compounds. It has two commercial operations. Through one, it either sells or licenses its discoveries to larger companies. Through the other, it operates a small manufacturing plant, selling output to pharmacies. Each commercial operation accounts for about 50% of annual sales. The most recent statement of financial position (balance sheet) for Varneena plc is given below. Balance sheet as at 29 February 2020 m Non-current assets Tangible at net book value 50 Intangible at net book value 120 170 Current assets Inventories (including work in 80 progress at balance sheet date) Receivables (customers) 20 Bank 5 105 Total assets 275 m m Current liabilities Trade payables (suppliers) Bank overdraft Non-current liabilities 10% bonds at nominal value Total liabilities (10) (20) (30) (40) 70 100 Equity Ordinary share capital (25p nominal value) Share premium account Revenue reserves - reinvested profits Shareholders' funds 50 55 205 Further information: 1. In the financial year to 29 February 2020, Varneena plc made total sales of 300 million, with a 25% operating profit on sales margin (i.e. after depreciation but before tax and interest). 2. The effective rate of corporation tax on operating profits is 20%, and this is likely to remain unchanged for the foreseeable future. 3. The tangible non-current assets have recently been valued at a re-sale value of 65 million, although this value is not reflected on the balance sheet above. 4. Varneena plc depreciates tangible non-current assets at the rate of 5 million each year. It amortises intangibles at the rate of 10 million each year. 5. The bonds have a market value of 50 million. 6. It is anticipated that free cash flows will increase by 5% annually in each of the years to the end of February 2021, 2022, and 2023. Thereafter it is assumed that the sales will continue to grow at 5%. All sales are treated by the company as being cash sales. The operating profit margin on sales should, in principle, remain at 25% for the foreseeable future. 7. Work-in-progress within inventories represents 20% of inventories. It is development work for a product for which no firm sales contract has been signed. A potential customer has paid (15 months ago) for an option to purchase the product when developed but has no obligation to proceed with that option. Varneena plc is of the opinion that this potential customer will not proceed with any sales contract and the work-in-progress will need to be written off immediately. Inventories which are not work-in-progress are shown on the balance sheet at cost which is, when applying the prudence principle, a realistic valuation. 8. The average PE ratio for quoted drug research companies at present is 22:1 and for pharmaceutical manufacturers is 14:1. However, Varneena plc's own PE ratio is 20:1. 9. The interest charge on the bank overdraft was 12% in the last financial year and will remain at that rate in the current financial year to 28 February 2021 and beyond. 10.Annual investment in the replacement of non-current assets is 5 million. (For the purposes of this scenario assume that no purchases of non-current assets qualify for capital allowances.) 11. Over the foreseeable future, adopting a conservative view, Varneena plc is anticipating no new projects. Required: Determine the PO value of one ordinary share of Varneena plc using each of the following methods: a) Net realisable value b) PE ratio c) Discounted free cash flows (using discount rate of 15%) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started