Answered step by step

Verified Expert Solution

Question

1 Approved Answer

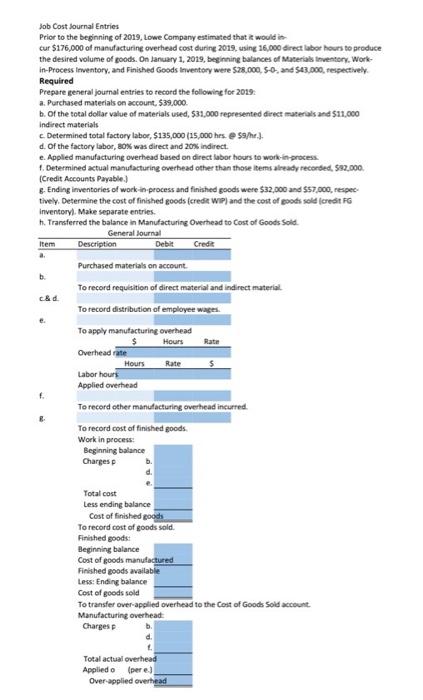

This is all the information that was provided (so sorry thats the same reason I cant seem to find a soultion) Job Cost Journal Entries

This is all the information that was provided (so sorry thats the same reason I cant seem to find a soultion)

Job Cost Journal Entries Prior to the beginning of 2019, Lowe Company estimated that would in cur $176,000 of manufacturing overhead cost during 2019, using 16,000 direct labor hours to produce the desired volume of goods. On January 1, 2019, beginning balances of Materials inventory Work in-Process inventory, and Finished Goods Inventory were 528,000, 50, and 543.000, respectively Required Prepare general journal entries to record the following for 2019 a. Purchased materials on account, $39,000 b. Of the total dollar value of materials used, $31,000 represented direct materials and $11,000 Indirect materials Determined total factory labor, $125,000 (15,000 hrs. @ $9hr.) d. Of the factory labor, 80% was direct and 20% indirect. e. Applied manufacturing overhead based on direct labor hours to work in process Determined actual manufacturing overhead other than those items already recorded, 582,000, (Credit Accounts Payable) B.Ending inventories of work-in-process and finished goods were $32,000 and $57,000, respec tively. Determine the cost of finished goods (credit WIP) and the cost of goods sold feredits Inventoryl. Make separate entries. h. Transferred the balance in Manufacturing Overhead to cost of Goods Sold General Journal Item Description Debit Credit Purchased materials on account To record requisition of direct material and indirect material &d To record distribution of employee wages To apply manufacturing overhead $ Hours Overhead rate Hours Rate $ Labor hours Applied overhead To record other manufacturing overhead incurred. a e f B To record cost of finished goods Work in process: Beginning balance Charges Total cost Less ending balance Cost of finished goods To record cost of goods sold. Finished goods Beginning balance Cost of goods manufactured Finished goods available Less: Ending balance Cost of goods sold To transfer over applied overhead to the Cost of Goods Sold account Manufacturing overhead Charges Total actual overhead Applied (pere) Over-applied overhead Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started