Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is all the information provided. Please show full workings Thank you. Question 1 a) A pension plan has committed to pay a client 2,000

This is all the information provided. Please show full workings Thank you.

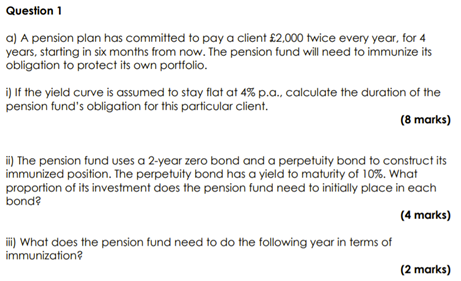

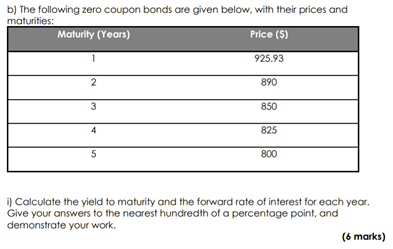

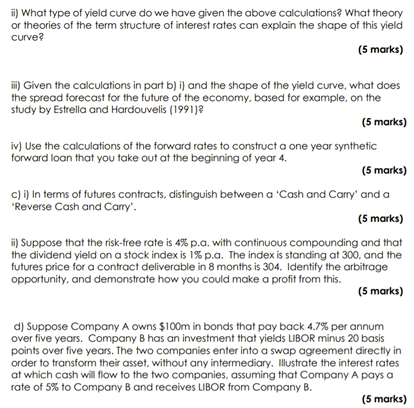

Question 1 a) A pension plan has committed to pay a client 2,000 twice every year, for 4 years, starting in six months from now. The pension fund will need to immunize its obligation to protect its own portfolio. i) If the yield curve is assumed to stay flat at 4% p.a.. calculate the duration of the pension fund's obligation for this particular client. (8 marks) ii) The pension fund uses a 2-year zero bond and a perpetuity bond to construct its immunized position. The perpetuity bond has a yield to maturity of 10%. What proportion of its investment does the pension fund need to initially place in each bonda (4 marks) ii) What does the pension fund need to do the following year in terms of immunization (2 marks) b) The following zero coupon bonds are given below, with their prices and maturities: Maturity (Years) Price (s) 1 925.93 2 890 3 850 825 5 800 i) Calculate the yield to maturity and the forward rate of interest for each year. Give your answers to the nearest hundredth of a percentage point, and demonstrate your work. (6 marks) ii) What type of yield curve do we have given the above calculations? What theory or theories of the term structure of interest rates can explain the shape of this yield curve? (5 marks) ii) Given the calculations in part b) i) and the shape of the yield Curve, what does the spread forecast for the future of the economy, based for example, on the study by Estrella and Hardouvelis (1991) (5 marks) iv) Use the calculations of the forward rates to construct a one year synthetic forward loan that you take out at the beginning of year 4. (5 marks) C) i) In terms of futures contracts, distinguish between a 'Cash and Carry' and a "Reverse Cash and Carry'. (5 marks) ii) Suppose that the risk-free rate is 4% p.a. with continuous compounding and that the dividend yield on a stock index is 1% p.a. The index is standing at 300, and the futures price for a contract deliverable in 8 months is 304. Identify the arbitrage opportunity, and demonstrate how you could make a profit from this. (5 marks) d) Suppose Company A owns $100m in bonds that pay back 4.7% per annum over five years. Company B has an investment that yields LIBOR minus 20 basis points over five years. The two companies enter into a swap agreement directly in order to transform their asset, without any intermediary. Illustrate the interest rates at which cash will flow to the two companies, assuming that Company A pays a rate of 5% to Company B and receives LIBOR from Company B. (5 marks) Question 1 a) A pension plan has committed to pay a client 2,000 twice every year, for 4 years, starting in six months from now. The pension fund will need to immunize its obligation to protect its own portfolio. i) If the yield curve is assumed to stay flat at 4% p.a.. calculate the duration of the pension fund's obligation for this particular client. (8 marks) ii) The pension fund uses a 2-year zero bond and a perpetuity bond to construct its immunized position. The perpetuity bond has a yield to maturity of 10%. What proportion of its investment does the pension fund need to initially place in each bonda (4 marks) ii) What does the pension fund need to do the following year in terms of immunization (2 marks) b) The following zero coupon bonds are given below, with their prices and maturities: Maturity (Years) Price (s) 1 925.93 2 890 3 850 825 5 800 i) Calculate the yield to maturity and the forward rate of interest for each year. Give your answers to the nearest hundredth of a percentage point, and demonstrate your work. (6 marks) ii) What type of yield curve do we have given the above calculations? What theory or theories of the term structure of interest rates can explain the shape of this yield curve? (5 marks) ii) Given the calculations in part b) i) and the shape of the yield Curve, what does the spread forecast for the future of the economy, based for example, on the study by Estrella and Hardouvelis (1991) (5 marks) iv) Use the calculations of the forward rates to construct a one year synthetic forward loan that you take out at the beginning of year 4. (5 marks) C) i) In terms of futures contracts, distinguish between a 'Cash and Carry' and a "Reverse Cash and Carry'. (5 marks) ii) Suppose that the risk-free rate is 4% p.a. with continuous compounding and that the dividend yield on a stock index is 1% p.a. The index is standing at 300, and the futures price for a contract deliverable in 8 months is 304. Identify the arbitrage opportunity, and demonstrate how you could make a profit from this. (5 marks) d) Suppose Company A owns $100m in bonds that pay back 4.7% per annum over five years. Company B has an investment that yields LIBOR minus 20 basis points over five years. The two companies enter into a swap agreement directly in order to transform their asset, without any intermediary. Illustrate the interest rates at which cash will flow to the two companies, assuming that Company A pays a rate of 5% to Company B and receives LIBOR from Company B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started