Answered step by step

Verified Expert Solution

Question

1 Approved Answer

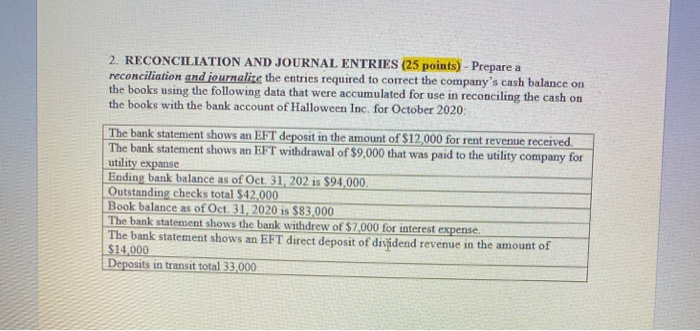

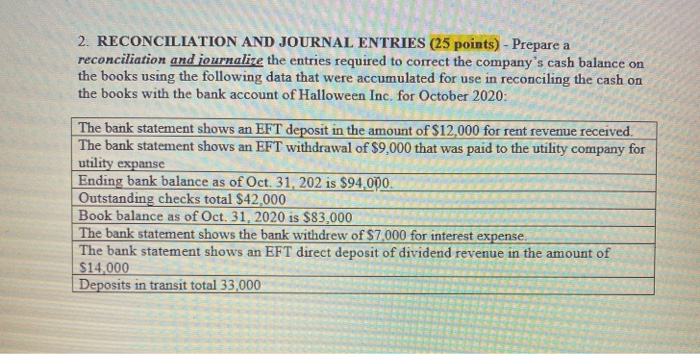

this is all the information i was given 2. RECONCILIATION AND JOURNAL ENTRIES (25 points) - Prepare a reconciliation and journalize the entries required to

this is all the information i was given

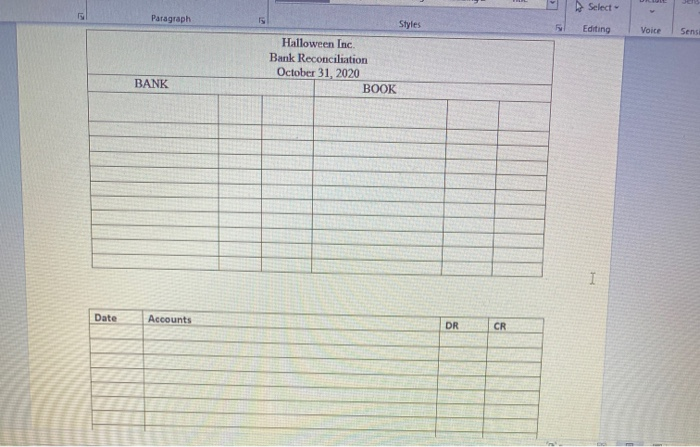

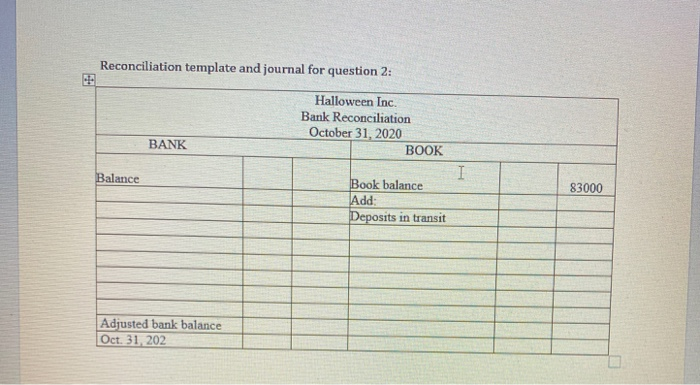

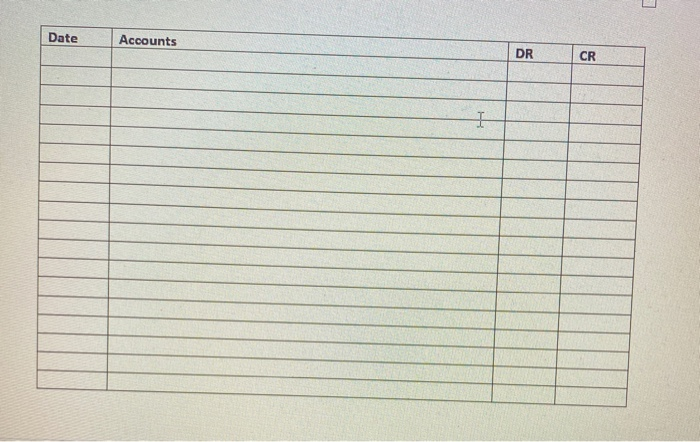

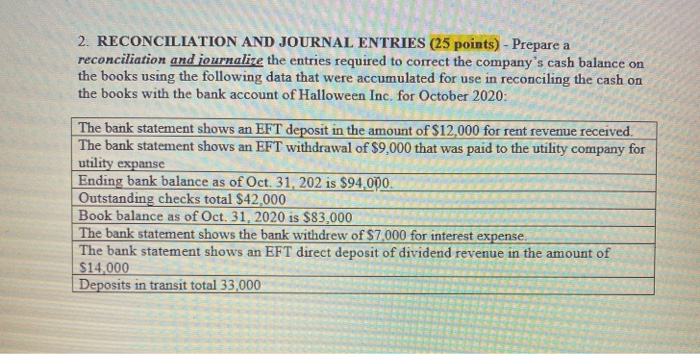

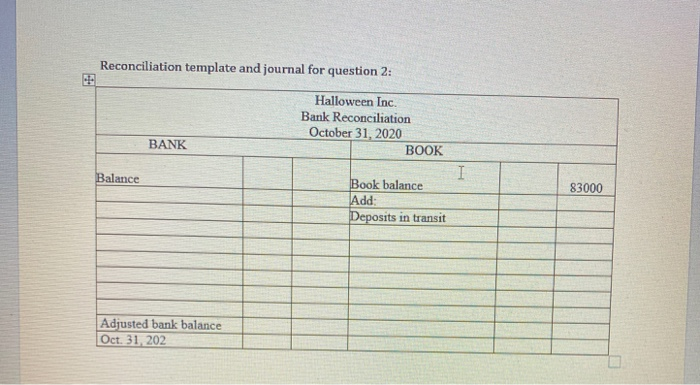

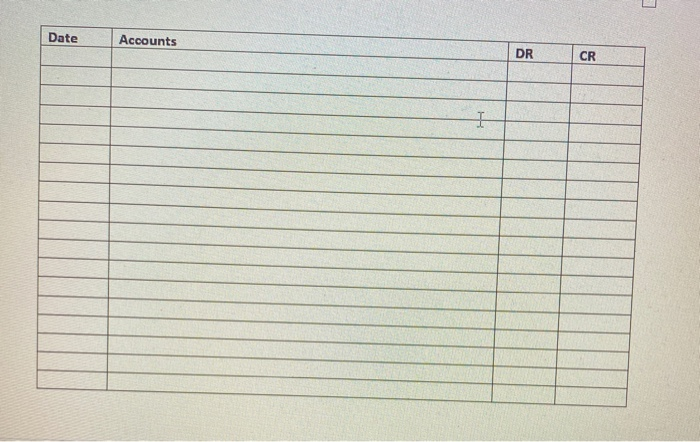

2. RECONCILIATION AND JOURNAL ENTRIES (25 points) - Prepare a reconciliation and journalize the entries required to correct the company's cash balance on the books using the following data that were accumulated for use in reconciling the cash on the books with the bank account of Halloween Inc. for October 2020: The bank statement shows an EFT deposit in the amount of $12,000 for rent revenue received. The bank statement shows an EFT withdrawal of $9,000 that was paid to the utility company for utility expanse Ending bank balance as of Oct 31, 202 is $94.000 Outstanding checks total $42,000 Book balance as of Oct 31, 2020 is $83,000 The bank statement shows the bank withdrew of $7,000 for interest expense. The bank statement shows an EFT direct deposit of dividend revenue in the amount of $14,000 Deposits in transit total 33,000 Select Paragraph Editing Voice Sens Styles Halloween Inc Bank Reconciliation October 31, 2020 BOOK BANK 1 Date Accounts DR CR 2. RECONCILIATION AND JOURNAL ENTRIES (25 points) - Prepare a reconciliation and journalize the entries required to correct the company's cash balance on the books using the following data that were accumulated for use in reconciling the cash on the books with the bank account of Halloween Inc, for October 2020: The bank statement shows an EFT deposit in the amount of $12,000 for rent revenue received. The bank statement shows an EFT withdrawal of $9,000 that was paid to the utility company for utility expanse Ending bank balance as of Oct. 31, 202 is $94.000. Outstanding checks total $42,000 Book balance as of Oct. 31, 2020 is $83,000 The bank statement shows the bank withdrew of $7,000 for interest expense. The bank statement shows an EFT direct deposit of dividend revenue in the amount of $14,000 Deposits in transit total 33,000 Reconciliation template and journal for question 2: Halloween Inc. Bank Reconciliation October 31, 2020 BOOK BANK Balance I 83000 Book balance Add: Deposits in transit Adjusted bank balance Oct 31, 202 Date Accounts DR CR I 2. RECONCILIATION AND JOURNAL ENTRIES (25 points) - Prepare a reconciliation and journalize the entries required to correct the company's cash balance on the books using the following data that were accumulated for use in reconciling the cash on the books with the bank account of Halloween Inc. for October 2020: The bank statement shows an EFT deposit in the amount of $12,000 for rent revenue received. The bank statement shows an EFT withdrawal of $9,000 that was paid to the utility company for utility expanse Ending bank balance as of Oct 31, 202 is $94.000 Outstanding checks total $42,000 Book balance as of Oct 31, 2020 is $83,000 The bank statement shows the bank withdrew of $7,000 for interest expense. The bank statement shows an EFT direct deposit of dividend revenue in the amount of $14,000 Deposits in transit total 33,000 Select Paragraph Editing Voice Sens Styles Halloween Inc Bank Reconciliation October 31, 2020 BOOK BANK 1 Date Accounts DR CR 2. RECONCILIATION AND JOURNAL ENTRIES (25 points) - Prepare a reconciliation and journalize the entries required to correct the company's cash balance on the books using the following data that were accumulated for use in reconciling the cash on the books with the bank account of Halloween Inc, for October 2020: The bank statement shows an EFT deposit in the amount of $12,000 for rent revenue received. The bank statement shows an EFT withdrawal of $9,000 that was paid to the utility company for utility expanse Ending bank balance as of Oct. 31, 202 is $94.000. Outstanding checks total $42,000 Book balance as of Oct. 31, 2020 is $83,000 The bank statement shows the bank withdrew of $7,000 for interest expense. The bank statement shows an EFT direct deposit of dividend revenue in the amount of $14,000 Deposits in transit total 33,000 Reconciliation template and journal for question 2: Halloween Inc. Bank Reconciliation October 31, 2020 BOOK BANK Balance I 83000 Book balance Add: Deposits in transit Adjusted bank balance Oct 31, 202 Date Accounts DR CR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started