Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is all the information provided. I am unsure what else you may require. The following information pertains to Yolue Close Corporation for the financial

This is all the information provided. I am unsure what else you may require.

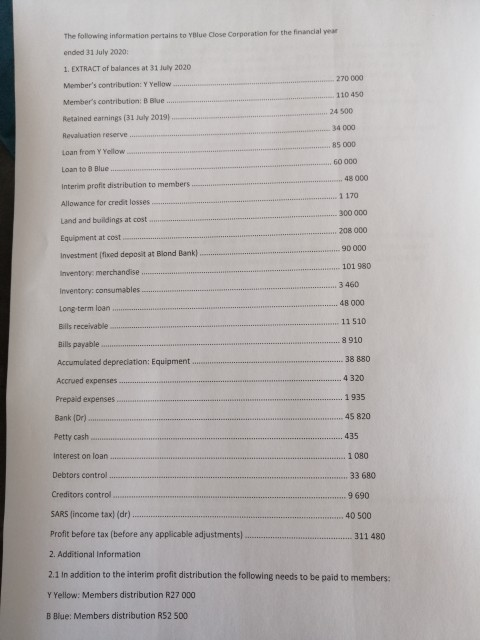

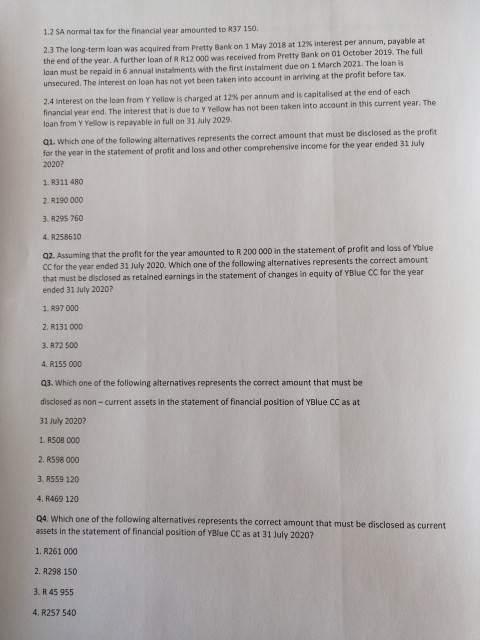

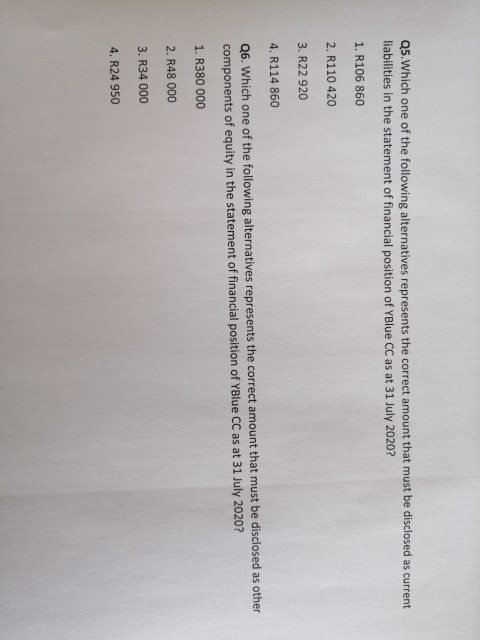

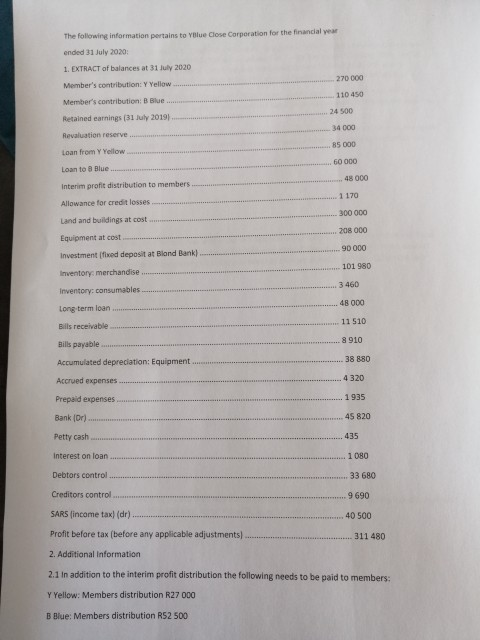

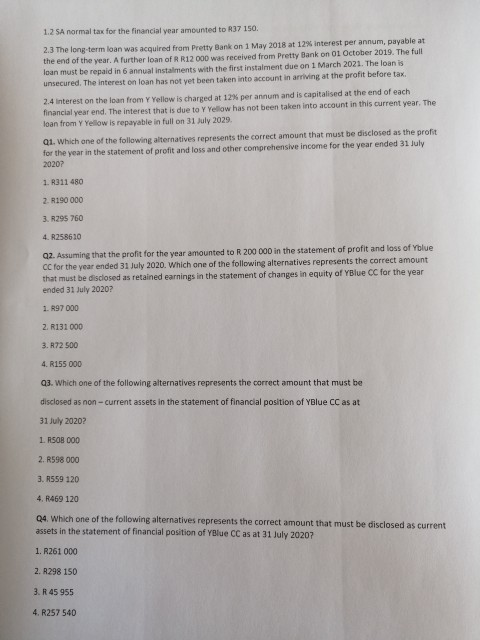

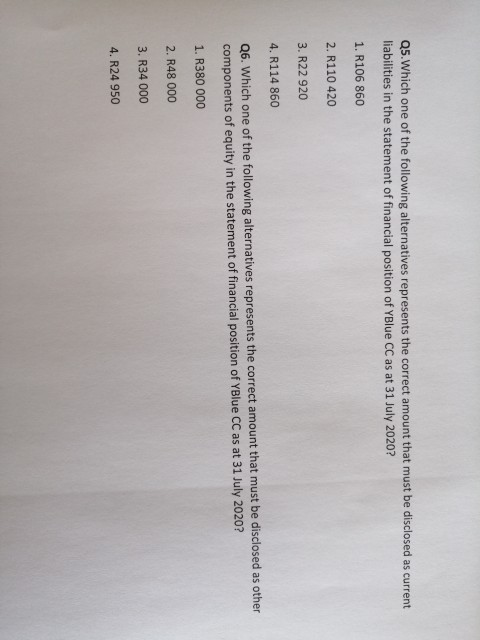

The following information pertains to Yolue Close Corporation for the financial year ended 31 July 2020 1. EXTRACT of balances at 31 July 2020 Member's contribution: Y Yellow 270 000 Member's contribution: Blue 110 450 Retained earnings (31 July 2019) 24 500 Revaluation reserve 34 000 Loan from Y Yellow 85 000 Loan to B Blue 60 000 Interim profit distribution to members 48000 1170 Allowance for credit losses 300 000 Land and buildings at cost 208 000 Equipment at cost 90 000 101 980 3460 Investment (fixed deposit at Blond Bank) Inventory merchandise Inventory: consumables Long term loan Bills receivable 48000 11 510 8 910 Bills payable Accumulated depreciation Equipment 38 880 Accrued expenses 4320 Prepaid expenses 1935 Bank (0) 45 820 Petty cash 435 Interest on loan 1 080 Debtors control 33 680 Creditors control 9 690 SARS income tax) (dr) 40 500 Profit before tax (before any applicable adjustments) 311 480 2. Additional Information 2.1 In addition to the interim profit distribution the following needs to be paid to members: Y Yellow: Members distribution R27 000 B Blue: Members distribution R52 500 1.2 SA normal tax for the financial year amounted to R37 150. 2.3 The long-term loan was acquired from Pretty Bank on 1 May 2018 at 12% interest per annum, payable at the end of the year. A further loan of R R12 000 was received from Pretty Bank on 01 October 2019. The full loan must be repaid in 6 annual installments with the first instalment due on 1 March 2021. The loan is unsecured. The interest on loan has not yet been taken into account in arriving at the profit before tax. 2.4 interest on the loan from Y Yellow is charged at 12% per annum and is capitalised at the end of each financial year end. The interest that is due to y Yellow has not been taken into account in this current year. The loan from Y Yellow is repayable in full on 31 July 2029 Q1. Which one of the following alternatives represents the correct amount that must be disclosed as the profit for the year in the statement of profit and loss and other comprehensive income for the year ended 31 July 20207 1. R311 480 2. R190 000 3. R295 760 4. R258610 Q2. Assuming that the profit for the year amounted to R200 000 in the statement of profit and loss of Yolue CC for the year ended 31 July 2020. Which one of the following alternatives represents the correct amount that must be disclosed as retained earnings in the statement of changes in equity of YBlue CC for the year ended 31 July 2020? 1. R97 000 2. R131 000 3. R72 500 4. R155 000 23. Which one of the following alternatives represents the correct amount that must be disclosed as non-current assets in the statement of financial position of YBlue CC as at 31 July 20202 1. ROB 000 2. R598 000 3. R559 120 4. R469 120 Q4. Which one of the following alternatives represents the correct amount that must be disclosed as current assets in the statement of financial position of YBlue CC as at 31 July 20207 1. R261 000 2. R298 150 3. R 45 955 4. R257 540 Q5. Which one of the following alternatives represents the correct amount that must be disclosed as current liabilities in the statement of financial position of YBlue CC as at 31 July 2020? 1. R106 860 2. R110 420 3. R22 920 4. R114 860 Q6. Which one of the following alternatives represents the correct amount that must be disclosed as other components of equity the statement of financial position of YBlue CC as at 31 July 2020? 1. R380 000 2. R48 000 3. R34 000 4. R24 950 The following information pertains to Yolue Close Corporation for the financial year ended 31 July 2020 1. EXTRACT of balances at 31 July 2020 Member's contribution: Y Yellow 270 000 Member's contribution: Blue 110 450 Retained earnings (31 July 2019) 24 500 Revaluation reserve 34 000 Loan from Y Yellow 85 000 Loan to B Blue 60 000 Interim profit distribution to members 48000 1170 Allowance for credit losses 300 000 Land and buildings at cost 208 000 Equipment at cost 90 000 101 980 3460 Investment (fixed deposit at Blond Bank) Inventory merchandise Inventory: consumables Long term loan Bills receivable 48000 11 510 8 910 Bills payable Accumulated depreciation Equipment 38 880 Accrued expenses 4320 Prepaid expenses 1935 Bank (0) 45 820 Petty cash 435 Interest on loan 1 080 Debtors control 33 680 Creditors control 9 690 SARS income tax) (dr) 40 500 Profit before tax (before any applicable adjustments) 311 480 2. Additional Information 2.1 In addition to the interim profit distribution the following needs to be paid to members: Y Yellow: Members distribution R27 000 B Blue: Members distribution R52 500 1.2 SA normal tax for the financial year amounted to R37 150. 2.3 The long-term loan was acquired from Pretty Bank on 1 May 2018 at 12% interest per annum, payable at the end of the year. A further loan of R R12 000 was received from Pretty Bank on 01 October 2019. The full loan must be repaid in 6 annual installments with the first instalment due on 1 March 2021. The loan is unsecured. The interest on loan has not yet been taken into account in arriving at the profit before tax. 2.4 interest on the loan from Y Yellow is charged at 12% per annum and is capitalised at the end of each financial year end. The interest that is due to y Yellow has not been taken into account in this current year. The loan from Y Yellow is repayable in full on 31 July 2029 Q1. Which one of the following alternatives represents the correct amount that must be disclosed as the profit for the year in the statement of profit and loss and other comprehensive income for the year ended 31 July 20207 1. R311 480 2. R190 000 3. R295 760 4. R258610 Q2. Assuming that the profit for the year amounted to R200 000 in the statement of profit and loss of Yolue CC for the year ended 31 July 2020. Which one of the following alternatives represents the correct amount that must be disclosed as retained earnings in the statement of changes in equity of YBlue CC for the year ended 31 July 2020? 1. R97 000 2. R131 000 3. R72 500 4. R155 000 23. Which one of the following alternatives represents the correct amount that must be disclosed as non-current assets in the statement of financial position of YBlue CC as at 31 July 20202 1. ROB 000 2. R598 000 3. R559 120 4. R469 120 Q4. Which one of the following alternatives represents the correct amount that must be disclosed as current assets in the statement of financial position of YBlue CC as at 31 July 20207 1. R261 000 2. R298 150 3. R 45 955 4. R257 540 Q5. Which one of the following alternatives represents the correct amount that must be disclosed as current liabilities in the statement of financial position of YBlue CC as at 31 July 2020? 1. R106 860 2. R110 420 3. R22 920 4. R114 860 Q6. Which one of the following alternatives represents the correct amount that must be disclosed as other components of equity the statement of financial position of YBlue CC as at 31 July 2020? 1. R380 000 2. R48 000 3. R34 000 4. R24 950 The following information pertains to Yolue Close Corporation for the financial year ended 31 July 2020 1. EXTRACT of balances at 31 July 2020 Member's contribution: Y Yellow 270 000 Member's contribution: Blue 110 450 Retained earnings (31 July 2019) 24 500 Revaluation reserve 34 000 Loan from Y Yellow 85 000 Loan to B Blue 60 000 Interim profit distribution to members 48000 1170 Allowance for credit losses 300 000 Land and buildings at cost 208 000 Equipment at cost 90 000 101 980 3460 Investment (fixed deposit at Blond Bank) Inventory merchandise Inventory: consumables Long term loan Bills receivable 48000 11 510 8 910 Bills payable Accumulated depreciation Equipment 38 880 Accrued expenses 4320 Prepaid expenses 1935 Bank (0) 45 820 Petty cash 435 Interest on loan 1 080 Debtors control 33 680 Creditors control 9 690 SARS income tax) (dr) 40 500 Profit before tax (before any applicable adjustments) 311 480 2. Additional Information 2.1 In addition to the interim profit distribution the following needs to be paid to members: Y Yellow: Members distribution R27 000 B Blue: Members distribution R52 500 1.2 SA normal tax for the financial year amounted to R37 150. 2.3 The long-term loan was acquired from Pretty Bank on 1 May 2018 at 12% interest per annum, payable at the end of the year. A further loan of R R12 000 was received from Pretty Bank on 01 October 2019. The full loan must be repaid in 6 annual installments with the first instalment due on 1 March 2021. The loan is unsecured. The interest on loan has not yet been taken into account in arriving at the profit before tax. 2.4 interest on the loan from Y Yellow is charged at 12% per annum and is capitalised at the end of each financial year end. The interest that is due to y Yellow has not been taken into account in this current year. The loan from Y Yellow is repayable in full on 31 July 2029 Q1. Which one of the following alternatives represents the correct amount that must be disclosed as the profit for the year in the statement of profit and loss and other comprehensive income for the year ended 31 July 20207 1. R311 480 2. R190 000 3. R295 760 4. R258610 Q2. Assuming that the profit for the year amounted to R200 000 in the statement of profit and loss of Yolue CC for the year ended 31 July 2020. Which one of the following alternatives represents the correct amount that must be disclosed as retained earnings in the statement of changes in equity of YBlue CC for the year ended 31 July 2020? 1. R97 000 2. R131 000 3. R72 500 4. R155 000 23. Which one of the following alternatives represents the correct amount that must be disclosed as non-current assets in the statement of financial position of YBlue CC as at 31 July 20202 1. ROB 000 2. R598 000 3. R559 120 4. R469 120 Q4. Which one of the following alternatives represents the correct amount that must be disclosed as current assets in the statement of financial position of YBlue CC as at 31 July 20207 1. R261 000 2. R298 150 3. R 45 955 4. R257 540 Q5. Which one of the following alternatives represents the correct amount that must be disclosed as current liabilities in the statement of financial position of YBlue CC as at 31 July 2020? 1. R106 860 2. R110 420 3. R22 920 4. R114 860 Q6. Which one of the following alternatives represents the correct amount that must be disclosed as other components of equity the statement of financial position of YBlue CC as at 31 July 2020? 1. R380 000 2. R48 000 3. R34 000 4. R24 950 The following information pertains to Yolue Close Corporation for the financial year ended 31 July 2020 1. EXTRACT of balances at 31 July 2020 Member's contribution: Y Yellow 270 000 Member's contribution: Blue 110 450 Retained earnings (31 July 2019) 24 500 Revaluation reserve 34 000 Loan from Y Yellow 85 000 Loan to B Blue 60 000 Interim profit distribution to members 48000 1170 Allowance for credit losses 300 000 Land and buildings at cost 208 000 Equipment at cost 90 000 101 980 3460 Investment (fixed deposit at Blond Bank) Inventory merchandise Inventory: consumables Long term loan Bills receivable 48000 11 510 8 910 Bills payable Accumulated depreciation Equipment 38 880 Accrued expenses 4320 Prepaid expenses 1935 Bank (0) 45 820 Petty cash 435 Interest on loan 1 080 Debtors control 33 680 Creditors control 9 690 SARS income tax) (dr) 40 500 Profit before tax (before any applicable adjustments) 311 480 2. Additional Information 2.1 In addition to the interim profit distribution the following needs to be paid to members: Y Yellow: Members distribution R27 000 B Blue: Members distribution R52 500 1.2 SA normal tax for the financial year amounted to R37 150. 2.3 The long-term loan was acquired from Pretty Bank on 1 May 2018 at 12% interest per annum, payable at the end of the year. A further loan of R R12 000 was received from Pretty Bank on 01 October 2019. The full loan must be repaid in 6 annual installments with the first instalment due on 1 March 2021. The loan is unsecured. The interest on loan has not yet been taken into account in arriving at the profit before tax. 2.4 interest on the loan from Y Yellow is charged at 12% per annum and is capitalised at the end of each financial year end. The interest that is due to y Yellow has not been taken into account in this current year. The loan from Y Yellow is repayable in full on 31 July 2029 Q1. Which one of the following alternatives represents the correct amount that must be disclosed as the profit for the year in the statement of profit and loss and other comprehensive income for the year ended 31 July 20207 1. R311 480 2. R190 000 3. R295 760 4. R258610 Q2. Assuming that the profit for the year amounted to R200 000 in the statement of profit and loss of Yolue CC for the year ended 31 July 2020. Which one of the following alternatives represents the correct amount that must be disclosed as retained earnings in the statement of changes in equity of YBlue CC for the year ended 31 July 2020? 1. R97 000 2. R131 000 3. R72 500 4. R155 000 23. Which one of the following alternatives represents the correct amount that must be disclosed as non-current assets in the statement of financial position of YBlue CC as at 31 July 20202 1. ROB 000 2. R598 000 3. R559 120 4. R469 120 Q4. Which one of the following alternatives represents the correct amount that must be disclosed as current assets in the statement of financial position of YBlue CC as at 31 July 20207 1. R261 000 2. R298 150 3. R 45 955 4. R257 540 Q5. Which one of the following alternatives represents the correct amount that must be disclosed as current liabilities in the statement of financial position of YBlue CC as at 31 July 2020? 1. R106 860 2. R110 420 3. R22 920 4. R114 860 Q6. Which one of the following alternatives represents the correct amount that must be disclosed as other components of equity the statement of financial position of YBlue CC as at 31 July 2020? 1. R380 000 2. R48 000 3. R34 000 4. R24 950Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started