Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This is all the information provided. True Temper Ltd is a steel manufacturing company that manufactures high quality stainless steel products for the building industry.

This is all the information provided.

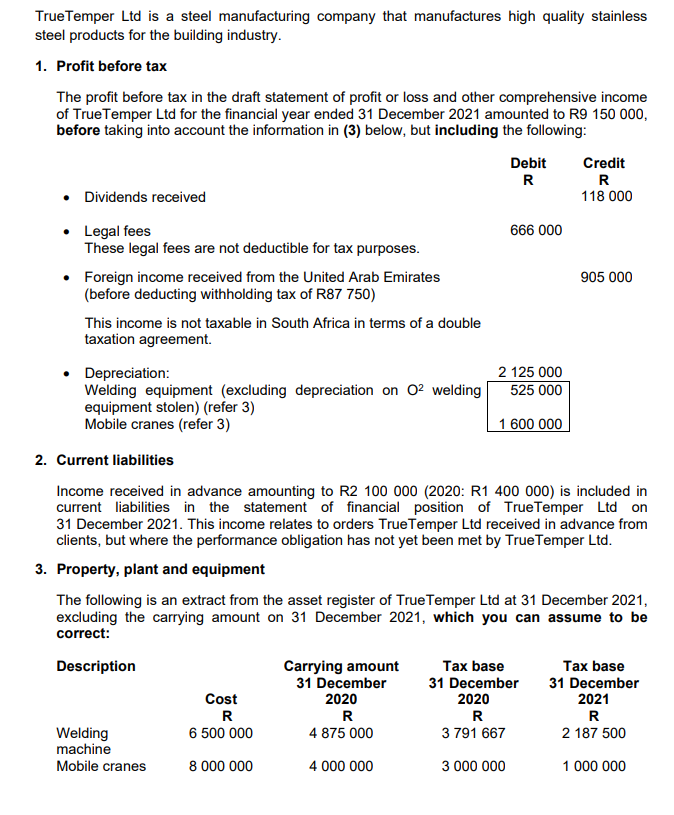

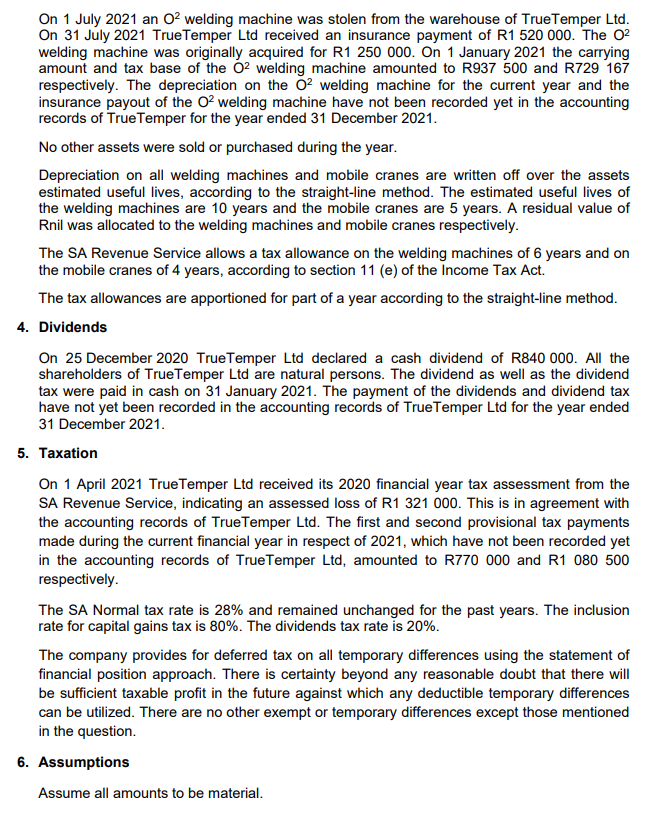

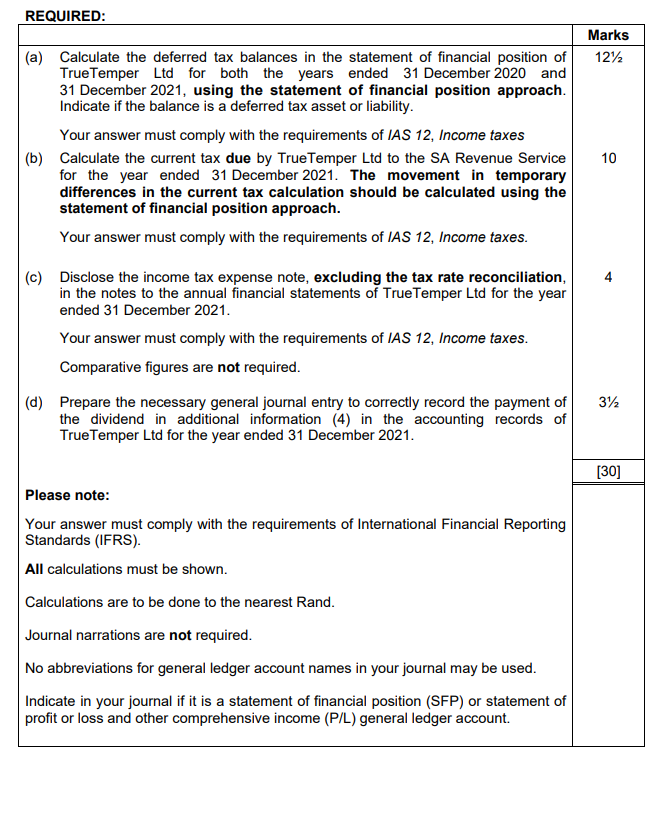

True Temper Ltd is a steel manufacturing company that manufactures high quality stainless steel products for the building industry. 1. Profit before tax The profit before tax in the draft statement of profit or loss and other comprehensive income of True Temper Ltd for the financial year ended 31 December 2021 amounted to R9 150 000, before taking into account the information in (3) below, but including the following: Debit Credit R R Dividends received 118 000 Legal fees 666 000 These legal fees are not deductible for tax purposes. Foreign income received from the United Arab Emirates 905 000 (before deducting withholding tax of R87 750) This income is not taxable in South Africa in terms of a double taxation agreement Depreciation: 2 125 000 Welding equipment (excluding depreciation on 02 welding | 525 000 equipment stolen) (refer 3) Mobile cranes (refer 3) 1 600 000 2. Current liabilities Income received in advance amounting to R2 100 000 (2020: R1 400 000) is included in current liabilities in the statement of financial position of True Temper Ltd on 31 December 2021. This income relates to orders True Temper Ltd received in advance from clients, but where the performance obligation has not yet been met by True Temper Ltd. 3. Property, plant and equipment The following is an extract from the asset register of True Temper Ltd at 31 December 2021, excluding the carrying amount on 31 December 2021, which you can assume to be correct: Description Cost R 6 500 000 Carrying amount 31 December 2020 R 4 875 000 Tax base 31 December 2020 R 3 791 667 Tax base 31 December 2021 R 2 187 500 Welding machine Mobile cranes 8 000 000 4 000 000 3 000 000 1 000 000 On 1 July 2021 an 02 welding machine was stolen from the warehouse of True Temper Ltd. On 31 July 2021 True Temper Ltd received an insurance payment of R1 520 000. The 02 welding machine was originally acquired for R1 250 000. On 1 January 2021 the carrying amount and tax base of the O2 welding machine amounted to R937 500 and R729 167 respectively. The depreciation on the O2 welding machine for the current year and the insurance payout of the Op welding machine have not been recorded yet in the accounting records of True Temper for the year ended 31 December 2021. No other assets were sold or purchased during the year. Depreciation on all welding machines and mobile cranes are written off over the assets estimated useful lives, according to the straight-line method. The estimated useful lives of the welding machines are 10 years and the mobile cranes are 5 years. A residual value of Rnil was allocated to the welding machines and mobile cranes respectively. The SA Revenue Service allows a tax allowance on the welding machines of 6 years and on the mobile cranes of 4 years, according to section 11 (e) of the Income Tax Act. The tax allowances are apportioned for part of a year according to the straight-line method. 4. Dividends On 25 December 2020 True Temper Ltd declared a cash dividend of R840 000. All the shareholders of True Temper Ltd are natural persons. The dividend as well as the dividend tax were paid in cash on 31 January 2021. The payment of the dividends and dividend tax have not yet been recorded in the accounting records of True Temper Ltd for the year ended 31 December 2021. 5. Taxation On 1 April 2021 True Temper Ltd received its 2020 financial year tax assessment from the SA Revenue Service, indicating an assessed loss of R1 321 000. This is in agreement with the accounting records of True Temper Ltd. The first and second provisional tax payments made during the current financial year in respect of 2021, which have not been recorded yet in the accounting records of True Temper Ltd, amounted to R770 000 and R1 080 500 respectively. The SA Normal tax rate is 28% and remained unchanged for the past years. The inclusion rate for capital gains tax is 80%. The dividends tax rate is 20%. The company provides for deferred tax on all temporary differences using the statement of financial position approach. There is certainty beyond any reasonable doubt that there will be sufficient taxable profit in the future against which any deductible temporary differences can be utilized. There are no other exempt or temporary differences except those mentioned in the question. 6. Assumptions Assume all amounts to be material. REQUIRED: Marks 1272 (a) Calculate the deferred tax balances in the statement of financial position of True Temper Ltd for both the years ended 31 December 2020 and 31 December 2021, using the statement of financial position approach. Indicate if the balance is a deferred tax asset or liability. Your answer must comply with the requirements of IAS 12, Income taxes (b) Calculate the current tax due by True Temper Ltd to the SA Revenue Service for the year ended 31 December 2021. The movement in temporary differences in the current tax calculation should be calculated using the statement of financial position approach. Your answer must comply with the requirements of IAS 12, Income taxes. 10 4 (c) Disclose the income tax expense note, excluding the tax rate reconciliation, in the notes to the annual financial statements of True Temper Ltd for the year ended 31 December 2021. Your answer must comply with the requirements of IAS 12, Income taxes. Comparative figures are not required. 32 (d) Prepare the necessary general journal entry to correctly record the payment of the dividend in additional information (4) in the accounting records of True Temper Ltd for the year ended 31 December 2021. [30] Please note: Your answer must comply with the requirements of International Financial Reporting Standards (IFRS). All calculations must be shown. Calculations are to be done to the nearest Rand. Journal narrations are not required. No abbreviations for general ledger account names in your journal may be used. Indicate in your journal if it is a statement of financial position (SFP) or statement of profit or loss and other comprehensive income (P/L) general ledger account. True Temper Ltd is a steel manufacturing company that manufactures high quality stainless steel products for the building industry. 1. Profit before tax The profit before tax in the draft statement of profit or loss and other comprehensive income of True Temper Ltd for the financial year ended 31 December 2021 amounted to R9 150 000, before taking into account the information in (3) below, but including the following: Debit Credit R R Dividends received 118 000 Legal fees 666 000 These legal fees are not deductible for tax purposes. Foreign income received from the United Arab Emirates 905 000 (before deducting withholding tax of R87 750) This income is not taxable in South Africa in terms of a double taxation agreement Depreciation: 2 125 000 Welding equipment (excluding depreciation on 02 welding | 525 000 equipment stolen) (refer 3) Mobile cranes (refer 3) 1 600 000 2. Current liabilities Income received in advance amounting to R2 100 000 (2020: R1 400 000) is included in current liabilities in the statement of financial position of True Temper Ltd on 31 December 2021. This income relates to orders True Temper Ltd received in advance from clients, but where the performance obligation has not yet been met by True Temper Ltd. 3. Property, plant and equipment The following is an extract from the asset register of True Temper Ltd at 31 December 2021, excluding the carrying amount on 31 December 2021, which you can assume to be correct: Description Cost R 6 500 000 Carrying amount 31 December 2020 R 4 875 000 Tax base 31 December 2020 R 3 791 667 Tax base 31 December 2021 R 2 187 500 Welding machine Mobile cranes 8 000 000 4 000 000 3 000 000 1 000 000 On 1 July 2021 an 02 welding machine was stolen from the warehouse of True Temper Ltd. On 31 July 2021 True Temper Ltd received an insurance payment of R1 520 000. The 02 welding machine was originally acquired for R1 250 000. On 1 January 2021 the carrying amount and tax base of the O2 welding machine amounted to R937 500 and R729 167 respectively. The depreciation on the O2 welding machine for the current year and the insurance payout of the Op welding machine have not been recorded yet in the accounting records of True Temper for the year ended 31 December 2021. No other assets were sold or purchased during the year. Depreciation on all welding machines and mobile cranes are written off over the assets estimated useful lives, according to the straight-line method. The estimated useful lives of the welding machines are 10 years and the mobile cranes are 5 years. A residual value of Rnil was allocated to the welding machines and mobile cranes respectively. The SA Revenue Service allows a tax allowance on the welding machines of 6 years and on the mobile cranes of 4 years, according to section 11 (e) of the Income Tax Act. The tax allowances are apportioned for part of a year according to the straight-line method. 4. Dividends On 25 December 2020 True Temper Ltd declared a cash dividend of R840 000. All the shareholders of True Temper Ltd are natural persons. The dividend as well as the dividend tax were paid in cash on 31 January 2021. The payment of the dividends and dividend tax have not yet been recorded in the accounting records of True Temper Ltd for the year ended 31 December 2021. 5. Taxation On 1 April 2021 True Temper Ltd received its 2020 financial year tax assessment from the SA Revenue Service, indicating an assessed loss of R1 321 000. This is in agreement with the accounting records of True Temper Ltd. The first and second provisional tax payments made during the current financial year in respect of 2021, which have not been recorded yet in the accounting records of True Temper Ltd, amounted to R770 000 and R1 080 500 respectively. The SA Normal tax rate is 28% and remained unchanged for the past years. The inclusion rate for capital gains tax is 80%. The dividends tax rate is 20%. The company provides for deferred tax on all temporary differences using the statement of financial position approach. There is certainty beyond any reasonable doubt that there will be sufficient taxable profit in the future against which any deductible temporary differences can be utilized. There are no other exempt or temporary differences except those mentioned in the question. 6. Assumptions Assume all amounts to be material. REQUIRED: Marks 1272 (a) Calculate the deferred tax balances in the statement of financial position of True Temper Ltd for both the years ended 31 December 2020 and 31 December 2021, using the statement of financial position approach. Indicate if the balance is a deferred tax asset or liability. Your answer must comply with the requirements of IAS 12, Income taxes (b) Calculate the current tax due by True Temper Ltd to the SA Revenue Service for the year ended 31 December 2021. The movement in temporary differences in the current tax calculation should be calculated using the statement of financial position approach. Your answer must comply with the requirements of IAS 12, Income taxes. 10 4 (c) Disclose the income tax expense note, excluding the tax rate reconciliation, in the notes to the annual financial statements of True Temper Ltd for the year ended 31 December 2021. Your answer must comply with the requirements of IAS 12, Income taxes. Comparative figures are not required. 32 (d) Prepare the necessary general journal entry to correctly record the payment of the dividend in additional information (4) in the accounting records of True Temper Ltd for the year ended 31 December 2021. [30] Please note: Your answer must comply with the requirements of International Financial Reporting Standards (IFRS). All calculations must be shown. Calculations are to be done to the nearest Rand. Journal narrations are not required. No abbreviations for general ledger account names in your journal may be used. Indicate in your journal if it is a statement of financial position (SFP) or statement of profit or loss and other comprehensive income (P/L) general ledger accountStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started