This is all the info you need for the problem, thank you in advance!

This is all the info you need for the problem, thank you in advance!

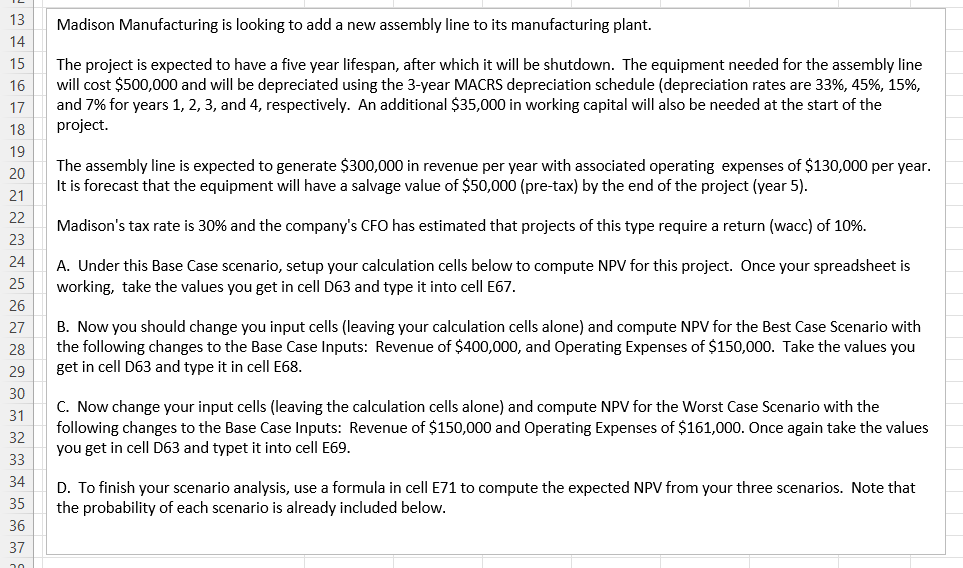

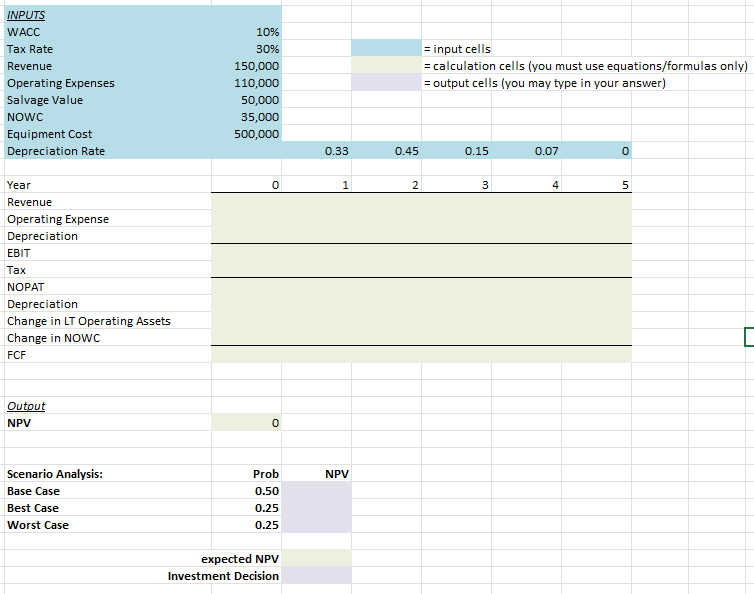

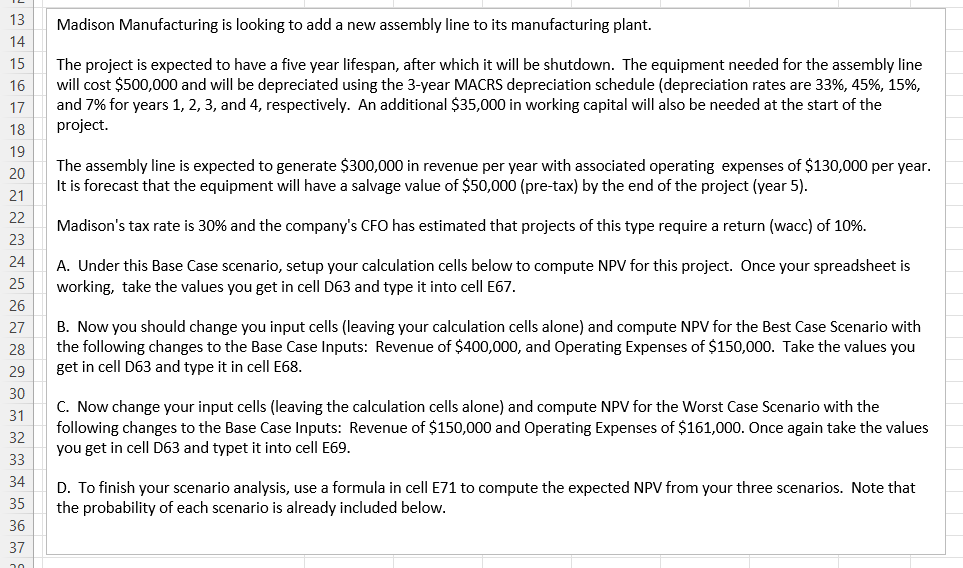

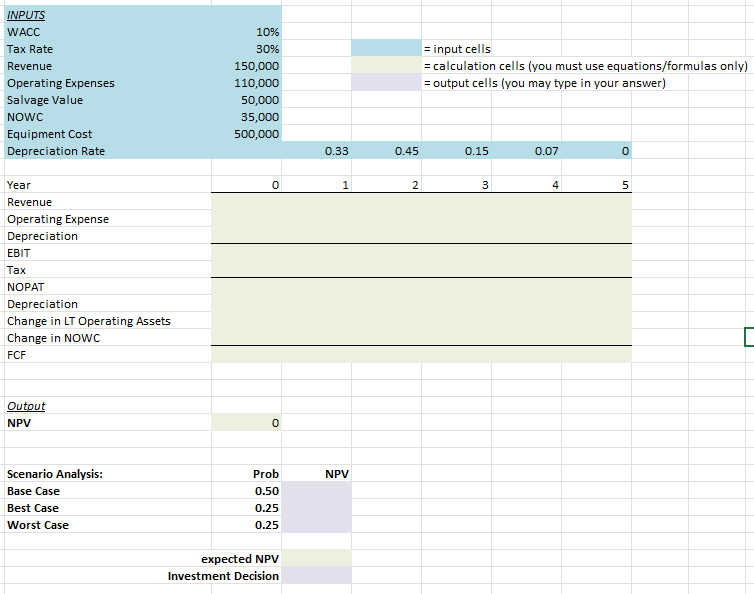

Madison Manufacturing is looking to add a new assembly line to its manufacturing plant. The project is expected to have a five year lifespan, after which it will be shutdown. The equipment needed for the assembly line will cost $500,000 and will be depreciated using the 3-year MACRS depreciation schedule (depreciation rates are 33\%, 45\%, 15\%, and 7% for years 1, 2, 3, and 4, respectively. An additional $35,000 in working capital will also be needed at the start of the project. The assembly line is expected to generate $300,000 in revenue per year with associated operating expenses of $130,000 per year. It is forecast that the equipment will have a salvage value of $50,000 (pre-tax) by the end of the project (year 5 ). Madison's tax rate is 30% and the company's CFO has estimated that projects of this type require a return (wacc) of 10%. A. Under this Base Case scenario, setup your calculation cells below to compute NPV for this project. Once your spreadsheet is working, take the values you get in cell D63 and type it into cell E67. B. Now you should change you input cells (leaving your calculation cells alone) and compute NPV for the Best Case Scenario with the following changes to the Base Case Inputs: Revenue of \$400,000, and Operating Expenses of \$150,000. Take the values you get in cell D63 and type it in cell E68. C. Now change your input cells (leaving the calculation cells alone) and compute NPV for the Worst Case Scenario with the following changes to the Base Case Inputs: Revenue of \$150,000 and Operating Expenses of $161,000. Once again take the values you get in cell D63 and typet it into cell E69. D. To finish your scenario analysis, use a formula in cell E71 to compute the expected NPV from your three scenarios. Note that the probability of each scenario is already included below. Madison Manufacturing is looking to add a new assembly line to its manufacturing plant. The project is expected to have a five year lifespan, after which it will be shutdown. The equipment needed for the assembly line will cost $500,000 and will be depreciated using the 3-year MACRS depreciation schedule (depreciation rates are 33\%, 45\%, 15\%, and 7% for years 1, 2, 3, and 4, respectively. An additional $35,000 in working capital will also be needed at the start of the project. The assembly line is expected to generate $300,000 in revenue per year with associated operating expenses of $130,000 per year. It is forecast that the equipment will have a salvage value of $50,000 (pre-tax) by the end of the project (year 5 ). Madison's tax rate is 30% and the company's CFO has estimated that projects of this type require a return (wacc) of 10%. A. Under this Base Case scenario, setup your calculation cells below to compute NPV for this project. Once your spreadsheet is working, take the values you get in cell D63 and type it into cell E67. B. Now you should change you input cells (leaving your calculation cells alone) and compute NPV for the Best Case Scenario with the following changes to the Base Case Inputs: Revenue of \$400,000, and Operating Expenses of \$150,000. Take the values you get in cell D63 and type it in cell E68. C. Now change your input cells (leaving the calculation cells alone) and compute NPV for the Worst Case Scenario with the following changes to the Base Case Inputs: Revenue of \$150,000 and Operating Expenses of $161,000. Once again take the values you get in cell D63 and typet it into cell E69. D. To finish your scenario analysis, use a formula in cell E71 to compute the expected NPV from your three scenarios. Note that the probability of each scenario is already included below

This is all the info you need for the problem, thank you in advance!

This is all the info you need for the problem, thank you in advance!